Ireland boasts a very attractive tax regime for shipping operations known as the tonnage tax regime. It is designed to ensure that shipping businesses based in Ireland pay tax on a nominal profit which is based on the tonnage of a vessel as opposed to on actual profit generated by the business. When the tonnage tax regime is combined with Ireland's low corporate tax rate of 12.5%, the result is an extremely low effective rate of tax for shipping businesses located in Ireland.

The main advantages of Ireland's tonnage tax regime are:

- Possibility to determine taxable profits upfront combined with a low 12.5% corporate tax rate on such fixed profits, thereby resulting in a low effective tax rate;

- No crew training requirements;

- No requirements regarding where the ship is registered;

- No Irish flag requirements;

- No capital gains tax ("CGT") on the disposal of a ship;

- Permanent tax saving (as opposed to deferral of tax) to participating companies; and

- Profits from ship management activities also qualify i.e. there is no vessel ownership requirement on ship managers.

Requirements of the Regime

The regime only applies to qualifying companies. In order to be a qualifying company the company must first fall within the charge to Irish corporation tax. Therefore the company must be Irish tax resident or operate the shipping business through an Irish branch.

The company must also carry on a business of operating qualifying ships. A company will be treated as operating ships if it owns ships, charters in ships or manages ships. A qualifying ship is defined in the legislation as a self propelled seagoing vessel of an adequate size (100 tonnes or more) to engage in reasonable commercial operations and which complies with all requirements for navigation at sea imposed by the competent authorities of any country or territory. Fishing vessels, river ferries, dredgers and recreational vessels are excluded from the regime.

Finally the company must carry on the strategic and commercial management of those ships in Ireland. While the legislation does not contain a definition of what exactly constitutes "strategic and commercial management" of ships, the Revenue Commissioners have provided some guidance in this regard. In their view in order for a company to be considered to be carrying "strategic and commercial management" a company must demonstrate that all elements of management activity relevant to the ships in question take place in Ireland. This means that an Irish physical presence is required. The Revenue Commissioners will consider factors such as where the company is headquartered, where decisions of the board of directors are made, where the awarding of contracts occurs and whether personnel are based in Ireland or not. Matters relating to route planning, the taking of bookings for passengers or cargo, personnel management and technical management of ships are all relevant factors in determining whether the company is carrying on commercial management of the ships.

Calculation of Irish Tax

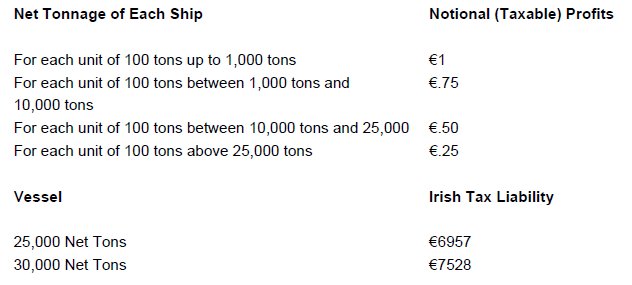

A qualifying company will be subject to Irish tax at the 12.5% corporate tax rate on notional profits calculated based on the net tonnage of the ship.

This notional profit per ship is then multiplied by the number of days the ship was operated in the accounting period by the company. The amount of the tonnage tax profits of a company for an accounting period is the aggregate of the profits determined in respect of each qualifying ship operated by the company. No deductions are allowed for capital allowances, depreciation or attributable financing costs and tonnage tax will be payable irrespective of the company's actual profits or losses. Furthermore a company cannot use losses carried forward from any period before entry into tonnage tax to reduce tonnage tax profits. The rates of tonnage tax are as follows:

The regime only applies to "relevant shipping income" as defined in the legislation. Any income earned by a shipping company which does not fall within the definition is taxable in the normal way. Relevant shipping income includes income earned from;

- Transport of passengers at sea;

- Transport of cargo at sea;

- Towage, salvage or other marine assistance;

- Transport services for services at sea (such as transport for cable laying activities);

- Provision on board a qualifying ship operated by the company of goods or services ancillary to the carriage of passengers or cargo (such as cinema, bars, restaurants and shops);

- Foreign exchange gains and forward freight agreements;

- Franchising or contracting out of such on board services whereby another person will provide such ancillary services on board a qualifying ship operated by the company;

- Income from ship related activities that are a necessary and integral part of the business of operating the company's qualifying ships (this would include income generated by the company from the loading and unloading of cargo and income earned from the moving of containers in a port area before or after a voyage;

- Income from certain lettings on charter of a ship;

- The provision of ship management services;

- Dividends from foreign shipping companies;

- Capital gains from shipping assets.

Unlike other jurisdictions the Irish tonnage tax regime imposes no ownership requirement. Ship management companies can therefore have their profits from the management of vessels taxed in the same way as ship owners. This means that international ship owners can opt to have their vessels managed by ship management companies and such companies will fall within the regime. In order for ship management services to qualify the Irish company must have possession and control of the ships in question and must have control of the management of day to day, technical, safety, training and bunkering/provisioning matters.

Election

To claim the benefits of the regime a company must make an election within 36 months beginning with the day on which the company first became a "qualifying company". A tonnage tax election has effect from the beginning of the accounting period in which it is made and remains in force for ten years. The commitment to stay in for 10 years can be renewed by election at any time in which case the period of the election is extended for a further period of 10 years from the date of this renewal election. All "qualifying companies" that are members of a group must elect into the tonnage tax regime as a group. The definition of "group" is widely drawn and is based on the concept of control. To elect into the tonnage tax regime it is necessary to submit a Tonnage Tax 1 Form along with supporting documentation to the Revenue Commissioners. A company which elects into the tonnage tax regime has the same obligations in respect of corporation tax return deadlines and preliminary tax deadlines as any other Irish resident company. To account for tonnage tax profits companies must complete a Form CT1 Supplement – Tonnage Tax Profits.

Other Taxation Advantages

In addition to the tonnage tax regime, Ireland offers a number of other tax advantages to businesses locating in Ireland.

Low Corporate Tax Rate

The most obvious advantage is one of the lowest corporation tax rates in Europe. In the event that not all a company's profits are eligible for the tonnage tax regime, the company would nonetheless still enjoy a low corporate rate of taxation of 12.5% on trading profits.

Extensive Tax Treaty Network

A company within the regime would also be able to avail of Ireland's extensive tax treaty network. Ireland currently has 48 tax treaties in force, 9 treaties which have been signed (and should come into force in 2010 or 2011) and it has concluded treaty negotiations with 10 other countries (meaning they should come into force in 2011 or 2012).

Financing of Irish Businesses

Debt financing of Irish businesses does not suffer withholding tax on interest receipts once the lenders are corporates resident in the EU or tax treaty countries or a country which has signed a tax treaty with Ireland which is not yet in force and are not lending out of their Irish office. A thin capitalisation rule applies where companies (or groups) in the tonnage tax regime seek to attribute an excessive portion of their overall debt financing to non-shipping activities. Companies are essentially prevented from artificially reducing their non-shipping profits. Furthermore there are various exemptions from Irish dividend withholding tax for dividends paid to overseas shareholders. Therefore an Irish business can be financed in a tax efficient manner either through debt or through equity.

Finance Leases

Ireland allows finance lessors to claim capital allowances in respect of their capital investments These lower lease payments can then be passed on to the shipping company.

Other Considerations

In tandem with the aforementioned tax advantages Ireland offers a straightforward ship registration process. Furthermore there are many favourable non tax factors when examining Ireland as a location for a shipping business. These include factors such as Ireland being English speaking, having a flexible labour market, being a common law jurisdiction and a long established member of the European Union. In addition the Government are focused on continually making the Irish maritime regime more attractive.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.