INTRODUCTION

We are pleased to present the latest edition of Tax Street – our newsletter that covers all the key developments and updates in the realm of taxation in India and across the globe for the month of November 2019.

- The 'Focus Point' section covers the recently introduced ITC restriction in relation to invoices not disclosed by suppliers.

- Under the 'From the Judiciary' section, we provide in brief, the key rulings on important cases, and our take on the same.

- Our 'Tax Talk' provides key updates on the important tax-related news from India and across the globe.

- Under 'Compliance Calendar', we list down the important due dates with regard to direct tax, transfer pricing and indirect tax in the month.

FOCUS POINT

ITC claim restricted to 120% of GSTR-2A

The linkage of a recipient's input tax credit (ITC) with the outward supplies disclosed by the supplier is one of the intrinsic principles of the GST law. However, due to the absence of adequate IT capacity in the initial stages of implementation of the GST law, the government suspended the relevant provisions and allowed ITC on a self-declaration basis by the recipient through GSTR-3B.

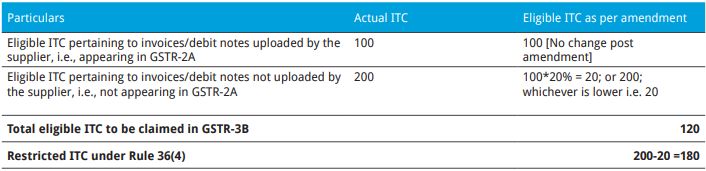

Recently, the government, vide Notification No. 49/2019-Central Tax dated 9 October 2019, inserted Rule 36(4) to the CGST Rules, 2017 whereby ITC with respect to invoices or debit notes, the details of which were not uploaded by the supplier, is restricted to 20% of the ITC with respect to invoices or debit notes uploaded by the supplier, i.e., appearing in GSTR-2A. The provision can be understood through the following illustration:

Government forced to introduce clarifications

The 37th GST Council meeting was held less than a month before the amendment was notified. However, no announcement was made post the council meeting in relation to its plans of implementing a restriction on ITC availment. Further, the amendment lacked clarity on various aspects such as the periodicity for which the restricted ITC had to be computed which led to confusion within the industry. Therefore, the government, vide circular No. 123/42/2019-GST dated 11 November 2019, issued the following clarifications:

- The restriction should be applicable only to invoices/debit notes on which ITC is availed after 9 October 2019.

- The restriction is imposed on the consolidated ITC, and not supplier-wise ITC.

- The calculation would be based on only those invoices which are otherwise eligible for ITC. Accordingly, those invoices on which ITC is not available, like, blocked credits under Section 17(5), would not be considered for calculating 20% of the eligible credit available.

- A taxpayer can avail ITC in respect of invoices/debit notes uploaded by the supplier only up to the due date of filing of GSTR-1 (i.e., taxpayers should download GSTR-2A on the 11th of every month to determine the amount of eligible ITC available for that month.)

- Taxpayers may avail full ITC in respect of a tax period, as and when the invoices are uploaded by the suppliers to the extent of 'Eligible ITC divided by 1.2.' This can be understood through the following illustration:

To view the full article click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.