H. ELECTRONIC ACCOUNTING

Taxpayers are required to have its accounting transactions in electronic fashion based on account catalogs and codes issued by tax authorities. They also have to send part of their accounting information in the following terms:

- From January 2015 taxpayers with income of 4,000,000.00 or more in the tax year 2013 have to send their accounting information.

- From January 015 taxpayers with income lower than the one indicated above have to send their accounting information.

Tax authorities may perform electronic reviews of the accounting information sent by taxpayers.

Personal Taxes

Persons residing in Mexico calculate their annual tax on their total income generated both in the country and abroad. In the case of foreign income, taxes paid abroad are generally credited against taxes payable in Mexico.

There are specific rules for each type of personal income such as: wages, fees, capital gains, dividends, etc. In the case of wages, the taxes are withheld by the employer.

In the case of salaries paid by a foreign company to a foreigner working in Mexico, personal taxes have to be computed and paid, except when the foreign company has no branch or fixed base in the country and the person spends less than 183 days in the country during the year.

There are only a few personal expenses that a taxpayer can deduct from their income which are as follows:

- School transportation for their children (only in certain cases);

- Medical and dental fees, including hospital expenses for the taxpayer, spouse, direct-line ascendants or descendants;

- Funeral expenses for the persons mentioned under (b) above;

- Donations to authorised entities;

- Contributions for employee retirement;

- Medical insurance payments;

- Interest paid related to mortgage loans for the purchase of family home.

From 2011, there is a decree in effect that allows the deduction on school tuition payments from basic up to High School level. Specific amounts and rules apply. Provisional payments have to be made on a monthly basis by the employer and the annual taxes must be calculated at the end of each year. Personal tax rates apply up to a maximum rate of 35% in the case of foreign residents.

The following tax rates apply to Mexican residents:

| Monthly Taxable

Income (MXN) |

Tax due on lower

limit (MXN) |

Marginal rate on

Excess (%) |

| Up to 496.07 | 0 | 1.92 |

| 496.08 - 4,210.41 | 9.52 | 6.40 |

| 4,210.42 - 7,399.42 | 247.24 | 10.88 |

| 7,399.43 - 8,601.50 | 594.21 | 16.00 |

| 16.00 | 1,090.61 | 21.36 |

| 20,770.30 - 32,736.83 | 3,327.42 | 23.52 |

| 32,736.84 - 62,500.00 | 6,141.95 | 30.00 |

| 62,500.01 - 83,333.33 | 15,070.90 | 32.00 |

| 83,333.34 - 250,000.00 | 21,737.57 | 34.00 |

| 250,000.01 and above | 78,404.23 | 35.00 |

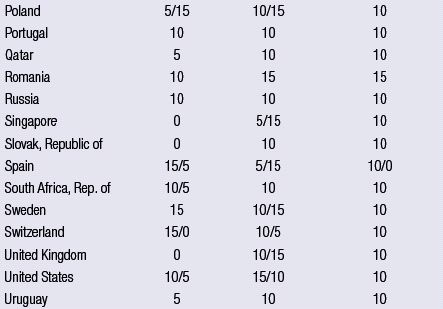

I. TREATY WITHHOLDING TAX RATES

Mexico is negotiating with Slovenia, Estonia, Hong Kong, Latvia, Lebanon, Lithuania, Malaysia, Malta, Morocco, Nicaragua, Pakistan, Qatar, Thailand, Turkey and Ukraine. The following rates apply:

Footnote

1. The lower rate applies provided the corporate shareholder holds a minimum percentage of share capital or voting power in the payer which varies depending on the country concerned. Individual tax treaties should be consulted to determine the applicable rate in particular circumstances.

To read this Guide in full, please click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.