Key Takeaways

- Following the insurance regulator IRDAI's lead, SEBI has now amended the SEBI (Mutual Funds) Regulations 1996 to expressly permit PE funds to sponsor mutual funds.

- The updated MF framework goes a step further than the IRDAI's insurance regulations by providing for "disassociation" of sponsors as well as AMCs becoming "self-sponsored".

- While a few niggling concerns remain, the changes are long overdue and much needed.

State of Play

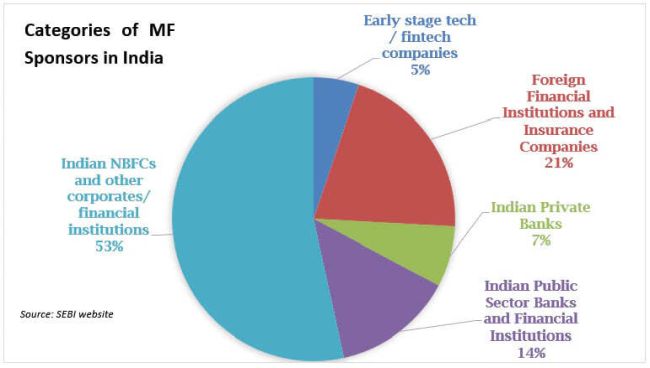

The assets under management (AUM) of the Indian mutual fund (MF) industry have increased significantly by over 80% during the last five years to reach USD 475 billion for FY 2023. However, with an AUM to GDP ratio of under 15%, the sector continues to remain severely underpenetrated. Despite the vast potential for growth, the MF industry has been historically dominated by large Indian banks and corporates.

A rule change introduced in December 2020, which exempted applicants from having a track record of profitability, triggered applications from a few new-age players such as Navi, Groww and Zerodha. However, the outsized influence of large domestic business groups has continued to be a reality (see chart above).

In the absence of an express enabling provision, private equity (PE) funds resorted to either having an indirect interest in the form of a stake in the sponsor (e.g., Bain Capital in 360 ONE, previously IIFL Wealth) or participating alongside an established Indian player (e.g., GIC and ChrysCapital participating alongside Bandan Bank in acquiring IDFC AMC).

Parallel Tracks for Eligibility as Sponsors

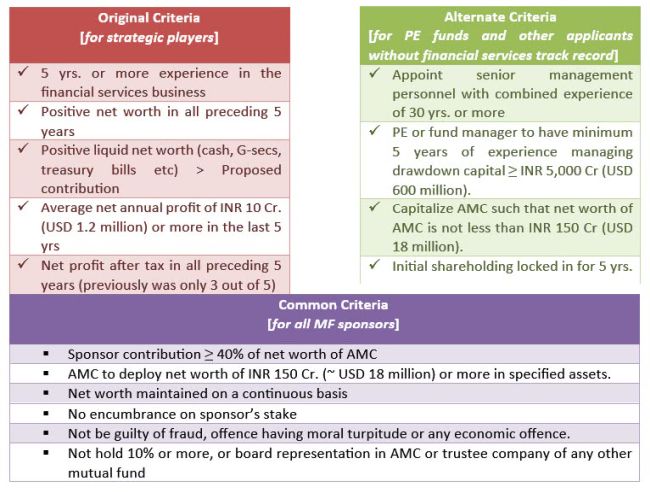

SEBI has now sought to address the above imbalance by expressly permitting private equity (PE) funds to become sponsors of asset management companies (AMCs). Rather than overhauling the entire framework, in keeping with the consultation paper issued earlier in the year, SEBI has left the original criteria for incumbents in the financial services business largely unchanged while creating a parallel track for PE funds and other applicants who do not fulfil the original criteria (see below).

Rather oddly, the updated MF framework does not include a definition of PE funds, but only requires the funds which seek to qualify as a sponsor to invest through a corporate structure and to have a minimum track record of five years of managing capital of at least INR 5,000 crores (USD 600 million) in the financial sector. In practice, as with the requirements introduced recently by the IRDAI for PE sponsors of insurance companies, SEBI will likely insist that the relevant funds (or their managers) are duly "registered" in India (i.e., as AIFs with SEBI) or overseas in an FATF compliant jurisdiction.

While the minimum capitalisation and KMP experience requirements under the alternate eligibility route are relatively straight forward, the enhanced lock-in requirement means that the shareholding equivalent to the minimum capital of at least INR 150 crores (USD 18 million) will be locked in for five years. At the same time, the sponsor will also need to make sure that its contribution does not drop below 40% of the net worth of the AMC at any stage.

Change of Control

Substantively, the process for a change of control in an AMC, which includes obtaining SEBI approval and providing an exit opportunity to the unit holders, remains unchanged from before (see below).

The updated framework, however, represents a missed opportunity to bring the control threshold in line with the Companies Act and SEBI's takeover regulations. While IRDAI had recently addressed this anomaly in the context of insurance companies by increasing the control threshold from 10% to 25%, the threshold under the MF regulations continues to remain pegged at 10%. By way of comparison, while the threshold is in line with the one in UK, the US follows a 25% threshold. So, effectively, the MF regime continues to have three categories of AMC shareholders – one, sponsors who have 40% or more of the share capital and will need to comply with the eligibility and lock-in requirements outlined above; two, other significant shareholders whose shareholding ranges between 10% to 40% and will need to comply with the cross-holding restriction in other MFs; and three, all other shareholders (i.e., holding less than 10%) who are not subject to any restrictions.

On the plus side, the updated MF regulations permit incoming sponsors in the context of a change of control to have "funds tied up" to the extent of the deal value, including by way of securing borrowing commitments. However, since the relaxation comes with the caveat that the shares of the AMC cannot be encumbered, the prospect of leveraged deals may not be realised any time soon. In any event, given that Indian banks continue to be prevented from financing share acquisitions, domestic acquirers are naturally constrained in securing loan financing for their acquisitions in India.

Self-Sponsored AMCs

The updated MF framework goes a step further than the IRDAI's insurance regulations by providing for "disassociation" of sponsors as well as AMCs becoming "self-sponsored". The disassociation concept, especially the obligation for the outgoing sponsor to reduce its shareholding in the AMC to below 10%, is derived from SEBI's rules for reclassification of promoters of a listed company as public shareholders. While SEBI has steered clear of introducing a mandatory divestment regime, sponsors who wish to disassociate themselves are required to commit to a graded stepwise reduction to fall below 10% over a five-year period (in case of listed AMCs) and over a three-year period (in case of unlisted AMCs). A failure to comply with the reduction plan should ideally mean that the relevant shareholder would continue as a sponsor, but not be treated as being in breach of the MF regulations. It will also be interesting to see if SEBI will require existing sponsors who hold between 10% to 40% in the underlying AMCs (e.g., the sponsors of UTI AMC) to sell down their shareholding to below 10% within a specified timeframe. However, any sponsor proposing to disassociate itself will need to have been a sponsor of the concerned mutual fund for at least five years before the proposed date of disassociation.

Apart from the outgoing sponsor reducing its shareholding to below 10%, the new rules require the AMC to have a five-year track record of positive net worth and profitability of INR 10 crores (USD 1.2 million) in order to become "self-sponsored". While the five-year track record is justified, the rules then go on to add that if these criteria are not met, following a one-year cure period, "the disassociated sponsor or any new entity shall become sponsor of the concerned Mutual Fund". As currently worded, the outgoing sponsor would carry a perpetual risk of getting reassociated as a sponsor for reasons which are attributable to the AMC's financial performance following the original disassociation. It is hopefully a matter of time before the "shall" is duly replaced with a "may"!

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.