On March 13, 2020, Dale Redman resigned his position as Chief Executive Officer of ProPetro Holding Corporation with immediate effect. His departure marked the end of a seven month-long inquiry into violations of SEC regulations and company policy. By the time the facts came to light, ProPetro's stock had fallen 86% and the Company found itself embroiled in investor lawsuits and a federal investigation. This article examines the corporate governance deficiencies that have been uncovered.

Background and Timeline

ProPetro Holding Corporation is a hydraulic fracturing equipment and services company at the heart of the 21st century U.S. oil boom. Founded in 2007 and operating in the Permian Basin oil field of west Texas, the company has seen healthy growth over the years and was in the process of bringing new hydrofracking technology to market when problems surfaced with the company's management.

In August of 2019, ProPetro initiated an internal review that originally focused on the disclosure of contracts it signed with AFGlobal Corporation to purchase a number of fleets of its Durastim® fracking pumps. The review, which included outside counsel and advisors, then expanded to include expense reimbursements made to ProPetro executives, related party transactions and potential conflicts of interest.

Review Uncovers Improper Activity

The preliminary findings of the internal review, which was conducted by management, found that due to inadequade documentation ProPetro was improperly expensed $370,000 by senior management but did not find any evidence of improperly disclosed related party transactions. However, the company did annouce that the review would likely find material weaknesses among its internal controls.

Nevertheless this prompted a class action lawsuit by investors filed in Septemeber.

In October, 62 days later, ProPetro announced substantive completion of its review and a round of management changes took place, although none of the executives under review actually left the company. The company also announced that it had confirmed the existence of accounting deficiencies and the review would need additional time to investigate previously undisclosed related transactions that had come to light.

Among the senior managers that were reshuffled included Chief Executive Officer Dale Redman, who retained his title, although was removed from day to day duties. Phillip Gobe, ProPetro's Chairman was appointed as Executive Chairman and became the Company's Principal Executive Officer. Jeffrey Smith, the Chief Financial Officer, filled the newly created role as Chief Administrative Officer and was replaced by Darin Holderness as Interim Chief Financial Officer. Chief Accouting Officer Ian Denholm resigned.

Following the announcement of this "improved organizational struture", ProPetro's shares rallied +19% appearing to quell market concerns and reassure investors that any governane issues were well in hand. Though this reassurance was shortlived.

Later that Month on October 24, 2019, the Securities and Exchange Commision (SEC) announced it had opened an investigation into ProPetro. And on Novemeber 13 more details were revealed about ProPetro executive's undisclosed transactions as the company announced that its former Chief Accounting Officer, Ian Denholm, had loaned money to a business partner for the development of real estate which was in turn sold or leased to ProPetro. In total, ProPetro paid out $3.6 million to Denholm's business partner.

Undisclosed Entities were used to Personally Enrich ProPetro Leadership

Eventually it came to light that members of ProPetro's board and senior executives were named as leaders (or involved parties) of several companies with whom ProPetro was doing business. FloCap Injection Services, LLC, a company that had named Chief Executive Officer Dale Redman, who later resigned, as a managing member along with ProPetro Finance Chief Jeffrey Smith. ProPetro board member and Audit Committee member Alan Douglas was also found to be Redman's personal accountant and and involved party to outside entitites in which Dale Redman was named as a managing member: Red Hogg, LLC and Energy Entreprenuer Fund 1, LLC. In fact, ProPetro employees had been in involved with a number of other undisclosed companies (Clarabby Development LLC, Conquistador Capital LLC, Dahlia Development LLC, Ener-Coil LLC, HR Double S LLC, South of the Border Materials LLC and others) to whom the ProPetro had eventually awarded business. And at least four deals, it was discovered, were awarded to private ventures owned by Redman. These undisclosed connections personally enriched Redman to the tune of hundreds of thousands of dollars.

Redman Steps Down

On March 16, 2020, ProPetro announced that Dale Redman resigned his position as Chief Executive. In that announcement it was also disclosed that, "... the company discovered that its former Chief Executive Officer entered into a pledge agreement covering all of the company's common stock owned by him at that time as collateral for a personal loan in January 2017, in violation of the shareholders agreement then in place ..." Redman put up 35% of his holdings in ProPetro worth $8 million, around 601,200 shares in all.

A Reformed ProPetro?

Clearly, over the past several years, ProPetro has been suffering a number of governance deficiencies. An era of improper personal enrichment on the part of executives, lack of board independence, weak interal controls, violations of SEC regulations and poor disclosure practices, should have come to end with the resrtucturing announced in October of last year and the resignation of CEO Dale Redman.

An analysis of ProPetro's Board Effectiveness should help investors find out if the company is well positioned to resume healthy operation going forward. Board Effectiveness is calculated by averaging the scores of a company on a number of underlying attributes outlined by the NYSE and other US guidelines. The CGLytics Risk Rating tool, of which Board Effectiveness is one the of main pillars, enables Corporate Boards to stand back and assess their strengths and areas for development through an independent lens and identify gaps and changes that will enable them to achieve their full potential.

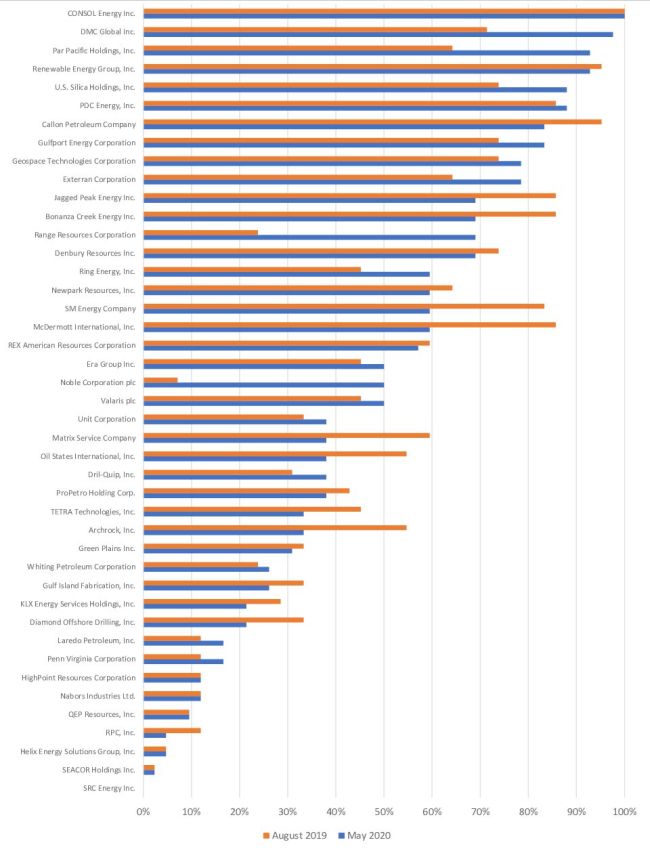

Board Effectiveness percentile rank within S&P Small Cap 600 - Energy Sector

Source: CGLytics Data and Analytics

ProPetro's Board Effectiveness score has improved slightly from 73 to 75 since the internal review was first announced in August of 2019 and since the company's leadership underwent restructuring. Even though the changes made at ProPetro have improved effectiveness in a couple of areas, the company's percentile rank did fall from 43% to 38%, placing it below median when compared to other companies listed on the S&P Small Cap 600 in its sector. However, this is mostly due to the improving scores of other companies comparatively.

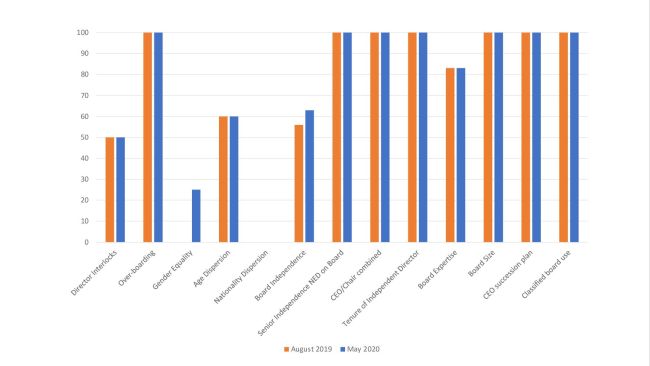

Source: CGLytics Data and Analytics

Of the factors contributing to ProPetro's improving score are gender equality due to the addition of Michele Choka to the all male board of directors in February of 2020. ProPetro also receives a modest 7 point boost on Board Independence due to the departure of long tenured individuals. The data suggests that the issues of Board Independence, Gender Equality and Director Interlocks may be connected to the Nationality score, which is where ProPetro is weakest.

The nationality attribute reflects variation in the nationalities of board members. The more nationally homogenous, the lower the score. This is likely a function of the regional character of ProPetro's business, being so closely linked with Permian Basin and the west Texas region generally. Nevertheless, it appears evident that board diversity is the key governance challenge for ProPetro going forward.

Altogether, the company's response in the form of its internal review and subsequent actions succeded in bringing matters to light and holding executives accountable, but not before the company's share price collapsed. Since the restructuing, ProPetro's stock has made a modest recovery and confidence in leadership appears to be returning. Long term success will depend on ensuring board diversity and Independence.

Interested to see how your company stacks up against 5,900 globally listed companies' board composition, diversity, expertise and skills? Click here to find out about CGLytics' boardroom intelligence capabilities and obtain the same insights used by institutional investors, activist investors and leading proxy advisor Glass Lewis.

References

Culper Research. (2019). ProPetro Holding Corp (PUMP): Friends & Family First at this Permian Cesspool. https://img1.wsimg.com/blobby/go/cc91fda7-4669-4d1b-81ce-a0b8d77f25ab/downloads/Culper_PUMP_10-31-2019.pdf?ver=1589202898850

Globe Newswire. (2019, December 3). Lawsuit for investors in ProPetro holding Corp. (NYSE: PUMP) shares announced by shareholders Foundation. Finance.Yahoo.com. https://finance.yahoo.com/news/lawsuit-investors-propetro-holding-corp-130010662.html

Liz Hampton. (2020, March 19). How a Texas oil CEO's luxury land deals cost him his job. Reuters.com. https://www.reuters.com/article/us-usa-oil-propetro-investigation-insigh/how-a-texas-oil-ceos-luxury-land-deals-cost-him-his-job-idUSKBN2161FD

ProPetro holding Corp. (2019, October 9). ProPetro announces substantial completion of fact finding for previously disclosed internal review. propetroservices.com. https://ir.propetroservices.com/press-releases/detail/45/propetro-announces-substantial-completion-of-fact-finding

United States Securities and Exchange Commission. (2019, August 8). Form 8-K. SEC.gov. https://www.sec.gov/Archives/edgar/data/1680247/000110465919044899/a19-16860_18k.htm

United States Securities and Exchange Commission. (2019, October 3). Form 8-K. SEC.gov. https://www.sec.gov/Archives/edgar/data/1680247/000110465919053592/a19-19705_18k.htm

United States Securities and Exchange Commission. (2019, November 13). Form 8-K. sec.gov. https://www.sec.gov/Archives/edgar/data/1680247/000110465919063353/a19-22679_18k.htm

United States Securities and Exchange Commission. (2020, February 11). Form 8-K. sec.gov. https://www.sec.gov/Archives/edgar/data/1680247/000110465920022476/tm208021d1_8k.htm

United States Securities and Exchange Commission. (2020, March 16). Form 8-K. sec.gov. https://www.sec.gov/Archives/edgar/data/1680247/000110465920033704/tm2012779d1_8k.htm

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.