TRAI ISSUES DIRECTION ON DIGITAL CONSENT ACQUISITION TO CURB THE PESKY CALLS AND MESSAGES

The Telecom Regulatory Authority of India ("TRAI") vide directions dated June 2, 2023, has issued directions for all the access providers to develop and deploy new Digital Consent Acquisition ("DCA") facility by August 1, 2023.

According to the directions: (a) there should be a facility to record and revoke the consents of the subscribers, maintain complete and accurate records of the consents, and accordingly update records of consent for the subscribers, (b) access providers should use a common short code 127xxx (or any other code as prescribed by the TRAI) for sending consent seeking message, (c) the consent seeking message which is sent through the short code should clearly mention the scope as well principal entity/brand name, (d) the consent acquisition confirmation message to the customers shall be inclusive of the information regarding the said consent's revocation, (e) principal entities should be educated regarding the process of taking consent as well as its verification through access providers, (f) every access provider shall ensure that any commercial communication using its network only takes place via registered headers assigned to the sender for the purpose of commercial communication, (g) establishment of the customer preference registration facility by every access provider and make necessary arrangements to facilitate its customers, on 24 hours and 7 days basis, throughout the year, (h) provide the customers with the ways and means to record consent or record revocation of consent related to commercial communication, (i) no commercial communication should takes place with any recipient, except as per the preferences or digitally registered consents registered according to the regulations, and (j) every access provider shall provide publicity and create customers awareness pertaining to the procedures and facilities for registration of preferences, registration and revocation of consents, and the procedures and facilities for making complaints or reporting Unsolicited Commercial Communications.

To read the direction click here

OTT PLATFORMS MUST DISPLAY TOBACCO WARNINGS

The Ministry of Health and Family Welfare, vide a flazette notification dated May 31, 2023, (World No Tobacco Day), notified the amendments in Cigarettes and Other Tobacco Products (Prohibition of Advertisement and Regulation of Trade and Commerce, Production, Supply and Distribution) Rules, 2004 ("Tobacco Rules"). A time period of 3 months is given by the ministry for the amendment to the Tobacco Rules to come into effect.

The amendment includes: (a) anti-tobacco health warning as a prominent static message to be displayed at the bottom of the screen during the period of display of the tobacco products or their use in the online circulated audio-video content, (b) anti-tobacco health spots, for a minimum period of 30 seconds, each at the beginning and the middle of programme, and (c) an audio-visual disclaimer pertaining to ill effects of tobacco use, for a minimum period of 20 seconds, should be displayed by the OTT platforms at the beginning as well as the middle of programme.

Further, the display of tobacco products or their use in online curated content shall not extend to – display of the brands of cigarettes or other tobacco products or any form of tobacco product placement and display of tobacco products or their use in promotional materials. The health spots, messages and disclaimers shall be made available on the website "mohfw.gov.in" or "ntep.mohfw.gov.in."

The anti-tobacco health warning message should be legible and readable, with font in black colour on white background and with the warnings "Tobacco causes cancer" or "Tobacco kills" and should be in the same language as used in the online curated content.

In the event of non-compliance of the aforesaid, an inter-ministerial committee can, suo motu or on receipt of complaint, issue notice giving reasonable opportunity to explain such failure and make appropriate modification in the content.

To read the notification click here

THE DIGITAL INDIA ACT - NEW REGIME OF INNOVATION IN THE IT SPHERE

The Ministry of Electronics and Information Technology has released a presentation on the Digital India Act, 2023 ("DIA") on March 9, 2023, ("Presentation"). On May 23, 2023, the MoS held Digital India Dialogues in Mumbai on the principles of the DIA.

The proposed DIA would replace the existing Information Technology Act, 2000. Further, the MoS mentions that safety and trust will be at the heart of the DIA and the concerns relating to misinformation and disinformation shall be addressed. The legal framework for global standard cyber laws as contemplated under the Presentation would consist of: (a) DIA Rules, (b) Digital Personal Data Protection (DPDP) Act, (c) Digital Personal Data Protection (DPDP) Act, and (d) The Amendments to the Indian Penal Code (IPC) pertaining to Cyber Crimes.

The key components of proposed DIA includes: (i) an open internet having choice, competition, online diversity, fair market access, (ii) curbing fake news and misinformation, (iii) digital governance's promotion, (iv) prevention and adjudication of user harm, (v) accountability of internet by the virtue of strengthening the grievance mechanism, stringent penalties for non-compliance and user disclosure norms for the data collected by the intermediaries, (vi) manage the complexities of internet as well rapid expansion of the types of intermediaries, (vii) protection of citizen's rights, and (viii) content monetisation rules for the user as well as platform generated content.

According to the Presentation, the DIA would provide for safeguarding innovation and promotion of digital governance as well as digital user rights (it includes right to be forgotten, right to secured electronic

means, right to redressal, right to digital inheritance, right against discrimination, rights against automated decision making, etc.) Further, as per the Presentation, the DIA would regulate and examine the discretionary moderation of the fake news by social media platforms under the rights of freedom and expression given under the Constitution of India. DIA may result in certain upgradation in the Competition Act, 2023. The Presentation enlists different types of intermediaries (eCommerce, Digital Media, Search Engines, flaming, Artificial Intelligence, OTT platforms, Telecommunications Service Providers, Ad-Tech Significant Social Media Intermediaries, etc.) under the ambit of DIA and contemplates the requirement of separate rules pertaining to each class of intermediaries.

To read the Presentation click here & to read the press-release of the Ministry of Electronics & IT click here

USE OF INTERNATIONAL CREDIT CARDS FOR MEETING EXPENSE WHEN ABROAD COVERED UNDER THE CAP OF LRS

The Ministry of Finance ("MoF"), vide notification dated May 16, 2023, has amended the Foreign Exchange Management (Current Account Transactions) Rules, 2000 by omitting Rule 7.

With effect from July 1, 2023, any payments made by an individual/ person by use of their international credit cards for meeting expenses while such person is on a visit outside India will fall under the maximum limit of USD 2,50,000/- per financial year provided under the Liberalized Remittance Scheme ("LRS"). Further, pursuant to the Finance Act, 2023, Tax Collection at Source ("TCS") on foreign remittance under LRS has been increased from 5% to 20% w.e.f. July 1, 2023, for all purposes except education and medical treatment.

To avoid any procedural ambiguity, MoF has issued a clarification that any payment made by an individual using their international debit or credit cards up to INR 7 Lakhs per financial year will not be counted under the LRS limits and accordingly, will not attract any TCS.

To read the notification click here

RBI ASKS BANKS TO COMPLETE TRANSITION AWAY FROM LIBOR AND MIFOR FROM JULY, 2023

The Reserve Bank of India ("RBI"), vide notification dated May 12, 2023, directed all the RBI-regulated banks and financial institutions to completely transition away from using London Interbank Offered Rate ("LIBOR") and Mumbai Interbank Forward Offer Rate ("MIFOR") from July 1, 2023.

RBI has advised the banks to use Alternate Reference Rate such as the Secured Overnight Financing Rate ("SOFR") and the Modified Mumbai Interbank Forward Outright Rate ("MMIFOR") instead of LIBOR.

The publication of the remaining 5 U.S. $ LIBOR/MIFOR settings will cease permanently after June 30, 2023. While certain synthetic LIBOR settings will continue to be published post June 30, 2023, the Financial Conduct Authority, U.K., which regulates the LIBOR, has clarified that these settings are not meant to be used in any new financial contract. MIFOR, a domestic interest rate benchmark reliant on U.S.

$ LIBOR, will also cease to be published by Financial Benchmarks India Private Limited after June 30, 2023.

Banks/financial institutions are advised to ensure that no new transactions undertaken by them are priced using U.S. $ LIBOR or the MIFOR or their customers rely on the U.S. $ LIBOR or the MIFOR. They are also advised to take all necessary steps to ensure insertion of fallbacks in all remaining legacy financial contracts that reference U.S. $ LIBOR or MIFOR.

To read the notification click here

THE NEW PMLA AMENDMENT BRINGS UNDER ITS AMBIT PRACTICING CA/CS/CMAS

The MoF, vide notification dated May 9, 2023, has widened the definition of 'person carrying on designated business or profession' pursuant to the powers conferred to it under Section 2(1)(sa)(vi) of Prevention of Money Laundering Act, 2002 ("PMLA"). The amendment has brought professionals, such as a chartered accountant, cost accountant or company secretary who have obtained certificate of participation and are practicing, under the ambit of PMLA.

Such person(s) will be classified as "reporting entity" under Section 2(1)(wa) of PMLA and accordingly, will be required to comply with the obligations of the reporting entity under the PMLA.

However, the amendment has specifically exempted professionals i.e., advocate, CA, CS, and CWA in practice who is engaged in formation of a company to the extent of filing a declaration under Section 7(1)

(b) of the Companies Act, 2013 ("Companies Act").

The objective behind this amendment is to address the challenges of money laundering and terrorism financing by extending the scope of reporting requirements and strengthening the accountability of professionals engaging in financial transactions on behalf their clienteles.

To read the notification of May 9, 2023, clickhere & to read the notification of May 3, 2023, click here

CHANGE IN THE RETAIL PRICE OF NEW DRUGS HAVING INGREDIENTS GOING OFF-PATENT

The Department of Pharmaceuticals ("DoP"), vide a notification dated May 11, 2023, has notified the Drugs (Prices Control) Amendment Order, 2023 ("Amendment Order") to amend the Drugs (Prices Control) Order, 2013 ("Order"). As per the said Amendment Order, new formula for determining price of off-patent drug has been devised and also the methodology for revision of the price of the off-patented drug after 1 year has been introduced.

The retail price of the new drugs with ingredients/ molecules or components that have become off-patent or about to become off-patent shall be reduced to 50% of the current ceiling price.

Additionally, the ceiling price shall be revised after a time period of 1 year from the date on which the retail price was fixed as per the provisions of the Order on the grounds of the market data. The timeline of 1 year would be later of (i) the date on which the retail price was fixed as aforesaid or (ii) the date on which "price to retailer" of at least 1 company was fixed as aforesaid and is captured in the pharmaceutical market database.

To read the original Order click here & to read the notification click here

NATIONAL MEDICAL DEVICES POLICY, 2023 NOTIFIED BY THE UNION CABINET

The Ministry of Chemicals and Fertilizers (DoP), vide notification dated May 3, 2023, has notified the National Medical Devices Policy, 2023 ("Policy"). The Policy has been issued pursuant to the 'Approach Paper to National Medical Device Policy, 2022' published by the DoP dated May 10, 2022.

The Policy aims at India becoming a global leader by the way of boosting the global market share in the MedTech sector up to 10-12% over the next 25 years' time period. The missions of the Policy inter alia includes: (a) universal access to good quality medical devices, (b) making the medical devices affordable, (c) improvement of the quality of medical devices by the enhancement of global positioning, acceptability and competitiveness, and (d) improvement in the quality of care and clinical outcomes as well as convenience of the patients.

Few of the key growth strategies proposed by the Policy:

(i) setting up of a single window clearance system for facilitating the licensing of medical devices, (ii) enhancement of the large infrastructures for setting up large medical device parks, medium-sized medical devices clusters, enhancing the number of medical device testing laboratories in proximity to the economic zones as well establishment of centers of excellences in premier academic and research institutions, (iii) promotion of research and development and innovation in the Pharma-MedTech sector in India, (iv) boosting the funding through private investment in the sector by the virtue of promoting seed capital and series of funding from venture capitalists and adopting new financing models like a mix of private and public funds and facilitating policies for strengthening the manufacturing in India such as Public Procurement (Make in India) Policy, Ayushman Bharat and other such policies, (v) promoting medical devices safety, standards awareness and ensure proactive communication and outreach on the value proposition amongst public at large, (vi) promotion and development of future ready MedTech and for the purpose of developing and promoting future ready MedTech human resource, existing institutions to inculcate multidisciplinary courses for medical devices as well as make optimum utilisation of the resources available in the Ministry of Skill Development and Entrepreneurship and to align these courses with the national skill qualification framework and integration of the skilling activities with skill India portal, (vii) development of a framework for a coherent pricing regulation, and (viii) promoting innovation and Research and Development ("R&D") which would be inclusive of joint R&D projects involving academic institutions and industry under the ambit of 'National Policy on R&D and Innovation in the Pharma- MedTech Sector in India'.

To read the notification click here

CLARIFICATION WITH RESPECT TO VOLUNTARY STRIKE-OFF OF COMPANIES

The MCA, vide notification dated May 10, 2023, has notified Companies (Removal of Names of Companies from the Register of Companies) Second Amendment Rules, 2023, which relates to pre-requisites of voluntary strike-off.

Certain provisos have been inserted in Rule 4(1) of Companies (Removal of Names of Companies from the Register of Companies) Rules, 2016, which states that:

- the company shall not file an application unless it has filed overdue financial statements under Section 137 of the Companies Act and overdue annual returns under Section 92 of the Companies Act, up to the end of the financial year in which the company ceased to carry its business operation;

- in case a company intends to file the application after the action under subsection (1) of Section 248 of the Companies Act has been initiated by the ROC, it shall file all pending financial statements under Section 137 and all pending annual returns under Section 92, before filing the application;

- once notice under sub-section (5) of Section 248 has been issued by the ROC for publication pursuant to the action initiated under sub-section (1) of Section 248, a company shall not be allowed to file the application under this sub-rule.

To read the notification click here

STRICTER TIMELINES INTRODUCED FOR FAST-TRACK MERGER UNDER SECTION 233 OF COMPANIES ACT

The MCA, vide notification dated May 15, 2023, has notified Companies (Compromises, Arrangements and Amalgamations) Amendment Rules, 2023 ("Amendment Rules") which will be effective from June 15, 2023.

As per Section 233(2)(a) of Companies Act read with Rule 25(4) of Companies (Compromises, Arrangements and Amalgamations) Amendment Rules, 2014, the transferee company shall file the scheme of merger with the Central flovernment, Regional Director ("RD") in Form CAA No. 11 within 7 days from the conclusion of meeting of members or creditors. Further, a copy of scheme of merger along with Form No. CAA 11 shall also be submitted with the Registrar of Companies ("ROC") and the Official Liquidator ("OL").

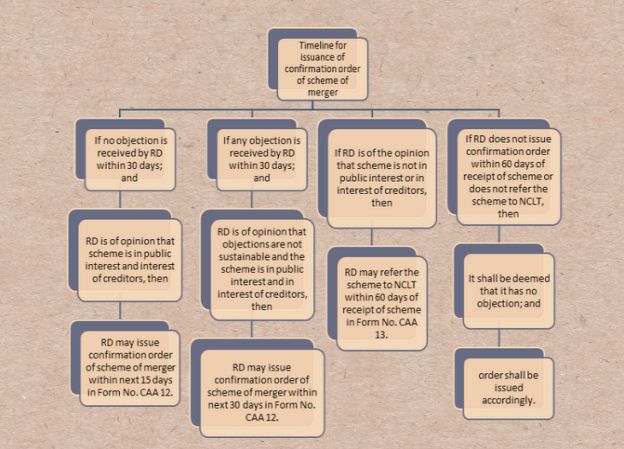

ROC and OL may raise objections to the scheme, if any, with the RD. According to the Amendment Rules, the timeline for issuance of confirmation order on scheme of merger by RD shall stand amended as below:

To read the notification click here

SUBSTITUTION OF EXISTING LLP FORM NO. 3

The Ministry of Corporate Affairs ("MCA"), vide notification dated June 2, 2023, has notified Limited Liability Partnership (Amendment) Rules, 2023, which has substituted the LLP Form No. 3 (intimation of information with regard to Limited Liability Partnership Agreement and changes, if any, made therein to the Registrar of Companies) in Limited Liability Partnership Rules, 2009.

To read the notification click here

SEPARATE FILING OF FORM CSR-2 FOR THE FINANCIAL YEAR 2022-23 CONTINUES

The MCA, vide notification dated May 31, 2023, has notified Limited Liability Partnership (Amendment) Rules, 2023.

As per Rule 12(1B) of Companies (Accounts) Rules, 2014, every company covered under the provisions of Section 135(1) of the Companies Act shall furnish a report on Corporate Social Responsibility in Form CSR- 2 to the Registrar of Companies as an addendum to Form AOC-4 or AOC-4 XBRL or AOC-4 NBFC (Ind AS) (filing financial statement and other documents with the Registrar of Companies), as the case may be.

In line with the Companies (Accounts) Third Amendment Rules, 2022, for the financial year 2022 – 2023 as well the companies are required to file Form CSR-2, separately on or before March 31, 2024, after filing of Form No. AOC-4 or Form No. AOC-4 XBRL or Form No. AOC-4-NBFC (Ind AS), as the case may be.

To read the notification click here

© 2020, Vaish Associates Advocates,

All rights reserved

Advocates, 1st & 11th Floors, Mohan Dev Building 13, Tolstoy

Marg New Delhi-110001 (India).

The content of this article is intended to provide a general guide to the subject matter. Specialist professional advice should be sought about your specific circumstances. The views expressed in this article are solely of the authors of this article.