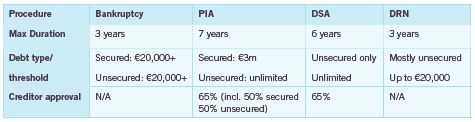

Bankruptcy

The Personal Insolvency Act 2012 represents an overhaul of bankruptcy law in Ireland.

The automatic discharge period for a bankruptcy will, once Part 4 of the Act is commenced (expected in November 2013) be reduced from 12 to 3 years, subject to earlier termination on payment of debts or discharge by creditors. To avail of the bankruptcy procedure, a debtor's debts, (secured or unsecured) will need to exceed assets by at least €20,000. Creditors owed over €20,000 will also be able to start the process. Reasonable efforts must have been made to enter into a PIA or DSA (see below) without success.

Three Types of Voluntary Arrangements

Three different types of Arrangement are now available between a debtor and his/ her creditors overseen by the Insolvency Service, namely Personal Insolvency Arrangements (PIA), Debt Settlement Arrangements (DSA) and Debt Relief Notices (DRN). The Insolvency Service officially opened for business, and began accepting applications on, 9 September 2013.

- Effect: The effect of these Arrangements is that the debtor will receive protection from initiation or continuation of proceedings from creditors specified in the Arrangement for a period between 3-7 years depending on the type of Arrangement, provided that the debtor complies with the Act's requirements and the terms of the relevant Arrangement.

- Ongoing: During the Arrangement the debtor may not obtain credit in an amount of obligations more than €650 without informing the creditor of the relevant Arrangement. Certain breaches of the Act or Arrangement are criminal offences.

- Termination: On termination the debtor will be discharged from unsecured debts in their entirety and from secured debts to the extent specified by the relevant Arrangement. On early termination, caused by breach or by six months' continuous default of payment, the debtor will be liable for the full amount of the debt covered by the Arrangement and cease to have protection from creditors.

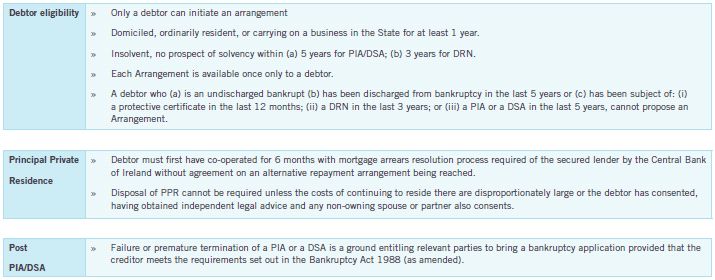

Key Themes

Procedures Applicable to PIA and DSA

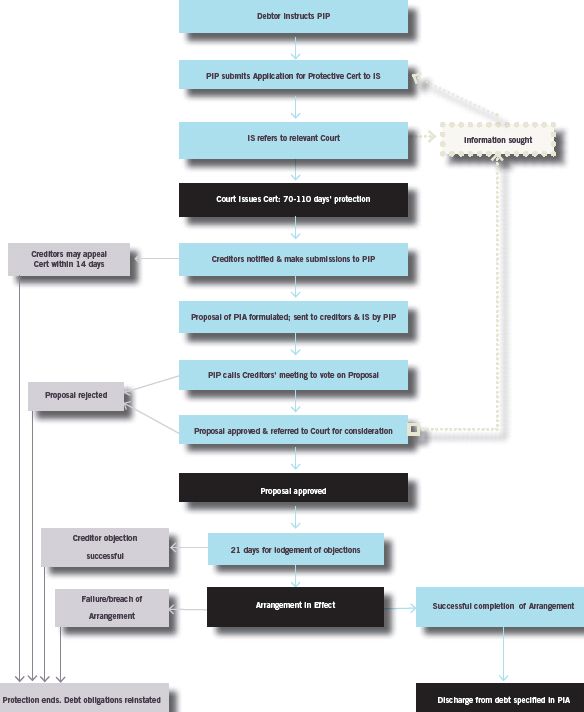

The first step in applying for an Arrangement is the debtor instructing a personal insolvency practitioner (PIP) to make an application to the Insolvency Service (IS) on the debtor's behalf. The IS may request further information. The application is then referred to the relevant Court by the IS. The relevant Court will grant a protective certificate if it is satisfied that debtor has provided all the relevant information. The protective certificate will be in force for 70 days (with possible extension of 40 days) and while in force, the issuing or continuation of proceedings against the debtor is prohibited. The first protective certificate (in respect of a DSA) was granted on 21 October 2013.

Unless a creditor successfully appeals against the protective certificate, creditors will make submissions to the PIP regarding how their debt should be treated. Once a Proposal for a PIA/DSA is formulated by the debtor in conjunction with the PIP and a protective certificate is issued, a creditors' meeting will be called by the PIP. If the Proposal is rejected, the protective certificate expires and debts are fully enforceable on their pre-Arrangement terms. If it is approved, dissenting creditors may lodge objections within 21 days on grounds of inaccuracy or omission in the information provided by the debtor; unfair prejudice against the creditor; evidence that the debtor entered into a transaction at an undervalue within the preceding 3 years, or evidence of a preferential payment to a creditor within the preceding 3 years.

The Proposal is then referred for consideration by the Court, which may request further information to be given at a hearing. If the Proposal is approved, it is entered in the PIA/ DSA register. If the debtor complies with its terms, the Arrangement will be completed successfully and debts, to the extent specified in the Arrangement, will be discharged. If the Arrangement is breached or the debtor defaults on payments for 6 months the Arrangement will fail and debts are due on their pre- Arrangement terms.

Treatment of Secured Creditors in PIA Proposals

Upon receipt of notification of the protective certificate, secured creditors may provide a valuation of the market value of security to the PIP and indicate how it wishes its security to be treated. The PIP must have regard to the preference of the creditor in formulating of the PIA.

When the PIP calls the creditors' meeting to vote on a PIA Proposal, the PIP must provide a detailed financial statement in respect of the debtor, the PIA Proposal and a report describing the outcome for creditors as compared with bankruptcy. This clearly sets the expectation that under any Proposal the treatment of any class of creditor must at least equal or improve upon the likely outcome of a bankruptcy for each such class.

The value of security for the purposes of a PIA shall be agreed between the PIP, debtor and creditor. Failing agreement on value, the PIP, the debtor and the relevant creditor shall appoint an independent expert to value the security.

If the parties do not accept the valuation of the independent expert, they shall apply to the IS to appoint an independent expert to value the property, whose decision shall be binding.

- Voting on Proposals: In order for a PIA to be approved, creditors representing at least 65% of the total market value of the debt held by creditors voting at a creditors meeting is required. Creditors holding at least 50% of the market value of the secured debt and 50% of the market value of the unsecured debt must vote in favour of the proposal. For a DSA, approval of creditors representing at least 65% of the value of the debt held by creditors voting at a creditors meeting is required. For voting purposes the value shall be the lesser of (a) the market value of the security concerned or (b) the amount of debt secured by that security on the date that the protective certificate is issued. If (a) the value of the secured creditor's security is valued at less than the secured debt due to that creditor on the date that the protective certificate is issued and (b) the PIA Proposals provides for all or part of that secured debt (the 'Relevant Portion') to be treated as an unsecured debt, then for the purposes of voting at the creditors' meeting that Relevant Portion shall be treated as unsecured. The creditor can vote as an unsecured creditor, up to the value of the Relevant Portion.

- Write-down: If, as

part of a Proposal, a secured creditor opts to retain its security

but accept a write-down of the principal secured thereby, the

reduced principal sum cannot be less than the value of the

security. The amount of that write-down must be treated as an

unsecured debt and will be subject to the write-down for unsecured

debt.

If a sale of the property subsequently realises an amount less than value attributed to the security, the balance of the debt shall be treated as unsecured and subject to the write down for unsecured debt.

If the property subsequently realises a value greater than the value attributed to the security, the secured creditor is entitled to be paid the lesser of (a) the difference between the sales proceeds and the value attributed to that property in the PIA or (b) the amount of the reduction of the principal amount as set out in the PIA. - Disposal: Where a Proposal provides for the sale of a secured property, it must, unless the secured creditor agrees otherwise contain a term which provides that the amount to be paid to the secured creditor shall be the lesser of (a) the value as determined according to the process above or (b) the amount of the debt secured by the security as of the date of the issue of the protective certificate.

PIA and DSA Procedures at a Glance

This article contains a general summary of developments and is not a complete or definitive statement of the law. Specific legal advice should be obtained where appropriate.