Buying real estate in Italy is an attractive form of foreign investment, that leans into the good real estate market still present in the State. However, the process to buy can be quite complex for foreign residents.

This guide will provide the background information on what to expect when willing to buy real estate in Italy, and some advice on the possible taxation. It will then cover the differences in buying as an individual, as a trust or as a company, local or foreign, and some indications on inheritance laws and how to plan for inheritance of a real estate located in Italy.

To buy real estate in Italy it is mandatory, even for foreign individuals, to require and obtain an Italian fiscal code. Moreover, the following requirements are necessary, depending on the personal circumstances:

- For foreign citizens resident in Italy, and related family members, it is necessary to also have a valid resident permit;

- For citizen of the European Union, or countries of the EEA, there is no restriction to buy; this is valid also for individual stateless for more than three years.

- At last, for foreign citizens not resident in Italy, the acquiring of real estate is subjected to the presence of an international treaty between Italy and the foreign state of citizenship that sets up reciprocity in acquiring real estate. As such, if the principle of reciprocity is confirmed even without an international treaty, buying real estate should be permitted. To check the reciprocity condition, it can be useful the consultation of the webpage on treaties of the Italian Ministry of Foreign Affairs.

A) The process to acquire real estate

The process disciplined by Italian law needs three different steps:

|

Purchase proposal |

an irrevocable offer that sets the fundamental terms of the future transactions, already negotiated with the prospected vendor and/or the real estate agent. The terms agreed on that needs to be part of the proposal are the identification of the parties (vendor and buyer), the description and cadastral data of the property, the agreed-on price and payment method, and the amount of deposit. |

|

Stipulation of the preliminary contract |

if and when the vendor accepts the purchase proposal, the next needed step is to conclude a preliminary contract. This agreement formally obliges the parties to conclude the definitive sell-and-purchase contract, with which the property of the real estate is transferred, unequivocally, to the purchasing party. Usually, the moment of the signing of the preliminary contract is also the moment in which the buyer transfers the deposit (10% to 30% of the purchasing price). The preliminary contract must be in writing to avoid nullity, and it must contain the entire provisions and conditions of the definitive sell-and-purchase agreement. The second step formally obliges the parties to conclude the final sale and purchase agreement, and refraining from signing the final agreement results in the loss of the deposit by the buyer, or the obligation to pay double the deposit by the seller. |

|

Conclusion of the definitive contract |

the definitive sell-and-purchase agreement is a public deed, mandatorily signed in front of a Notary public. The notary will also provide the necessary transcriptions and transfer the necessary information to the competent offices for registration purposes. Unless the foreign buyer declares to understand and read the Italian language, the deed needs to be completed with an official translation in the foreign language of the buyer. |

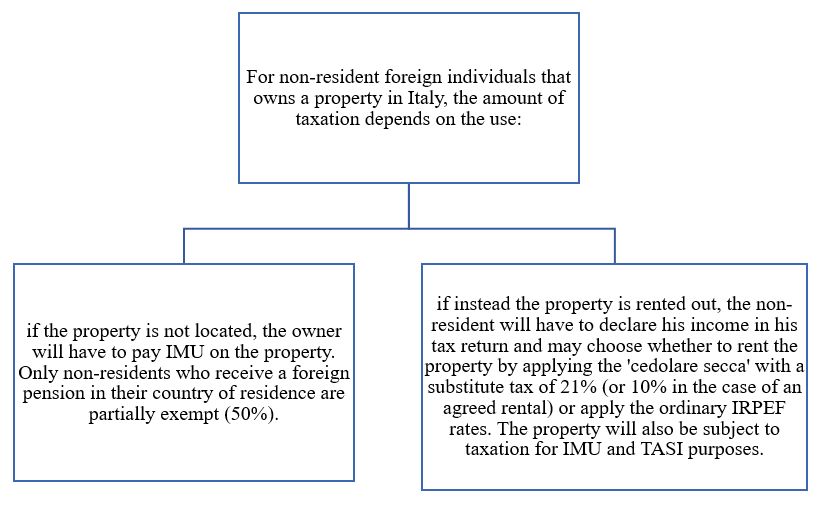

B) Taxation of real estate for non-resident owners

The tax burden on real estate in Italy is divided into two types: direct taxes linked to purchase, divided into registration tax or VAT, mortgage tax and cadastral tax; and taxes linked to property taxation, or indirect taxes, i.e. IMU.

Moreover, the taxation can be correlated to the type of real estate and to the type of vendor. If the vendor is a private individual, the buyer will need to pay the registration, cadastral and mortgage taxation. If the vendor is a company, instead, it needs to be added the payment of VAT, in the percentage set by Italian laws.

It is important to note that purchasing a property in Italy does not, automatically, trigger the assumption of an Italian residency. However, in some cases, it can be the basis to prove a domicile in Italy, with the subsequent tax residency. It is important to plan carefully with an expert.

C) Buy property in Italy

|

As an individual |

As a trust |

As a company |

|

The moment in which the foreign individual buys real estate in Italy, their rights and burdens related to the property become the same as an Italian citizen. This means that: · If the foreign individual sells after being owner for over five years, the capital gain on the future sale is not taxable; · It is possible to buy with the mechanism of the "value price", by which real estate is taxed on the cadastral value of the building instead of the sale price; · It is possible to access the "first home" taxation benefit: this comprises of paying the 2% registration tax (instead of 4%), or 4% VAT (instead of 10%). However, it is applicable only if the property is the first one owned in Italy, and the buyer transfers their residence in Italy in the next 18 months. Moreover, it is applicable only for non-luxury dwellings. There are also some disadvantages in buying as a foreign individual: · There is a lack of confidentiality in the buying process, as well as in the name of the owner of the real estate, · The future transfer off participations in non-resident companies and entities derived directly or indirectly from immovable property located in Italy can be taxed; |

Trusts are legally recognised in Italy due to the 1985 Hague Convention. As a tool to buy real estate in Italy, it ensures asset preservation, family transition and long-term rules. Moreover, the event immovable contributions in trust does not trigger any gift or inheritance taxation, which become relevant only at the moment of the final assignment of the asset to the beneficiaries. |

This third case need to be differentiated between local

companies and foreign companies. |

D) Some principles of Italian inheritance law to plan for real estate succession

The buyer is the direct owner of the property in Italy. For this reason, an individual should be aware, and plan, for inheritance.

Inheritance law in Italy is subjected to the EU Regulation 650/2012 that adopts, for law harmonisation and uniformity purposes, the general rule of the habitual residence as a contacting factor to determine the lex successionis. The EU Regulation discipline is universal in nature and apply not only to citizens of EU Member States, but also to non-EU citizens habitually resident in a Member State. For this reason, the applicable law on inheritance is determined by the residence of the deceased, independently of the place in which they were living in.

Moreover, also due to the EU Regulation, the deceased can determine the applicable law on their succession which is a very important tool to plan for the future of the estate. The law determined by the EU Regulation will, then, apply also for real estate located in a different EU member state, such as Italy.

If Italian law applies to the succession, the estate is subjected to the rule of forced heirship provided by the Italian Civil Code, applicable to Italian and foreign owners both. If the owner dies without a will, the estate is transferred by default to their legal heirs (spouse or civil union partner and descendants, ascendants, siblings and, as a last option, other relatives). In case of the planning of the succession with a will, instead, the owner can include other people (de facto partners and non-relatives and even corporations, charities or other legal entities); however, the will cannot affect the legitimate quota provided by law to the legitimate heirs, in the form of a share of the estate of the deceased. For foreigners that owns a property in Italy it is suggested to plan for inheritance with a local will, not only to made the testator's wishes more understandable and easily followed, but also to avoid controversies related to the legitimate quotas and to prevent conflicts among the heirs.

Regarding inheritance taxation, instead, there is no harmonisation between EU member states. For Italian residents the taxation will be applied on the entire estate succession, following the worldwide taxation principles. For foreign residents, instead, Italian inheritance tax will be applied exclusively on properties located in Italy at the moment of the opening of the succession, following the territorial principle.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.