This briefing focuses on the enforcement of security in Ireland by way of a fixed charge receiver (an "FCR") where the secured creditor holds a fixed charge. In Ireland, broadly, there are three categories of creditor: secured, preferential and unsecured. The most common way for security to be taken is by way of a fixed or floating charge is through a debenture or mortgage.

This briefing discusses the possibility of appointing a fixed charge receiver to enable the creditor to recover amounts owing to it in priority to most other creditors, whether or not the chargor is in an insolvency/bankruptcy situation.

Order of Priority

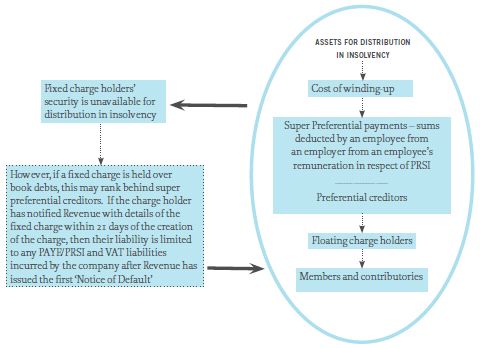

In an insolvency/bankruptcy, the property secured by way of fixed charge falls outside of the pool of assets available for distribution, together with assets held in trust, monies that must be set-off and stamp duty on monies received in the realisation of company assets. Fixed charge holders1, while they will rank behind what are known as "super-preferential creditors", will therefore rank in priority to the cost of winding-up, preferential creditors, floating charge-holders, members and contributories and can enforce their security and remain outside the winding-up process2.

|

The following are categories of preferential debts in corporate insolvency:

|

The appointment of a fixed charge receiver ("FCR") is a mechanism by which a creditor who holds a fixed charge can enforce against the secured property and recover its debt from the realisations of the secured property in priority to all other creditors.

Fixed ChargeA fixed charge is taken over a specified asset. The level of control that the chargor retains in the secured asset must be limited to avoid the fixed charge being re-characterised as a floating charge – for example, the chargor is generally restricted from disposing of, or otherwise dealing with, the asset during the term specified by the charge. Real property, equipment and shares are examples of assets usually secured by way of fixed charge. |

Where a receiver has been appointed under a floating charge and a company is not at that time being wound up, preferential debts must be paid from the proceeds received by the floating charge receiver. When a debtor has been adjudged bankrupt or is being wound up and there are insufficient assets to pay preferential creditors then such preferential creditors will be paid from any property subject to a floating charge.

Floating ChargeA floating charge is generally taken over assets that the chargor wishes to be free to use in the ordinary course of its business. Before an event of default occurs, the floating charge 'hovers' over those assets and the composition of the assets (often stock-in-trade, plant, machinery and monies) may change regularly. Once an event of default occurs, the floating charge 'crystallises', attaches to the assets and the chargor can no longer deal with those assets autonomously. A debenture from a company should ideally take a fixed charge over specific assets while taking a floating charge over all remaining assets. An individual cannot create a floating charge. |

Appointment of an FCR

Appointment under the terms of the security document

The terms of the charge document should ideally provide for the appointment of a FCR and the circumstances which will trigger the secured creditor's power to appoint a receiver (usually when an event of default has occurred and the creditor's demand for repayment has not been met). The FCR is appointed by the execution of a deed of appointment by both the secured creditor and the FCR. Once the receiver is appointed, the secured creditor must publish notice of this with 7 days and must also notify the Companies Registration Office.

Appointment under legislation

If the security document does not provide for an FCR to be appointed, or does not afford the secured creditor adequate powers, the secured creditor may seek to appoint a receiver (a "Conveyancing Act Receiver") under the Conveyancing and Law of Property Act 1881 (the "1881 Act") in respect of security entered into prior to 1 December 2009 or under the Land and Conveyancing Law Reform Act 2009 (the "2009 Act") in respect of security entered into on or after 1 December 2009. The 2009 Act repealed or amended various provisions of the 1881 Act and the Registration of Title At 1964 which has, since 2011, led to uncertainty in Ireland in relation to the ability to enforce security over primary residences comprising registered land. Further detail can be found in the Arthur Cox Finance Group Briefing "Legal Issues in Irish Residential Mortgages" which can be found here. On 28 March 2013, the Irish Government introduced draft legislation (the Land and Conveyancing Law Reform Bill 2013) designed to remedy these issues and this is expected to be signed into law over the coming months. Under the 1881 Act, the secured creditor can appoint a receiver when the secured debt has become due. Under the 2009 Act, the secured creditor can appoint a receiver where the chargor has been asked to pay the secured debt and has failed to pay all or part of that for 3 months, or where interest is unpaid for two months after becoming due, or where the chargor has breached a provision of the security document other than the covenant to pay. Where a receiver is appointed under the 1881 Act or the 2009 Act and the security document does not include receiver-related provisions, the receiver's appointment will be over the income generated from the property only and he will not have power of sale.

The National Asset Management Agency ("NAMA") also has the power to appoint what is known as a "Statutory Receiver" under the National Asset Management Agency Act 2009 (the "NAMA Act") in respect of an "acquired bank asset" (i.e. a loan and related security arrangement which it has acquired from a participating institution under the NAMA Act) once the power of sale or power to appoint a receiver in respect of the underlying security has become exercisable. Such a Statutory Receiver has the powers, rights and obligations that a receiver has under the Companies Acts, the additional powers set out in the NAMA Act and will not be subject to the restrictions on the powers of a receiver and the manner in which security can be enforced set out in the 1881 Act and in the 2009 Act.

Court Appointment

Although rare, it is also possible for any party to apply, on an ex-parte basis or on notice, to the Court to make an interlocutory order within its inherent jurisdiction to appoint a receiver. The order may be made upon such terms and conditions as the Court thinks just. Unless otherwise ordered, the receiver must first give security to account for what is received.

Powers and duties

Fixed Charge Receivers

Because both the 1881 Act and the 2009 Act give very limited powers to a receiver, a well-drafted security document over Irish property usually provides for the appointment of an FCR over a specific asset when the security becomes enforceable. The FCR should be granted wide-ranging powers, in particular power to take possession of and sell the charged property with a view to discharging amounts owing to the secured creditor.

Depending on the circumstances and the nature of the charged property, the terms of the security document may also provide for the appointment of a receiver-manager, in which case the receiver can continue to operate the business during the course of the receivership with a view to maximising the value of the charged property.

|

The Conveyancing Act Receiver must apply income generated by the property to payments in the following order:

|

Ideally, the security document will stipulate that the FCR is an agent of the borrower, rather than the secured creditor, thereby mitigating liability of the secured creditor for actions of the FCR – instead, the chargor will be liable for the FCR's actions. The alternative, in an enforcement situation, is that the secured creditor becomes a 'mortgagee in possession' (outlined below) under the terms of a security document which would have the opposite effect i.e. placing full liability to account for the income from the charged property on the secured creditor.

Conveyancing Act Receivers

Conveyancing Act Receivers are agents of the chargor. Their powers are limited to making demand for and recovering all the income to which the appointment relates, to the full extent of the estate or interest which the chargor could dispose of and the powers delegated to the Conveyancing Act Receiver under the 2009 Act must be exercised in accordance with that Act. It is common to extend the powers of a Conveyancing Act Receiver or contract out of some of the limitations on these powers in the relevant security agreement.

While a Conveyancing Act Receiver does not have sufficiently extensive powers to carry on a business and is only entitled to the income generated from the charged property, there is an obligation on the Conveyancing Act Receiver to obtain the best price reasonably obtainable so far as is reasonably practicable.

The Conveyancing Receiver may also be directed in writing by the secured creditor to insure against loss or damage by fire, flood, storm or other events commonly covered by comprehensive insurance, out of the money received, any charged property.

The residue of any money so received after making the payments in the order set out in the box (above, left) would have to be paid by the Conveyancing Act Receiver to the person who, but for the possession of the Conveyancing Act Receiver, would have been entitled to receive that money or who is otherwise entitled to the charged property.

Secured creditor going into possession

Another option available to a mortgagee is to take possession as 'mortgagee in possession' (which is not desirable from a liability perspective). However, where intervening judgment mortgages affect the charged property, the secured creditor would need to exercise its statutory power of sale and sell as 'mortgagee in possession' to 'overreach' these and sell clear of them. It is usual for the secured creditor to appoint a receiver to manage the property pending that sale, but to terminate the receiver's appointment before the sale and sell as 'mortgagee in possession'.

Traditionally, secured lenders tend to avoid the option of becoming 'a mortgagee in possession' because, once entering into possession, the secured lenders as 'a mortgagee in possession' becomes strictly liable to account for the rents and profits which he receives and also for those which he would have received but for his default or mismanagement.

Personal Insolvency Arrangements

The Personal Insolvency Act 2012 (the "2012 Act") has introduced voluntary arrangements which are designed to grant protection to debtors from certain enforcement actions while they pay back their debt. The effect of each of these new arrangements on the enforcement of security depends on the voluntary arrangement in question.

|

Debt Relief Notices (DRN) apply mostly to unsecured debts and Debt Settlement Arrangements (DSA) apply only to unsecured debts only and so would not have any effect on secured creditors; however the formulation of either a DRN or a DSA does take into account the entire debt position of the debtor. Unlike PIAs, neither DRNs nor DSAs contain express provisions on the treatment of a debtor's principal private residence. In order for a PIA to be approved, creditors representing at least 65% of the total market value of the debt held by creditors voting at a creditors meeting is required. Creditors holding at least 50% of the market value of the secured debt and 50% of the market value of the unsecured debt must vote in favour of the proposal. If the value of the secured creditor's security has decreased the secured creditor may elect that all or part of that secured debt be treated as an unsecured for so that the creditor can vote as an unsecured creditor, up to the value of that election. |

Personal Insolvency Arrangements (PIA) can be availed of in relation to secured debts of up to €3 million (and an unlimited amount of unsecured debt). Once a debtor has been successful in applying for a PIA, any legal action against the debtor, including 'taking any step to enforce the security held by the creditor' is prohibited.

While this clearly prohibits the appointment of an FCR when a PIA is already in place, there is some ambiguity in the 2012 Act on whether this prohibition is intended to catch the continuation of the appointment of an FCR in place prior to the adoption of the PIA. The 2012 Act does state that a PIA prevents a creditor from taking 'any step to prosecute legal proceedings already initiated' however it is unlikely that the term 'legal proceedings' would be defined as including the carrying out of the duties of the FCR.

Debt Write-Down

If, as part of a Proposal, a secured creditor opts to retain its security but accept a write-down the principal secured thereby, the reduced principal sum cannot be less than the value of the security. The amount of that write-down must be treated as an unsecured debt and subject to the write-down for unsecured debt.

If a sale of the property subsequently realises an amount less than value attributed to the security, the balance of the debt shall be treated as unsecured and subject to the write down for unsecured debt.

If the property subsequently realises a value greater than the value attributed to the security, the secured creditor is entitled to be paid the lesser of (a) the difference between the sales proceeds and the value attributed to that property in the PIA or (b) the amount of the reduction in the principal amount as set out in the PIA.

Summary

In conclusion, the appointment of a FCR is the most effective method of realising security and the terms of virtually all security agreements will contain the power to have one appointed. It must be borne in mind, however, that the appointment of an FCR will not always be an option for enforcement (i.e. this would not be the usual enforcement option for family homes). However while the practice of appointing FCRs has been relatively rare in Ireland in the past, it is becoming more common. Liability issues surrounding going into possession are avoided and the powers of the FCR can be more extensive and flexible than the powers granted to Conveyancing Act Receivers in order to facilitate the running of a business. While negative equity can affect the return available for unsecured creditors and floating charge holders, FCRs can assist in significant debt recovery.

Footnotes

1 Section 1001, Taxes Consolidation Act 1997, which applies only to fixed charges on the book debts of a company within the meaning of the Companies Act, 1963, states that where a fixed charge is placed over the book debts of a company, the holder of the fixed charge may become liable for the company's outstanding PAYE/PRSI or VAT liabilities.

2 Alternatively, secured creditors may waive their security and prove as an unsecured creditor in the insolvency/bankruptcy.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.