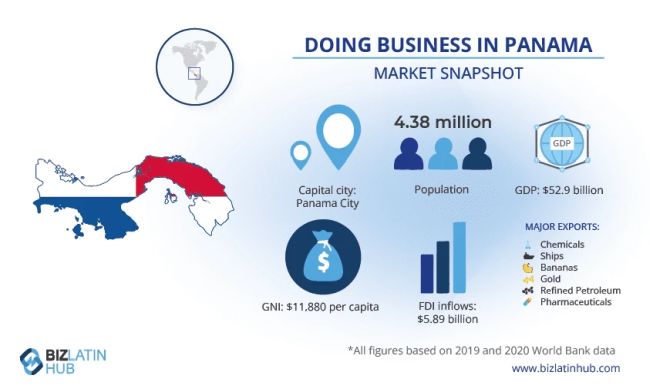

Panama, despite being one of the smallest countries in Latin America, presents a plethora of opportunities and benefits for companies. Indeed, these benefits vary depending on the different types of legal structures in Panama. Its' appeal in attracting Foreign Direct Investment (FDI) is significant. Firstly, the nation maintains political stability, boasts a robust and expanding economy, and its strategic location is ideal for trade. The Panama Canal enhances access not only to Latin American markets but also to global markets at large. Now, lets learn about the different types of legal structures in Panama.

Different types of legal structures in Panama – Learn some economic data of the country if you are thinking of incorporating a company in Panama.

There are many different types of legal structures in Panama which serve diverse purposes, including facilitating international trade, establishing trusts and foundations, setting up offshore banking and investment accounts, holding real estate and intellectual property, and managing various assets. It is noteworthy that Panama's territorial tax system ensures that income generated outside of Panama remains untaxed, even if the business conducts operations within the country. This advantageous tax framework exempts businesses from taxation unless their income arises from activities carried out within Panama. An important aspect of effective tax planning involves the default residency of Panama corporations in the Republic of Panama, which can be further reinforced by engaging local professional directors and obtaining local/municipal business licenses. This approach reduces the likelihood of legal disputes regarding the company's residency, distinguishing Panama from traditional International Business Company (IBC) jurisdictions. This, however, varies based on the different types of companies in Panama.

Furthermore, Panama's service sector, encompassing legal, banking, and financial services, holds a prominent position and makes a significant contribution of around 75% to the country's GDP. These contributions are distributed amongst the different types of legal structures in Panama. Additionally, Panama presents enticing opportunities for foreign investors due to its trade liberalization policies, a multitude of Free Trade Agreements (FTAs), and the presence of Free Trade Zones (FTZs). The Colón Free Trade Zone stands as the world's second-largest, while Panama has successfully negotiated FTAs with various nations including Canada, Chile, the USA, and Mexico.

Incorporating a company in Panama holds several advantages, and one particularly appealing aspect for entrepreneurs and businesses is the remarkably low value-added tax (VAT) rate of only 7% on most goods. Now, lets dig further into the different types of legal structures in Panama.

Different types of legal structures in Panama – why Incorporate a Company in Panama?

Undoubtedly, Panama is an attractive destination for conducting business. Whilst establishing different types of legal structures in Panama, whether it be an onshore or offshore entity, businesses must carefully select the appropriate type of entity that aligns with their specific needs. This decision holds great significance because once a particular company type is formed, there are inherent legal limitations on the permissible business activities. These activities vary depending on the different types of legal structures in Panama that are referred to.

When registering a business, there are several different types of legal structures in Panama to choose from, but the three most commonly utilized options are:

- Corporation (Sociedad Anonima – S.A.): A corporate structure that provides limited liability to shareholders and is commonly employed for various business activities.

- Limited Liability Company (Sociedad de Responsabilidad Limitada – S.R.L.): A company structure that offers limited liability to its members and is well-suited for small to medium-sized enterprises.

- Private Interest Foundation (Fundacion de Interes Privado): A unique legal entity that operates similarly to a trust, providing a flexible framework for asset management, estate planning, and charitable purposes.

Some reasons to consider opening a company or doing business in Panama

Corporation (Sociedad Anonima – S.A.)

Engaging in business activities in Panama and opting to form companies is a relatively straightforward process, as long as certain requirements are adhered to, and the different legal structures in Panama are considered. Company formation serves as the initial step among the four necessary stages for incorporating a Corporation in Panama, with the remaining three being obtaining a Commercial License, opening a Bank Account, and amending the Company Statutes. This one of the different types of legal structures in Panama

It is crucial to note some key characteristics associated with the formation of this entity. Most notably, shareholders bear responsibility solely for their own assets and contributions. Panama's legislation does not specify a minimum social capital requirement for the company, although a recommended minimum of USD$10,000 is advised. The incorporation of an S.A can typically be completed within a period of two to three weeks (without a bank account), provided the business fulfills the following essential requirements:

- Maintain a minimum of three directors.

- Appoint a president, secretary, and treasurer, who also serve as named dignitaries.

- Have at least two subscribers, who may be individuals from the board of directors or the appointed dignitaries listed in the Social Pact. Each subscriber must

- commit to subscribing to at least one share at the time of registration.

- Elect a legal representative for the company, who can be one of the directors.

- Designate a resident agent (as mandated by law, a Panamanian lawyer is required).

- Register a fiscal address for the company.

- Submit monthly and annual tax declarations.

- Maintain a minimum of one shareholder.

- Fulfill the annual payment obligation to the Public Registry for account maintenance.

Limited Liability Company (Sociedad de Responsabilidad Limitada – S.R.L.)

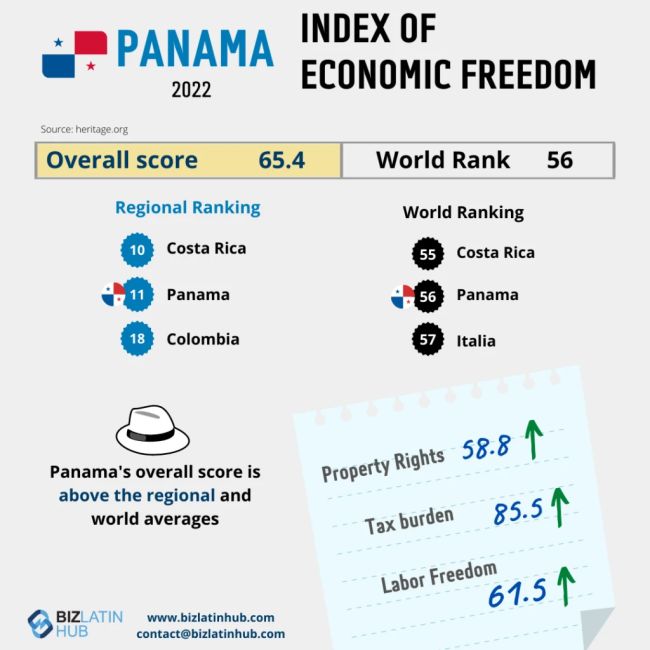

Panama index of economic freedom

Establishing a Limited Liability Company (S.R.L) is the initial step in the process of incorporating a company in Panama, followed by the same subsequent steps as for forming an S.A. These incorporations occur within specific legal structures in Panama. Typically, one can accomplish the incorporation of an S.R.L within a timeframe of approximately two weeks (excluding the bank account setup). From an investor's perspective, an S.R.L may seem like the most appealing option as it provides personal liability protection, relieving individuals of personal responsibility for the company's funds or debts. The key prerequisites for forming an S.R.L in Panama are outlined below:

- To form an S.R.L in Panama, the following principal requirements must be fulfilled, alongside considering the key legal structures in Panama:

- Appoint at least one administrator.

- Elect a president, secretary, and treasurer, who also serve as named dignitaries.

- Have a minimum of two subscribers, who may be individuals from the board of directors or the appointed dignitaries listed in the Social Pact. Each subscriber must agree to subscribe to at least one share at the time of registration.

- Appoint a legal representative for the company, who can be the president, an associate, or one of the administrators as established in the Social Pact.

- Elect a resident agent (a Panamanian lawyer is mandatory by law).

- Register a fiscal address for the company.

- Prepare and submit annual tax declarations.

- Maintain a minimum of two shareholders or associates.

- Fulfil the annual payment obligation to the Public Registry for account maintenance.

Private Interest Foundation (Fundacion de Interes Privado)

Forming a Private Interest Foundation offers specific legal advantages that appeal to foreign businesses. While establishing this type of company requires a minimum of three weeks, the entity enjoys exemption from all taxes and contributions in Panama, with the exception of the Annual Quota payment. If the entity intends to engage in commercial development, it must obtain a license and comply with tax declaration requirements as mandated by law. This is an additional legal structure in Panama that must be considered. The following outlines some key characteristics and requirements of a Private Interest Foundation:

- Does not issue shares like other types of companies do

- Includes a Private Protectorate Document from a notary

- One beneficiary and one protectorate must be designated from the Foundation Council

- Not subject to judicial orders on the seizure or confiscation of assets

- Recommended shared social capital of the company USD$50,000 (not obligatory)

- A fiscal address is required

- A company legal representative (a Panamanian lawyer) is required

- The aim/purpose of the foundation and the period of time (indefinite or definite) that you wish the company to be open for, must be stated

- In the case of dissolution – name the recipient/destination of the assets of the foundation and the type of liquidation process

- A bank account must be set up (this process can take a minimum of four weeks). Some references must be supplied from the founder and protectorates.

Originally published 27 October, 2018 | Updated on: 19 July, 2023

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.