Introduction

In the case of Grasim Industries Ltd. v. DCIT and others (ITA No. 1935/Mum/2020)1, the Hon'ble Income Tax Appellate Tribunal, Mumbai (Tribunal) has inter alia held that (a) Financial Services Business (FSB) can be considered as 'undertaking' under Section 2(19AA) of the Income Tax Act 1961 (Act) considering the facts of the case, (b) issuance of shares by resulting company to shareholders of demerged company pursuant to tax neutral demerger does not amount to distribution of dividend by demerged company for levying Dividend Distribution Tax (DDT) and (c) approval of a restructuring scheme by National Company Law Tribunal (NCLT) does not debar Tax Authority to independently assess income-tax implications of such restructuring in tax assessment proceedings.

Background

Under the Act, demerger of an 'undertaking' does not attract any income tax liability in the hands of the parties (i.e., demerged company / shareholder of demerged company / resulting company) subject to satisfaction of certain conditions such as (a) all the property and liabilities pertaining to the undertaking is transferred at its book value (b) proportionate issuance of shares by resulting company to shareholders of demerged company (c) at least 3/4th shareholders (in value) of demerged company becomes the shareholder of resulting company and (d) undertaking is transferred on a 'going concern basis'. The undertaking is also defined to include any part of an undertaking, or a unit or division of an undertaking or a business activity taken as a whole but does not include individual assets or liabilities or any combination thereof not constituting a business activity.

Additionally, any distribution of 'accumulated profits' which entails release of all or any part of the assets of the company to its shareholders is treated as dividend income. Till Financial Year 2019-20202, payment of dividend by a company to its shareholders would have attracted DDT levy (15%3) in the hands of company and consequently such dividend income was exempt in the hands of recipient shareholders. However, issuance of shares by a 'resulting company' to the shareholders of 'demerged company' pursuant to a tax neutral demerger does not amount to deemed dividend hence do not attract DDT.

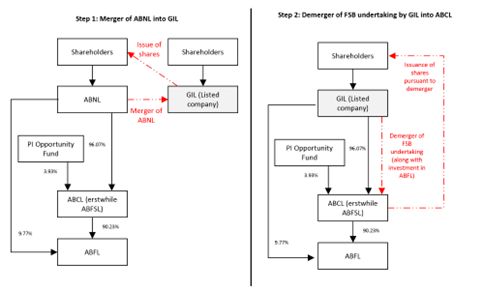

In the present case, a composite scheme of merger of Aditya Birla Nuvo Limited (ABNL) with Grasim Industries Limited (GIL) with an Appointed Date being 1 July 2017 followed by demerger of FSB from merged GIL into Aditya Birla Financial Services Limited (ABFSL) [later renamed as Aditya Birla Capital Limited (ABCL)] with an Appointed Date, being 4 July 2017, was approved by NCLT. In consideration of merger, GIL's shares were issued to the shareholders of ABNL and of demerger, ABCL's shares were issued to the shareholders of merged GIL on proportion basis. These steps are set out below:

Reason for dispute

Tax Authority held that demerger was not tax neutral as FSB does not amount to 'undertaking' under Section 2(19AA) of the Act (a) since GIL (and ABNL) was not carrying on FSB as it was only holding shares of companies which allegedly are into FSB, (b) in relation to FSB, taxpayer failed to substantiate that who were its clients, service recipient, how many transactions took place as financial transactions, what are the taxes charged on the processing fees, payment of GST and STT or any other indirect tax collected on the processing fee charged from its clients, periodic return with regulatory authorities and licenses issued in its own name to conduct FSB, etc. (c) substantial value of FSB undertaking was derived from single investment (ie shares of ABFL) and (d) all other assets and liabilities so transferred along with investment in ABFL (in the form of FSB undertaking) did not constitute 'business activity' in itself. Tax Authority vehemently argued that bundle of assets and liabilities which were transferred as part of alleged FSB undertaking were not capable of running an independent business activity but was merely transfer of assets and liabilities.

Therefore, the Tax Authority alleged that, in substance, the transaction was of transfer of investment in ABFL by GIL for consideration in kind (i.e., shares of ABCL) which in-turn was distributed to its shareholders and hence GIL was liable to pay DDT.

As against that, Taxpayer defended the tax neutrality of demerger principally on the ground that ABNL was undertaking FSB since 2005 and the said undertaking was vested into GIL due to merger of ABNL into GIL and hence GIL has transferred a business 'undertaking' on going concern basis. Further, all other conditions of tax neutrality of demerger were satisfied and hence issuance of its shares by ABCL (i.e., resulting company) to the shareholders of GIL (i.e., shareholders of demerged company) does not amount to distribution of dividend and consequently does not attract DDT.

Tribunal Ruling

The Tribunal, after considering mammoth arguments, held that on the facts of the case, the demerger was tax neutral as under:

- FSB undertaking amounts to business 'undertaking' as

required under Section 2(19AA) of the Act: (a) One of the

businesses of ABNL was FSB, as supported by history of ABNL; (b)

merely because in tax returns FSB has not been disclosed as

separate business does not go against the taxpayer; (c) tax audit

report of taxpayer contained detailed description of the businesses

which recognized FSB as a one of the businesses of the taxpayer;

(d) interest income arising from the lending business in the form

of intercorporate deposits have been offered as a business income

and was accepted by Tax Authorities; and (e) GIL (i.e., merged

entity) was holding financial assets of ~ INR 5,800 crores and the

magnitude of the assets shows that there was FSB carried out by

ABNL.

The taxpayer had not transferred singular asset as an 'undertaking' but transferred all other assets and liabilities (such as fixed assets, other investments, fund-based lending in the form of intercorporate deposits, deposits with regulatory authorities, borrowings, current liabilities, deferred tax liability, etc.) which forms part of FSB.

- Transfer of FSB undertaking was on a going concern basis: All contracts, litigations were transferred, and it was not shown by Tax Authority that there were some assets which were though part of FSB but not transferred to the resulting company; FSB was a business activity which can be run independently for the foreseeable future.

- There was no dispute on satisfaction of other conditions of tax neutral demerger under Section 2(19AA) of the Act (e.g. all property and liability of FSB undertaking were transferred at book value, etc.).

Further, DDT should not be levied in the present facts because (a) there was no distribution by GIL to its shareholders and (b) issuance of its shares by resulting company to the shareholders of demerged company was specifically excluded from the scope of dividend under the Act.

Additionally, Taxpayer's argument that once a scheme of reorganization was approved by NCLT then Tax Authority was debarred from doubting such transaction was rejected by the Tribunal holding that the Tax Authority have right to examine the income-tax implications which may arise on such approved scheme.

Concluding Comments:

This is a welcome decision wherein the Tribunal, based on the facts of the case, held that there was no distribution of dividend in a tax neutral demerger. Given that the dispute arose in this case resulted in huge DDT levy, it once again signifies the importance of what constitutes an 'undertaking' as is contemplated in Section 2(19AA) of the Act for a tax neutral demerger. Due care needs to be taken that what is being transferred in a scheme of demerger is an 'Undertaking' proper /a business/business activity so as to avoid any dispute on that fundamental aspect. This decision is also important from the perspective of cases where the value of transferred 'undertaking' is substantially derived from certain assets/investments and related aspects.

Footnotes

1. Order dated 30 November 2022

2. Amendments made vide FA 2020 (ie Finance Year 2020-21), dividend income is taxable in the hands of shareholders and no DDT levy will apply in the hands of company distributing the dividend.

3. Net rate (ie subject to gross up provision)

The content of this document do not necessarily reflect the views/position of Khaitan & Co but remain solely those of the author(s). For any further queries or follow up please contact Khaitan & Co at legalalerts@khaitanco.com