The initial enquiry was received via the Sovereign website, with John – our main point of contact – requesting assistance with a proposed reorganisation of his company structure. John, a UK national, and his business partner Yuzhe, a Chinese national, are co-founders of a start-up FinTech operation that provides services to e-commerce businesses in the PRC.

Currently, the corporate structure involves two separate entities: a UK company that develops the algorithm and a PRC entity that promotes and sells the service in China. John manages the UK company and Yuzhe manages the PRC company. However, while John and Yuzhe each own 50% of the UK company, Yuzhe owns 90% of the PRC company with his mother holding the remaining 10%.

John explained that this imbalanced ownership structure was a result of lockdown during Covid, when it had been simpler to have the PRC company established solely by Yuzhe. Despite this rationale, we understood that this imbalance was a concern for John and was one of the main drivers for the proposed restructuring.

Another reason for the restructuring was at some point, John would like to seek investors and list the company on the Hong Kong Stock Exchange. Having a simplified ownership structure would better reflect the true value of the operation, whilst also ensuring that the management of the operating companies would not be affected.

Finally, both founders believed it was not only important to retain and incentivise their key members of staff, but it was equally important to be able to attract top talent to the business. As a start-up, it was difficult to pay full market rates for developers. One solution is to establish an Employee Share Option Plan (ESOP) to attract, incentivise and retain talent through equity ownership.

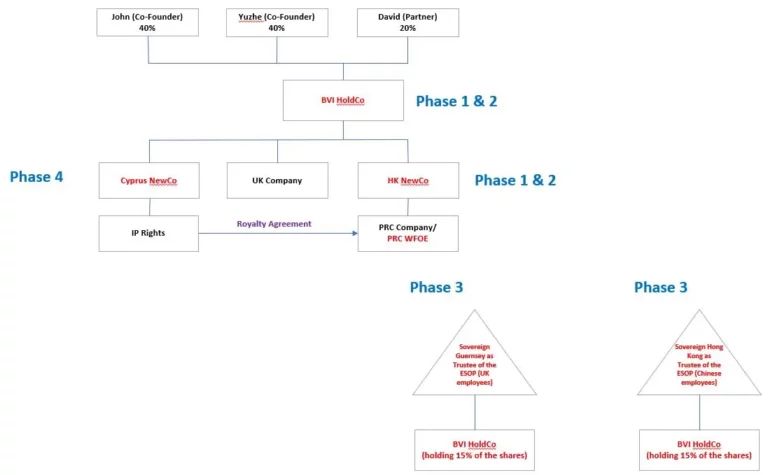

Based on our discussions with John and Yuzhe and the requirements of the business, Sovereign HK proposed the following structure:

Phase 1 – A BVI holding company was proposed as a practical solution to redress the current ownership issues and to offer better protection of its interests from potential litigation. BVI companies offer a highly effective solution as investment holding entities and, since this is a start-up, BVI company registration is cost-effective and straightforward.

A new partner, David, is to join the company, and it was agreed by the co-founders to give him a 20% shareholding. David has been brought on board to contribute to the strategic development of the business in its next phase of growth.

Finally, whilst we were aware that there was clearly a close personal relationship between, John, Yuzhe and David, it was agreed that Sovereign would prepare a shareholder's agreement to help protect their individual business interests and resolve any conflicts that may arise in the future.

Phase 2 – The next phase would involve the establishment of a holding company in Hong Kong (Hong Kong NewCo), so that the PRC entity can become a Wholly Foreign-Owned Entity (WFOE). This is important because WFOEs remove the operational risks that can arise from having a Chinese partner in many industry sectors, making the structure more attractive to future investors.

Having a Hong Kong entity in the group structure also provides investors with more flexibility in terms of selling their PRC investment. Hong Kong has a preferential tax regime and adopts a territorial basis of taxation, allowing profits to be repatriated back to Hong Kong efficiently and with minimum withholding tax leakage.

Hong Kong is one the largest offshore RMB clearing centres and is well-equipped to handle RMB-denominated banking, including receiving dividends and other fees from China-based entities. It also enables the holding company to assume cash pooling functions.

In summary, the proposed restructuring will offer the following benefits:

- Both the UK and PRC companies can operate individually through common ownership.

- Should any litigation arise in respect of one of the entities, the other business can continue to operate without being affected.

- Either the UK or PRC company can be disposed of, without affecting the other part of the business.

- The common ownership allows the business to expand into other markets i.e., the Middle East, Europe etc.

Phase 3 – Sovereign will set up two Trusts to serve as the ESOP into which 15% of the shares in the new BVI HoldCo can be transferred. Separate trusts are required because the tax considerations for the UK employees and Chinese employees will be different. We have proposed that Sovereign Guernsey acts as the trustee of the ESOP scheme for UK employees and Sovereign Hong Kong will act as the trustee of the ESOP scheme for the Chinese employees.

Employees will have accounts within the ESOP to which stock can be allocated. Contributions, either in cash or stock, accumulate in the ESOP until an employee leaves or retires. Distributions can be made in a lump sum or instalments and may be immediate or deferred.

We have also suggested further steps to John in respect of the business's intellectual property (IP) that he had not previously considered. The management and licensing of IP is important to all sorts of businesses, particularly those in the tech sectors, and can assist in securing investment, establishing new revenue streams, and minimising tax.

The main IP rights (IPR) include copyrights, patents, trademarks and designs. Know-how (trade secrets) may also be an important element of an IP portfolio. Companies can derive significant income from licensing, and licensing can offer flexibility in the way a business develops.

Phase 4 – We will establish a new company in Cyprus (Cyprus NewCo) to control and own the IP assets. This Cyprus NewCo will be owned 100% by the BVI HoldCo and will act as the 'licensor' to license the IP assets to the operating company(ies) as 'licensee(s)', ensuring that the IP assets are shielded from the commercial activities of the operating company(ies).

Cyprus is an ideal IP holding jurisdiction. It offers an 80% income tax exemption for worldwide royalty income generated from IP owned by Cypriot resident companies, net of any direct expenses. The remaining 20% will then be subject to the standard corporation tax rate of 12.5%, to give an effective tax rate of 2.5% or less.

The feedback from John during our discussions was that Sovereign's approach was different (and something which he valued above our competitors) for the following reasons:

- We offered a tailored approach – the competition simply offered a 'tinned' product.

- We listened to him and really understood the business.

- We had considered other matters such as protecting the IP.

- We had considered the need to protect the two separate entities.

- We had devised a highly flexible structure that would allow for future expansion into different countries without the need to amend the original structure.

"Sovereign is not simply a corporate service provider; we are an international trust and business advisory service provider that has the technical knowledge, expertise and resources to deliver advice and practical assistance on a global basis," said Alan Fong, Commercial Director at Sovereign Trust (Hong Kong).

"We have a strong legal team and can establish entities in various jurisdictions. We are a solution-driven firm that focuses on meeting the needs and requirements of the client, whilst also having the capacity to raise any concerns or additional matters that have been overlooked or that should be considered for the future."

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.