One of my favourite childhood memories will always be scanning the game reserve bushveld for animals. On a bad day you could go for hours without spotting anything big or exciting. "Just another impala!" or "Is that a white zebra with black stripes or black zebra with white stripes?" we would pipe sarcastically from the back of the car as the novelty of the large herd animals had worn off hours earlier. And then, just as we were about to head back to camp, someone would catch a glimpse of an unusual outline in the long grass. Straining my eyes through the savannah I would eventually make out the silhouette of a lioness, sitting motionless, meticulously picking out her prey. As the herd inches ever closer, heads down happily grazing and completely oblivious to the pending danger, she is ready to pounce. It is all over in a flash - with the precision of an assassin, the lioness strikes, easily bringing down an older impala ewe.

The first time you witness nature's brutality close up leaves a big impression. The conversation around the campfire that night was something like "Why are there predators?" Dad would explain the need for the natural balance of the ecosystem to be maintained through the right balance between prey and predators.

Over the past five years there has been precious little talk about hedge funds. Unlike bitcoins, biotech or social media investments, hedge funds are certainly not fashionable or headline grabbing. Yet we believe that hedge funds are poised to rediscover their place in the investment ecosystem.

Hedge fund growth from 2003 to 2007

In the run-up to the credit crisis, hedge funds became increasingly popular and were often held out as the panacea for all investment objectives. Investors found favour with nimble and fast moving arbitrage funds which exploited the inefficiencies in markets created by large institutions whose transactions were often motivated by factors other than valuation or relative price attractiveness. Long-short equity funds mushroomed where the talented fund manager could identify alpha generating opportunities both on the long side and on the short side whilst hedging the market risk. The industry grew rapidly between 2003 and 2007 and in essence became a victim of its own success. Talent, by definition, should always be limited in supply but the allure of the 2 and 20 fee model (2% management fees and 20% performance fees) attracted a lot of mediocre investment managers to the industry. The size of many funds ballooned and the arbitrage opportunities dwindled and eventually evaporated as the hedge fund trading volumes dwarfed those of the institutional long-only investor. Problems were further compounded by the vast number of leveraged positions carried by the proprietary trading desks of investment banks which were promptly unwound during the credit crisis.

With hindsight it should hardly be a surprise that when the number of predators had increased so rapidly the natural balance had been distorted and it would self-correct at some point to move back towards equilibrium. In the wake of the worst financial crisis in 80 years, hedge funds experienced large outflows, many shut down altogether and much tighter regulation forced investment banks to aggressively scale down their trading desks.

Despite delivering returns consistent with their long-term objectives over recent years, sentiment towards hedge funds has remained negative. Closed-ended listed hedge funds are trading at discounts to the net asset value of the underlying assets whereas, leading up to 2007, most of these funds were trading at premiums. In many cases, the discounts to net asset value have steadily been widening as the allure of eye watering long-only equity returns have again overwhelmed the retail investor.

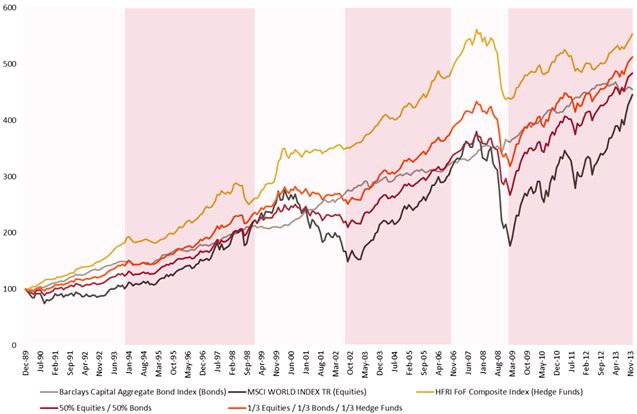

As can be seen from the chart below, over the long term hedge funds (after fees) have outperformed traditional asset classes. Similarly a portfolio with 1/3 allocated to equities, 1/3 to bonds and 1/3 to hedge funds over the last 24 years also comfortably outperformed a traditional balanced portfolio with 50% invested in equities and 50% invested in bonds.

Hedge funds still at the top of the food chain

In the above chart, we have used the HFRI Fund of Funds Composite Index as a representative benchmark for hedge funds. This is a diversified index comprising the returns of more than 500 of the largest funds of hedge funds globally. We believe that this index most closely represents the average investment returns for all investors in hedge funds over this period. Fund of fund returns are stated after all fees (both at the level of the underlying hedge funds and at the level of the funds of hedge funds) and, by using actual returns of fund of hedge funds, the various biases which sometimes impact index returns are mitigated.

The pink-shaded areas on the chart represents periods when equities have outperformed hedge funds. It is interesting to note how aggressively equities have been closing the performance gap with hedge funds in recent times. Since early 2009 equity returns have constantly trumped hedge funds. This is however the longest winning streak that equities have had over hedge funds since representative fund of hedge fund data has been available. In the same way as nature's ecosystem chips away at the edges to stay in balance, financial markets often overshoot and then undershoot as fear and greed influence investors. It is clear that the equity "herd" has flourished in recent years.

The importance of limiting losses in down markets and outperforming in trendless markets is however highlighted by the fact that although equity returns have outpaced hedge funds for more than 60% of the years since 1990, hedge funds have still outperformed equities over the full period by a healthy margin.

Don't forget about the risks

The level of returns should be put into context with the amount of risk taken to generate such returns. Diversifying into hedge funds adds value to a typical portfolio by generally boosting portfolio returns while reducing overall risk.

The ability of hedge fund managers to tactically adjust market exposures by investing long and short, and to optimise the use of cash, represents a flexible tool that can be used to help preserve capital and generate appealing returns.

Hedge funds' long-term risk-adjusted returns are compelling compared to traditional asset classes. As shown below, over time, this flexibility has produced attractive returns with lower volatility than traditional asset classes (standard deviation measures volatility). As 2008 proved, hedge funds are not immune to losses in times of market stress but they have always outperformed equity markets during major downturns. This ability to preserve capital when needed is a vital ingredient in the recipe for positive compounding of returns over a full market cycle.

So why do we feel that hedge funds are poised to rediscover their place in the investment ecosystem?

Economic and investment fundamentals were distorted by the unconventional approach taken by major central banks and governments initially to rescue the financial system during the dark days of the credit crisis and then resuscitate economic growth. As quantitative easing is withdrawn, interest rates will eventually normalise and fundamentals will again start playing a greater role in financial markets.

A well-constructed and carefully selected portfolio of arbitrage and relative value hedge fund managers can generate returns which are consistent with that of a traditional fixed income portfolio while carrying similar levels of risk. An allocation to traditional fixed income has rightfully been the cornerstone of many portfolios but with fixed income facing the headwind of rising interest rates over the next three to five years many investors are considering making an allocation to arbitrage and relative value hedge funds which would not be exposed to interest rate risk in the same manner as a traditional fixed income portfolio is. As interest rate volatility picks up, these hedge fund managers can take advantage of bonds whose prices become dislocated from fair value.

Free cash flow and cash on corporate balance sheets remain at very high levels. Whilst cash is already being returned to shareholders through higher dividends and share buy-backs, swollen corporate balance sheets may also lead to increased mergers and acquisitions. Event-driven hedge funds should do well in such an environment.

Equity long-short hedge funds can also complement an overall equity allocation, and have historically been particularly valuable when equity markets trade sideways, slightly down or heavily down. The only environment when it is not attractive to carry exposure to equity long-short funds is during a steep rising equity market and 2013 certainly fitted that category! In an increasingly uncorrelated market, opportunities to invest both long and short have increased. For example, innovation within technology provides ongoing attractive buying opportunities as the sector continues to benefit from improving content for mobile devices, network upgrades and data protection whilst also providing short opportunities from ageing business models and technologies.

We view hedge funds as a core allocation in a diversified portfolio, providing a measure of stability by offering the potential for enhanced returns while protecting on the downside. Avoiding large losses is a vital component of building wealth over time. Over the past five years the herds of grazing animals have thrived, but is the current generation of impala oblivious to the stalking eyes in the tall grass?

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.