Introduction

Do you know that in the year 2005, the popular music track identifying application, "Shazam", assigned its "Audio Recognition technology" and related patents to Broadcast Music Inc.® (BMI®), to facilitate immediate funding for its development, and in turn acquired an exclusive license from BMI® to use the same technology?

Also, do you know that in 2011, when Shazam successfully built its IP Portfolio and attracted a large "loyal" customer base, it reacquired the earlier assigned "Audio Recognition technology and related Patents" from BMI® for an undisclosed amount?

But how does this transaction facilitate? Why would BMI® even allow Shazam to reacquire its technology and related intellectual property despite knowing that there are about 200 commercially viable patents filed for this technology, all of which are synonyms of success?

Well, this is simply an example of an IP BUY-BACK Arrangement that took place between Shazam and BMI.

Intellectual Property Buyback: Concept and Relevance

Buyback is simply an arrangement wherein the 'Original Seller' repurchases its own intellectual property from the 'Original Buyer' after a certain time period and at a price, usually pre-defined by both the parties earlier in the Agreement.1 It is one of the smartest strategies for sustaining in the market, where parties through their "mutual cooperation" enter into a win-win arrangement.

Generally, when a start-up with revolutionary IP enters the market, it requires financial resources to maintain and commercialize that IP as well as to further its research and development to come up with newer IPs. So, it looks for the investor who could finance it in exchange for a benefit that would work best for that investor, and mostly in these situations, it is the ownership rights in the IP that get transferred to the investor who agrees to maintain and exploit it for the time he owns the rights in IP.

However, since the start-up knows the worth of its current IP, it might feel reluctant in selling the ownership rights in that IP to an investor who promises to provide funds to the start-up, but then without funding it becomes extremely difficult to progress towards the targeted aim. So, the start-up and the investor, mutually and strategically, decide to enter into a two-way beneficial arrangement, whereby the start-up, here the 'Seller', assigns the ownership right in IP to an investor, here the 'Buyer', in exchange of a consideration, which the seller then uses to fund its start-up. Since the start-up knows the worth of its IP, it takes an exclusive license from the Investor, who is now the new IP owner, to commercialize the IP, and in return pays royalty at an agreed limit to the investor. Along with this, the Seller retains the option to "buy-back" the assigned IP from the Buyer, after a particular time period or after an event (say when the IP becomes commercially successful and holds a particular value in the market), at a certain price, which is either pre-defined during the transaction or could also be an inflated value as per the fair market value of that IP during the time the buy-back option is exercised.

The concept of exclusive license allows only the named licensee to exploit the licensed intellectual property, in exchange for a payment of royalty. Interestingly, the licensor is also excluded in this arrangement from exploiting the concerned IP, but he agrees to it because he is getting paid the royalty.

Once the predefined time period or pre-defined event happens, the Seller can exercise its buy-back option to reacquire the IP. Oftentimes, the Original Seller, subsequently, may even get into a co-ordinating relationship with the original buyer, if the parties so desire and if it benefits their market strategy, especially now when both the parties have acquired the credibility and trust of each other.

This is what happened between Shazam and BMI®.

Shazam, the London-based application, when entered the market in 2000 as a 'Music Identifying Application', it attracted 225 million people who used Shazam app approximately 10 million times per day.2 However, Shazam did not just want the market to recognize it as a "Music Recognition" app, rather it wanted to leverage its revolutionary technology to further its research and reinvent itself as a modern-day application, whose usage extends beyond mobile phones.

In 2005, it decided to sell its IP to another UK-based company, named Broadcast Music Inc.® (BMI®), who in exchange agreed to enter into this mutual buy-back transaction, which in time, no doubt, proved beneficial for both the parties. Shazam, in its initial years, was forced to launch directly to consumers (D2C) since at that time, neither the customers were interested to invest in music nor the digital technology was developed to support Shazam's ambitions and ideas. The app was appreciated by UK consumers only, while people in North America showed no or little interest.

Fortunately, with time, the brand found its inflection point when the market witnessed a 360° turn, enabling Shazam to reinvent itself:

- Mobile technology with better music players started to develop.

- The idea of buying digital content started to normalize.

- Unlimited data plans to use the internet were introduced.

- Consumers started to get the content online at the same price as that of the offline content.

With its effort and change in approach from D2C to engaging in strategic relationships with carriers and manufacturers like Verizon and AT&T, the app co-branded itself in the market. Soon the app became one of the 500 applications to be offered by Apple in its version 2.0 iPhone software, which helped it tract customers from the United States as well. Apple's television ad campaign and PR activities, along with Shazam's partnership with the National Broadcasting Company (NBC), accelerated the growth of Shazam in the consumer market.

This was the optimal time when Shazam decided to exercise its buy-back option to purchase the IPs previously assigned to BMI®, and moved towards a broader and better strategy.

Intellectual Property Buy Back Agreement

IP Buy Agreement is ancillary or parallel to the standard/master assignment agreement containing the buy-back option. When the Original Seller decides to exercise its buy-back option, the Intellectual Property Buy Back Agreement comes into the picture.

In this agreement, the "Original Assignee" transfers all rights without any restrictions related to the commercialization of the works as well as the right to sue or take legal action in case of any infringement, current, and after the execution of this agreement, to the "Original Assignor".

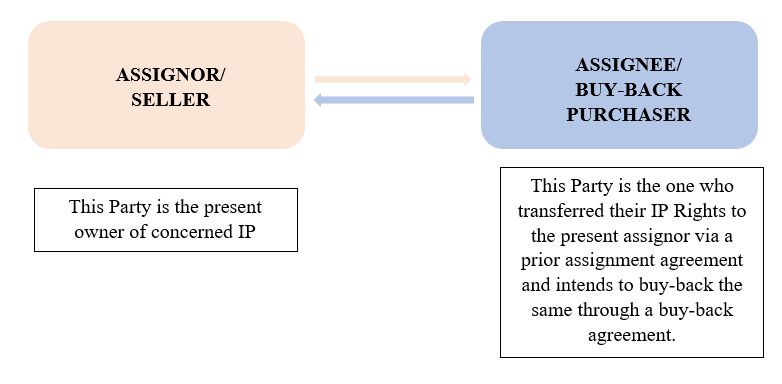

In other words, it involves two parties,- the Buyer and the Seller. The Seller is buying back the IP rights previously given by him to the Buyer, at a pre-defined or inflated price. The application of buy-back clauses can be seen in all places where an assignment of Intellectual Property rights is involved, including the Media & Entertainment sector.

For instance, if a party A, a film producer has assigned exploitation rights to a party B with a corresponding agreement that party A can buy back the assigned rights at a specific price (or a mutually agreed price) if the expected commercialization threshold remains unaddressed.

In the absence of a "buy-back clause" in the Assignment Agreement, the Assignor of the Assignment agreement will have to convince the other party to return the assigned rights and if the assignee denies the same, then the previous Assignor would not be able to repurchase or buy back the concerned intellectual property rights. Therefore, it is advisable to have a buy-back clause in an assignment agreement, if the Assignor intends to buy-back his rights at some point in time.

Benefit of a Buy-Back Agreement

To the Original Assignor: The person buying the intellectual property rights can use and enjoy the asset to fulfil his qualitative and quantitative interests in the intellectual property. Such a person exclusively owns the IP asset and can exploit the related commercial rights to its maximum advantage, and can sue and be sued for the same. Such a person can also resell the same at a better price and pursue his endeavours with financial liquidity.3

To the Original Assignee: The person selling the intellectual property rights will be free from maintaining the asset and paying for its renewal fee. The original Assignee will get lump-sum royalty for intellectual property works.

The buy-back agreement safeguards the interest of the Original Assignee without offending or causing damage to the interests of the Original Assignor. Both sides in the agreement are protected by certain warranties.

Important Clauses in an Intellectual Property Buy Back Agreement

Recital Clause

This clause highlights-

- The background information related to the parties involved,

i.e., the Original Assignor and Original Assignee;

- If the parties are individuals: Their names, KYC details (PAN/Aadhar No.), permanent address.

- If the parties are a company: The name of the company, CIN no., law under which the company was incorporated, and permanent address.

- The purpose of the Agreement, which is inclusive of the intention of the Parties to "Buy-Back" or "Re-transfer" of assigned IP;

- The date from which the agreement comes into effect (Effective Date);

Definition Clause

This is one of the imperative clauses of all the agreements which helps in interpreting the meaning and scope of the terms used in the agreement. The prominent definitions would be that of "Assigned Rights", "Intellectual Property", "Intellectual Property Rights", "Assignment", "Buy-Back", "Confidential Information", etc.

Repurchase/Transfer and Payment Clause

This clause enunciates that the Original Seller/Assignor hereby agrees to repurchase from the Original Buyer/Assignee the assigned IP Rights, and that the Original Buyer/Assignee hereby agrees to re-transfer the assigned IP rights to the Original Seller/Assignor.

The Payment Clause highlights the price at which the Original Assignor would buyback the assigned IP from the Original Assignee. This could be a pre-defined price agreed upon between the parties during the main assignment and mentioned in the master Assignment Agreement, or it could be the current market price of the IP. The price of the IP, after the pre-defined terms, say 5 years, could be calculated by using the DCF method of income approach, and be adjusted keeping in mind the probable market factors. It is important to note that the income valuation approach does not take into account the market factors, and so the same has to be separately taken note of by the parties to arrive at a suitable value.

Confidentiality Clause

This is the binding clause that describes the time period for which any confidential information related to the assigned IP rights, the business transaction of the Original Assignor and the Original Assignee, their financials, etc. will stay confidential and not be disclosed to any third party without prior consent of the other party to whom the confidential information belongs.

Non-Compete and Non-Solicitation Clause

This clause clearly prohibits the parties from competing with each other, post-buyback, by using the earlier assigned IP or any other confidential information exchanged between the parties. To align with the fundamental right to practice any business or activity, this clause has to be reasonably drafted, restricting the time period for which the prohibition would continue. Most preferably, 12 months is the minimum time period for which the parties agree to abide by this clause, however, depending on the negotiations, the time period could be extended up to 5 years as well. The parties could also restrict the carrying out of the same business in the same radius as that of the other party which might result in the diversion of customers, affecting the business revenue.

The non-solicitation clause restricts the Original Assignee from soliciting any of the employees, clients, or customers of the Original Assignor, post-buyback, for a reasonable time period, which could affect the legitimate business interests of the Original Assignor. This can also be drafted as a surviving clause saving interests of both the parties.

Representation and Warranties Clause

This Clause prescribes that the Original Assignor -

- is the exclusive owner of the re-assigned IP rights;

- has the right to commercialize the works, without any restrictions;

- has the right to sue or take legal action in case of any infringement, current, and after the execution of this agreement;

This clause also represents and lays out warranties by the Original Assignee/Original Buyer, like the re-assigned IP rights are free from encumbrances, liens, any restrictions on transfer; that they do not infringe upon third-party intellectual property rights; and there do not lie any legal proceedings or claims related to such assigned IP rights.

Dispute Resolution Clause and Governing Law

It prescribes the law by which such buy-back or re-transfer or repurchase of IP rights would be governed. The dispute resolution clause would lay down the mechanism agreed by both the parties to solve the disputes related to the present transaction, which could be arbitration, mediation, or even reaching out to the court of a particular jurisdiction as defined in the agreement itself.

Stamp Duty and Registration

Any assignment of IP rights is subject to the payment of Stamp Duty,4 the amount of which varies from state to state, and must be procured and paid before executing the assignment or in this case, re-assignment deed.

Along with this, registration of such re-assignment of IP in favour of the Original Assignor is also mandatory, thus, such IP assignment deed must be registered with the relevant IP office in India.

Documentation

In the execution of the Buy-Back Agreement, the Parties consent to assist each other with any paperwork that may seem necessary and the Original Assignee promises to deliver any or all records, documents, and material in physical or digital form in the same manner as transferred by the Original Assignee pursuant to the main assignment agreement. Such documents and materials shall be affixed with the Agreement as an Annexure.5>

Where do third-party agreements with the Original Assignor stand?

After the assignment of IP Rights to another party prior to a buy-back agreement, the Assignee commercializes the IP Rights by giving licenses to third-parties. The question then comes as to the fate of the revenues received from third-parties.

The agreements in force by the Original Assignor and his licensees do not cease to exist, although, at the time of buy-back of rights in the IP, the developments made in the commercialization of the IP Asset will be transferred to the buyer and such person will then be the right person to enjoy the royalties and compensations, if any, from the licenses, unless anything related to the treatment of revenue streams from third-party agreements is not expressly mentioned in the buy-back agreement.

Footnotes

1. UPCOUNSEL, Buy Back Agreement Definition: Everything You Need to Know (Oct. 14, 2020), https://www.upcounsel.com/buy-back-agreement-definition.

2. JVG, How Shazam stayed on top by reinventing itself- twice, VENTURE BEAT (Aug. 31, 2012, 5:00 PM), https://venturebeat.com/2012/08/31/shazam-evolution/.

3. LawSikho, Copyright Monetization and Licensing, Buy-Back Agreement, 2.

4. The Indian Stamp Act, 1899, Schedule 1, No. 2, Acts of Parliament, 1899 (India).

5. LawSikho, Copyright Monetization and Licensing, Buy-Back Agreement, 5.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.