Receivables as a mission-critical cash source

With almost all major economies of the world coming to a

standstill due to stringent lockdown and social-distancing

measures, most organizations are reeling for cash. The tremors of

disruption have been felt across supply chains, and the retail

sales for certain sectors are down to almost zero. Consequently,

most firms are cutting down non-critical expenses like research and

development, capex, and more. For MSMEs (Medium, Small & Micro

Enterprises) already facing a severe cash crunch, this condition is

aggravated by the unwillingness of banks to lend to

"non-reputed" firms during these times of crisis.

No inflow of cash, alongside still, fixed costs going out in of

the form of employee expenses, rentals, plant, and equipment

maintenance, has necessitated an aggressive approach towards

receivables. This approach is a must for firms to manage a healthy

working capital as they tide over this crisis.

Taking Stock of Situation

Before making sure that one's account receivables (AR) strategy can adapt to changes in the current business scenario, let's take a step back and assess how COVID can impact your receivables strategy.

Gauging the COVID Impact

Organizations must identify business lines and geographies that are most-impacted during these times and must try to assess the impact on customers in terms of supply and demand disruption. It is not uncommon to find businesses at both ends of the spectrum. While some industries like healthcare and essential supplies experience minimal or positive impact, others like capital goods have been badly affected.

Furthermore, it is also important to assess the long-term impact of the outbreak. Some industries might take a longer time to come out of this crisis and the ensuing recession, while others may bounce back quickly. Sales and collection teams can get in touch with customers for more inputs and collect crucial data to define their plan for the future.

Government Stimulus

Governments across the world have stepped in with fiscal and monetary packages, intending to soften the blow for businesses. India too has received a much-awaited and much-discussed INR 20 lakh crore stimulus. This could be an opportune time to focus specifically on clients who have been benefitted by such moves, considering they might be in a better position to cough up money now. Further, basis past credit history, the COVID impact, and government support, one should segregate customers who are unable to pay from those who are unwilling to pay.

Multi-pronged Receivables Approach

The use of intuition-based, limited, and loosely defined KPIs and a one-size-fits-all collection strategy are some of the key factors that lead to an increase in Days Sales Outstanding (DSO). Here's our take on a solution that makes use of data and analytics for value unlocking in AR management.

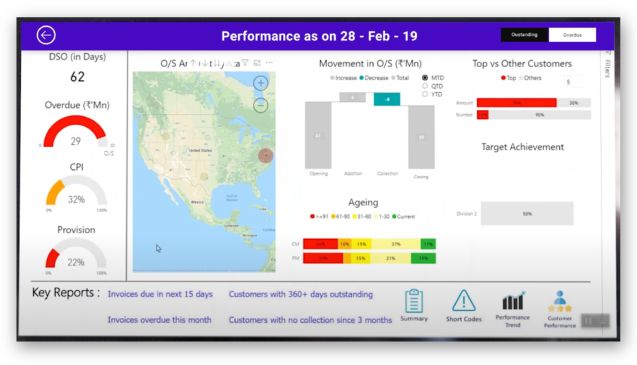

Visibility

In most organizations, decision-makers don't have access to all data in the same place, as data is spread across functional silos. Dashboards can be leveraged to bring all this information under a single umbrella, enabling customer-level insights and drill-downs.

A glimpse of the Receivables Dashboard by Nexdigm (SKP)

Risk Re-Assessment

Due to COVID-19, there is a need to re-evaluate customer level risk by fine-tuning credit-risk models and hence, adjust credit limits and payment terms per findings. This would mostly apply to future sales, for pre-existing invoices and discounting practices can be adjusted in lieu with payment risk to minimize loss. For example, large haircuts can be taken for instant cash realization instead of the long process of liquidation. In addition to past collection data, organizations must make use of external data, and incorporate insights from sales and ops teams. The following table sums up key data sources to evaluate credit risk.

Data Sources for Credit Risk Assessment

| Internal Data | Economic Indicators | External Proxy Data | Other Factors |

|---|---|---|---|

| Customer Order and Payment History | Impact on industry and region | Liquidity Indicators | Sales disruption due to lockdown |

| Customer Master Data | Customer Credit Rating | Consumer Sentiments | Logistical disruptions |

| Customer Credit Terms | D&B Data | Govt. Support to Sector | Unavailability of labor |

| CRM and Follow-up data | IHS Markit PMI | Raw material supply disruptions |

Personalized Collections

For current outstanding payments, customers can be segmented according to industry, past payments data, CoVID-19 impact on their business, delinquency risk, and potential lifetime value. Basis this framework, a case-to-case assessment must be done. Appropriate actions like additional discounts, late-fee waivers, or engaging a collection agency can then be taken to minimize risk and payment loss. If needed, extreme steps like inventory clawbacks and large haircuts can be made to reduce business losses. Along with this, a follow-up strategy needs to be chalked up, which helps identify the right time, right mode, and the right model for follow-up communications.

Detailed Approach for Receivables Management

Conclusion

A quick revamp of receivables practices supported by data-backed initiatives like renewed credit scoring, proactive monitoring, and customer-specific prioritization strategy can help in effective AR management during this crisis.

Post-COVID, a lot is going to change, inevitably. Increasing digital adoption and the shift in channel and consumer mix, clubbed with fewer feet-on-ground, call for a digital approach to AR management as well. Digital CRM platforms, e-invoices, and digital payments are indeed the new norm.

A long-term strategy should take efficient and scalable processes into focus and must be backed by AI and digitization. This should be done with the clear aim of reducing DSO and shortening the cash conversion cycle. Wherever possible, automation should be deployed to reduce costs, turnaround time, and manual errors. These efforts will go a long way in optimizing collections and shortening the O2C cycle.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.