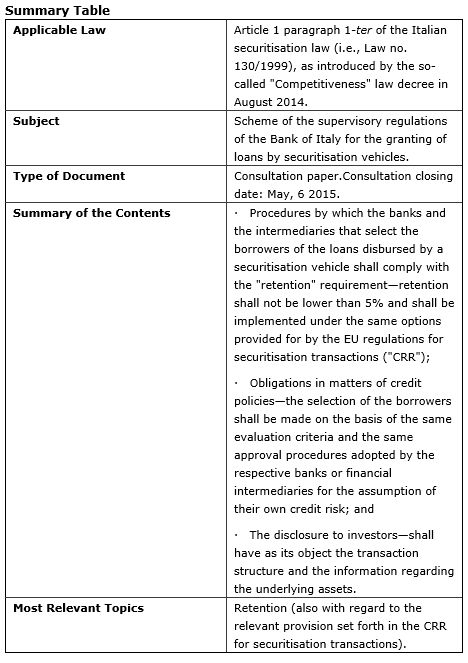

On March 6, 2015, the Bank of Italy published a consultation paper relating to the supervisory regulations for loans by securitisation vehicles incorporated under the Italian securitisation law.

The new regulations were provided for by the so-called "Competitiveness" law decree ("Decreto Competitività "), which became law in August 2014. The "Competitiveness" law decree provides for SPVs to provide loans to entities other than individuals and micro-enterprises.

On the basis of the new law, SPVs may grant loans to a wider range of borrowers upon satisfaction of certain conditions. One such condition is that the bank or financial intermediary that sources the borrowers of the relevant loans maintains a "net economic interest" in the transaction (i.e., "retention" or "skin in the game"), in compliance with the terms set forth by the supervisory regulations to be issued by the Bank of Italy.

The scheme for the supervisory regulations published by the Bank of Italy—in the form of a consultation paper—regulates in detail three aspects of loans by securitisation SPVs:

- Procedures to be adopted by banks and financial intermediaries in order to comply with the "retention" requirement: Such retention should not be lower than 5 percent and will be implemented under the same options provided for by the EU regulations on the retention rule for securitisation transactions;

- Certain obligations related to credit policies: The selection of the borrowers will be made on the basis of the same evaluation criteria and approval procedures adopted by the respective banks or financial intermediaries for the assumption of their own credit risk; and

- Disclosure to the investors: The objective of the disclosure will be to communicate the transaction's structure and information regarding the underlying assets.

The most significant aspect seems to be the "retention" rule for this specific kind of transaction.

In this regard, the consultation paper specifies that the new law regulates "an autonomous and separate requirement other than that set out in the supervisory regulations for securitisations." The regulations for SPVs are, however, different from the EU supervisory regulations (which are set forth in the EU regulation known as the "CRR"), since there is no reference to the "tranching" of transactions

Tranching consists of segmenting the risk profile in connection with the underlying assets of the relevant securitisation. Such segmentation typically consists of the issuance of different classes of notes/securities, each of them having a different level of priority/ranking.

Therefore, the Bank of Italy's paper discusses the difference between the two transactions: it is acknowledged that "ordinary" securitisations with no tranching would not be subject to the retention rule (as provided for by the CRR), whilst the retention would be required for loans granted by SPVs whether or not there is a tranching thereof.

In substance, should the loans be disbursed by a bank or a financial intermediary that later assigns the relevant monetary receivables to an SPV, and that SPV in turn issues asset-backed notes without a tranching, the transaction should not be subject to retention, since it does not qualify as a "securitisation" pursuant to the CRR. This is the case based on the literal interpretation of the CRR's provisions and the view widely shared by market operators.

However, should the loans be directly granted by an SPV pursuant to the new law provision, and such SPV issues notes secured by the relevant loans, a "retention" is required even though there is no tranching.

It should be noted that the retention rule for this specific kind of transaction, as set forth in the Bank of Italy's consultation paper (i.e., retention without tranching), is consistent with a certain trend that recently emerged in the securitisation market (in the UK, for example): investors, probably for their own internal investment policies, sometimes require originator retention even for securitisation transactions without a tranching, although this would not be required by the CRR.

This approach by investors is also linked to the fact that the EU regulations on the retention rule impose a compliance obligation only on the investors, rather than the originators or the sponsors.

Another noteworthy aspect involves the procedures for complying with retention obligations: the Bank of Italy's paper refers to the options provided for by the CRR.

Considering the particular structure of the new transaction (and the relevant purpose), an additional form of retention could be the retention by the bank of 5 percent of the respective loan, to be realized, for instance, by means of disbursement of 95 percent of the loan by the SPV and the residual 5 percent by the bank. This procedure (which is not provided for by the) could be more efficient for the banks and the financial intermediaries from a capital-requirements perspective.

Care will need to be taken in structuring transactions to ensure that the retention structure complies with the new law, CRR, and any investor guidelines.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.