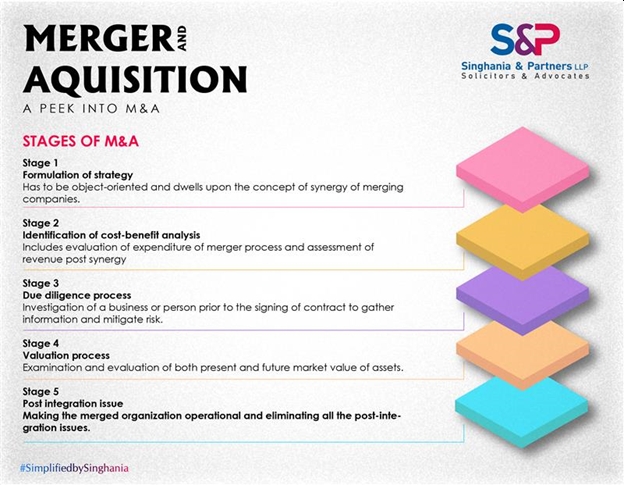

There are several critical steps involved in the Merger and Acquisition process from planning to valuation to integration. The decision of merger and acquisition is taken only after analysing various factors such as the current status of companies, the present market scenario, threats and opportunities. A detailed analysis of the stages involved in M&A are given in this article in our Mergers and Acquisitions series:

1. Formulation of Strategy

The success of mergers and acquisitions depends upon the strategies followed by the company. It is essential to know what they are going to gain through the merger. A good acquisition strategy revolves around the acquirer having a clear idea of what they expect to gain from making the acquisition and what their business purpose is for acquiring the target company, for instance, whether to expand product lines or gain access to new markets.

It must be object-oriented and dwells upon the concept ofsynergy. The term synergy is of great importance as it is often the driving force behind a merger or acquisition. A merger and acquisition are worthwhile if the projected value and performance of the joined entities is greater than the sum of its individual parts. Thus, the first and foremost step involved in the M&A process is creating a good acquisition strategy.

2. Identification of Cost-Benefit Analysis

This step involves evaluation of expenditure of the merger process and assessment of revenue post synergy. To maximise the probability of M&A success and prediction of resources to be allocated, costs -benefits analysis isinevitable before making any decisions on the deals.

The component of cost-benefit analysis is essential in providing the evidence in terms of costs of managing the deal and the value of the target company to support M&A decision-making. Companies that have done well researched work have the opportunity to win and rise from the competitors. A preliminary valuation involving the cost and estimated returns through acquisition is essential for the success of M&A.

3. Due Diligence Process

The success of M&A acquisition would depend upon how well the company conducts the process of due diligence. It involves an investigation of the target company, its operations, human capital, tax and legal structure and its financials prior to the signing of a contract.

A detailed examination is done in this stage by analysing each and every aspect of the target company's operations. The objective of due diligence is to ensure that information is correct based on which the offer was made. If it is wrong then revision is done to justify the actual information.

4. Valuation Process

This stage involves the examination and evaluation of both present and future market value. This is one of the critical steps in the M&A process. The acquirer may ask the target company to provide substantial information that will enable the acquirer to further evaluate the target, both as a business on its own and as a suitable acquisition target.

The seller tries to find out what would be the good price that would result in shareholders gaining from the deal. It also tries to know what would be a reasonable offer for the target or purchaser of businesses. A company in M&A produces multiple valuation models that can help them to decide whether or not to pursue a deal.

5. Post-Integration Issue

The main purpose of this stage is to make the merged organisation operational so that the strategic value expectations can be delivered. After the deal is closed, the management teams of both the companies work together to integrate the two businesses into one as possible. It involves the integration of processes, systems, strategies etc.

It also involves integrating people and changing the organisational culture of the merging firms, possibly to develop into a hybrid culture. This integration involves change in the mindset and behaviour of the people. It is therefore necessary to address the cultural issues during the integration process.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.