India is one of the world's rapidly growing economies, creating an increasingly attractive and flourishing landscape for investors.1 Boasting the largest young population globally,2 India presents prospective investors with a valuable asset – youth waiting to fulfil their aspirations! Against this backdrop, and further fuelled by the recent geo-political developments, the investment landscape shows compelling tailwinds in the M&A and private equity / venture capital space, which picked up in Q3 of 2023, and may see further upswing in the year 2024. In this report, we touch upon (a) deal activities in the M&A and PE space including, in brief, sectoral deal analysis, (b) certain observations in the corporate governance space, and (c) certain developments in the legal / regulatory space which may benefit M&A and PE transactions in the near future.

Deal activity in India

Mergers & Acquisitions

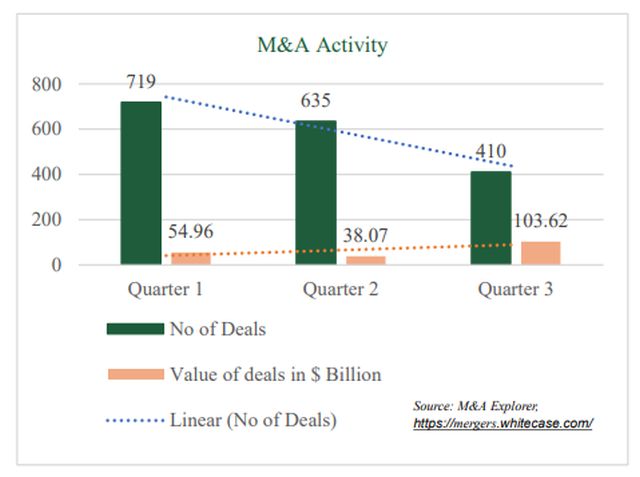

M&A suffered in India during 2023. M&A deal value at a global level saw a decrease, ranging from 41–45%. 3 In India, deal value plunged by 61% in comparison to its 2022 figures.4 One possible reason behind such drop could be that in 2022 there was a mega merger between HDFC and HDFC Bank. It is expected that India's M&A activity will grow strong in the year 2024 due to global interest in Indian markets.

Private Equity

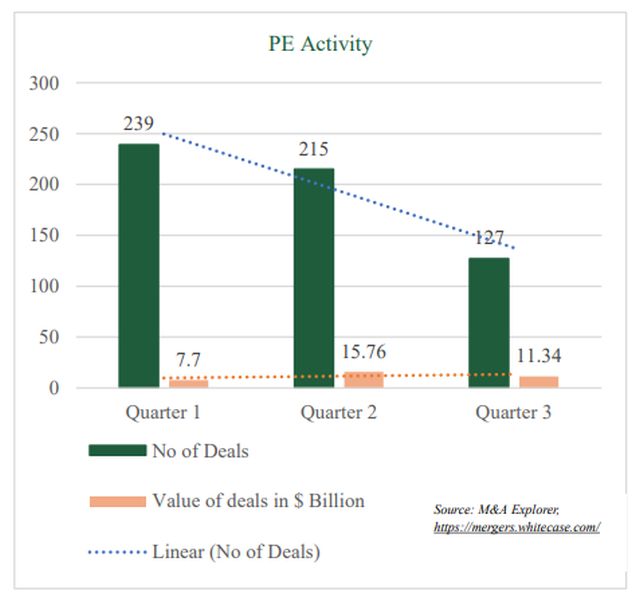

In Q3 of 2023, private equity activity remained moderate yet consistent, comprising of 127 deals totalling to USD 11.34 billion. Notably, there was an uptick in deal value from Q1 to Q2 of 2023, followed by a subsequent decline from Q2 to Q3 of the same year. This pattern is evident on a global scale, with the peak deal value occurring in Q2 of 2023 and a subsequent dip in Q3.5 On an annual basis, there is a noteworthy 44% decrease in global PE deal value for the year 2023.6 This global decline is mirrored in India, where the PE deal value experienced a 40% downfall compared to the figures recorded in year 2022.7

Footnotes

1. World Bank, Overview (27 September 2023), access here

2. UNFPA, What we do (visited on 26 December 2023), access here

3. BCG, M&A Set to Pick Up in 2024 Despite Ongoing Headwinds (26 October 2023), access here

4. Business Standard, M&A deals plummet to $70.9 bn in 2023, down 63% from previous year's high (17 December 2023), access here

5. EY, Private Equity Pulse: Five takeaways from Q3 2023 (25 October 2023), access here

6. SP Global, The Private Equity and Venture Capital Deal Landscape Q3 2023 (25 October 2023), access here

7. Economic Times, Inflows from private equity, venture capital funds to domestic comanies plunge to $27.9 billion in 2023 (27 December 2023), access here

To view the full article, click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.