Greek banks are under significant pressure to dispose their non-performing assets. They can choose between Greek Securitization Law and NPL Law to sell massively their loans. Greek Securitization Law is expected to gain ground in view of rumored future developments in the Greek NPL market.

In any case, after the acquisition of the loan portfolio comes the recovery process which determines the success of an NPL transaction. Various risks can be hidden in both consensual and legal recovery. Despite the recent reforms towards an investor-friendly legal framework, certain debtor-protection rules still pose challenges for investors.

A. Loan portfolio acquisition

Greek systemic banks face significant pressure from supervisors (i.e. the SSM) to cleanse their balance sheets of NPLs. The goals set by supervisors are quite ambitious and demand prompt and bold action. To this end, Greek banks can choose between the new Law 4354/20151 (the so called "NPL Law") and the pre-existent securitization framework, i.e. the Greek Securitization Law (Law 3156/2003), to dispose their non-performing assets. The choice of the applicable legal framework depends largely on the objectives of the banks and the type of loans consisting the portfolio.

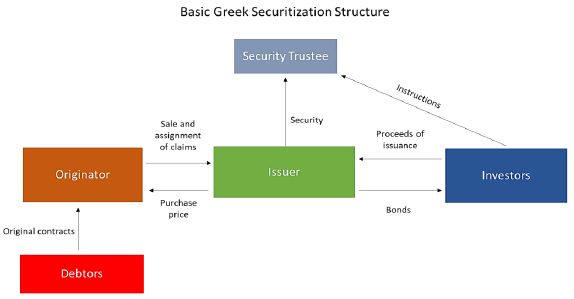

As regards the deal structure, the choice of the Greek Securitization Law means that an SPV has to be established which shall issue and offer, by private placement only, any kind of bonds, the repayment of which is to be funded by (a) the proceeds of the transferred claims or (b) loans, credits or financial derivative agreements.

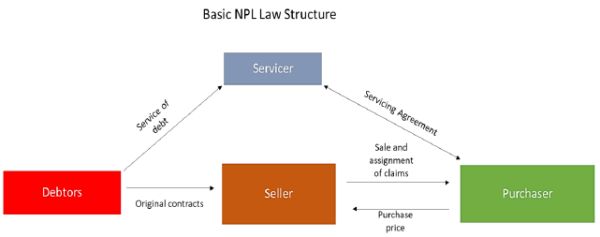

On the other hand, should the NPLs be disposed under the new NPL Law, the creation of an SPV and the subsequent issuance of bonds are not required. An operating entity, whose statutes should have among their business objective the acquisition of claims from loans and credits, can be the purchaser/assignee of the claims.

Regarding potential threats and obstacles in the recovery process, the protection of securitization structure from servicer's/bank's insolvency, as well as from any claw-back risk, consist distinct advantages compared to the NPL Law structure.

Moreover, under NPL Law, in order for a sale and transfer of NPLs to be valid, banks are required to offer to co-operating debtors the possibility to settle their claims 12 months prior to the sale. They are also required to notify debtors about the portfolio sale.

Securitization Law does not set such requirements and the registration of the portfolio sale to the pledge registry is sufficient.

Under Securitization Law, as servicer can act a credit or financial institution operating in the EEA, the originator or a third party, provided that the latter acts as guarantor of the receivables or was assigned with the servicing of the loans prior to the transfer. With regard to securitization of consumer loans, the servicer is required to have an establishment in Greece.

On the other hand, according to NPL Law, the servicer can be either a Greek SPV in the form of a Société Anonyme whose exclusive business objective shall be the management of loans and credits or a company domiciled in any other EEA country operating in Greece through a branch office with a business objective to manage loans and credits. In both cases the servicer shall be licensed by the Bank of Greece.

Servicing companies acting within the framework of NPL Law have to follow the same debtor protection requirements as banks. The same requirements apply to securitization deals given that in most cases the originators (i.e. the banks) act as servicers. Accordingly, any discussion about servicers in securitization transactions acting outside the scope of NPL law is of limited scope and mostly theoretical.

From a commercial point of view, Greek lenders are expected to use Greek Securitization Law, especially for mortgage NPLs, in order to benefit from segmentation of loans in different tranches of issue on a risk basis. In this way, they expect to achieve higher consideration for NPLs with high security coverage and recovery ratios, which shall comprise the senior tranche, compared to a sale under NPL Law.

Additionally, the possible launch of an Asset Protection Scheme proposed by Hellenic Financial Stability Fund (a state guarantee scheme aiming to enhance the rating and the attractiveness of the senior tranche of bonds whose underlying assets are NPLs) is also expected to facilitate the sale of 'good NPLs' in higher prices through securitization structures. The use of securitization structures would also be relevant in the case of the Bank of Greece proposal for the transfer by the Greek banks' of about half of their deferred tax claims against the Greek State to a special purpose vehicle, which would then sell bonds and use the proceeds to buy approximately €42 bn. of NPLs from the originators at market prices. After all, securitization is a tested tool in the Greek market.

However, it involves higher costs compared to an NPL deal structure, whilst the adequacy of recoveries for covering investors' repayment and costs should be ensured.

To read this article in full, please click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.