A targeted analysis of European sector leaders provides indications of potential focus areas

On January 5 2023, the EU Corporate Social Responsibility Disclosure (CSRD) went into force—the first companies governed by the directive will have to apply the new requirements for the financial year 2024. Eventually, the CSRD will apply to an estimated 50,000 companies across the EU. Our targeted analysis suggests that firms in the pharma and healthcare sectors may need to enhance their efforts in selected dimensions applicable for CSRD reporting.

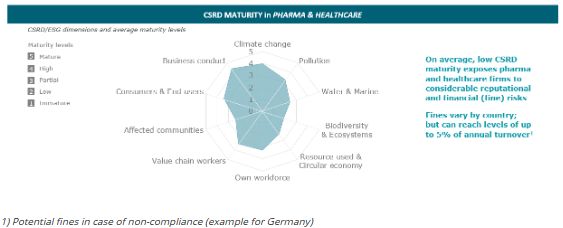

AlixPartners analyzed five pharma and healthcare leaders within the European Union and their readiness to comply with CSRD requirements. Generally, our analysis suggests considerable need for action, as the reviewed firms display, on average, only low to medium CSRD maturity levels in several of the CSRD pillars.

While we observed that reporting regarding climate-associated topics for healthcare players appears relatively advanced, there are other environment-related pillars with rather underdeveloped characteristics, such as "water and marine", "biodiversity and ecosystems" or "circular economy". Regarding the reporting on "social" aspects we assessed, on average, that there was only "partial" maturity, meaning there is room for improvement. Particularly, target values and action plans appear to be lacking or have limited reporting quality around the ESG pillars.

Given the advanced CSRD reporting requirements, action likely needs to be taken for pharma and healthcare companies to comply with the European Sustainability Reporting Standards (ESRS).

To face these challenges head-on and to enhance the reporting efficiently, we recommend pharma and healthcare companies conduct targeted reviews of the current reporting (and underlying measures) versus the reporting standards supplementing the CSRD, following a structured methodology. The targeted review, however, should not only compare against legal requirements but also consider best practices from industry peers and companies with highly effective sustainability reporting systems. Based on a thorough understanding of one´s positioning, targeted investments should be considered.

While there is likely a need for mitigating measures, we also see this situation as an opportunity to create and integrate management reporting systems, enabling the integration and streamlining of often disbursed management reporting systems. Optimizing from a more holistic perspective may even unveil revenue opportunities, potentially offsetting the required reporting investments.

AlixPartners helps clients implement the CSRD and drive ESG transformation and value creation. If you are interested in learning more about our analysis or discussing how we can best support your company in implementing the CSRD, please reach out to the authors of this blog.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.