The COVID-19 pandemic continues to pose several challenges to the domestic as well as international economic and commercial market. This pandemic has lead to a temporary suspension of global trade operations and brought the world to a standstill. The outbreak has a far-reaching impact on the ability of businesses to honor their commitments, resulting in issues such as businesses taking shelter under force majeure clauses, termination of contracts, forfeiture of advances, re-negotiation of contracts to name a few. Handling these challenging times may require organizations to forecast and evaluate possible defaults in honoring their commitments well in advance and adopt suitable strategies to mitigate the risks.

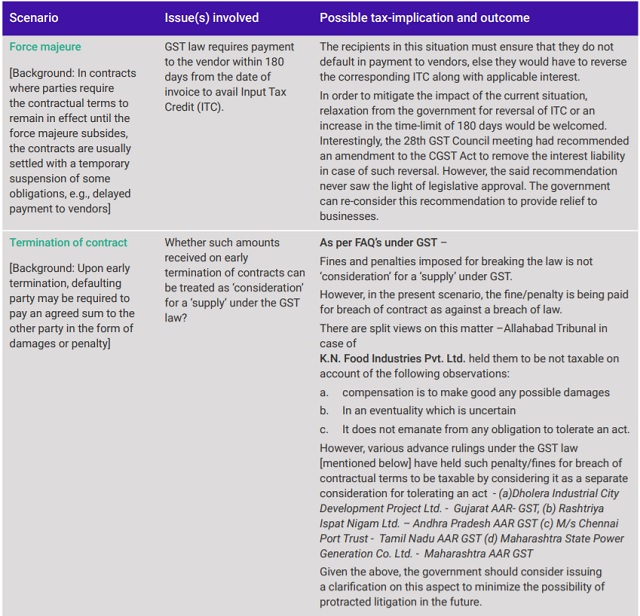

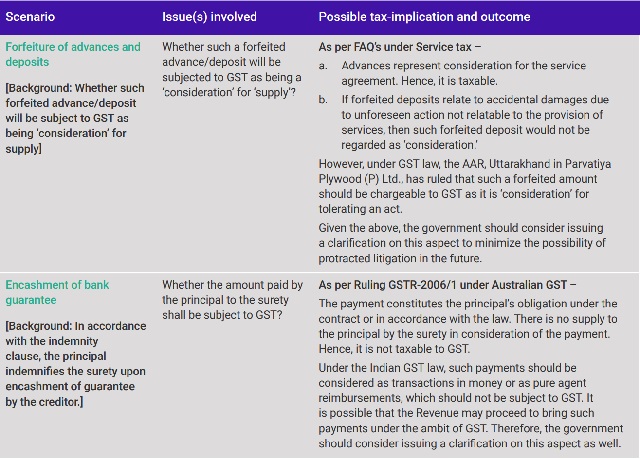

Issues and possible GST implications

In order to get a complete picture and minimize unforeseen risks, it is imperative to ensure that such evaluations and strategies account for their GST impact as well. An insight into a few issues caused by failure to honor business commitments due to the pandemic and the GST exposure on the same is captured below

Considering the above aspects, the businesses would have to revitalize their strategies by implementing certain measures, which include revisiting contractual terms, proposing amendments to relevant clauses, etc. to avoid future disputes and litigation. On the other hand, businesses would also require further assistance from the government by way of effective measures to tide over the unprecedented crisis created by the pandemic. Further, relaxation from stringent GST provisions and/or appropriate clarification on GST implications in case of breach of contracts which appear to be a new normal in the short and medium-term in the post-COVID-19 era, would surely help businesses to manage their stretched cash flows effectively in this tough situation as well as avoid protracted litigation in the future.

Originally published 20 May, 2020

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.