Overview

According to a recent study conducted by PMS Bazaar, the alternative investment landscape in India, which includes both Portfolio Management Services (PMS) and Alternative Investment Funds (AIFs), has demonstrated remarkable growth, outpacing the expansion observed in traditional mutual funds in recent years. AIFs have emerged as trailblazers in India's investment landscape, demonstrating an impressive Compound Annual Growth Rate (CAGR) of 36% over the last five years. Within this category, Category II AIFs, which include venture capital, private equity, real estate funds, and private credit, have experienced significant growth, primarily driven by the increased interest and participation of High-Net-Worth Individuals (HNIs) and Ultra High Net Worth Individuals (UHNIs).1 The alternative investment landscape in India, is poised for substantial expansion, projected to reach Rs 43.64 lakh crore in the upcoming five years.

India's International Financial Services Centre (IFSC) in Gujarat International Finance Tec-City (GIFT City) is becoming a key player in the global alternative investment landscape. With a favourable regulatory environment, including exemptions from certain Indian taxes, Gift City attracts AIFs globally. Its strong global connectivity facilitates easy capital sourcing and allocation for AIFs. Gift City also acts as a gateway to India's thriving markets, attracting both domestic and international AIFs. This growing presence enhances foreign investments in India and contributes significantly to the development of the Indian alternative investment sector.2

Background

The Government of India has meticulously laid the groundwork for a robust IFSC through the enactment of a regulatory framework under the Special Economic Zones Act, 2005. Operating under the auspices of the GIFT City in Gandhinagar, Gujarat, which stands as the sole approved IFSC in India, this financial hub holds the esteemed designation of a Special Economic Zone (SEZ). Within the confines of the IFSC, both 'Units' and entities are accorded the distinguished status of 'persons resident outside India,' as per India's exchange control laws. Positioned as a global financial and IT services hub, GIFT City is strategically poised to compete with established international financial centres.

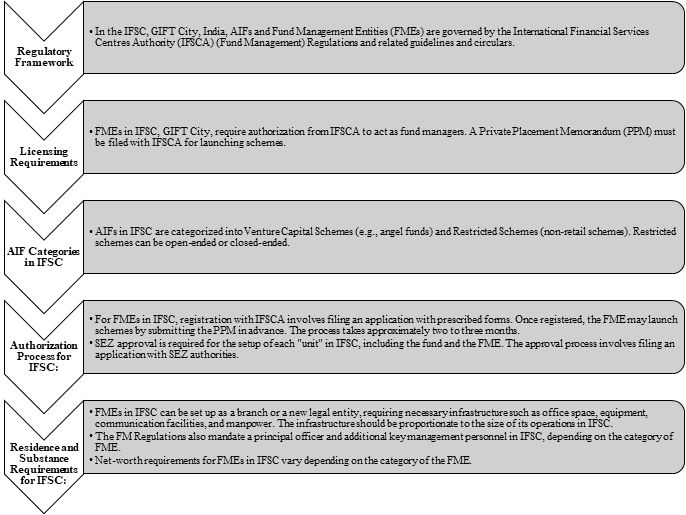

A pivotal milestone in this journey is the recent enactment of the International Financial Services Centre Authority3 (IFSCA) (Fund Management) Regulations, 2022 (IFSCA Fund Regulations). This regulatory framework supersedes and renders inoperative various regulatory provisions and circulars issued by the Securities and Exchange Board of India (SEBI) concerning funds in the IFSC. This includes the SEBI (Alternative Investment Funds) Regulations, 2012, SEBI (Mutual Funds) Regulations, 1996, and Chapter VI of SEBI (International Financial Services Centres) Guidelines, 2015.

Operating beyond the purview of the Foreign Exchange Management Act, 1999, as amended from time to time (FEMA), IFSC markets enjoy exemption from capital account restrictions. Adding to its allure, the IFSC's designation as a SEZ jurisdiction entitles it to favourable tax treatment. Particularly noteworthy are the IFSC Indian Rupee (INR) markets, governed by a distinct regulatory agency and adopting a hands-off stance by the Reserve Bank of India (RBI), thereby maintaining a technically offshore status. This offshore characterization, nestled within the territorial boundaries of India, is instrumental in fostering market confidence and attracting participants in the Non-Deliverable Forward (NDF) market.

Crucially, despite their offshore appearance, IFSC markets remain subject to regulation by Indian authorities. A key facet of this oversight involves the mandatory reporting of all Over-The-Counter (OTC) Foreign Exchange (FX) derivative transactions to the Clearing Corporation of India Limited4 (CCIL). This reporting mechanism ensures transparency and accountability, aligning seamlessly with the overarching regulatory objectives.

The establishment of a parallel regulatory framework within the IFSC emerges as an exemplar paradigm. This framework, projecting the optics of an offshore market, operates harmoniously within the purview of regulatory authorities. The deliberate absence of capital account restrictions in this parallel framework signifies a strategic compromise, specifically chosen to facilitate regulatory supervision over offshore markets.

In essence, this parallel regulatory framework stands as a sagacious solution, providing the avenue to potentially onshore the NDF markets without compromising the fundamental objective of maintaining a stable INR exchange rate. It expertly navigates the delicate balance between the imperative for regulatory control and the necessity to cultivate an offshore perception, thereby nurturing an environment conducive to both market stability and investor confidence.

Key advantages for AIFs in IFSC's favourable environment5

- Lower Operating Costs: Operating within the IFSC translates to lower operational costs for AIFs. The efficient infrastructure and supportive ecosystem contribute to streamlined processes, optimizing resource utilization.

- Competitive Tax Regime: A significant draw for AIFs in IFSC is the competitive tax regime. This favourable taxation environment enhances financial viability, making AIFs more attractive to potential investors seeking optimal returns.

- No Diversification Limits with Risk-Appropriate Disclosures: A distinctive feature of AIFs in IFSC is the absence of diversification limits on investments. AIFs have the freedom to diversify their portfolio without restrictive mandates, provided that investment decisions align with the risk appetite of investors. Comprehensive disclosures ensure transparency and informed decision-making.

- No Limits on Outbound Investments: A notable advantage in IFSC is the absence of restrictions on outbound investments for AIFs. This flexibility empowers AIFs to explore diverse investment opportunities globally, thereby maximizing their potential for returns.

- Permission for Borrowing and Leveraging Activities: AIFs in IFSC have the autonomy to borrow funds and engage in leveraging activities. This permission provides AIFs with strategic financial flexibility, enabling them to optimize their capital structure and potentially enhance returns.

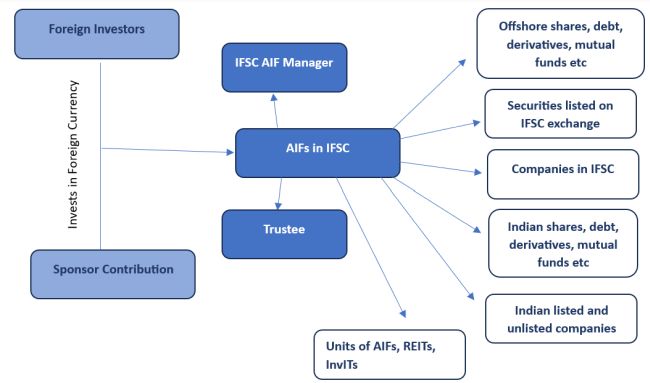

Inbound Investments (AIFs in IFSC)

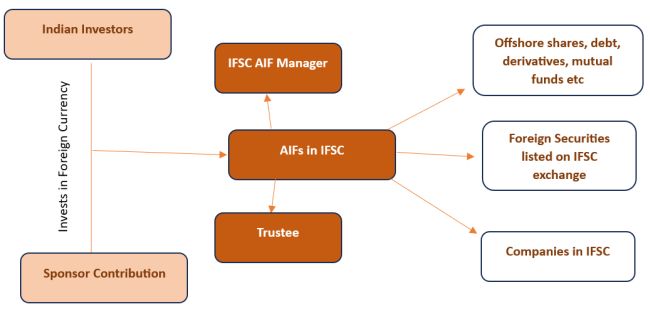

Outbound Investments (AIFs in IFSC)

CATEGORIES OF FUND MANAGEMENT ENTITY (FME)

The Fund Management Entity (FME) in IFSCA Fund Regulations stipulate that all entities, including existing fund managers, intending to engage in fund management activities within IFSCA must undergo registration as per the regulations outlined. The categorization of fund managers is based on their activities, as detailed below:

In the IFSC GIFT City, the various categories of AIFs include:

1. Venture Capital Schemes (including Angel Funds):

- These schemes focus on investing in start-ups, emerging ventures, or early-stage venture capital endeavours primarily engaged in new products, services, technology, and activities related to intellectual property rights.

- Venture Capital Schemes are exclusively closed-ended, with a minimum tenure of three years.

2. Restricted Schemes (Non-retail Schemes):

- These schemes have a broader scope, investing in start-ups, early-stage ventures, social ventures, SMEs, infrastructure, or other sectors deemed socially or economically beneficial by regulators or the government.

- They can make investments in diverse or complex trading strategies, including both listed and unlisted derivatives, as well as permitted investments under longevity finance.

- Restricted Schemes are flexible and can be launched as either open-ended or closed-ended.

For closed-ended schemes, the minimum tenure is one year, and the tenure must be predetermined and disclosed in the memorandum of the scheme.

FEATURES OF DIFFERENT SCHEMES6

1. Authorised FME

- Authorized Fund Management Entities (FMEs): Accredited investors or those exceeding specified thresholds participate in private placements facilitated by authorized FMEs. These entities pool funds to invest in start-ups and early-stage ventures through venture capital schemes.

- Venture Capital Schemes: Focused on unlisted securities of start-ups and emerging ventures, venture capital schemes, including angel funds, are instrumental in supporting early-stage businesses.

- Low Regulatory Oversight: The Authority exercises minimal regulatory oversight over these ventures, allowing flexibility while ensuring compliance with established standards.

- Diverse Legal Structures: FMEs may adopt legal structures such as companies, LLPs, branches, or any other form permissible under Authority guidelines, providing versatility in organizational frameworks. Notably, the branch structure is permissible only for an FME already registered and/or regulated by a financial sector regulator in India or a foreign jurisdiction for similar activities.

- Minimum Net Worth Requirement: Entities are mandated to maintain a minimum net worth of USD 75,000, ensuring a robust financial foundation for effective participation in venture capital activities.

- Experienced Workforce: FMEs are obligated to employ personnel with relevant experience as specified in the Regulations, ensuring a knowledgeable and proficient workforce.

- Principal Officer Responsibility: A designated principal officer assumes comprehensive responsibilities for the FME's activities, encompassing fund management, risk management, and compliance.

- Mandatory IFSC Office: FMEs are required to establish an office within the IFSC, promoting physical presence and active engagement within the designated financial hub.

2. Registered FME (Non-Retail)

- Registered Fund Management Entities (FMEs) - Non-Retail: Accredited investors or those exceeding specified thresholds participate in private placements facilitated by Registered FMEs (Non-Retail). These entities pool funds to invest in securities, financial products, and other permitted asset classes through restricted schemes.

- Expanded Portfolio Management Services: These FMEs have the added capacity to provide portfolio management services, including services for multi-family offices. Moreover, they can act as investment managers for the private placement of investment trusts, such as Real Estate Investment Trusts (REITs) and Infrastructure Investment Trusts (InvITs).

- Versatile Activities: FMEs registered as non-retail entities enjoy the flexibility to undertake all activities permitted for Authorized FMEs, enhancing their range of investment and service offerings.

- Stringent Regulatory Oversight: Regulatory oversight by the Authority is notably high, ensuring a robust and closely monitored operational environment for these entities.

- Diverse Scheme Offerings: These entities can offer Restricted Schemes (Non-Retail) on a private placement basis, in addition to Venture Capital schemes, expanding the scope of investment opportunities.

- Flexible Legal Structures: The legal structure of Registered FMEs (Non-Retail) may take the form of a company, LLP, branch, or any other structure permitted by the Authority, providing adaptability in organizational frameworks. Notably, the branch structure is permissible only for an FME already registered and/or regulated by a financial sector regulator in India or a foreign jurisdiction for similar activities.

- Minimum Net Worth Requirement: Entities are mandated to maintain a minimum net worth of USD 5,00,000, ensuring a robust financial foundation for effective participation in diverse investment activities.

- Experienced Workforce: These FMEs are required to employ personnel with relevant experience as specified in the Regulations, ensuring a knowledgeable and proficient workforce.

- Comprehensive Compliance and Risk Management: A designated principal officer and an additional Key Management Personnel (KMP) serve as the Compliance and Risk Manager. They are collectively responsible for ensuring compliance with the Regulations and implementing suitable risk management policies and practices at the FME.

- Mandatory IFSC Office: Registered FMEs (Non-Retail) are obligated to establish an office within the IFSC, reinforcing their commitment to a physical presence and active engagement within the designated financial hub.

3. Registered FME (Retail)

- Registered Fund Management Entities (FMEs) - Retail: Registered FMEs (Retail) are authorized to pool funds from all investors or a specific segment under one or more schemes, investing in securities, financial products, and other permitted asset classes through both retail and restricted schemes.

- Extended Role in Investment Management: These FMEs have the capacity to act as investment managers for the public offer of investment trusts (REITs and InvITs) and are also empowered to launch Exchange Traded Funds (ETFs).

- Versatile Activities Comparable to Authorized and Non-Retail FMEs: FMEs registered as retail entities have the flexibility to undertake all activities permitted to Authorized FMEs and Registered FMEs (Non-retail). This inclusive framework is especially attractive to large financial services groups seeking a broader range of fund management activities.

- Heightened Regulatory Oversight: Regulatory oversight by the Authority is marked as high, ensuring stringent monitoring and adherence to regulatory standards.

- Diverse Scheme Offerings: These entities can offer both Restricted Schemes (Retail and Non-Retail) and Venture Capital schemes, providing a comprehensive range of investment opportunities.

- Legal Structure Options: The legal structure of Registered FMEs (Retail) may take the form of a company or branch. Notably, the branch structure is permissible only for an FME already registered and/or regulated by a financial sector regulator in India or a foreign jurisdiction for similar activities.

- Minimum Net Worth Requirement: Entities are mandated to maintain a minimum net worth of USD 10,00,000, ensuring a robust financial foundation for effective participation in diverse investment activities.

- Experience and Expertise Criteria: Registered FMEs (Retail) or their holding companies are required to have not less than five years of experience in managing Assets Under Management (AUM) of at least USD 200 million, with more than 25,000 investors. Alternatively, at least one person in control of the FME holding more than 25% shareholding in the FME must have a financial services business background spanning a minimum of 5 years.

- Additional KMP for Fund Management: In addition to one principal officer and one Key Management Personnel (KMP), the FME is mandated to appoint an additional KMP responsible for fund management.

- Mandatory IFSC Office: Registered FMEs (Retail) are required to establish an office within the IFSC, emphasizing their commitment to a physical presence and active engagement within the designated financial hub.

Comparative analysis between the schemes:

|

Basis |

Venture Capital Schemes |

Restricted Schemes (Non-Retail) |

Retail Schemes |

|

Investor Pool |

Less than fifty (50) investors. |

Limited to specified categories. |

Minimum of twenty (20) investors. |

|

Eligible Investors |

Accredited Investors or those investing above USD 250,000. |

Accredited Investors or those investing above USD 150,000. |

No single investor can invest more than twenty-five percent (25%). |

|

Nature |

Close-ended schemes with a minimum tenure of three (3) years. |

Close-ended schemes filed as Category I Alternative Investment Fund. |

Can be open-ended or close-ended, with specified conditions. |

|

Permitted Investments |

Primarily in unlisted securities of start-ups and other specified instruments. |

Various investment strategies, including venture capital, with specified conditions. |

Diverse investment strategies with certain sectoral and exposure limits. |

|

Minimum Corpus |

USD 5 Million. |

USD 5 Million. |

USD 5 Million. |

|

Disclosures |

Detailed placement memorandum required, with periodic disclosures and NAV reporting. |

Placement memorandum required, with periodic disclosures and NAV reporting. |

Draft offer document filed with the Authority, with various disclosures, periodic NAV reporting. |

|

Borrowing |

Permitted with specified conditions. |

Permitted with specified conditions. |

Limited to meet temporary liquidity needs. |

|

Valuation |

Compliance with specified valuation norms. |

Compliance with specified valuation norms. |

Compliance with specified valuation norms. |

|

Contribution by FME |

Mandatory contribution of 2.5% to 10% of the targeted corpus. |

Mandatory contribution of 2.5% to 10% of the targeted corpus. |

Mandatory contribution of 1% of the AUM or USD 200,000. |

Process flow for setting up an AIF in GIFT IFSC

OTHER ACTIVITIES OF THE FME IN IFSC

The IFSC has streamlined regulations for various financial activities, consolidating PMS, Investment Advisory, Investment Trust, and Family Office under the IFSCA Fund Regulations.

Family Office:

Family Offices are classified into two main segments i.e., Single Family Office and Multiple Family Office. The former is a self-managed fund exclusively pooling resources from a single family, adhering to the IFSCA Fund Regulations and registered as an Authorized FME. Net worth requirements do not apply to a Family Investment Fund. The latter involves an FME providing services to a multi-family office under a portfolio management agreement, subject to additional guidelines stipulated by the IFSCA. A Family Investment Fund, with a minimum corpus of USD 10 million, can be established as a company, LLP, or contributory trust, with similar permissible investments as Restricted Schemes, free from caps and restrictions.

Other Fund Management Activities:

- Special Situation Funds (SSF): A Registered FME has the authorization to initiate a Special Situation Fund (SSF), designed as a closed-ended scheme spanning a minimum of three years, with a focus on investing in special situation assets as defined by financial market regulations. SSFs primarily target stressed loans/assets and security receipts issued by asset reconstruction companies. While the governance structure parallels that of a closed-ended restricted scheme, further elucidation on corpus, eligible investors, and related matters is anticipated from the IFSCA.

- Exchange Traded Funds (ETF): Registered FMEs (Retail) possess the prerogative to launch ETF. These ETFs are obligatory to be listed and traded on a recognized stock exchange, encompassing various categories such as equity index-based ETFs, debt index-based ETFs, commodity-based ETFs, gold ETFs, silver ETFs, hybrid ETFs (investing in two or more asset classes), actively managed ETFs, and any other ETFs subject to approval from the relevant recognized stock exchange and regulatory authority. The financial market regulations delineate comprehensive guidelines for each of the aforementioned ETF types.

- Environmental, Social and Governance (ESG): FMEs managing AUM exceeding USD 3 billion at the close of a financial year or as stipulated by the IFSCA are now obligated to: (i) institute a governance policy addressing material sustainability-related risks and opportunities; and (ii) disclose within their annual report the methodologies employed in identifying, assessing, and managing material sustainability-related risks, as well as the integration of sustainability-related considerations into the fund manager's investment strategies and processes

IFSC Fund Classification and Tax Implications:

In the context of IFSCA Fund Regulations, depending upon the nature of investment it may be treated as Category I/II AIF or Category III AIF as in the previous regime for tax purposes.

IFSC Fund regarded as (Category I/II AIF):

- Withholding Tax on Distribution: Category I/II AIF have tax pass-through status for Indian income-tax purposes (except for business income, which is taxable in the hands of the AIF for which 100% tax holiday can be claimed for a period of 10 consecutive years out of a block of first 15 years).

- Taxability in India: The IFSC Fund is not subject to taxation in India as per section 10(23FBA).

- Income Tax Return Filing: Filing of income tax return is mandatory, and the IFSC Fund is treated as a resident of India for income tax purposes.

- Withholding Tax on Distribution to Non-Resident Investors: The IFSC Fund is required to withhold tax on income credited/paid to non-resident investors at the prevailing rates as per the Income-tax Act or applicable Double Tax Avoidance Agreement (DTAA), whichever is more favorable (section 194LBB).

- Taxability for Non-Resident Investors: Interest income paid to non- Residents Investors on monies lent to IFSC units not taxable.

IFSC Fund regarded as (Category III AIF):

- Withholding Tax on Distribution: AIF is obligated to withhold tax at 10% on income credited/paid to the IFSC Fund. However, no withholding tax applies to exempt income of the IFSC Fund if all unit holders, excluding the sponsor/manager, are non-residents (section 194LBB/196D/section 10(4D)).

- Taxability in India: Transfer of specified securities listed on IFSC exchanges by a non-resident or Category III AIF located in IFSC not treated as transfer - Gains accruing not chargeable to tax in India - Specified securities include Bond, GDR, Foreign currency denominated bond, Rupee- denominated bond of an Indian company, Derivatives, Unit of a Mutual Fund, Unit of a business trust, Unit of Alternative Investment Fund and Foreign currency denominated equity share of a company

- Income Tax Return Filing: Similar to Category I/II AIF, filing of income tax return is mandatory, and the IFSC Fund is considered a resident of India for income tax purposes.

- Withholding Tax on Distribution to Non-Resident Investors: No withholding tax is imposed on the IFSC Fund when distributing to non-resident investors.

- Taxability for Non-Resident Investors: Non-resident investors in the IFSC Fund are not subject to additional income tax, as the tax withheld by the fund is deemed as their final tax liability.

Tax Incentives for Fund Manager in IFSC

- 100% tax holiday for business income for any 10 consecutive years out of 15 years beginning with the year in which registration in IFSC is obtained.

- Minimum Alternate Tax (MAT) not applicable if Fund Manager is set up as a company and opts for new concessional tax regime.

- Exemption from GST on services rendered in IFSC.

Concluding remarks

The emergence and rapid ascent of India's alternative investment sector, particularly within the IFSC in Gift City, stands as a testament to the nation's commitment to fostering a dynamic and globally competitive financial landscape. This transformative journey, backed by strategic regulatory initiatives, has not only propelled the IFSC into the spotlight but has also positioned India as a formidable player in the international alternative investment arena.

The IFSC in Gift City has not merely created a regulatory haven but has evolved into a vibrant and sophisticated financial ecosystem. The tailored framework for FMEs, coupled with a supportive regulatory environment, reflects a nuanced understanding of the diverse needs of investors and fund managers. This adaptability, combined with robust oversight, has created an environment conducive to innovation, efficiency, and sustained growth.

The advantages offered to AIFs within the IFSC, such as lower operating costs, a competitive tax regime, and the freedom to diversify without stringent mandates, position it as an attractive destination for both domestic and international investors. The IFSC's role as a gateway to India's markets, coupled with its global connectivity and simplified capital flow mechanisms, further solidifies its standing as a preferred hub for financial activities.

Furthermore, the tax incentives provided to IFSC Funds and Fund Managers demonstrate a forward-looking approach by the Indian government. The 100% tax holiday for business income, exemption from Minimum Alternate Tax (MAT), and relief from Goods and Services Tax (GST) on services rendered within the IFSC not only enhance the financial viability of investments but also underscore the commitment to creating a conducive and competitive financial environment.

In broad strokes, the IFSC in Gift City is a pivotal force in reshaping India's financial narrative on the global stage. It has transcended the traditional confines of regulatory jurisdictions, evolving into a symbol of financial excellence, innovation, and investor confidence. The continued growth of the alternative investment sector within the IFSC is poised not only to attract substantial investments but also to catalyse a broader transformation of India's financial landscape, solidifying its place as a leading global financial hub.

Footnotes

1. Article, Economic Times, PMS, "AIF AUM expected to grow at 26% CAGR to Rs 43 lakh crore by 2028: Report", dated November 02, 2023, available at: https://economictimes.indiatimes.com/markets/stocks/news/pms-aif-aum-expected-to-grow-at-26-cagr-to-rs-43-lakh-crore-by-2028-report/articleshow/104889430.cms

2. Article, Live Mint, "PMS, AIF industry estimated to expand at 26% CAGR to ₹43 lakh crore by 2028: PMS Bazaar", dated November 02, 2023, available at: https://www.livemint.com/money/personal-finance/pms-aif-industry-estimated-to-expand-at-26-cagr-to-rs-43-lakh-crore-by-2028-pms-bazaar-11698846075332.html

3. International Financial Services Centres Authority of India (IFSCA) is the regulatory authority for all financial services in IFSCs in India.

4.Reserve Bank of India, "RBI/2019-20/233 FMRD.FMID.26/02.05.002/2019-20" (Issued on May 18, 2020), available at: http://www.rbi.org.in/Scripts/NotificationUser.aspx?Id=11889&Mode=0.

5. Page 17, GIFT IFSC, 2021 available at: https://ifsca.gov.in/Document/Slider/IFSCA_Funds_Digital_18122021.pdf

6. INTERNATIONAL FINANCIAL SERVICES CENTRES AUTHORITY (FUND MANAGEMENT) REGULATIONS, 2022, available at: https://ifsca.gov.in/Document/Legal/ifsca-fund-management-regulations-2022-as-amended-upto-april-11-202324042023105305.pdf

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.