The Insolvency and Bankruptcy Code, 2016 ("Code") came into effect on 1.12.2016 as transformative legislation to ensure a healthy behavioural change in the creditor-debtor relationship and reform the insolvency space in India. Although the Code was touted as "the" success story in its initial years, there are rising concerns that the Code is losing much of its sheen.

Some of the valid criticisms and concerns centre around excessive delays, slow adjudication, loss of value of assets in the resolution process, unjustified haircuts, the limited scope of the pre-pack insolvency resolution process, etc. It is worth noting that issues such as delays and pace of adjudication are not issues with the Code but rather a result of the slow and bureaucratic process involved in selection of members of the adjudicating authorities.

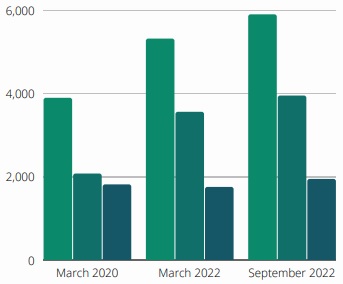

A total of 5,893 CIRPs have commenced by the end of September 2022. Of these, 3,946 have been closed. Of the CIRPs closed, the("Corporate Debtor") CD was rescued in 2,139 cases, of which 846 have been completed on appeal or review or settled; 740 have been withdrawn; 553 cases have ended in approval of resolution plans. In 1,807 cases, the orders for liquidation were passed.

Fig 1: Corporate Insolvency Resolution Processes (Source: IBBI)

The Insolvency Law Reforms Committee ("ILRC") in its fifth report released in May, 2022 recommended some amendments which could make the Code more effective in terms of processes and more result oriented. It has put forth some recommendations to propose timelines for approval of resolution plans, standards of conduct of CoC meetings, SCC meetings, etc. Moreover, some of the recommended changes have started taking effect and more reforms are likely to take place in this regard.

Originally Published January 2023

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.