Introduction

Following a consultation process, the Central Bank of Ireland (the "CBoI") has introduced its Corporate Governance Code for Credit Institutions and Insurance Undertakings (the "Code") in November, 2010. The Code establishes a set of governance rules designed to ensure sufficient oversight exists and is exercised by boards of credit institutions and of insurance undertakings to minimise the effect of any future financial crises.

In this briefing we focus on the key provisions of the Code applicable to insurance undertakings in Ireland. For more detail on how to comply with the provisions of the Code, please contact Andrew Bates or David Nolan of Dillon Eustace.

At the outset it is important to note that the Code does not apply to:

(i) captive insurance undertakings;

(ii) special purpose reinsurance vehicles ("SPRVs"); or

(iii) foreign incorporated subsidiaries of an Irish insurance undertaking (the Code

recommends that such subsidiaries adopt equivalent good governance practices).

The Code will apply with effect from 1 January, 2011 and insurance undertakings will be given until 30 June, 2011 to implement any necessary changes. Where changes are required to board memberships then the CBoI shall extend the compliance period to 31 December, 2011 to allow insurance undertakings the time to identify and to assess suitable candidates.

Highlights

Main highlights of the Code are:

- the introduction of a definition of "Major Institution" with Major Institutions attracting more onerous obligations in certain areas;

- the imposition of minimum board sizes;

- the imposition of board composition requirements including requirements concerning board chairs, minimum number of independent non-executive board members, periodic board membership and individual membership reviews;

- the introduction of factors to determine "independence";

- the imposition of limitations on number of directorships that a board member may hold;

- the imposition of requirements as to role of board chair;

- the imposition of obligations on director to report to CBoI material concerns regarding corporate governance which are not addressed by board within short timeframe;

- the imposition of requirement on boards to set and adopt risk appetite for the undertaking and to review annually;

- the imposition of a annual compliance statement requirement as to compliance with the Code;

- the imposition of conflicts of interest policies.

Each of these requirements is outlined separately below.

Institution v Major Institution

In the Code, distinction is made between an "Institution" and a "Major Institution", with Major Institutions attracting more onerous obligations. A Major Institution is defined in the Code as an institution that in the CBoI's view has any or all of the following features;

(i) a significantly large presence in the local market; and/or

(ii) carries on significant international activities outside the State; and/or

(iii) is significant (including, but not limited to, by reference to size, substitutability, and reputation).

In forming a view as to whether or not an insurance undertaking is a Major Institution, the CBoI will consider the nature, scale and complexity of the insurance undertaking and will take account of any or all of the following;

(i) its business profile (e.g. whether wholesale or retail);

(ii) its asset size;

(iii) number of contracts;

(iv) the degree of risk involved in its business (e.g. involvement in riskier business such as variable annuity business) and liability;

(v) its technical provisions;

(vi) its premium income;

(vii) its capital position;

(viii) its ownership structure;

(ix) the type/class of insurance provided;

(x) the number of its employees; and

(xi) whether it is a publicly listed company, a private company or a private company that is a subsidiary of a publicly traded company.

The CBoI will notify an insurance undertaking in writing should it deem that undertaking to be a Major Institution.

Composition of the Board

The Code requires that the board of an institution be of a sufficient size and expertise to oversee adequately the operations of the institution. The minimum number of directors for an insurance institution is 5 directors, or 7 in the case of a Major Institution (see further information in the Appendix).

The board must be compiled of a majority of independent non-executive directors (this majority may include the Chairman). However in the case of insurance undertakings that are subsidiaries of groups, the majority of the board may be group non-executive directors, provided that in all cases the subsidiary institution shall have at least 2 independent nonexecutive directors (3 in the case of a Major Institution) or such greater number as is required by the CBoI. Group directors are required to act critically and independently so as to exercise objective and independent judgement.

Insurance undertakings are obliged to review board membership at least once every 3 years. Where an individual has been a member of the board for 9 years or more, that individual's membership must be reviewed and the rational for their continuance on the board must be put in writing and sent to the CBoI.

Independence

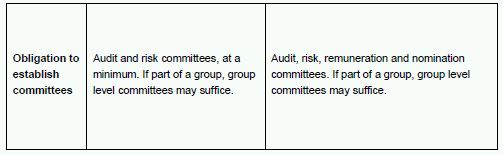

The board is required to ensure that the key control functions such as compliance, audit and risk are independent of business units and have adequate resources and authority to operate effectively.

Of note is that neither the Chairman nor CEO may be a member of the audit committee. They may attend an audit committee meeting but only on invitation and it shall be managed to ensure the independence of the committee is maintained. The board may act as the risk committee but only on the prior approval of the CBoI.

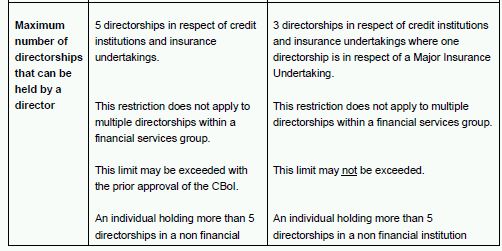

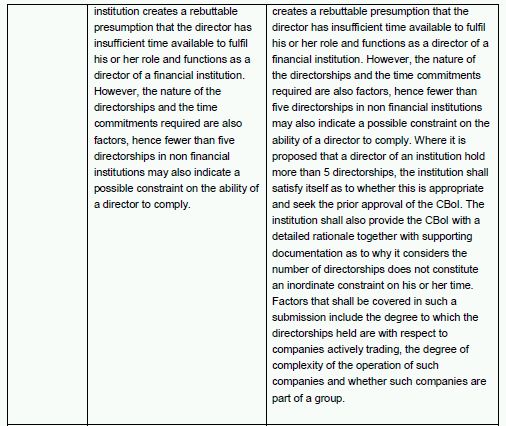

Obligations/Restrictions of Directors

A director of an insurance institution (be it a Major Institution or otherwise) will be limited in the number of directorships they may hold, as follows:

- 51 insurance institution directorships, however this limit may be increased with the prior approval of the CBoI (this limit is reduced to 3 where one of the directorships held is in a Major Institution, with no leave to have this figure extended by the CBoI);

- 8 non-financial institution directorships, however regard must be had to the time commitments given to these other directorships (this limit is reduced to 5 where one of the directorships held is in a Major Institution. These limits may be exceeded by prior CBoI approval).

Directorships held in the public interest on a voluntary and pro bono basis will not be included in calculating the number of directorships held by an individual provided such directorships do not interfere with the director's ability to fulfil properly his or her role and functions as a director of the insurance undertaking.

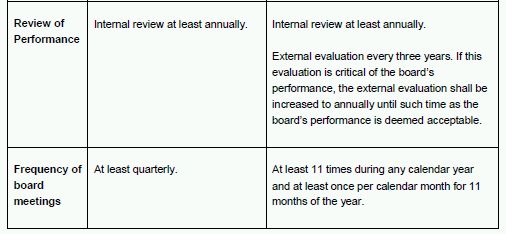

The board must satisfy themselves as to the independence of a director prior to that director's appointment. In addition, the board must review its overall performance and that of each individual director at least annually. In the case of a Major Institution, an external evaluation must be carried out every three years. If this external evaluation is critical of the board's performance, the external evaluation must then be carried out on an annual basis until such time as the board's performance is deemed acceptable. A director's attendance at each board meeting is compulsory, unless they are unable to attend due to circumstances beyond their control.

The Chairman

The role of Chairman must be separate to that of CEO. The Chairman must be an independent non-executive director (except in the case of a subsidiary where the Chairman may be a group director) and is required to seek the prior approval of the CBoI should he/she wish to take on any other directorships (other than within the group). A Chairman may not have acted as CEO, executive director or in senior management within the insurance undertaking during the previous 5 years. The Chairman shall not hold the position of Chairman or CEO of a credit institution or insurance undertaking for more than one institution at any one time. There are similar provisions applicable to CEOs.

Obligatory Reporting to the CBoI

A director with a material concern about the overall corporate governance of an insurance undertaking shall report the concern without delay to the board in the first instance and if the concern is not satisfactorily addressed by the board within 5 business days, the director shall promptly report the concern directly to the CBoI. The director is obliged to notify the CBoI of the background to the concern and any proposed remedial action. 8

Risk Appetite

The board must establish a documented risk appetite for the insurance undertaking which is subject to annual review. In the event of a material deviation from the defined risk appetite measure, the details of the deviation and of the appropriate action to remedy the deviation shall be communicated to the CBoI by the board promptly in writing and no later than 5 business days of the board becoming aware of the deviation. It should be noted that 'material' is not defined and open to interpretation.

Annual Compliance Statement

An insurance undertaking is now obliged to submit an annual compliance statement to the CBoI specifying whether the undertaking has complied with the Code during the period to which the statement relates. The first report will be for the year end 2011 and shall be submitted, with the insurance undertaking's annual report. In the event of the insurance undertaking deviating materially from the Code, the compliance report shall include a report on any material deviations, advising of the background to the breach and the actual or proposed remedial action.

Conflicts of Interest

The board shall establish a documented conflicts of interest policy for its members and where conflicts arise the board shall ensure they are noted in the minutes.

Appendix

Comparison between an Insurance Undertaking and a Major Insurance Undertaking

Footnotes

1 This restriction does not apply to multiple directorships within a financial services group.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.