You hang up the phone and realise that this is the third time this week that this client has called for investment advice but hasn't invested anything. Back at your desk, you check your inbox and see that another client, whom you haven't spoken to in a while, has just placed an order—the fifth this week! With this order, you've reached your target for the month. But two months later, this trigger-happy client informs you that she wishes to terminate her account because the fees are too high.

So what should you have done? Should you have reduced fees for the more profitable client and spent more time on her, while increasing the fees for your other, more reluctant, client?

Happens every day

A recent KPMG and ACCA study shows that while most companies calculate their overall product profitability, only 45% globally know how profitable their customers are.

Furthermore, our experience has shown that the top 20% of your customers create approximately 200-300% of the annual profit, while the remaining 80% destroy the profit by approximately 100-200%.

Customer profitability can provide information that supports implementation of strategic and tactical changes within an organisation. Intense competition and pressure in many industries still drive companies to seek deeper cost savings which will require more innovative strategies.

What might be wrong with existing profitability calculations?

They could be perfectly right! However, experience has shown that even traditional cost allocation models are often...

- not up-to-date and thus no longer reflective of reality

- not supported by the right tools and thus can't be simply adapted

- subject to a long and difficult data collection process

As you know, being able to choose innovative strategies and to take informed decisions to achieve sustainable growth requires strong and stable baseline financial information. This makes profit calculation very important.

What are the benefits of calculating customer profitability?

By doing such calculations organisations can efficiently and effectively analyse business costs, income, and profitability at multiple levels to help make better-informed business decisions.

But they can go further, too.

We are living in the age of the customer, and the currency of our age is customer experience. At no prior time has the customer had such an influence on how a company does business. Customers desire consistent and high-value experiences, transparent pricing, and customised offerings, and may go elsewhere if they don't receive these things. We believe success belongs to those companies who master the economics of customer experience, by which they will find the optimal balance between customer satisfaction and organisational performance.

Organisations will have to move away from snapshot financials and move towards trending and prediction on a more frequent or event-driven basis. Putting data and metrics in context and correlation with one another will be synonymous with finding the winning formula that works for organisations and their customers alike.

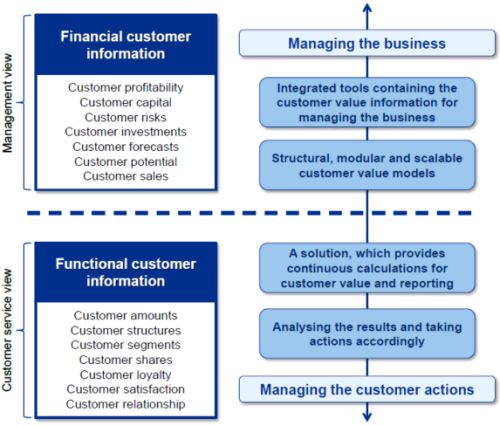

The figure below illustrates how organisations, in order to combine customer experience with customer profitability, should take both a management view as well as a customer service view:

Furthermore, by implementing customer profitability calculations, the company can achieve significant benefits in a range of areas, such as:

- sales/marketing: enhanced pricing

- production: improvements in value chain and efficiency

- insight: enhanced efficiency

- management: profitability, customer investments, direction of resources

- overall: increase in company value

- HR: creation of a profitability culture

- competitive environment: initiation of correct customer actions

What are the challenges of a customer profitability model?

Identifying the most profitable customers from the current customer base is not an easy exercise, but what's even harder is identifying who will be the most profitable customers in the future. The challenge lies in measuring the allocation of costs to customers. While it is usually clear what revenue each customer generated, it is often not clear at all what costs the firm incurred serving each customer.

Like other profit measures, customer profitability is historical. It is a financial summary of what happened in a previous period. The forward-looking measure of the value to be derived by serving a customer is called customer lifetime value. However, unprofitable customers can have high customer lifetime values (and vice versa).

What's next?

In order to further analyse the profitability of your customer (whether you have a customer profitability model in place or not), a more innovative methodology has been developed. It works by analysing the customer profitability by product and sales channel. Read more on Multidimensional Profitability in our next blog.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.