In the ever-evolving landscape of business, Artificial Intelligence stands out as a transformative force, challenging traditional paradigms and reshaping decision-making processes. This article explores the burgeoning role of AI in corporate governance, focusing on its potential impact on essential aspects of leadership and management structures. Recognizing the dynamic nature of corporate decision-making, the article examines how AI applications are poised to streamline administrative tasks, allowing human directors to focus on nuanced, strategic decisions. It addresses the critical intersection of AI and legal qualifications, emphasizing the current legal limitations on appointing AI as directors while contemplating potential future developments.

"We know what we are, but know not what we may be."- William Shakespeare

I. Introduction

In the dynamic world of business, change remains the only constant. Throughout centuries, numerous transformations have occurred, yet none have been as intriguing as the ascent of Artificial Intelligence (AI). In 1950, Alan Turing, a pioneer in computer science, posed a profound question: "Can Machines think?" Since then, the field of computer science has made remarkable strides in collecting and analyzing data, recognizing patterns, predicting outcomes, and solving complex problems. This progress has led to the emergence of AI. Initially considered a concept reserved for science fiction, AI has firmly grounded itself in the 21st century as a tangible scientific idea.

AI essentially refers to the development of computers and machines capable of performing tasks, processing information, and making decisions independently, without human intervention. In simpler terms, AI systems have the ability to think for themselves, even at a basic level. When harnessed strategically, AI holds tremendous potential to revolutionize how we approach our work.

AI has already left its mark on various aspects of our lives, ranging from healthcare and education to transportation and entertainment. Corporate governance is no exception to this transformative wave. Increasingly, companies are incorporating AI into their decision-making processes, aiming to create more efficient, innovative, and resilient business environments.

As AI continues to evolve and influence decision making in general, it is certain to assume a more prominent role in corporate decision making. This article delves into the potential implications of this development for corporate law and governance. Specifically, it explores how AI may impact essential aspects of corporate leadership and management structures.

II. Corporate Boards and their functions

A company is an artificial person, and it acts through directors. Directors are collectively known as the Board of Directors. The management of the affairs of the company is vested in the Board of Directors ('BOD'). The BOD of the company is said to be its nucleus and they are selected according to the procedure prescribed in the Companies Act, 2013 ('Companies Act') and the Articles of Association of the company.

Since the position of each director in the BOD is that of a trustee, they are entrusted with the responsibility to manage the affairs of the company, work in the interest of the company and safeguard the interest of all the stakeholders. The key function of the BOD is to ensure the company's prosperity whilst meeting the appropriate interests of the shareholders. They have a multifaceted role, ranging from strategic planning to legal compliance, financial oversight, and risk management - quite intuitively, all these functions can be suitably augmented with AI.

III. Role of Directors in a Company

In the ever-evolving corporate world, the role of directors in decision-making is pivotal. Directors play a unique part in the governance and management of a company. Based on the role of the Directors, they can be categorized into two types:

A. Executive Directors: The Driving Force

Executive Directors are the driving force behind a company's day-to-day operations. They are internal professionals who actively manage the organization's functions. They implement strategies, make operational decisions, and work towards achieving the company's goals. In essence, they are the hands-on leaders of the company. An executive director is also a whole-time director 1. The managing director who is entrusted with substantial powers of management of the affairs of the company, is also an Executive Director.

B. Non-executive Directors: The Guardians of Governance

Non-executive Directors are external professionals on a company's board, not engaged in day-to-day operations. They influence board decisions, adding valuable insights without daily involvement, and promoting responsible corporate governance. Non-Executive Directors come in different forms, such as:

i. Independent Directors 2: They are experts having knowledge in a particular field or ex-officials hired for their industry knowledge. They help maintain transparency, boost corporate governance, and protect shareholder's interests.

ii. Nominee Director 3: They are appointed by the board only if it is authorized by the Articles of Association (AOA) of the company. They are representatives of the stakeholder and protect the stakeholder's interests.

In simple words, Executive directors are actively involved in the day-to-day management of the company and are often full-time employees of the organization. On the other hand, non-executive directors are generally independent, and their primary role is to provide independent oversight, strategic guidance, and governance to the company.

IV. AI in Boardrooms and its Impact on Decision-Making

In the fast-paced world of corporate governance, the role of corporate boards in decision-making is pivotal. As businesses evolve, so do the expectations and challenges faced by directors. In the corporate world, AI is making significant strides and reshaping how corporate boards make decisions. As AI applications become more prevalent, they promise to streamline the work of human directors by taking over routine administrative tasks. This shift will allow directors to focus on tasks requiring human judgment and expertise.

Corporate decision-making involves three key entities: shareholders, stakeholders, and directors. Shareholders and stakeholders often make binary decisions and delegate day-to-day management to the BOD. With time, the board's role in larger corporations has evolved into one of supervision, monitoring, and strategic decision-making, as daily managerial tasks are typically handled by the management team 4.

In the short term, as AI takes over administrative tasks, directors will need to oversee these AI-driven actions. In the long term, the line between directorial and managerial functions could blur, as AI, unhindered by time constraints, can handle both.

Compliance with the Duties of a Director

Before analyzing the role of AI in impacting board decisions, let us first analyze its role in complying with the duties of a director. Directors are bound by various responsibilities outlined in the Companies Act. One fundamental duty is to act in alignment with the company's Articles of Association (AOA) 5. Further, the Directors must "act in good faith" to advance the company's objectives and the interests of stakeholders. They are also prohibited from making decisions that conflict with the company's interests or seeking undue personal gain.

Under s. 166(2) of the Act, the director of a company must act in the best interests of the company and all the stakeholders. Correspondingly, under s. 166(4) of the Act, directors are not permitted to make decisions or involve themselves in matters in which they have a direct or indirect interest which conflicts or may conflict with the interest of the company; or under s. 166(5) acquire or attempt to acquire any undue gain or advantage to himself or his relatives.

In the case of an AI director, these obligations can be converted into algorithmic data sets. AI directors, unlike humans, will process this data rigorously, ensuring strict compliance with the AOA. This would minimize the risk of inadvertent deviations, which humans might overlook. AI directors can operate on codes and algorithms, that align with both the company's goals and legal standards. Their impartial nature would reduce the likelihood of diverting corporate resources for personal benefit. However, it's important to note that not all decisions can be solely based on logic; some require emotional intelligence and intuition, which AI may lack 6.

AI's Role in Complex Decision-Making

The heart of the matter lies in the strategic decisions made by directors, which are inherently complex. A BOD is designed to discuss and direct top-level topics that affect the company's future. In some instances, the BOD must take a more detailed approach to their involvement which includes:

- Large matters that affect the company's financial status.

- Long-term vision of the company in relation to quality, growth, finances, and people.

- Borrowing or lending money.

- Diversification of the business activities of the company.

- Address the Shareholder's Grievances.

- Identification and appointment of directors.

To enable better and more focused attention on the above-stated affairs of the company, the BOD generally delegates these matters to the committees of the board set for the purpose. Committees review these matters in great detail and place them before the board for its consideration. Based on the groundwork and research done by the committees the board can make a decision.

In such cases, the AI's potential impact is most likely to shine in the boardroom due to its ability to process vast amounts of data. While AI may not entirely replace human decision-makers in such complex situations, it can certainly assist directors in making more informed decisions, whether in complex scenarios or simpler ones.

Currently, AI is already equipped to assist directors in their functions by processing complex and extensive data, thereby improving the decision-making process. AI minimizes uncertainties, enabling corporate boards to make quick, well-informed decisions. Real-world examples, like VITAL's role in Deep Knowledge's recovery, highlight the effectiveness of AI in practice 7. VITAL also assisted the venture capital firm company in making investment decisions 8.

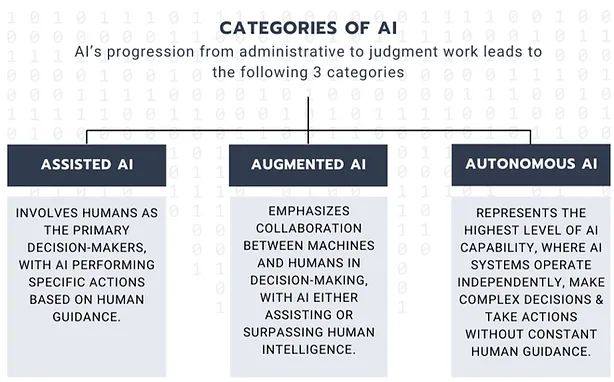

Categories of AI in decision-making

AI's future role in the boardroom can be categorized into administrative work and judgment work. Administrative work includes routine tasks like scheduling and resource allocation, while judgment work involves creative, analytical, and strategic skills. Much of directors' responsibilities fall into the judgment work category, where AI can complement human experience by rapidly processing data for better decision-making.

To understand this better let us take a few examples where AI can have an impact on the board decision-making process under the three categories.

Scenario I: A publicly listed company has received an influx of shareholder grievances related to issues such as corporate governance, executive compensation, and dividend policies. The board of directors is tasked with addressing these grievances to maintain shareholder trust and uphold corporate responsibility.

- Assisted AI can gather and process a vast amount of data related to shareholder grievances, including emails, social media mentions, and regulatory filings. It can categorize and prioritize grievances based on their severity and potential impact on the company's reputation and financial performance. Assisted AI can also perform sentiment analysis on shareholder communications to gauge the level of dissatisfaction.

- Augmented AI can provide the board with comprehensive reports summarizing the key grievances and their underlying causes. It can offer insights into industry best practices and benchmark the company's governance and compensation policies against those of peers. It can suggest potential solutions and strategies to address specific grievances and mitigate shareholder concerns.

- Autonomous AI can automate the creation of regular shareholder reports and disclosures. It ensures that all required information is accurately presented and submitted in compliance with regulatory requirements. It can set up an autonomous monitoring system to track changes in shareholder sentiment and regulatory updates. When significant shifts occur, it can trigger alerts to the board for immediate attention. It can draft responses to common shareholder grievances, speeding up the resolution process and maintaining consistency in communications.

Scenario II: A fast-growing technology startup has reached a stage where it needs to appoint directors to its board to provide guidance, governance, and industry expertise.

- Assisted AI can search through publicly available data, professional networks, and startup databases to identify potential director candidates. It can compile a list of candidates with relevant experience, industry knowledge, and startup expertise.

- Augmented AI can provide detailed profiles of potential director candidates, including their professional backgrounds, entrepreneurial experience, and startup investments. It can analyze each candidate's fit with the startup's growth stage, strategic direction, and unique challenges. Augmented AI can offer insights into how the candidates' networks and connections can benefit the startup's growth and fundraising efforts.

- Autonomous AI can streamline the appointment process by automating tasks such as candidate outreach, interview scheduling, and reference checks. It can manage the logistics of board meetings and ensure that all necessary documentation and compliance requirements are met. Autonomous AI can generate reports summarizing the appointment process and present them for review by the startup's founders or early-stage board.

Thus, incorporating AI into the boardroom can bring several advantages. A collaborative AI approach would help the board make well-informed decisions and automate their routine tasks, which would make governance more effective.

V. Legal Qualifications

Companies are recognized as legal persons under the law, despite being artificial entities with no physical existence. They rely on human agency to function because they lack their own brains and bodies. They are distinct legal entities separate from their managers, employees, and shareholders. Consequently, they can only operate effectively with the assistance of human decision-making, which is why the role of managing a company is delegated to BODs elected by the shareholders. This delegation is based on the understanding that human judgment and decision-making are essential for effective management.

Recognition under the Companies Act

S. 2(34) of the Companies Act defines a director as "any person appointed to the Board of a company." This definition explicitly states that only natural persons can be appointed as directors, and therefore, AI cannot be appointed as a director. Additionally, to become a director, one must obtain a Director Identification Number (DIN) issued by the government. AI cannot fulfil this requirement, as it lacks a legal identity. It is though noteworthy that most statutes define a 'person' as inclusive of an 'artificial juridical person'. Whether this limb of the definition of 'person' would/could be interpreted wide enough to cover AI, is a question yet to be answered judicially. Furthermore, certain disqualifications, such as unsound mind, insolvency, and criminal convictions, prevent individuals from becoming directors. These disqualifications cannot be applied to AI, making it challenging to apply these criteria to artificial entities.

Duties and Liabilities of a Director

In the context of s. 149 of the Companies Act, it is challenging to assign liability to AI or an artificial entity. The law is designed to hold individuals accountable, making it difficult to establish responsibility for AI-driven actions. Directors have fiduciary duties to the company and its shareholders. The duties of a director are codified under s. 166 of the Companies Act, and directors can face penalties for not adhering to them. AI lacks the capacity to autonomously fulfil these fiduciary duties.

Under the Companies Act, liability for contraventions falls on the officer in default, which includes natural persons. If AI assists in decision-making and directors rely on its recommendations, directors may still be held liable for AI's actions or decisions. Directors can be held civilly and criminally liable for various offenses, such as not discharging their fiduciary duties, issuing misleading statements, and engaging in fraudulent activities. AI cannot be held liable in this manner.

Way Forward

While AI technology has the potential to assist in decision-making, the current legal framework and the nature of corporate governance require human directors to fulfil their roles and responsibilities. If AI's role is to be expanded in the future, it must be done with careful consideration of legal and ethical implications, along with heightened directorial oversight.

For instance, if AI is to be integrated into the boardroom in the future, certain precautions and considerations are necessary. AI should be programmed with internal codes that align with the company's Articles of Association, ensuring that AI acts in the best interests of the company and in good faith. Furthermore, directors will have to exercise vigilant oversight over AI, including monitoring its source code, its functioning, and the reports it generates. This will ensure that AI's actions align with the company's goals and legal obligations. Lastly, special emphasis would have to be placed on maintaining the confidentiality of sensitive information, as AI's involvement may pose privacy risks that could harm the company's reputation and business.

In conclusion, it is evident that with the necessary precautions and diligent oversight, AI can indeed be successfully integrated into corporate boards and contribute to streamlining the decision-making process. As William Shakespeare aptly put it, "A rose by any other name would smell as sweet." Similarly, whether we refer to it as code or a board member, the essence of AI's potential remains unchanged. By aligning AI with the company's values, legal obligations, and ethical standards, while also maintaining strict confidentiality, we can harness its capabilities to enhance decision-making and propel businesses into a more efficient and dynamic future.

Footnotes

1. Section 2(94) of Companies Act, 2013 – Rule 2(1) (k) of Companies (Specification of Definitions Details) Rules, 2014.

2. Section 149(2) of Companies Act, 2013.

3. Section 149(7) and Section 161(3) of the Companies Act, 2013.

4. Rudresh Mandal & Siddharth Sunil (2021): The road not taken: manoeuvring through the Indian Companies Act to enable AI directors, Oxford University Commonwealth Law Journal, DOI: 10.1080/14729342.2021.1901191.

5. Section 166 of Companies Act, 2013.

6. Artificial Intelligence v. Intuitive Decision Making: How far can it transform corporate governance? https://gnlu.ac.in/Content/the-gnlu-law-review/pdf/volume-8-issue-2/01_aashirwa_baburaj.pdf.

7. Burridge (n 13); Kandace Miller, 'How Artificial Intelligence can be Applied To Executive Talent Acquisition' (Forbes, 13 November 2018).

8. Algorithm Appointed Board Director, BBC News (May 16, 2014), https://www.bbc.com/ news/technology-27426942.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.