Our second law firm survey has just been completed. 101 law firms took part in the survey including 16 of the top 20 firms. This year has seen an improvement in outlook. Two in three firms surveyed expect improvement in the sector in 2014 as opposed to two in five last year. This is particularly so for the largest firms where 88% expect an improvement in 2014. The areas of business where most improvement is anticipated are in property/conveyancing and in litigation services.

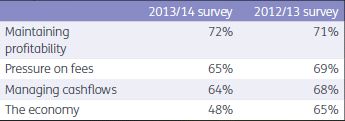

The key issues facing the sector continue to be as follows.

The key actions taken by legal firms in the previous 12 months to improve performance are as follows.

Revenues and profitability

Revenues have increased in 81% of the larger firms surveyed and in 45% of the mid-tier and smaller firms surveyed in the sector. Revenues have decreased in 26% of the firms surveyed. Profits have increased in 68% of the larger firms and in 40% of the remainder of the sector.

However fee pressures continue in the sector as almost one in three firms surveyed have seen:

- profits decrease (30% of firms surveyed)

- bad debts/bad debt provisions increase over last year (34% of the firms surveyed)

- billing rates decrease (36% of firms surveyed).

Employment in the sector

The good news for students interested in a career in law is that one in three of the firms surveyed predicts an increase in the number of trainee solicitors to be taken on by their firm over the next 12 months and that the level of qualifying solicitors being retained post qualification will increase particularly in the larger firms. At an operating level most firms have either continued to employ the same or increased numbers of full time solicitors. 81% of the top 20 firms have increased their numbers of full time solicitors. This is significantly lower in the rest of firms as only 22% have increased their full time solicitor numbers over prior year levels.

International business

The UK continues to be the most significant source of international business for the legal sector in Ireland. Almost half of all international work carried out by the firms surveyed comes from the UK. It therefore continues to be key for firms to have established relationships with UK law firms and lawyers. Europe accounts for 29% of international business and the USA accounts for 17% of international business of those surveyed. The US business is significantly higher for the larger legal firms and represents 36% of their international business. Most (75%) of the top 20 firms surveyed are increasing their efforts to attract international business.

The new personal insolvency legislation

There is significant concern in the legal sector as to whether the new personal insolvency legislation will address the debt issues of people in difficulty. 89% of the partners surveyed are either unsure or perceive that the legislation inadequately addresses the issues. The areas identified for improvement are the bank veto, the realism attached to debt forgiveness and the complexity of the legislation.

Most of the partners surveyed (61%) were of the opinion that the UK bankruptcy regime is preferable for individuals as it is quicker and more efficient. It is also fair to state that it has well defined and established procedures and operating processes with lots of case precedent and learning experience as it has been enacted for some time.

Conclusion

The legal sector appears more positive about the outlook for the sector in the next 12 months. The larger top 20 firms are more optimistic but there is a strong sense of positivity in the results of the survey across the sector. Our economy continues on the road to recovery in small steps. There has been a noticeable increase in activity in recent months which will hopefully continue. It appears that the legal sector can look forward to growth opportunities in the domestic and international markets albeit that fee pressures continue to be a feature of life in the sector for the foreseeable future.

We wish to thank most sincerely those who participated in our survey. The survey is available at: www.smith.williamson.ie/publications

We have taken great care to ensure the accuracy of this newsletter. However, the newsletter is written in general terms and you are strongly recommended to seek specific advice before taking any action based on the information it contains. No responsibility can be taken for any loss arising from action taken or refrained from on the basis of this publication. © Smith & Williamson Holdings Limited 2013. code 13/1077 exp: 31/03/2014