GO FIRST'S SAGA CONTINUES...

India is witnessing yet another instance of airline insolvency proceedings within the past 5 years, following the case of Jet Airways. This time the airline in question is Go Airlines (India)Limited ("Go First")

Background:

Go First, incorporated on April 29, 2004, took its first flight from Mumbai to Ahmedabad in November 2005, marking the commencement of its flight operations. The fleet of Go First consists of 59 aircrafts, including 54 - A320 NEO aircrafts and 5 - A320 CEO aircrafts. Positioned as India's low-cost airline, Go First aimed to make air travel affordable and accessible to the masses. Unfortunately, Go First seems to have landed itself in a financial distress from which its take-off does not appear to be easy.

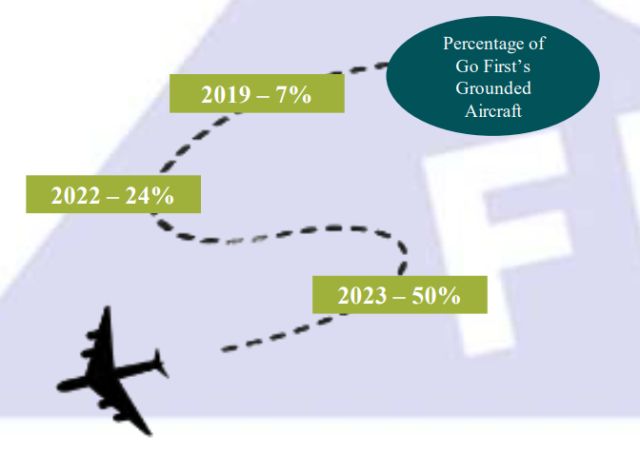

Go First attributed its financial turmoil to the presence of faulty engines supplied by Pratt & Whitney ("P&W"), which allegedly resulted in the grounding of Go First aircrafts and hindering their operations. The number of aircrafts grounded due to P&W's faulty engines has notably increased over time, the details of which are given below:

The Unfortunate Landing:

On May 02, 2023, Go First, owned by the Wadia Group, filed for voluntary insolvency proceedings under Section 10 of the Insolvency and Bankruptcy Code, 2016 ("IBC 2016") before National Company Law Tribunal, Delhi ("NCLT"). At the time of filing the petition, Go First had a fleet of 54 aircrafts, of which only 26 were operational, while the remaining 28 were grounded due to faulty engines, anxiously awaiting replacements.

Due to Go First's ongoing struggles with engine problems, it invoked emergency arbitration proceedings against P&W at the Singapore International Arbitration Centre. The emergency arbitrator issued 2 awards on February 3, 2023 and April 15, 2023, ordering P&W to provide 10 serviceable engines by April 27, 2023 and an additional 10 serviceable engines each month until December 2023. However, due to P&W's noncompliance with the orders issued by the emergency arbitrator, Go First initiated enforcement proceedings against P&W in Delaware, U.S. as well as other relevant jurisdictions where Go First's engines were/are located.

The extensive grounding of approximately 50% of its aircraft fleet, resulting from the repeated failures of P&W's engines, inflicted heavy losses on Go First in terms of lost revenues and additional expenses. Despite the considerable support received from the government, the detrimental impact caused by the faulty engines seem to be immense, rendering Go First unable to fulfil its financial commitments.

Order by National Company Law Tribunal:

VOLUNTARY INSOLVENCY

A Voluntary Insolvency is a mechanism, as provided under Section 10 of IBC, 2016,wherein Corporate Debtor itself file a CIRP to resolve its debt and revive its operations.

Vide the Voluntary Insolvency Petition No. (IB)- 264(PB)/2023, Go First prayed for initiation of Corporate Insolvency Resolution Process ("CIRP") in order to prevent lessors from taking control of its aircrafts and to ensure the continuity of its operations and for grant of an interim moratorium.

MORATORIUM

It has been observed by the Bombay High Court in the case of Shiv Kumar Tulsian and another v. Union of India, 1986 SCC OnLine Bom 351 that the Moratorium implies staying the commencement or continuance of all actions and proceedings against the company for a fixed period of time.

On May 10, 2023, NCLT delivered a lightning-fast order admitting the application of Go First under Section 10 of the IBC 2016 and thus allowing the commencement of CIRP ("NCLT's Order"). Along with this decision, NCLT also granted interim moratorium and imposed certain restrictions which include the following;

- There can be no initiation of suits or continuation of pending suits including the execution of any judgment, decree or order in any court of law, tribunal, arbitration panel or other authority against Go First.

- Go First cannot transfer, encumber, alienate, or dispose of any of its assets, legal rights or beneficial interests relating to it.

- No action can be brought against Go First to foreclose, recover or enforce any security interest relating to its property including any action under the Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002.

- All lessors or owner of property are prohibited from recovering property from Go First

Order by National Company Law Appellate Tribunal:

Following the NCLT's Order, aircraft lessors ("Appellants") who had granted operating leases of aircrafts, filed an appeal against the order issued on May 10, 2023. However, on May 22, 2023 the National Company Law Appellate Tribunal, Delhi ("NCLAT") upheld the NCLT's Order. The NCLAT held that the absence of notice to creditors or an opportunity for objectors prior to the hearing of Go First does not invalidate the procedure or violate the principles of natural justice, particularly when the objectors were heard by the NCLT. NCLAT further held that it cannot be concluded at this stage that application filed by Go First was fraudulent or made with malicious intent.

The NCLAT disposed the appeal and ordered in Para 41which has been reproduced below:

".... 1) The order dated 10.05.2023 admitting Section 10 Application is upheld.

2) The Appellants(s) are at liberty to file an appropriate Application under Section 65 of the Code with appropriate pleadings and material and Adjudicating Authority while considering the said Application shall not be influenced by any observations made in this order.

3) The Appellants(s) as well as IRP are at liberty to make appropriate Application before the Adjudicating Authority for declaration with regard to applicability of the moratorium on the aircrafts with regard to which Leases in favour of the Corporate Applicant were terminated prior to admission of Section10 Application, which Application need to be considered and decided by the Adjudicating Authority in accordance with law.

4) The Appellant(s) and the IRP are also at liberty to make an appropriate Application under section 60, sub-section (5) with regard to claim of possession and other respective claims of both the parties relating to the aircrafts in question, which need to be decided by the Adjudicating Authority in accordance with law."

Turbulence for the Lessors:

As soon as Go First's application for the CIRP was admitted, it became impossible for the lessors to repossess the leased aircrafts. This situation drew attention to the Cape Town Convention ("Convention").

The Cape Town Convention

Cape Town Convention is a global treaty created with the aim of promoting the financing and leasing of aircraft, engines, and spare parts. Its purpose is to minimize the risks faced by lessors and improve the legal certainty surrounding these transactions, particularly in situations involving an airline's insolvency or default. The Convention was concluded in Cape Town in 2001, along with the Protocol on Matters Specific to Aircraft Equipment.

Despite India's accession to the Convention in 2018, it has not yet been ratified by Parliament. This means that the Convention doesn't have legal force in the country. Other existing laws, like the IBC 2016, take precedence over the Convention.

To read the full article click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.