For an extended period, affluent individuals and families have been establishing family offices in locations such as Dubai, London, and Singapore, among others. These regions have been favoured for their business-friendly incentives, favourable tax structures, progressive regulations, and unrestricted access to global markets. In a strategic move to attract such high-net-worth individuals and families, the International Financial Services Centre Authority (IFSCA) has introduced a comprehensive framework for Family Investment Funds (FIFs) under the IFSCA (Fund Management) Regulations, 2022 (FM Regulations)1. The FM Regulations enable companies to establish a Fund Management Entity (FME) in the form of a FIF, subject to specified criteria.

Notably, the Gujarat International Finance Tec-City (GIFT) hosts India's first and only International Financial Services Centre (IFSC), where units enjoy special tax benefits in addition to standard Special Economic Zone advantages. These benefits encompass a hundred per cent (100%) tax exemption for ten (10) consecutive years out of fifteen (15) years, a Minimum Alternate Tax (MAT) or Alternate Minimum Tax of nine per cent (9%) of book profits for IFSC-based companies, and no MAT for companies opting for the new tax regime. Furthermore, transactions on IFSC exchanges are exempt from Securities Transaction Tax, Commodities Transaction Tax, and stamp duty.

The primary objective of the IFSCA's FM Regulations is to regulate fund managers within the IFSC. A FIF is defined as "a self-managed fund pooling money only from a single family and has been set up in terms of these regulations"2. The term "scheme" is synonymous with "fund" under these regulations, with Regulation 17 of the FM Regulations explicitly stating that an FME may launch a scheme, indicating that a FIF is a unique form of FME and also constitutes a scheme3.

Structure of Family Office

Single Family Office: The term "single family office" is not explicitly defined in the FM Regulations. However, according to the definition of a FIF (as defined above), it inherently represents a single family (as defined below) and thereby investment by a FIF can be made by a single family office.

After its establishment, a FIF is exclusively authorized to pool funds from a single family. The initial definition of a "single family" under the FM Regulations was initially defined as "a group of individuals who are the lineal descendants of a common ancestor and includes their spouses (including widows and widowers, whether remarried or not) and children (including stepchildren, adopted children, ex-nuptial children)".

However, vide circular F. No. 333/IFSCA/FIF/2022-23 dated March 1, 2023 (Circular)4, the IFSCA provided further clarification. According to the Circular, a single family not only includes individuals but also extends to entities such as sole proprietorship firms, partnership firms, companies, limited liability partnerships, trusts, and body corporates. For these entities to be considered part of the single family, it is required that the family exercises control over them and holds substantial economic interest. "Substantial economic interest" shall mean at least ninety per cent (90%) economic interest, as demonstrated by the FIF5.

To determine whether the entities qualify as a single family, we can assess the scenarios presented in the following illustrations:

Illustration 1: Imagine a family with Mr. Smith as the first-generation grandfather (A), Mr. Johnson as the son of Mr. Smith (B), Mrs. Johnson as the wife of Mr. Johnson (C), and their children, Emily (D), Ethan (E), and Fiona (F). Additionally, they collectively own and control XYZ Holdings, a private limited company. Considering the familial ties, XYZ Holdings, being controlled and owned by the lineal descendants of Mr. Smith, would qualify as part of a single family.

Illustration 2: Let's consider the Bansal family, where Mr. Bansal (A) is the patriarch, and his son, Mr. Vikas (B), is married to Mrs. Madhu (C). They have two children, Suryanshi (D) and Shivang (E). The family manages a partnership firm called ABC Capital Partners. Given that ABC Capital Partners is controlled and substantially economically interested in by the lineal descendants of Mr. Bansal, it qualifies as part of a single family.

Illustration 3: In the Agarwal family, Mr. Agarwal (A) is the first-generation family head. His son, Mr. Vikas (B), is married to Mrs. Kalpana (C), and they have a child, Varuna (D). D operates a sole proprietorship named T&P Enterprises. Given that T&P Enterprises is under the control and substantial economic interest of D, it falls within the definition of a single family.

Illustration 4: Consider the Morgan family, where Mr. Morgan (A) is the common ancestor. His daughter, Mrs. Walker (B), is married to Mr. Walker (C), and they have a child, Sophia (D). The family manages a limited liability partnership named Morgan Wealth Advisors LLP. Given that Morgan Wealth Advisors LLP is controlled and has substantial economic interest by the lineal descendants of Mr. Morgan, it qualifies as a single family.

Further, prior to the issuance of this Circular, FIFs encountered limitations in mobilizing funds beyond the specified single-family unit. Their fundraising avenues were confined to individual family members, each restricted to remitting a maximum of USD 250,000 annually under the Liberalised Investment Scheme6 (LRS).

In light of recent changes to the Circular, the revised definition of single family has been expanded to include trusts as well. It is noteworthy for Indian families to recognize that the LRS presently prohibit trusts from transferring funds overseas.7 As a result, families employing domestic trust structures for purposes of succession planning and wealth management must explore alternative mechanisms for transferring funds to their FIF.

A FIF can also accept contributions from its employees, directors, FME, or other service providers, in accordance with its internal policy. This is intended either as a recognition of services rendered to the FIF or to align the interests of these individuals with those of the FIF. Contributions may be accepted from these parties solely for the specific purpose of granting an economic interest, capped at a maximum aggregate of twenty per cent (20%) of the FIF's profits. It is imperative that all associated investment risks are transparently disclosed to these contributors.

In the event that a person outside of a single family who has invested in the FIF decides to discontinue their investment, an exit option may be extended to them by members of the single family who already possess an interest in the FIF. The exit price will be determined by an independent third-party valuer. Additionally, the FIF has the flexibility to establish additional investment vehicles within the IFSC. These supplementary investment entities will be considered integral to the main FIF for the purpose of fulfilling the regulatory requirements of the FM Regulations.

Multi-Family Office (MFO): The FM Regulations do not specifically mention the classification pertaining to the family offices but the Regulation 81 of FM Regulations do state that an FME may also provide services to an MFO under a portfolio management agreement. It may prescribe additional conditions, additional permissible investment, etc., for FMEs providing services to multi-family office under a portfolio management agreement.

- Eligibility Conditions

Following are the applicable eligibility conditions on FIF as per FM Regulations8:

- A FIF can be established in the following four forms:

- a Company;

- Trust (Contributory trust only);

- Limited Liability Partnership; or

- any other forms permitted by IFSCA.

- Certificate of Registration: Pursuant to Regulation 12 of the FM Regulations, a FIF is required to obtain a certificate of registration from the IFSC Authority as an FME under the appropriate category. Furthermore, FIFs engaged in investments across securities, financial products, and other permissible asset classes must also seek registration as an Authorized FME, in accordance with Regulation 3. This regulation underscores the obligation to seek registration under the three specified categories:

- Authorized FME,

- Registered FME (Non-Retail), and

- Registered FME (Retail).

Notably, an Authorized FME is defined as an entity pooling funds from accredited investors or those surpassing a specified investment threshold through private placement, directing investments into startups or early-stage ventures via the Venture Capital Scheme.

- Corpus Requirement: Subsequent to obtaining the certificate of registration of FIF, within a period of three years the Corpus requirement of USD 10 million shall be fulfilled. It is to be noted that where family members are funding the FIF directly, each individual is subject to a cap of USD 250,000 under the LRS route. This may cause some difficulties for families who do not wish to bring multiple family members into the FIF structure as contributors. In such case, the family may consider using existing group companies / limited liability partnerships (LLPs) or setting up a new structure for funding the FIF - both options have a range of considerations to keep in mind.

As per the FM Regulations FIFs are not bound by the provisions mentioned in Regulation 5 and 8 of the FM Regulations, including legal form and net-worth criteria,9. Consequently, FIFs are solely obligated to maintain a minimum corpus.

- Open or Close ended: A FIF offers the flexibility of being either open ended or close ended, based on its structure to align with the unique requirements and preferences of the family involved.

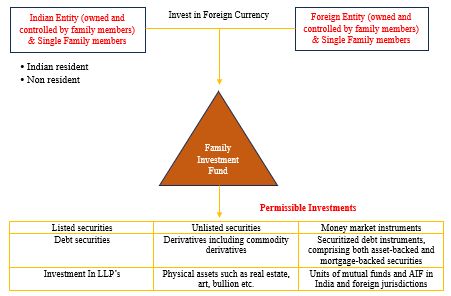

- Permitted Investors with permissible investments10

FIFs established in the IFSC have the flexibility to make investments both within India and in foreign jurisdictions. When a FIF decides to invest in Indian entities or assets, it must adhere to Indian foreign exchange laws. This includes compliance with sectoral caps, pricing guidelines, and other provisions outlined in the Foreign Direct Investment (FDI) policy, particularly in the case of equity or equity-linked investments.

However, when the FIF makes investments outside India, these transactions fall beyond the scope of Indian foreign exchange laws. In other words, the regulations governing foreign exchange in India do not apply to investments made by the FIF in foreign jurisdictions.

- Procedural requirements

Prior to the commencement of investment activities, individuals from the single-family contributing to the FIF need to provide an undertaking to the FME's Principal Officer (PO). The said undertaking will acknowledge that they understand the risks, costs, and benefits associated with FIF investments. Additionally, it acknowledges that certain regulatory measures and disclosures available to other schemes within the IFSC might not apply to FIFs. This will enable the FIF to operate in a more effective manner as compared to other schemes, by cutting down on cost and time with respect to inspections and disclosures, while also simultaneously ensuring that the potential risks of FIF investments are well understood by individuals of the single family.

FIF in IFSC by non-residents

The FM Regulations have introduced a new opportunity for foreign residents, including non-resident Indians, and their entities to establish investment entities in India without the need to comply with the FDI policy and Indian foreign exchange laws. Unlike the existing FDI policy and foreign exchange laws, there is no requirement for prior government approval for foreign investments in core investment companies or investing entities engaged in the activity of investing in the capital of other Indian companies or LLPs, provided such investing entities are not registered with the Reserve Bank of India (RBI) as non-banking financial companies. Notably, any repatriation of funds from the IFSC does not necessitate regulatory approval.

FIF in IFSC by Indian residents

Investment by way of Overseas Direct Investments (ODI)

ODI as defined under the Foreign Exchange Management (Overseas Investment) Rules, 202211, and Foreign Exchange Management (Overseas Investment) Directions, 202212 (ODI Laws) means investment by way of acquisition of unlisted equity capital of a foreign entity, or subscription as a part of the memorandum of association of a foreign entity, or investment in ten per cent (10%), or more of the paid-up equity capital of a listed foreign entity or investment with control where investment is less than ten per cent (10%) of the paid-up equity capital of a listed foreign entity. Any outbound investment which is made in a manner resulting in control of the remitting Indian entities should be classified as an ODI. Since, the Indian entities will have control over the FIF, such remittances could fall within the definition of ODI.

Further, the ODI Laws, have paved the way for residents in India to engage in overseas investments within the IFSC under specific conditions:

- For investments made in an IFSC, approval from the relevant financial services regulator must be granted within forty-five (45) days of a complete and properly submitted application. Failure to receive approval within this timeframe will result in automatic approval.

- Indian entities not involved in financial services activities within India can make ODI in foreign entities engaged in financial services, excluding banking or insurance, even if they do not meet the net profit condition as required by the rules (for Indian entities investing abroad, but not in the IFSC, are obligated to meet the net profit condition, which specifies that such entities should have posted net profits during the preceding three (3) financial years);

- Resident individuals are allowed to make ODIs in foreign entities, including those involved in financial services activities (excluding banking and insurance) within an IFSC, as long as these entities do not have subsidiaries or step-down subsidiaries outside the IFSC where the resident individual holds control.

In light of these regulations, resident individuals and Indian entities that meet the criteria for a single-family office can establish FIFs within the IFSC to effectively manage their overseas investments.

It's important to note that any direct investment in FIFs by Indian residents must adhere to the guidelines of the LRS and the ODI Laws. The LRS permits a remittance limit of USD 250,000 per financial year, while the Indian companies making investments in the IFSC need to comply with the ODI Laws, including the limit for financial commitment, set at four hundred (400%) of the net worth as on the date of the last audited balance sheet of the Indian investing entity.

Investment by way of Overseas Portfolio Investment (OPI)

When Indian individuals and listed entities choose to invest in overseas funds, the ODI Laws clearly outline that this falls under the regulatory purview of the financial services regulator in the host jurisdiction. Then, this form of investment is permissible through OPI.

As per the ODI Laws, resident individuals and listed entities may make investments (including sponsor contributions) in the units of an investment fund or vehicle set up in an IFSC as OPI. Accordingly, in addition to listed Indian companies and resident individuals, unlisted Indian entities may also make such investments in IFSC.

The ODI Laws establish a more favourable framework for remittances to the IFSC. Specifically, any investment made into pooling vehicles established in IFSC should be treated as OPI. This provision enables families to remit funds to a FIF by way of OPI, either individually or through their listed or unlisted group entities. The FIF, in turn, can undertake global investments without being encumbered by restrictions imposed by Indian foreign exchange laws. Notably, individual investments through the LRS are capped at USD 250,000 per person per financial year, while listed and unlisted entities are subject to a cap of fifty per cent (50%) of their net worth per financial year.

Concluding remarks

The comprehensive framework for FIFs, complemented by foreign exchange provisions and a tax regime comparable to popular offshore jurisdictions, has positioned GIFT City as an attractive jurisdiction for Indian families seeking global market access. The strategic introduction of FIFs by the Indian government aligns seamlessly with the broader objective of establishing GIFT City as a financial powerhouse and enhancing the overall ease of doing business. The recent Circular by the IFSCA for clarification has not only facilitated the attraction of investments but has also encouraged single families to establish FIFs, ensuring the protection of non-family members' economic interests within the family entity.

The expanded eligibility criteria for single families, encompassing various entities and establishing a minimum threshold, underscores the commitment to safeguarding family interests. These regulatory changes create a conducive environment for family offices to thrive in the IFSC. These significant positions it as a preferred destination for setting up family offices.

While investors express optimism about Indian families increasingly considering FIFs in the IFSC over other alternatives, it is essential to seek clarifications on material aspects to mitigate potential conflicts with regulators. Addressing these concerns will further strengthen investor confidence and contribute to the continued growth and success of family offices in the dynamic landscape of GIFT City.

Footnotes

1 INTERNATIONAL FINANCIAL SERVICES CENTRES AUTHORITY (FUND MANAGEMENT) REGULATIONS, 2022, available at: https://ifsca.gov.in/Document/Legal/ifsca-fund-management-regulations-2022-as-amended-upto-april-11-202324042023105305.pdf

2 Regulation 2(n), International Financial Services Centres Authority (Fund Management) Regulations, 2022.

3 Regulation 17, International Financial Services Centres Authority (Fund Management) Regulations, 2022

4 IFSCA Circular F. No. 333/IFSCA/FIF/2022-23 dated March 01, 2023.

5 Substantial economic interest' means at least 90% economic interest which may include (i) percentage of shareholding in a company with share capital; or right to exercise control in case of a company without share capital; (ii) percentage share of profits in case of partnership firm and limited liability partnership; (iii) percentage of beneficial interest specified in trust deed in case of a determinate trust; or pro-rata share in the trust property in case of an indeterminate trust.

6 Master Direction No.7/2015-16,available at:https://www.rbi.org.in/Scripts/BS_ViewMasDirections.aspx?id=10192

7 Master Direction No.7/2015-16,available at:https://www.rbi.org.in/Scripts/BS_ViewMasDirections.aspx?id=10192

8 Regulation 104, International Financial Services Centres Authority (Fund Management) Regulations, 2022.

9 Regulation 104, International Financial Services Centres Authority (Fund Management) Regulations, 2022.

10 Regulation 106, International Financial Services Centres Authority (Fund Management) Regulations, 2022.

11 Foreign Exchange Management (Overseas Investment) Rules, 2022, available at: incometaxindia.gov.in/Documents/Provisions for NR/FEM-Overseas-Investment-Rules-2022.htm

12 Foreign Exchange Management (Overseas Investment) Directions, 2022, available at: https://www.rbi.org.in/Scripts/NotificationUser.aspx?Id=12381&Mode=0

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.