1 Legal framework

1.1 What domestic legislation governs restructuring and insolvency matters in your jurisdiction?

The most important insolvency law is the Dutch Bankruptcy Act (DBA). The DBA contains both restructuring and insolvency proceedings. In the Netherlands, there are four different types of insolvency proceedings:

- a liquidation procedure for natural persons and legal entities, aimed at the liquidation of the assets of the debtor (faillissement);

- a suspension of payments procedure, aimed at the reorganisation of the debtor (surseance van betaling);

- a debt restructuring procedure for natural persons (schuldsanering natuurlijke personen), which is not discussed further in this Q&A; and

- since 1 January 2021, a pre-insolvency scheme which is similar to a restructuring procedure known by its Dutch acronym, WHOA.

Besides the DBA, the Civil Code and the Code of Civil Procedure may apply. The DBA contains some insolvency exceptions to the regular civil procedure, mostly in relation to the deadlines and possibilities for appeal.

1.2 What international / cross-border instruments relating to restructuring and insolvency have effect in your jurisdiction?

As the Netherlands is a member of the European Union, the EU Insolvency Regulation (215/848) has direct effect in the Netherlands and applies to all insolvency proceedings opened after 26 June 2017. This regulation governs insolvency proceedings across the European Union and ensures that judgments concerning insolvency proceedings issued in the European Union are, in principle, recognised in the Netherlands without any need for a further court order (subject to certain conditions).

Moreover, as an EU member state the Netherlands is bound by the EU Restructuring Directive (2019/1023). This has been implemented into Dutch national law, most notably in the WHOA.

1.3 Do any special regimes apply in specific sectors?

A special regime applies to:

- banks;

- certain types of investment companies; and

- insurance companies.

1.4 Is the restructuring and insolvency regime in your jurisdiction perceived to be more creditor friendly or debtor friendly?

This depends on the procedure that is used:

- In a WHOA, the debtor remains in possession, so the WHOA can be considered to be more debtor friendly. However, this procedure can also be initiated by a creditor (before the debtor actually becomes insolvent). The procedure also provides for supportive measures for creditors, such as the appointment of an observer or a restructuring expert who can subsequently offer a restructuring plan.

- The bankruptcy procedure is considered to be creditor friendly. The debtor is no longer in possession and a court-appointed bankruptcy trustee takes over the management and proceeds with liquidation of its assets. Creditors also have rights to interfere by requesting the supervisory judge that the bankruptcy trustee refrain from certain actions or be ordered to perform certain actions.

- In the suspension of payments procedure, the debtor remains in possession jointly with a court-appointed administrator. Entering into new legal or business activities or ceasing activities requires the approval of both the debtor and the insolvency administrator.

1.5 How well established is the legal regime and infrastructure relevant to restructuring and insolvency in your jurisdiction (e.g. extent of recent legislative changes, availability of specialist judges / courts / advisers)?

The legal regime in the Netherlands is extremely well established. For all court-involved proceedings, the courts have a list of persons who can be appointed to serve as a liquidator or an administrator, and these persons are all very well equipped and skilled. The system also ensures that complicated insolvency procedures are handled by the most experienced liquidators. Furthermore, insolvency administrators and liquidators are monitored by supervisory judges who are specialised in insolvency law.

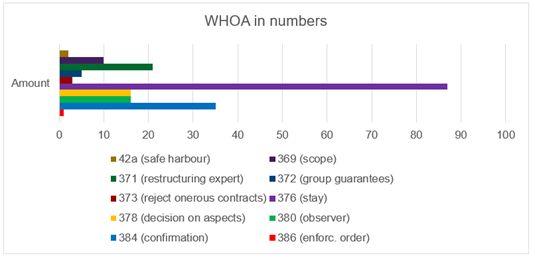

Although the WHOA is relatively new, it has developed rapidly and the legal infrastructure around it is already well established. The development of the WHOA in terms of legal proceedings is reflected in the figure below. The period covered runs from 1 January 2021 until 1 June 2023.

To summarise:

- since 1 January 2021, over 260 commencement notices have been filed with the court;

- these have resulted in more than 85 moratoriums or stays; and

- there have been 35 confirmation requests, of which about 25 have been sanctioned by the courts.

There is a selective pool of judges who are specifically equipped and educated to handle WHOAs. In addition to their legal background, they have been trained by all sorts of financial experts (eg, debt advisers, corporate finance advisers and valuators) in order to gain a better understanding of the financial aspects of the restructuring process.

The legal landscape has also evolved extremely rapidly, with many conferences, publications in academic journals and various (post-academic) courses emerging. These developments have been accelerated by the incorporation of the Dutch Restructuring Association (DRA). The DRA is instrumental to the facilitation and development of Dutch restructuring practice, ensuring that the highest and most stringent local and international quality standards are maintained. The DRA brings together all stakeholders involved in a financial restructuring in order to:

- enhance their understanding of each other's positions; and

- enable them to share and learn from their different perspectives and experiences.

More information can be found at https://vereniging-herstructurering.nl/

2 Security

2.1 What principal forms of security interest are taken over assets in your jurisdiction?

In the Netherlands, it is possible to create security over almost every type of asset (eg, tangible assets such as stock, inventory, furniture and fixtures; but also IP rights, receivables and shares), unless an asset is non-transferable. An asset can be non-transferable:

- by law;

- by contract; or

- by its nature.

Security can be created over movable and over immovable assets. Security rights over movable assets (including rights) are created in the form of a pledge. Security rights over immovable assets are created in the form of a mortgage.

In addition to the right of pledge and mortgage, it is also possible to deliver goods under a retention of title. The retention of title:

- can be broader than the payment connected to the delivered assets; and

- can exist until any debt towards the supplier is paid.

The retention of title is considered to be semi-bankruptcy proof. The delivered goods are considered to be owned by the supplier and not by the insolvent debtor, and are thus not part of the bankruptcy estate. However, in practice, the supply agreements usually provide that the retention of title lapses if a debtor (or subsequently the bankruptcy trustee) sells the goods in the ordinary course of business.

Dutch law also provides for the right to suspend the obligation to (re)deliver goods owned by the debtor, also known as the right of retention or a possessory lien. Outside of bankruptcy, such a creditor may sell the asset and use the proceeds to satisfy its claim against the debtor. In bankruptcy, the creditor retains its rights and the associated preferred ranking of its claim; but the trustee may take possession of the encumbered asset, sell it and distribute proceeds to the creditor only if any remain after satisfaction of the estate costs.

Finally, third-party guarantees play an important role. These remain in place during traditional insolvency proceedings, but a WHOA allows for the restructuring of some third-party guarantees.

2.2 How can those security interests be enforced (and what factors could complicate or prevent this process)?

Pledges and mortgages can be enforced if the debtor is in default. If a debtor is in default, the creditor with a pledge or mortgage is entitled to enforce its rights. The enforcement process will in principle take place through a sale by means of a public auction. However, it is possible to request a judge:

- to allow a different manner of sale; or

- to agree with the pledgor on an alternative enforcement sale.

The request to the judge is likely to be granted if the proceeds would be higher than those that could be realised through public auction. If granted, the sale can take place through a private and negotiated sale. The execution of a right of pledge over receivables in principle takes place through collection of the pledged receivables instead of through a public or private sale of the receivables (but the private sale of the pledged receivables is also possible). A retention of title can be executed by revindication of the assets.

In both formal insolvency proceedings and a suspension of payments, creditors with rights of pledge and/or mortgages can in principle act as if there is no insolvency or suspension of payments. However, the rights of pledge and mortgage can be restricted if a stay is declared. During a stay, a creditor is not allowed to foreclose on the encumbered assets. A creditor with a right of pledge or mortgage can ask a judge for approval to exercise its security right.

During a WHOA, a stay can also be ordered by the court. During a stay in a WHOA, the debtor can be allowed:

- to use its assets in the ordinary course of business; and

- to sell, use or dispose of assets that are encumbered by a mortgage, pledge or retention of title if such transactions are part of the ordinary course of business.

However, in such instances, the debtor may be ordered by the court to replace the lost security rights with new or alternative security rights.

3 Restructuring

3.1 Are informal workouts available in your jurisdiction? If so, what forms do they typically take, and what are the benefits and drawbacks as compared to formal restructuring proceedings?

In the situation of financial distress, the informal workout or restructuring plan usually involves multiple stakeholders – most notably the banks and/or the shareholders. The formal insolvency proceedings are then used as contingency plan or the 'plan B' scenario against which the 'plan A' scenario is being worked out.

From this perspective, the WHOA can be deemed to be both a formal and an informal workout. It essentially consists of an agreement between the debtor and all or some of its creditors and stakeholders. If all creditors ultimately agree with the negotiated restructuring plan, it is no longer necessary to present it to the court and ask to sanction the plan upon dissenting capital providers. Having the WHOA as a fallback instrument which can bind dissenting creditors can help the negotiations outside a formal WHOA procedure.

3.2 What formal restructuring proceedings are available in your jurisdiction, and what are the benefits and drawbacks of each?

The formal restructuring proceeding are the WHOA and the suspension of payments.

WHOA: The benefits of a WHOA are as follows:

- The debtor remains in possession, but supportive measures to safeguard the rights of creditors are possible.

- A stay can be declared.

- The plan can be offered only to certain creditors instead of all creditors.

- It is possible to bind dissenting creditors, including if they are preferred creditors.

- A variety of restructuring instruments can be used, such as:

-

- the suspension of interest payments;

- debt-for-equity swaps; and

- the (partial) cancellation of debts.

- It is possible to terminate contracts.

- There is an option to choose between a private or public procedure.

- There is automatic recognition of the plan in the European Union in the case of a public procedure.

- There is early access to a restructuring procedure, including its supportive measures (ie, a WHOA is possible before the debtor is insolvent).

- It can be used both as a restructuring instrument and as a controlled wind-down instrument.

The drawbacks of a WHOA are as follows:

- It is not possible to restructure employee rights or the workforce, including debts to retirement funds.

- It cannot be used by natural persons, banks or insurance companies.

Suspension of payments: The benefits of a suspension of payments are as follows:

- There is an automatic moratorium in respect of unsecured creditors.

- It is intended to enable a plan that temporarily bridges temporary liquidity problems.

- It is possible to restructure the workforce in parallel.

- It is possible to terminate some (but not all) contracts.

- It is possible to bind dissenting unsecured creditors.

- There is automatic recognition of the plan in the European Union.

The drawbacks of a suspension of payments are as follows:

- It is not possible to bind dissenting preferred creditors such as secured creditors and tax authorities to the plan.

- Only a public procedure is available.

- It is possible only if the entity is viable.

- The debtor remains partially in possession, together with the court-appointed administrator.

- It cannot be used by natural persons, banks and insurance companies.

3.3 How, by whom and on what grounds are formal restructuring proceedings initiated? What are the main preconditions for success?

A WHOA plan can be offered by the debtor or the court-appointed restructuring expert. The appointment of the restructuring expert can be requested by:

- the debtor itself;

- a creditor;

- the shareholders; or

- the works council.

The threshold for opening a WHOA is that it is reasonably likely that the debtor will be unable to continue paying its debts now or in the near future. The 'near future' can be a year in advance – for example, this may be the case if the debtor foresees that it will be unable to repay a loan that is due in a year. The WHOA can commence by the debtor filing a commencement notice with the court, following which certain court measures can be initiated (eg, the request for a stay). However, it is possible that a debtor may already have started preparing a plan before filing a commencement declaration or a request. Most judges are of the opinion that for a WHOA request to be approved, the debtor must still be able to fulfil its current obligations as they fall due.

A suspension of payments can only be initiated by the debtor. The threshold for opening a suspension of payments is that a debtor can demonstrate, to the satisfaction of the court, that it cannot continue to pay its debts as they fall due. A suspension of payments commences by filing an application with the court, signed by the debtor and its lawyer. A suspension of payments will be provisionally granted by the court immediately after filing of the application, without any material test.

3.4 What are the effects of the commencement of formal restructuring proceedings, both for the debtor and for creditors?

After the filing of a WHOA commencement notice, the debtor and creditors can both request supportive measures.

Supportive measures for a debtor may include:

- a stay, which can be a complete stay or a partial stay for specific creditors and specific actions;

- the termination of onerous contracts;

- early access to decisions on aspects of the plan, helping to create deal certainty;

- approval for the creation of new securities for new financing; and

- customised provisions.

Supportive measures for creditors may include:

- the appointment of an observer to supervise the formation of a composition plan by the debtor and to safeguard the interests of the joint creditors;

- the appointment of a restructuring expert to compose the plan and offer it to the creditors; and

- the possibility of substitute security (under certain circumstances).

After the commencement of suspension of payments proceedings, an automatic moratorium applies, meaning that attachments are suspended and unsecured creditors cannot take recourse, even when the debtor is in default. Also, requests for bankruptcy are stayed. Further, an administrator will be appointed. Any actions taken by the debtor also require the approval of the administrator.

3.5 Does a moratorium or stay apply and, if so, what is its scope? Are there exceptions?

In a WHOA, the debtor or a restructuring expert (if appointed) can request a stay. A stay allows the debtor to continue in its ordinary course of business while preparing a plan. Therefore, the debtor can use, sell or even dispose of its business assets if this is necessary for the continuance of its ordinary course of business. A stay can be ordered for a maximum period of eight months. During the stay:

- previous attachments can be lifted; and

- requests for bankruptcy are stayed.

The stay also applies to secured creditors. For example, if a pledgee has an undisclosed pledge over receivables, it cannot disclose its pledge or collect payment of those receivables during the stay.

A stay can be a complete stay or a specific stay. A complete stay is directed against all creditors (including creditors that are not included in the plan) and prohibits all creditors from taking any recourse actions. A specific stay can be directed towards a specific creditor and/or against specific recourse actions. However, if a creditor wants to take action during the stay, it may file a request to do so with the court and the court may grant this request if the conditions upon which the stay is based are no longer met.

During a suspension of payments procedure, a moratorium is automatically declared. During the moratorium:

- the debtor cannot be forced to fulfil its payment obligations against unsecured ordinary creditors; and

- all recourse actions taken by unsecured creditors are suspended.

The moratorium does not apply to secured creditors. Secured creditors can still foreclose on the collateral and take recourse on the debtor's assets.

3.6 What process do restructuring proceedings typically follow (including likely length of process and key milestones)?

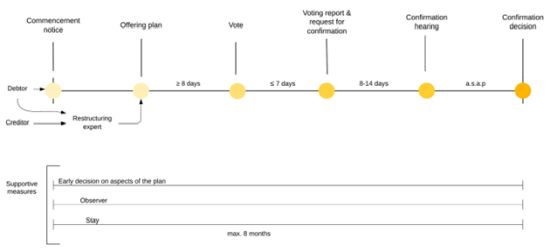

The process of the WHOA is as follows:

The formal or court-involved part of a WHOA procedure can be very short: after offering a plan, the confirmation decision can (under the best circumstances) be given within 30 days. The timeframe for preparing the plan is up to the debtor or its restructuring expert and will depend on several factors, such as:

- the information available; and

- whether valuation reports and/or other expert opinions are needed.

Also, it may be deemed reasonable to extend the term of eight days between offering a plan and the voting date if:

- the plan is more complicated; or

- the creditors:

-

- are less professional;

- are living abroad; or

- require financial and or legal advice in respect of the plan.

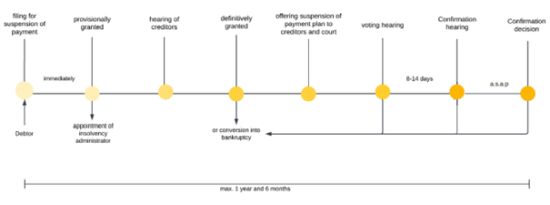

The process of the suspension of payments is as follows:

Immediately upon filing the application, the provisional suspension of payments is granted by the court and an administrator is appointed. As indicated, the administrator will be appointed and the debtor will be co-managed by the management board and the administrator – meaning that the decisions must be taken jointly. The administrator must report to the supervisory judge periodically. The supervisory judge can convert the suspension of payments into bankruptcy at any time if he or she is of the opinion that the debtor is no longer viable and will be unable to eventually resume the payment of its debts. The suspension of payments procedure can take up to a year and a half.

3.7 What are the roles, rights and responsibilities of the following stakeholders in restructuring proceedings? (a) Debtor, (b) Directors of the debtor, (c) Shareholders of the debtor, (d) Secured creditors, (e) Unsecured creditors, (f) Employees, (g) Pension creditors, (h) Insolvency officeholder (if any), (i) Court.

(a) Debtor

The debtor can initiate a WHOA procedure. The debtor can thus prepare the plan, unless a restructuring expert is appointed. After the appointment of a restructuring expert, the restructuring expert will take over the preparation of the plan (but not the management of the business or the assets; the WHOA is therefore qualified as a debtor-in-possession procedure). Even after the appointment of a restructuring expert, the debtor may offer its envisaged plan to the restructuring expert with a request to make it his or her own and allow the creditors to vote on the plan. It is also possible that both the plan proposed by the debtor and the plan proposed by the restructuring expert may be brought to a vote.

The debtor initiates a suspension of payments, in which case it is only allowed to control its assets together with the administrator.

(b) Directors of the debtor

During a WHOA, the debtor remains in possession. Therefore, the directors of the debtor remain in control and continue to manage the company and represent it in legal matters. If no restructuring expert is appointed, the directors will prepare and negotiate the plan. Directors must be more careful during a WHOA when entering into new liabilities and making payments to certain creditors, because of the enhanced directors' liability risks.

During a suspension of payments, the debtor is no longer completely in control. The directors can only continue to manage the company and represent it in legal matters together and with the approval of the insolvency administrator.

(c) Shareholders of the debtor

The rights of shareholders can be restructured through a WHOA plan and shareholders must then vote on the plan. Shareholders cannot be forced to provide new money; they may act in their own interests. Some shareholder rights from the articles of association can be set aside by the court during a WHOA – for example, new shares can be issued and shareholders can be diluted against their will, due to a debt-for-equity swap. Except in small and medium-sized enterprises (SMEs), shareholders have no right to give prior shareholder approval of the plan, which may not be withheld on unreasonable grounds. For SMEs, different rules may apply.

In a suspension of payments, shareholders do not have a specific role.

(d) Secured creditors

The rights of secured creditors can be restructured in a WHOA. If a plan restructures creditors that are 'in the money', one of the requirements for a court to approve the plan is that at least one of the consenting classes is in the money. A secured creditor is usually in the money for the secured part of the debt. Tax authorities are usually also in the money. Secured creditors can therefore play an important role in negotiations of the plan. Secured creditors can be in two classes if the expected proceeds of the collateral are less than the secured claim. The claim will then be split in two classes accordingly (bifurcation).

A suspension of payments has no effect on secured debts. Secured creditors can act as if there is no suspension of payment. They can start or continue with the execution of their security rights. It is not possible to bind secured or preferential creditors to the plan.

(e) Unsecured creditors

In WHOA proceedings, unsecured creditors that are SME creditors are in principle entitled to at least 20% of their claim (either in cash payment or in financial instruments), unless there are substantial grounds as to why this requirement cannot be met. The court will decide whether the grounds are substantial.

A suspension of payments plan can only restructure the rights of unsecured creditors or the unsecured claims of secured creditors. A plan cannot cram down secured claims without consent of the secured creditor. The threshold for the approval is that creditors representing at least half of the total amount of the claims vote in favour of the plan.

(f) Employees

A WHOA has no effect on the rights of employees. Employees, however, can initiate a WHOA through the works council (assuming that the debtor has a works council).

In a suspension of payments procedure, it is possible to terminate employment contracts with a notice period of six weeks. The payment of the wages for those six weeks are an estate debt. These wages must be paid and cannot be restructured with the plan. Moreover, overdue wages are usually preferred claims and therefore are not bound by the suspension of payments proceedings. After termination of an employment contract, the transition compensation payment which is normally required need not be paid in a suspension of payments procedure.

(g) Pension creditors

Pension fund liabilities cannot be restructured in a WHOA plan. The contribution that a company must pay to a pension fund is seen as a claim of the employees, and the WHOA cannot restructure rights and claims of employees.

(h) Insolvency officeholder (if any)

In a WHOA, the following insolvency officeholders may – separately but not jointly – be appointed by the court:

- a restructuring expert, whose task is to compose the plan and offer it to the creditors; or

- an observer, whose task is to:

-

- observe the manner in which the debtor composes the plan; and

- determine whether the rights and interests of the creditors are sufficiently safeguarded by the plan.

Either an observer or a restructuring expert is appointed; they are not appointed simultaneously. The officeholders can be appointed on the request of:

- the debtor;

- a creditor;

- a shareholder; or

- the works council.

Appointment is not mandatory. However, if no officeholder is appointed and not all classes consent to the plan and the debtor asks the court to confirm the plan, the court will appoint an observer and ask for his or her opinion before ruling on a cross-class cramdown.

In a suspension of payments, an administrator is appointed immediately after the (provisional) declaration of a suspension of payments is granted. The task of the administrator is to offer a debt restructuring plan jointly with the debtor and take into account the rights and interests of the joint creditors. A debtor is no longer allowed to enter into new liabilities without the consent and cooperation of the administrator. The administrator is overseen by a supervisory judge who can give advice and can declare a stay.

(i) The court

WHOA cases are handled by a nationwide pool of specialised judges. The court in a specific WHOA procedure is comprised of three specialised judges from this small pool, of whom at least one is from the respective local court. It is possible that the court may rule (only) on confirmation of the plan – that is, at the end of the WHOA procedure. However, in many WHOA procedures, the court plays a bigger role. Long before the confirmation stage, the debtor can request early rulings on potential deal-breakers of the plan, such as:

- the recognition and classification of claims;

- whether a creditor is a secured creditor and for which part the claim is secured;

- whether the valuation of the liquidation or reorganisation scenario is correct; and

- many more issues that might arise when composing the plan.

These rulings enable deal certainty and may resolve legal uncertainties around the plan at an early stage. Also, the court may:

- appoint an observer or restructuring expert; or

- declare a stay.

In a suspension of payments, the court declares the suspension of payments and appoints an administrator. There is also a supervisory judge who supervises the administrator and provides advice when necessary. The administrator must keep the supervisory judge informed on a regular basis. The supervisory judge can also:

- declare a stay;

- approve or decline recognition of claims; and

- ultimately confirm the plan.

3.8 Can restructuring proceedings be used to "cram down" and bind dissentient creditors to a transaction supported by other creditors? Are creditors separated into classes for the purposes of voting in the proceedings? What are the relevant voting thresholds? Is "cross-class cramdown" available?

In a WHOA, both a cramdown (of dissenting creditors) and a cross-class cramdown (of a dissenting class) are possible. In the plan, creditors and possibly involved shareholders are divided into classes. Creditors must be placed in separate classes if they cannot reasonably consult together on the plan, which is assumed when they have a different ranking in liquidation proceedings or are presented with different offers under the plan. The voting threshold is based on the financial interest in the class. A class consents with the plan if the creditors that voted in favour of the plan represent two-thirds of the total amount of the claims (or shares) in that class. Only one consenting class is needed to confirm of the plan and thus bind dissenting creditors. If the plan includes in-the-money classes, the consenting class must be an in-the-money class. If none of the classes is in-the-money, this requirement does not apply.

A suspension of payments plan can only bind unsecured creditors. A suspension of payments has no effect on:

- creditors with a preferential right; or

- secured creditors.

The unsecured creditors must file their claims for recognition. If the claims are recognised, they can be admitted to the plan. The voting threshold for confirmation is that the creditors voting in favour of the plan must represent at least half plus one of the recognised and admitted debt claim, both in number (of creditors) and in claim amount. Once the plan is confirmed, it binds all creditors against which the suspension of payments has effect, including unsecured creditors that:

- have not filed their claim; or

- have voted against the plan.

3.9 Can restructuring proceedings be used to compromise secured debt?

In a WHOA, this is possible. All debt instruments can be restructured by the plan and can also be crammed down.

In a suspension of payments procedure, this is not possible. The suspension of payments has no effect on secured debts. However, if a secured creditor accidentally files its secured claim for recognition, it will be included in the procedure. The suspension of payments will then have effect on that specific claim.

3.10 Can contracts / leases be disclaimed or otherwise addressed through restructuring proceedings?

In a WHOA, all contracts – except for employment contracts – can be amended or terminated. A debtor can propose the amendment or termination to the counterparty of the contract. If the counterparty does not agree with the proposal, the debtor can terminate the contract unilaterally by a request to the court when requesting confirmation of the plan. The court can approve the termination only if the court confirms the plan. After the early termination, the counterparty has the right to claim compensation of damages incurred by the early termination. In anticipation thereof, the debtor can restructure that compensation claim in the plan.

In a suspension of payments procedure, lease agreements and employment contracts can be terminated, subject to a notice period of respectively three months or six weeks. They can be terminated only by the debtor together with its administrator, and not by a creditor solely on the basis of the suspension of payments. The wages and rent of that notice period are an estate debt that must be paid, but no further compensation need be paid.

3.11 Can liabilities of third parties (e.g. guarantors) be released through restructuring proceedings?

The WHOA provides for the possibility to restructure a group of companies and thus to release or amend the joint and several liabilities of other corporate entities within the same group. Besides a group restructuring, it is also possible to restructure the recourse claims and/or subrogation claims of a guarantor or surety. For example, if a surety is provided for a debt and that secured debt is restructured under a plan, the debtor need not pay more than the amount offered under the plan to either the creditor or the surety. Hence, even if the surety (partially) pays the secured creditor after enactment of the plan, the combined claims of the creditor and the surety against the main debtor can never amount to more than what is offered under the plan.

The suspension of payments has no positive effect on guarantors or on joint and several debtors. A release from third-party liabilities is therefore not possible.

3.12 Is any protection and/or priority afforded to the providers of new money in the context of restructuring proceedings (i.e. is "DIP financing" available)?

There is no statutory super-priority possible for providers of new money in Dutch restructurings, although it is occasionally arranged contractually. Statutory law provides a basis for protection from avoidance actions against security rights vested for debtor-in-possession financing during WHOA proceedings should bankruptcy proceedings follow. To enjoy such protection from avoidance actions, the debtor must request the approval of the court.

3.13 How do restructuring proceedings conclude?

Once the confirmation decision of the plan is final and conclusive, the WHOA is concluded. A WHOA can also end if the court, a restructuring expert or an observer is of the opinion that it is no longer possible to compose a plan that will be accepted by the creditors and/or can be confirmed by a court. In this scenario, it is likely that the debtor will subsequently be declared bankrupt.

A suspension of payments is concluded once the confirmation decision of the plan becomes final and conclusive. A suspension of payments proceeding can also end by converting the suspension of payments into a bankruptcy procedure.

4 Insolvency

4.1 What types of insolvency proceeding are available in your jurisdiction, and what are the benefits and drawbacks of each?

The Dutch Bankruptcy Act (DBA) contains multiple procedures:

- the bankruptcy procedure;

- the suspension of payments procedure;

- the WHOA; and

- a procedure for natural persons, which is not discussed further in this Q&A.

In principle, the suspension of payments and the WHOA are aimed at restructuring the debts and reorganising the company (see question 3).

The bankruptcy procedure is aimed at liquidating the assets of the debtor. This can be done through either:

- the sale of individual assets; or

- a restart of the company.

The benefits of the bankruptcy procedure are as follows:

- It is creditor friendly.

- The bankruptcy trustee also investigates probable fraud.

- It can be used to restructure the workforce.

- There is automatic recognition in the European Union.

The drawbacks of the bankruptcy procedure include the following:

- There is a risk of directors' liability.

- Secured creditors can act as if there is no bankruptcy procedure.

- There may be problems with empty bankruptcy estates (that is, when there are insufficient funds to pay the estate creditors).

- The bankruptcy trustee has no right to terminate contracts other than employment contracts and lease agreements.

4.2 How, by whom and on what grounds are insolvency proceedings initiated? Can the instigating party (or any other parties) select the identity of the relevant insolvency officeholder?

A bankruptcy procedure can be initiated by either:

- the debtor; or

- any creditor that remains unpaid or has reasonable grounds to fear that it will be left unpaid.

The threshold for commencing a bankruptcy procedure is that the debtor has ceased to pay its debts as they fall due. To demonstrate this, there must be multiple creditors, of which at least one has a debt that is due and payable which remains unpaid. If a creditor files for bankruptcy, it must substantiate the claim that the debtor has ceased to pay by showing that there is at least another claim of another creditor which remains unpaid.

4.3 What are the effects of the commencement of insolvency proceedings, both for the debtor and for creditors?

After a debtor is declared bankrupt, a bankruptcy trustee and a supervisory judge are appointed. The bankruptcy trustee takes over the administration and liquidation of the assets of the debtor. The supervisory judge:

- advises and supervises the bankruptcy trustee; and

- can declare a stay or rule regarding other supportive measures.

The bankruptcy procedure can be considered as a general attachment over the assets of the bankruptcy estate. All previous attachments are automatically cancelled after the commencement of the bankruptcy procedure. After commencement of the bankruptcy procedure, the bankruptcy estate is fixed. The bankruptcy proceedings commence with retroactive effect at midnight on the date of the bankruptcy order. After the commencement of the bankruptcy procedure, the bankruptcy trustee has the exclusive right to legally dispose of and administer the property, rights and interests of the debtor. The directors of the debtor remain in place and may represent the debtor in other matters. As regards shares in subsidiaries, the trustee controls those in matters pertaining to the monetary interest of the estate in those shares.

During the bankruptcy procedure, secured creditors can act as if there is no bankruptcy. They can start or continue the enforcement of their security rights. The trustee may set a reasonable timeframe for the secured creditors to do so.

4.4 Does a moratorium or stay apply and, if so, what is its scope? Are there exceptions?

Creditors with admissible claims in the bankruptcy can only submit those claims to the trustee. Creditors with estate claims can still (try to) enforce their claims against the estate.

Moreover, a special moratorium or cooling-down period may be invoked to temporarily suspend parties with proprietary interests from taking action, such as:

- creditors with in rem security rights; and

- suppliers invoking their retention of title.

This allows the trustee to gain a better understanding of the estate. The stay can be applied by the supervisory judge at the request of the bankruptcy trustee or an affected party. A stay can be applied for a maximum period of four months. In general, a stay is applied simultaneously with the bankruptcy order. During a stay, creditors or third parties cannot take recovery actions towards the assets of the bankruptcy estate.

4.5 What process do insolvency proceedings typically follow (including likely length of process and key milestones)?

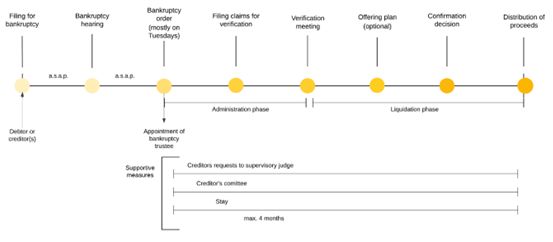

The bankruptcy procedure progresses as outlined below:

The above timeline represents the key milestones and the order as stated in the DBA. In practice, however, most bankruptcy procedures do not follow this order; instead, the trustee starts with liquidation directly after his or her appointment. The liquidation of assets can take place through:

- a public sale of the individual assets; or

- more commonly, a sale of the company of the debtor via a restart.

In practice, the trustee:

- liquidates the assets; and

- then, depending on the amounts available in the estate, either:

-

- satisfies the estate claims as far as possible and end the bankruptcy procedure; or

- commences proceedings for the admission of ordinary (pre-insolvency) claims.

In many bankruptcies, the proceeds are insufficient to cover the costs of the estate and the bankruptcy ends prematurely. If the proceeds are sufficient to cover the estate costs, the verification meeting is a crucial step in the process, at which:

- claims are either admitted or disputed; and

- a plan in bankruptcy may be offered by the debtor.

A bankruptcy can end through the division of proceeds through a bankruptcy plan; but most bankruptcies end with the pro rata distribution of the proceeds according to Articles 3:277 and following of the Civil Code.

Usually, a bankruptcy procedure can take from between a year and a half to up to four years. If a bankruptcy is more complicated due to legal procedures and/or if there is more money in the estate, it can take even longer than four years.

4.6 What are the respective roles, rights and responsibilities of the following stakeholders during the insolvency proceedings? (a) Debtor, (b) Directors of the debtor, (c) Shareholders of the debtor, (d) Secured creditors, (e) Unsecured creditors, (f) Administrator, (g) Employees, (h) Pension creditors, (i) Insolvency officeholder, (j) Court.

(a) Debtor

The debtor can initiate the bankruptcy procedure. A bankruptcy trustee is appointed with the bankruptcy order. The bankruptcy trustee takes over the administration and liquidation of the bankruptcy estate. The debtor loses its rights to dispose of and administer its property, rights and interests.

(b) Directors of the debtor

The directors of the debtor can file for bankruptcy. After the commencement of the bankruptcy procedure, the directors remain in place but lose the right to represent, administrate and dispose of assets from the bankruptcy estate. They can still represent the debtor:

- in matters that do not involve the bankruptcy estate; and

- in matters against the bankruptcy estate.

The directors must cooperate with the bankruptcy trustee – for example, by:

- handing over the administration; and

- providing the trustee with information.

Under some circumstances, directors can be held liable by the bankruptcy trustee for causing the bankruptcy for the shortages in the bankruptcy estate.

(c) Shareholders of the debtor

A decision by a company to apply for its own bankruptcy usually requires the approval of the shareholders. After the commencement of the bankruptcy procedure, the shareholders remain in place but have no direct role. They cannot be forced to provide new money and can act in their own interests. They can still make shareholders' resolutions; however, these cannot be detrimental to the creditors. If the shareholders have provided money to the debtor in the form of a loan, they will be treated in the same way as any other creditors.

(d) Secured creditors

During the bankruptcy procedure, secured creditors can act as if there is no bankruptcy procedure taking place. They can enforce their security rights in the regular fashion. However, if they do not act expeditiously, the bankruptcy trustee can set a reasonable timeframe within which they must enforce their security rights. If a secured creditor does not sell the secured assets within that period, the bankruptcy trustee can sell those assets himself or herself. The secured creditor will still have a claim on the proceeds, but this is a preferential claim that is admissible in the bankruptcy and is paid after the estate costs are paid. In practice, secured creditors often coordinate their liquidation with the bankruptcy trustee. Often, the bankruptcy trustee can sell the debtor's company as a going concern; in that transaction, he or she also represents the secured creditor, which formally forecloses on the collateral through the execution of the going-concern sale. The bankruptcy trustee is then compensated for his or her work by the secured creditor through a payment in the bankruptcy estate.

(e) Unsecured creditors

Unsecured creditors have no specific role in the bankruptcy procedure. They may request the supervisory judge to order or prohibit the bankruptcy trustee to take certain actions. Unsecured creditors can expect a payment on their claim of, on average, approximately 5% in a regular bankruptcy procedure.

Sometimes, a creditors' committee is established. This committee will receive (nearly) all information regarding the bankruptcy estate and will advise the bankruptcy trustee. This committee can be comprised of both secured and unsecured creditors.

(f) Administrator

A bankruptcy trustee is appointed once the court commences the bankruptcy procedure. The bankruptcy trustee takes over the administration and liquidation of the bankruptcy estate. The bankruptcy trustee is responsible for ensuring that the bankruptcy procedure is handled correctly and has a duty to act in the best interests of the joint creditors. The payment of the bankruptcy trustee is determined by the court. The claim of a bankruptcy trustee is an estate debt which must be paid before all other creditors.

(g) Employees

Employment contracts can be terminated during a bankruptcy procedure with a notice period of six weeks. The employment wages for that notice period constitute an estate debt. The payment of those wages is taken over by the Employee Insurance Agency, which then becomes an estate creditor. Transition compensation payments need not be paid if the employment contracts are terminated pursuant to the DBA. Other claims of employees are largely preferential claims (eg, unpaid wages from before the commencement of the bankruptcy procedure).

Also, the Transfer of Undertakings Act, which normally applies to companies established in the European Union, does not apply if a company restarts through a bankruptcy.

(h) Pension creditors

If a debtor, before it becomes bankrupt, can no longer pay its pension contributions, it must report this to the tax authorities and the pension creditor. The Employee Insurance Agency then takes over the payment obligations towards the pension creditor for a maximum period of one year. If the debtor fails to report its inability accordingly, its directors may be held personally liable for the unpaid contribution. During the bankruptcy procedure, pension creditors have no real role. Unpaid pension contribution up to a year before bankruptcy constitute preferential admissible claims.

(i) Insolvency officeholder

The insolvency officeholder is the bankruptcy trustee as described in question 4.6(f).

(j) The court

The court declares the bankruptcy and appoints the bankruptcy trustee and its supervisory judge. The court also can play a role in procedures regarding the admissibility of claims.

4.7 What is the process for filing claims in the insolvency proceedings?

After a debtor is declared bankrupt, the creditors can file their claims to be recognised or admitted by the bankruptcy trustee. The bankruptcy trustee reviews the claims and will admit or dispute them. If a claim is disputed, the supervisory judge will try to arrange a settlement between the creditor and the bankruptcy trustee. If no settlement is reached, the supervisory judge will refer the dispute to court for a procedure on the admissibility of the claim. The court will then decide whether the claim should be admitted.

In a Dutch bankruptcy procedure, there are three types of claims:

- admissible claims;

- non-admissible claims that are not estate claims; and

- estate claims.

A claim can be admitted if it originated:

- before the commencement of the bankruptcy; or

- directly from a legal relationship that existed on the date of commencement of the bankruptcy procedure.

If a claim originates from a later date, it can be either:

- a claim that cannot be admitted; or

- an estate debt. A claim is an estate debt if:

-

- it is stated as such by law (eg, rent and wages for a limited period after opening of the bankruptcy);

- the bankruptcy trustee has (willingly) entered into a liability (eg, a contract in which the trustee engages); or

- it results from actions by the bankruptcy trustee that are in breach of the obligations that bind him or her in his or her capacity as trustee (eg, the inadvertently sale of assets that do not belong to the estate).

4.8 How are claims ranked in the insolvency proceedings? Do any claims have "super priority" and is there scope for subordination by operation of law (e.g. equitable subordination)?

Claims can be divided into the following types:

- Estate debts are claims arising during the bankruptcy procedure – for example:

-

- the wages of the bankruptcy trustee;

- payments for a valuation report;

- employment wages for six weeks (but only after termination of the employment contract); and

- rent for three months (but only after termination of the lease agreement).

- If the proceeds of the bankruptcy are insufficient to cover the estate debts, these debts are also paid according to ranking:

-

- The wages of the bankruptcy trustee are paid first;

- These are followed by any preferential estate claims, such as employees' wages; and

- Finally, ordinary estate debts such as rent and payments due under other contracts are paid.

- Secured claims do not fall within the normal ranking of claims, as secured creditors may take recourse from the proceeds of the encumbered assets outside of the insolvency proceedings. The only exception are those rare creditors with priorities over secured creditors, such as the tax authorities with regarding to some specific assets.

- Preferential admissible claims are then paid – for example:

-

- claims of the tax authorities; and

- claims of creditors with a preferential right on a specific asset (including creditors with a right of retention).

- Non-preferential claims are then paid – for example:

-

- claims of trade creditors; and

- the remaining claims of secured creditors for that part of their claim which is unsecured.

- Non-admissible claims are not paid in the bankruptcy, such as interest on admissible claims following the commencement of bankruptcy proceedings. If any proceeds are left after payment of the above claims, non-admissible claims will be paid after conclusion of the bankruptcy procedure.

4.9 What is the effect of insolvency proceedings on existing contracts? Is the counterparty free to terminate? Can they be disclaimed?

The bankruptcy procedure has no direct effect on existing contracts. Neither the bankruptcy trustee nor counterparties of the debtor can terminate contracts due to the bankruptcy procedure. Contracts can only be terminated:

- in the manner as described in the contract; or

- based on statutory powers to do so.

In the case of lease agreements and employment contracts, the bankruptcy procedure entitles either the bankruptcy trustee or the counterparty to terminate the agreement or contract if the debtor is the tenant or the employer, but not if it is the landlord or an employee. For other types of contracts, the counterparty may find sufficient powers in either the contract or statutory law to terminate the contract due to the debtor's bankruptcy and the implied insecurity about further performance.

If the obligations under a contract have not been fully performed by both parties when the bankruptcy is opened, the counterparty may request the bankruptcy trustee to provide clarity on whether the obligations under the contract will be performed. If the bankruptcy trustee affirms that the estate will perform, the debts under the contract become estate debts and the trustee is then obliged to provide security for those debts. If the bankruptcy trustee fails to respond to the counterparty within reasonable time, he or she loses his or her right to claim performance from the counterparty.

4.10 Can transactions entered into by the debtor prior to be insolvency be challenged and set aside? What are the relevant grounds / look-back periods / defences?

The DBA contains two avoidance actions for the bankruptcy trustee to challenge transactions that took place prior to the opening of bankruptcy proceedings:

- avoidance of non-obligatory legal acts, such as:

-

- the payment of a debt that was not due; or

- the grant of (new) security rights without a legal obligation to do so; and

- avoidance of obligatory legal acts, such as:

-

- the payment of a due debt; and

- the grant of new security rights pursuant to a contractual obligation to do so.

Non-obligatory legal acts can be avoided if both the debtor and the counterparty knew or should have known that the action would be detrimental to the creditors. The DBA contains an evidentiary presumption for non-obligatory legal acts that:

- took place less than one year prior to the bankruptcy; and

- either:

-

- were made between related (legal) persons;

- granted security rights for a debt that was not due; or

- were at an undervalue.

For legal acts that were for no consideration:

- the counterparty need not have known of the detriment to creditors; and

- the debtor's knowledge is presumed if the transaction occurred less than a year before opening of the bankruptcy proceedings.

An obligatory legal act can be nullified only if:

- it prejudiced the creditors; and

- the creditor:

-

- (subjectively) knew that the bankruptcy request had been filed; or

- colluded with the debtor to the detriment of the other creditors. Based on case law, such collusion may be assumed to exist between companies that have the same director.

4.11 How do the insolvency proceedings conclude? Can any liabilities survive the insolvency proceedings?

The bankruptcy procedure may end:

- if the judgment opening the bankruptcy procedure is reversed on appeal;

- prematurely, if the proceeds of the estate are insufficient to cover the estate debts. In this case, the liabilities technically continue to exist, but (assuming that the debtor is a company) the debtor is dissolved, so it no longer exists;

- after final distribution of the proceeds or once the approval of a plan is final and conclusive; or

- after full payment of all creditors.

5 Cross-border / Groups

5.1 Can foreign debtors avail of the restructuring and insolvency regime in your jurisdiction?

Both the private and public procedure of the WHOA are available for foreign debtors if:

- either the debtor or one of its creditors (the requesting creditor) has its habitual residence or its statutory seat in the Netherlands; or

- a 'sufficient connection' with the Netherlands can be established.

For debtors located in the EU the public procedure of the WHOA is also available if the jurisdiction can be based on the centre of main interests (COMI) of the debtor (based on the concept of the COMI from the EU Insolvency Regulation) and the COMI is located in the Netherlands. An advantage of opting for the public procedure whereby the jurisdiction of a Dutch court is based on the EU Insolvency Regulation is that the plan is automatically recognized in the EU. If the jurisdiction of a Dutch court is not (or cannot be) based on the EU Insolvency Regulation (for example, because the COMI is not located in the Netherlands), the debtor can still opt for the public procedure if one of the above requirements is met. However, such plan is not automatically recognized in the EU.

The suspension of payments or bankruptcy procedure is only available for debtors with a statutory seat or an office in the Netherlands.

5.2 Has the UNCITRAL Model Law on Cross Border Insolvency or the UNCITRAL Model Law on Recognition and Enforcement of Insolvency-Related Judgments been adopted or is it under consideration in your country?

The Netherlands has not adopted:

- the UNCITRAL Model Law on Cross Border Insolvency; or

- the Model Law on Recognition and Enforcement of Insolvency-Related Judgments.

Both are under consideration as part of legislative initiatives to adopt further provisions on international insolvency law. The EU Insolvency Regulation (2015/848) applies directly in the Netherlands.

5.3 Under what conditions will the courts in your jurisdiction recognise and/or give effect to foreign insolvency or restructuring proceedings or otherwise grant assistance in the context of such proceedings?

The EU Insolvency Regulation applies to European matters. It ensures the automatic recognition of insolvency proceedings within the European Union and sets out rules on the recognition of rights and powers of bankruptcy trustees.

Foreign (non-European) insolvency proceedings can be recognised by a judge in the Netherlands if the following requirements are met:

- The jurisdiction of the court that rendered the judgment was based on rules for establishing jurisdiction that are generally accepted by international standards;

- The foreign judgment was rendered in a judicial proceeding that meets the requirements of due process and has sufficient safeguards;

- Recognition of the foreign judgment is not contrary to Dutch public order; and

- The foreign decision is not incompatible with an earlier decision:

-

- given by a Dutch or foreign court between the same parties;

- concerning the same subject matter; and

- based on the same cause of action.

Recognition of the rights and powers of a foreign (non-European) bankruptcy trustee or insolvency trustee takes place through the territorial principle, which has been heavily mitigated by case law over the last years. According to this principle, assets located in the Netherlands do not automatically fall under the bankruptcy attachment, but do fall under the bankruptcy estate. A bankruptcy trustee is therefore allowed to liquidate the assets located in the Netherlands, but must respect potential attachments on the assets by creditors. Also, the liquidation should take place according to the rules on liquidation under Dutch law. A stay declared in a foreign country has no effect on the assets located in the Netherlands. This mitigated recognition of foreign proceedings has been shown to be sufficient for other countries that recognise foreign insolvency proceedings based on mutuality to recognise Dutch insolvency proceedings.

5.4 To what extent will the courts cooperate with their counterparts in other jurisdictions in the case of cross-border insolvency or restructuring proceedings?

There are no rules governing such cooperation under Dutch law. The willingness to cooperate will depend on the individual circumstances. A Dutch bankruptcy trustee and its supervisory judge must act in accordance with the best interests of the joint creditors. It will depend on the circumstances whether it is in the best interests of the joint creditors to cooperate with foreign courts or foreign insolvency administrators. Courts and judges are generally willing to cooperate with foreign courts. Where the EU Insolvency Regulation applies, the Dutch courts are obliged to cooperate with foreign courts and will do so accordingly.

5.5 How are corporate groups treated in the context of restructuring and insolvency proceedings? If there is no concept of a group proceeding (or consolidation), is there any regime through which insolvency officeholders must / may cooperate?

There is no special bankruptcy regime for groups set out in the Dutch Bankruptcy Act. In practice, this means that each of the different entities of the group must file for bankruptcy or suspension of payments separately. It is customary to describe the structure of the group in the petition. Courts are then likely to appoint the same insolvency or bankruptcy trustee(s) for all debtors. However, the assets should in principle be liquidated per debtor separately and the proceeds divided among the creditors of that individual debtor. If the group consists of entities organised and existing under the laws of different EU member states, it is possible to request the opening of a group coordination procedure pursuant to the EU Insolvency Regulation.

In a WHOA procedure, it is possible to restructure the debts of group entities if the following conditions are met:

- The individual debtors are considered to be a group according to the conditions of Article 2:24b of the Civil Code;

- The debtors are jointly and severally liable for the debts of the creditors whose rights are to be amended;

- All debtors meet the threshold for entering into a WHOA (as described in question 3.3);

- All debtors have agreed to the composition plan or the plan is composed by a restructuring expert; and

- The Dutch courts have jurisdiction over all individual debtors based on the rules for jurisdiction of the WHOA.

In practice, group restructurings often also take place in formally independent but strongly coordinated restructuring proceedings. Regularly, a single coordinated document functions as formally separate plans for multiple legal entities.

5.6 Is your country considering adoption of the UNCITRAL Model Law on Enterprise Group Insolvency?

The UNCITRAL Model Laws have not been adopted in the Netherlands and the Dutch government is not considering adopting them. Most authors in legal literature are in favour of adopting the model laws; but unfortunately, the Dutch government has not put this on the political agenda.

5.7 How is the debtor's centre of main interests determined in your jurisdiction?

The debtor's centre of main interests (COMI) is determined on the basis of the EU Insolvency Regulation (2015/848). According to this regulation, the COMI is determined as the place:

- where the debtor habitually manages its interests; and

- which is recognisable as such to third parties.

The presumption is that the COMI is the place where the debtor has its registered office. This presumption can be rebutted if, after a comprehensive assessment of all relevant factors, it can be established that the debtor's actual COMI is located in another country. Relevant factors for this rebuttal can include:

- the location of the management;

- the location of the debtor's central administration; and

- the location of a major part of the debtor's assets.

5.8 How are foreign creditors treated in restructuring and insolvency proceedings in your jurisdiction?

The form and timeframe for filing claims are the same for foreign creditors as for Dutch creditors (as described in question 4.7). The bankruptcy trustee will notify the creditors to file their claims within a certain timeframe. If a creditor is located outside of the Netherlands and the bankruptcy trustee knows or suspects that the creditor does not speak Dutch, he or she can correspond with the creditor in English.

6 Liability risk

6.1 What duties do the directors of the debtor have when the company is in the "zone of insolvency" (or actually insolvent)? Do they have an obligation to commence insolvency proceedings at any particular time?

In the Netherlands, directors have no legal obligation to file for bankruptcy. However, in the period where bankruptcy is foreseeable, directors must take extra precautions. During this period, it is recommended that directors document their decisions extra carefully – most notably, to ensure that decisions pertaining to the payment of (part of) the creditors will not be annulled as selective payments in the event of bankruptcy (as described in question 4.10). Directors must also take extra precautions when entering into new liabilities. If a director knows or should reasonably know, at the moment of entering into new liabilities, that the company will be unable to meet its obligations and will not offer recourse for the damages that creditors may suffer as a result, the company should not enter into these new liabilities.

6.2 Are there any circumstances in which the directors could incur personal liability in the context of a debtor's insolvency?

In principle, directors of a company incorporated under Dutch law are not personally liable for obligations of the company (the corporate veil). However, directors can be held liable based on the following grounds:

- Liability towards the debtor: Directors can be severally liable towards the debtor for improper management. 'Improper' means clearly negligent and insufficient. For this liability to arise, it must be possible to attribute sufficiently serious reproach to the directors. The liability is in principle a 'collective liability', in the sense that directors are held liable jointly and severally for each breach. An individual director may exonerate himself or herself by proving that:

-

- the act or omission is not attributable to him or her; and

- he or she has not neglected his or her duty to take measures to avert the consequences of such act or omission.

- Liability for the deficit in the bankruptcy estate (this can only be claimed by the bankruptcy trustee): Directors can be held severally liable if:

-

- they performed their duties in an obviously improper manner; and

- this was a major cause of the debtor going bankrupt.

- If the accounting obligations have not been met, it is established that the directors performed their duties in an improper manner and it is presumed that this was a major cause for the bankruptcy. This liability is also a collective liability and the same rules for the exoneration of individual directors apply.

- Liability towards third parties based on tort: Directors can be personally liable on the basis of tort if:

-

- a wrongful act is attributable to the director; and

- it is possible to attribute serious blame to the director for that wrongful act.

- A director can, for example, be held liable on the basis of tort if he or she entered into new liabilities during the 'zone of insolvency' (see question 6.1).

6.3 Is there any scope for any other party to incur liability in the context of a debtor's insolvency (e.g. lender or shareholder liability)?

Shareholders can be held liable in certain circumstances. The basis for liability is:

- tort; or

- irresponsible dividend payments.

Liability on the basis of tort mostly arises in a group structure where the shareholder is the (grand)parent entity. With this liability, a correlation exists between the level of involvement of the shareholder and its liability. If a shareholder interferes intensely and/or structurally with the policy and strategy of its subsidiary, it may have a duty of care towards the creditors of its subsidiary. This may be the case, for example, if the shareholder created the appearance of creditworthiness of the subsidiary. It may also be the case that the shareholder created a group structure in which:

- a subsidiary is consistently loss-making and all profits and assets are in another entity or are pledged to a related entity; and

- this structure is not transparent to the creditors and the creditors are not informed of this structure.

Liability is not limited to these examples, but these are the most common.

The shareholders can also be liable for irresponsible dividend payments. A dividend payment is 'irresponsible' if the shareholder knew or reasonably should have foreseen that the debtor would be unable to continue paying its due debts after the payment. A shareholder is at most liable for the received amount.

7 The Covid-19 pandemic

7.1 Did your country make any changes to its restructuring or insolvency laws in response to the Covid-19 pandemic? If so, what changes were made, what is their effect and are they temporary or permanent?

On 1 January 2021, the WHOA entered into force.

During the COVID-19 pandemic, it was possible to hold shareholders' meetings through videoconferencing or audioconferencing. This change has now been made permanent.

Under the same legislation, directors' liability risks due to the late publication of annual accounts were also mitigated if the delay was attributable to COVID-19. This change was temporary and has since lapsed, but it may still have some effect on debtors that went bankrupt within two years of 1 June 2021.

During the pandemic, the tax authorities allowed an extension of payment for a variety of taxes, including value added tax, income tax and taxes on wages. The debtor had to request this extension by sending a request to extent taxes to the tax authorities. The tax authorities were also more lenient with regard to the obligation to notify them of the inability to pay (as described in question 4.6(h), the notification mentioned in question 4.6(h) also pertains to the inability to pay taxes and should be made towards both the tax authorities and the pension creditor). During this time, the notification obligation of the inability to pay was met with the request to extent taxes. The extension of payment lapsed on 1 October 2022. Accrued tax debts are due to be paid within 60 months of 1 October 2022. However, it is likely that the tax authorities will discuss customary arrangement for debtors in financial distress if the debtor can provide a sound restructuring or liquidation plan.

Furthermore, during the pandemic, the Temporary Payment Deferment Act entered into force. According to this act, a debtor could request the court to suspend the ability of a specific creditor to:

- file for insolvency proceedings of the debtor; or

- seize the assets of the debtor for recourse.

This was a temporary act and has since lapsed.

8 Other

8.1 Is it possible to effect a "pre-pack" sale of assets, and is it possible to sell the assets free and clear of security, in restructuring and insolvency proceedings in your jurisdiction?

Pre-packs were introduced in the Netherlands in 2011. Essentially, the courts were willing (without a statutory basis) to indicate who is to be appointed as insolvency trustee in the case of the opening of insolvency proceedings. In this way, the (prospective) insolvency trustee could be involved in the negotiations on a going-concern sale and execute that sale right after the formal opening of bankruptcy proceedings. However, this practice came under close scrutiny because of the Transfer of Undertakings Act, since some considered that this law applied to such sales, which meant that all employees would transfer to the buyer. This has since been litigated before the Court of Justice of the European Union (CJEU), which has indicated that pre-pack proceedings need not qualify as a transfer of undertakings, but that a statutory basis is required. This statutory basis has been under development in the Netherlands for quite some time while the decision of the CJEU was awaited and remains pending before the Dutch Senate. If this bill passes (as is expected), the pre-pack has a legal basis and can also be used to restart a debtor if not all employees are taken over by the seller. The primary goal of a pre-pack must be to liquidate the debtor and maximise the distribution to the joint creditors, possibly by a going-concern sale. It should be ensured that the pre-pack is not only intended to circumvent the protection of employees.

In order to sell assets free of security rights, a going-concern sale (either through a pre-pack or otherwise) is usually coordinated with the secured creditors. They may be actively involved in the negotiations or represented by the trustee. With regard to assets that the debtor sold in its day-to-day business, the trustee may, under the existing financing documents and/or supplier contracts, be entitled to sell those assets unencumbered as long as the trustee continues the business in bankruptcy.

8.2 Is "credit bidding" permitted?

Credit bidding is permitted by law for pledgors. Mortgage holders can bid on the mortgaged asset(s), but the payment must – in principle – be made to the notary. According to the letter of the law, cash is needed. Some lower courts are willing to permit credit bidding by a mortgage holder without payment of the notary so that no cash is needed. There are no rules or regimes that limit the right of the pledgor to credit bid. However, if there is an attachment on the assets which is older than the right of pledge or if the credit bid is higher in rank than the claim of the secured creditor, the secured creditor must pay that amount to the other creditor(s) in cash either directly or through a bailiff.

9 Trends and predictions

9.1 How would you describe the current restructuring and insolvency landscape and prevailing trends in your jurisdiction? Are any new developments anticipated in the next 12 months, including any proposed legislative reforms?

In March 2023, the Temporary Act on Transparency in Turbo Liquidation was passed. The previous law on turbo liquidation enabled companies to wind down outside of an insolvency procedure if they had no assets. This law was criticised due to its lack of transparency and the fear of probable misuse of the law. The new act addressed these criticisms by imposing more disclosure and information obligations when winding down a company through turbo-liquidation.

The law providing a legal basis for the pre-pack (as described in question 8.1) is pending in the Senate. It will most likely be discussed together with the Act on the Transfer of Undertakings in Bankruptcies, which enables a restart through bankruptcy with continued employment. This act was deemed necessary due to case law from the Court of Justice of the European Union (CJEU). However, following a recent decision of the CJEU, it is uncertain whether the act is still necessary. It remains uncertain as to whether and how these two bills are to be connected.

10 Tips and traps

10.1 What are your top tips for a smooth restructuring and what potential sticking points would you highlight?

- Ensure that your (financial) administration is up to date and publicised in accordance with the Dutch law.

- Stakeholder management is key.

- Proper and timely legal advice matters – involve experienced professionals early on in the process (preferably before restructuring is inevitable).

- Document your decisions during the restructuring period extra carefully, paying particular heed to the justifications for your decisions (eg, why certain creditors were paid and not others; why you believed the company was/is viable; the point at which you knew you had to file for bankruptcy and why).

- Comply with information duties towards creditors and financiers.

- Jointly with the main stakeholders, start working on a restructuring and sound business plan for the company after the restructuring. In this respect, valuation will usually be required and therefore, ultimately, an independent valuation report of the company with a restructuring value and a liquidation value.

- Next to the restructuring plan, it makes sense to prepare for contingency planning in case stakeholders ultimately do not cooperate as anticipated.

- If the restructuring is about to fail and insolvency seems imminent, make an information memorandum with an outline of:

-

- the company's business;

- the reasons why bankruptcy is inevitable;

- the efforts you have made in preventing the bankruptcy; and

- other information that might be useful for a bankruptcy administrator to get up to speed as soon as possible.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.