The Reserve Bank of India (RBI) by way of a circular issued 'Guidelines on Default Loss Guarantee (DLG) in digital lending' on 8 June 2023 (DLG Guidelines), provided the much needed legitimacy to default loss guarantee (also known as first loss default guarantee (FLDG)) between a regulated entity (RE) (such as a bank or non-banking financial company (NBFC)) and lending service provider (LSP) (typically an unregulated fintech) or inter se REs, with some qualifiers and conditionalities.

FLDG as a concept

Simply put, FLDGs are risk sharing arrangements between an RE and an LSP, whereby default on loans extended by REs to borrowers originated through the LSP are guaranteed by the LSP. FLDGs are provided in various forms which, inter alia, include funded risk participation by way of cash deposits or non-funded risk participation in form of corporate guarantees or bank guarantees, and even a combination of funded and non-funded risk participation. The risk participation is up to a certain percentage of the lending by the RE through the LSP which is mutually decided by the RE and the LSPs based on various considerations such as the lending segment, credibility and market reputation of the LSP etc.

Such risk participation and support from LSPs (ranging from underwriting to loan monitoring and recovery) enabled REs to expand their customer base, beyond the conventional borrower profile, by tapping otherwise underserved sectors like micro, small and medium enterprises (MSME) and small and medium-sized enterprises (SME) finance and consumer finance. This innovation in traditional financial services provided an edge to the Indian fintech sector, giving a fillip to funding and investments in the sector.

While FLDG strengthened credit penetration and was a step in the right direction to attain India's financial inclusion goals, FLDG as an unregulated financial product was susceptible to certain weaknesses on account of its structuring, like concerns over LSP's wherewithal to provide the guarantee, lack of standardisation in form and nature of LSP guarantee to RE, the inadequacy of contractual arrangement / cover. Lack of restriction on REs end use of guarantee collateral and utilisation of deposit for on-lending by RE, led to the apprehension of 'lend-a-license' model being offered by REs to LSPs, wherein the RE was a mere conduit (with financial exposure) in the larger picture of FLDG transactions, which is a flagrant violation.

This brought FLDGs on regulatory radar of authorities like Directorate of Enforcement, the Serious Fraud Investigation Office, and the RBI to the Registrar of Companies (Ministry of Corporate Affairs) pulling up REs and LSPs for participating in FLDG arrangements, and even Institute of Chartered Accountants of India was seen scrutinising the statutory auditor of such REs.

Regulatory regime for FLDG prior to DLG Guidelines

Worthwhile to note that 2021 onwards, the RBI has been dabbling in FLDG regulation and governance. It started with the Working Group on Digital Lending (Working Group) being set up by RBI on 13 January 2021, which submitted its report on 18 November 2021 titled 'Report of the Working Group on Digital Lending including Lending through Online Platforms and Mobile Apps' (WG Report).1 Based on the WG Report, the RBI on 10 August 2022 released 'Recommendations of the Working group on Digital Lending - Implementation' (DL Recommendations), which stated that the RBI was examining FLDG related recommendations of the Working Group, and in the meantime required the REs to ensure compliance with Master Direction - Reserve Bank of India (Securitisation of Standard Assets) Directions, 2021 dated 24 September 2021 (Securitisation MD) with respect to "financial product involving contractual agreement, in which a third party guarantees to compensate up to a certain percentage of default in a loan portfolio of the RE". Soon after on 2 September, the RBI issued 'Guidelines on Digital Lending' (DL Guidelines) advising REs to adhere to Securitisation MD for FLDG (in an unequivocal manner), implying that FLDG arrangements were completely prohibited.

DLG Guidelines

The RBI revisited its stance in the DL Guidelines which had imposed abrupt restrictions on FLDG and relaxed the regime through the latest DLG Guidelines. It would not be an overstatement to say that the RBI has managed to balance the regulatory concerns of systemic risks associated with FLDG and the need for a robust digital lending ecosystem that is not inhibiting the radical financial product offerings and innovation of fintech.

The key takeaways from the DLG Guidelines are as follows:

- REs and LSPs are the only entities permitted to enter FLDG

arrangements: FLDG arrangements have been permitted between: (a) RE

as the lender (RE Lender) on one hand, and (b) LSP or another RE

(DLG Provider) on the other hand. The RE and the LSP have the same

definition as in the DL Guidelines, with an additional requirement

that the LSP acting as a DLG Provider should be incorporated as a

company.

Comment: This would affect lending penetration for specific sectors including agriculture and MSME lending where structuring FLDG arrangements would be difficult as the stakeholders may not be organized as companies.

- Defined scope of FLDG: FLDG (referred to as DLG in the DLG

Guidelines) has been categorically defined as a contractual

arrangement between the RE Lender and DLG Provider, under which the

DLG Provider guarantees to compensate the RE Lender for a loss due

to default up to a certain specified percentage of the loan

portfolio of the RE Lender. Any other implicit guarantee of similar

nature linked to the performance of the loan portfolio of the RE

Lender has also been brought within the ambit of the definition.

Accordingly, structures involving performance guarantees and

indemnities linked with collections / recovery obligations for an

underlying portfolio are also intended to be covered by the DLG

Guidelines.

Further, the below mentioned guarantees are not covered within the definition, and thereby not within the ambit of the DLG Guidelines:- Guarantee schemes of Credit Guarantee Fund Trust for Micro and Small Enterprises, Credit Risk Guarantee Fund Trust for Low Income Housing and individual schemes under National Credit Guarantee Trustee Company Limited.

- Credit guarantee provided by Bank for International Settlements, International Monetary Fund, as well as Multilateral Development Banks as referred to in Paragraph 5.5 of the RBI Master Circular on Basel III Capital Regulation dated 12 May 2023.

Comment: The RBI clearly intends to create a closed framework of players involved in FLDG, given the explicit recognition of REs and LSPs from its earlier DL Guidelines. It also unclear whether FLDG arrangements under co-lending arrangements entered into between regulated lenders would be covered by the DLG Guidelines.

- FLDG Cover to be maintained by RE Lender only in certain

recognised forms: RE Lenders may accept FLDG Cover only in any of

the three forms or hybrid thereof: (a) cash deposits with the RE

Lender; (b) fixed deposits maintained with a scheduled commercial

bank with a lien marked in the RE Lender's favor; or (c) bank

guarantee in the RE Lender's favor.

Comment: This implies that structures involving corporate guarantees and risk participation arrangements in form of contractual indemnities without any funded participation or bank guarantees would not be permitted.

- FLDG Cover of outstanding portfolios to be capped at 5% of such

loan portfolio: By way of such ceiling on FLDG, the RBI has

prescribed a risk sharing cap of 5% on RE Lender, inter

alia, in a ring-fencing attempt to reduce the

financial exposure of the RE Lender to FLDG arrangements.

This rule also extends to implicit guarantee arrangements (such as performance indemnities for collections and recoveries as specified above), and the DLG Provider's performance risk cannot exceed 5% of the underlying loan portfolio.

Comment: There is lack of clarity whether the abovementioned 5% would be computed on the basis of total outstanding / sanctioned loan amount or defaulted / unpaid loan amount. This clarity would also be crucial for the statutory auditor to review while drawing up financials of the RE Lender as well as the DLG Provider.

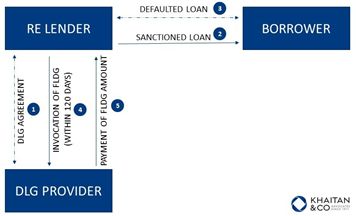

- FLDG arrangement in a written contract format: It is a

mandatory requirement that the FLDG arrangement should be in a

legally enforceable contract between the RE Lender and DLG Provider

(DLG Agreement), explicitly setting out the terms and structure of

the FLDG arrangement, with a categorical requirement to include:

(a) extent of the cover provided by the DLG Provider (DLG Cover),

(b) form in which DLG Cover is maintained with RE Lender, (c)

timeline for DLG Cover invocation by the RE Lender, in extenuating

circumstances, and (d) terms for LSP to disclose the FLDG

arrangement on their website along with certain statutorily

required specifics.

Additionally, the RBI has mandated that the period of the DLG Agreement shall not be less than the longest tenor of loan in the underlying loan portfolio.

Comment: The DLG Guidelines place rigorous disclosure requirements on LSPs, requiring them to publish details of their FLDG involvement in all portfolios. This may potentially impact competition amongst REs and LSPs as well.

- RE Lender obligations prior to entering FLDG arrangements: RE

Lenders must keep the following in mind prior to entering a DLG

Agreement:

- RE Lenders shall formulate and adopt a policy for entering FLDG arrangements, and such policy shall be approved by its board of directors; and

- The RE Lender should put in place a credit appraisal mechanism and credit underwriting standards regardless of whether it has entered an FLDG arrangement or not.

At the time of entering or renewing FLDG arrangement (including the underlying DLG Agreement), the RE Lender shall review the DLG Provider's ability to honour the agreement, obtain a declaration to this effect certified by the statutory auditor in relation to the aggregate DLG amount outstanding, and the number of other RE Lenders and portfolios against which DLG has been provided (including past default rates on similar portfolios) by such DLG Provider.

Comment: Given that the RBI places the ultimate responsibility for the FLDG arrangements on RE Lenders, RE Lenders should, as a matter of caution, undertake detailed due diligence not only prior to setting up FLDG arrangements but also conduct such due diligence on an ongoing basis for its existing FLDG arrangements, to ensure 'checks and balances'.

- Prudential norms legislated for FLDG:

- Recognition of Non-Performing Assets (NPA): The RE Lender shall be responsible for recognition of individual loan assets as NPA and the consequent provisioning as per the extant asset classification and provisioning norms irrespective of FLDG Cover available at the portfolio level. Further, the amount of FLDG invoked cannot be set off against underlying individual loans. Recovery by the RE Lender from the loans on which FLDG has been invoked and realised may be shared with the DLG Provider based on the underlying DLG Agreement.

- Invocation time period: The RE Lender shall invoke FLDG within a maximum overdue period of 120 days, unless made good by the borrower prior to expiry of 120 days.

- Treatment of FLDG for regulatory capital: The RE Lender shall undertake capital computation of exposure and application of credit risk mitigation benefits on individual loan assets as per the extant norms.

- Borrower protection mechanism: The RE Lenders shall be required to comply with the instructions on customer protection measures and grievance redressal issues provided in the DL Guidelines.

Comment: Certain practical aspects in relation to prudential norms for FLDGs such as whether the overdue period would start from the first date of default or at the end of the repayment timeline still remain unclear. While market players may interpret a shorter timeline for the same, the RBI may yet issue FAQs to, inter alia, clarify on this aspect.

With respect to the NPA classification, the RBI has now clarified that all defaulted loans in respect of which FLDG is invoked will have to be reported as NPA irrespective of the RE Lender recovering the defaulted amounts from the DLG provider. This would require REs to revisit their current practices relating to treatment of such loan accounts and related compliance of prudential norms.

For ease of understanding, a graphic summary of how FLDG operates on default by borrower under the DLG Guidelines is as follows:

The DLG Guidelines come into effect from the date of publication, which clears the air on retrospective application and compliance requirement vis-à-vis FLDG.

Comment

The DLG Guidelines are a welcome step towards permitting FLDG arrangements from LSPs and settles much of the disquiet around the future of this industry. Although the ceiling prescribed for the FLDG exposure appears to remain below the industry standard, it is indicative of the RBI's balancing act of ensuring that the systemic risks associated with such arrangements continue to remain with the REs and all safeguards in form of regulatory compliances, asset provisioning, customer protection and credit underwriting related protective measures remains the primary responsibility of the REs.

As a financial sector regulator, the RBI has attempted to tighten the screws on certain opportunistic arbitrage to ensure that the digital lending ecosystem remains transparently managed and insulated against various risks. As highlighted above, several grey areas remain, and it shall have to be seen whether the RBI issues FAQs to clarify various operational aspects.

Footnotes

1. The WG Report referred to 'rent-an-NBFC model by digital lenders' alluding to a synthetic structure enabling 'unregulated entities' to lend without complying with prudential norms through credit risk sharing arrangements by way of FLDG extended by the LSPs, and recommended that REs should not be allowed to extend arrangements in the nature of FLDG, to prevent loan origination by 'unregulated entities', and suggested wider consultation with stakeholders and examination by regulators and government agencies.