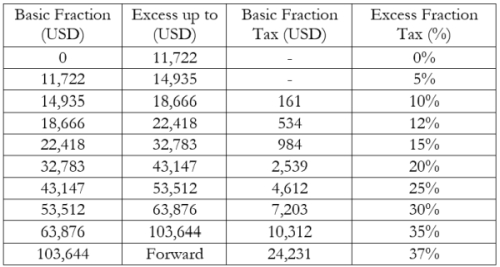

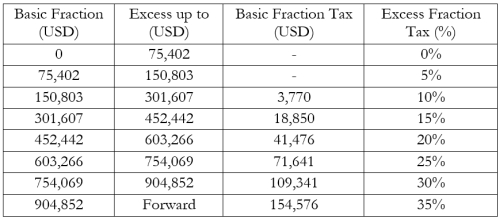

The Internal Revenue Service issued the Regulation NAC-DGERCGC22-00000058 on December 27, 2022, by which it updated the ranges of the income tax charts as follows:

- For calculating the income tax for individuals and undivided estates, the applicable chart for the fiscal year 2023 is:

- For calculating the tax on inheritance, legacies, donations, finds and any type of act or contract by which the domain of goods and rights is acquired, free of charge, the applicable chart for the fiscal year 2023 is:

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.