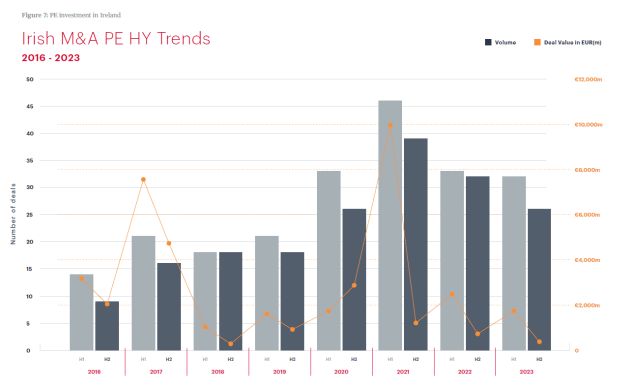

The number of M&A deals involving a PE investor decreased in 2023 with 58 transactions announced, down 11% from 2022; these were collectively worth €2.2bn, down 33% on the previous year.

It is important not to overstate the extent of the decline in terms of deal value. PE investors continue to do deals in Ireland; indeed, as Figure 7 shows, activity levels remain robust compared with the years before 2021 and 2022 (i.e. before the jump in activity in the immediate aftermath of the Covid period).

In the largest PE transaction of 2023, I Squared Capital Advisors, the US-based firm, agreed to acquire Enva Ireland, for €779m from Exponent Private Equity. Other large PE deals in 2023 included the sale of Immedis to UKG, which gave Scottish Equity Partners an exit, and the sale by KKR and Palm Capital of a portfolio of logistics properties to Ingka Investments of the Netherlands.

PE investor activity also slowed in the European and North America markets during 2023. After two years of tighter monetary policy, the industry is no longer able to raise money at ultra-low interest rates. Even where investors are sitting on substantial amounts of dry powder, this shift in the financing market has made them reluctant to accept the kind of valuations sellers got used to in 2021 and 2022. The longer-term effects of an economic downturn and the ongoing impact of inflation on business revenues have also made some buyers less eager to make new investments, and instead prioritise exits. PE investors have generally been more conservative than trade buyers on price, giving sellers some relief. Given the limited number of trade buyers, however, PE sentiment is likely to continue to weigh on the market generally.

Click on the image below to download William Fry's M&A Review for 2023

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.