Peru is one of the fastest-growing economies in Latin America. Peru's economy has grown by an average of 6.4 percent per year since 2002 and is projected to continue on an upward trajectory in 2017, fueled by external demand and the return of fixed investment to grow.

If you are interested in setting up a company in Peru, make sure you are aware of the types of legal entities in Peru

LatinFocus panelists expect GDP to accelerate and increase over the coming years. This growth in the Peruvian economy has resulted in an increase in FDI, particularly in the mining and export sectors.

Government policies have encouraged this investment which has benefited investors, local communities, and the economy in general. There is a vast range of business opportunities available in Peru, and both local and foreign investors are getting involved. Below we present to you 5 types of legal entities in Peru.

Types of legal entities in Peru – Which Legal Entity Should You Use?

Do you have a great business idea and are looking to find the right structure for your company in Peru? Depending on the activity that you plan to undertake, there are different legal entities regulated by the Peruvian Companies Law under which you can set up your new venture.

Below is a list of 5 types of legal entities to set up your business in Peru most commonly used by foreign investors. Should you require more information regarding each of these legal entities, we recommend that you make contact with a professional company that has an extensive understanding of the legal Peruvian entities and have experience in the formation and incorporation of companies depending on the types of operations being conducted.

Joint Stock Company (Sociedad Anónima or S.A)

This type of company is the most popular type of legal entities in Peru for business entities as it's fairly easy to open. The legal entity requires a minimum of two shareholders and an initial capital contribution of s/.1000; approximately $350. Liability is limited to the amount of the contribution and the joint-stock company must have a Board of Directors and General Manager.

Private Closed Corporation (Sociedad Anónima Cerrada or S.A.C)

One of the types of legal entities in Peru is the Private Closed Corporation. This legal entity requires a minimum of two and a maximum of twenty shareholders. Although a Board of Directors is not necessary, the corporation must have a General Manager.

Public Corporation (Sociedad Anónima Abierta)

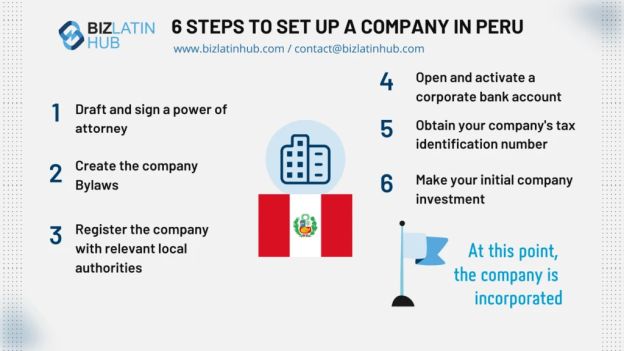

6 Steps to set up a company in Peru. Legal entities in Peru

For companies with a large number of shareholders, a publicly held corporation can be a good option. To create this legal entity, an initial public offering should be made, the company must have more than 750 shareholders, and/or over 35% of share capital distributed among more than 175 shareholders.

Limited Liability Company (Sociedad Comercial de Responsabilidad Limitada or S.R.L)

A minimum of two and a maximum of twenty partners are allowed. All partners have limited liability and capital is divided up amongst them. This company corporation does not issue shares and its procedures are the same as those of other corporations.

Branch (Sucursal)

Another type of legal entities in Peru is the Branch (Sucursal). Established outside its legal address, the branch should realize the same activities as its head office. The branch has the same status as a head office but can be considered as an independent company for tax purposes. To open a branch, a permanent legal representative or General Manager must be present.

Originally published 23 March 2016 | Updated on: October 19, 2022

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.