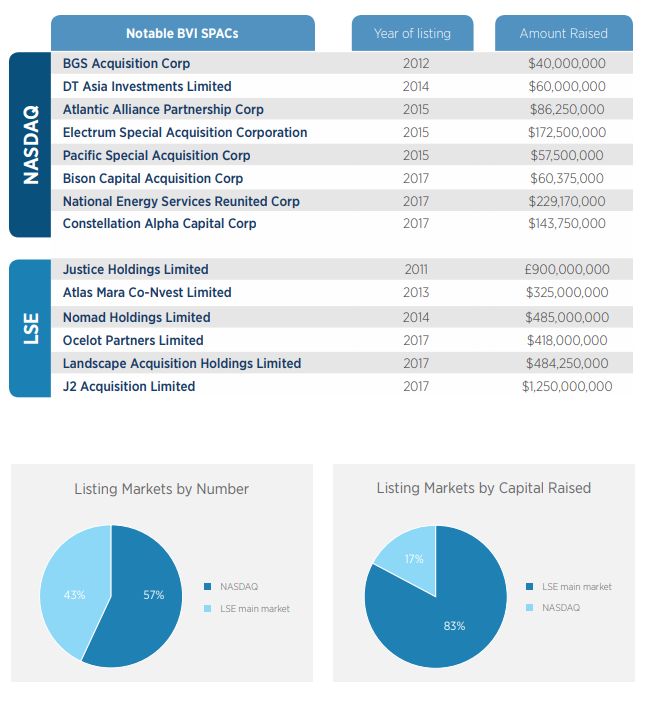

There has recently been a resurgence of interest in special purpose acquisition companies (SPACs), which are also known as 'blank check' or 'cash shell' companies. Over the past 7 years SPACs incorporated in the British Virgin Islands (BVI) have raised aggregate capital of over US$5 billion and, in 2017 alone, new BVI SPACs raised gross proceeds of approximately US$2.5 billion1. This article outlines the key features of a SPAC, explores recent market trends and explains why the BVI is a popular domicile for these vehicles.

In this newsletter, Anton Goldstein, Partner and Eric Flaye, Associate provide an overview on the characteristics of a SPAC, a comparison of SPACs vs a Typical Private Equity Fund and why the British Virgin Islands is a popular jurisdiction for incorporating a SPAC.

Characteristics of a SPAC

A SPAC is a newly-formed company which raises capital by way of an initial public offering (IPO) for the purpose of using the proceeds to acquire or merge with one or more existing operating businesses. The unique and defining feature of a SPAC is its model of 'raising equity capital upfront by way of IPO to buy operating businesses later'. At the time of its IPO, the listing vehicle has no portfolio investments or substantive operations (or even any earmarked for acquisition2). Upon listing, all or most3 of the net capital proceeds are placed into a third party escrow/trust account4 and the SPAC then has a mere 12-36 months5 in which to source and consummate a transaction (failing which the venture must be wound-up and funds must be returned to investors6).

For investors who buy shares in the IPO, an investment in a SPAC constitutes a bet on the ability of the SPAC's experienced (and often high-profile) management team to quickly identify and consummate attractive investment opportunities – referred to as 'business combinations' - following its listing. A SPAC provides investors with access to the type of 'buy-out' investment strategy typically restricted to private equity funds, while at the same time providing a degree of liquidity in that the shares of the SPAC are publicly traded. Further, the matching warrants issued in a typical SPAC structure provide potential equity upside for investors. If no business combination is consummated within the prescribed time period, capital is returned to the investors.

For the founders, a SPAC is attractive as it enables them to raise funds for a general acquisition strategy while typically providing greater flexibility and potentially superior economics than pursuing the same strategy through a private equity fund.

Once the SPAC has raised funds through its IPO and an appropriate target business has been identified, a business combination is effected that normally results in the target business being acquired by or merged into the SPAC (and therefore becoming a listed business). In recent years SPACs have been involved in transactions to acquire a number of household names, including Burger King, Iglo Foods, Jamba Juice and American Apparel.

Footnotes

1 All data herein is based on BVI SPACs listed on NASDAQ and London Stock Exchange (LSE) main market during the period 1 January 2011 to 31 December 2017, and stated averages are by incidence of listings (not weighted averages).

2 Applicable onshore securities laws and listing requirements effectively prohibit any substantive discussions with potential targets prior to the IPO.

3 At least 90% for NASDAQ listings.

4 An escrow/trust account is not required (and therefore uncommon) for LSE main market listings

5 A maximum of 36 months for NASDAQ listings. The primary period may be extendable with investor consent or if a binding letter of intent to consummate a business combination has been signed prior to expiry of the primary period.

6 For NASDAQ listings, the SPAC must then return the balance of the escrow account to its public investors (i.e. to investors other than the founders such that the founders' equity in the SPAC will become worthless if a business combination is not consummated).

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.