As of 1 January 2012, offerors (both Dutch and foreign) of financial products and services on the Dutch market will be subject to important new rules.

These include:

- the introduction of a uniform warning, called the "wild west sign", for offerors of certain financial products and services if they make use of an exception or an exemption from the requirement to obtain a licence and comply with certain ongoing obligations or from the requirement to publish a prospectus; and

- the raising of the EUR 50,000 threshold to EUR 100,000 for offerors of securities, participation rights in investment institutions or investment objects who make use of an exception/exemption.

In addition, a voluntary supervision regime for managers of investment institutions and investment institutions without a separate manager has been introduced with effect from 1 July 2011.

These new rules are briefly explained below.

Wild west sign

As of 1 January 2012, an offeror of participation rights in investment institutions or investment objects that makes use of an exception or an exemption from the obligation to obtain a licence and comply with certain ongoing obligations will be required to include a warning in a form prescribed by the AFM – a "wild west sign" – in its documentation to indicate that it is not regulated in the Netherlands. The same applies to advisors and intermediaries with respect to financial products other than financial instruments that make use of an exemption from the obligation to obtain a licence and comply with certain ongoing obligations. In addition, the same applies to offerors of securities that make use of an exception or exemption from the requirement to publish an approved prospectus. This obligation will not apply where offerings of securities or participation rights are made solely to qualified investors.

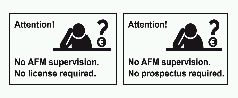

Pursuant to the above, the following text must be included: "Attention! This investment falls outside AFM supervision. No licence required for this activity", or: "Attention! This investment falls outside AFM supervision. No prospectus required for this activity", followed by a prescribed pictogram. The AFM has, among other things, laid down rules regarding the size of the prescribed text and pictogram.

The pictograms look as follows:

Increase of the EUR 50,000 threshold to EUR 100,000

At present, offerors of participation rights in investment institutions and offerors of investment objects are exempted from the requirement to obtain a licence and to comply with certain ongoing obligations if the participation rights or investment objects offered have a nominal value or are offered against a total consideration of at least EUR 50,000. Similarly, offerors of securities are excepted from the requirement to publish a prospectus if the securities' nominal value or the total consideration is at least EUR 50,000. As of 1 January 2012, these thresholds will – in keeping with the Prospectus Directive – be increased from EUR 50,000 to EUR 100,000.

Voluntary supervision regime

Managers of investment institutions offering participation rights solely to qualified investors are currently exempted from the requirement to obtain a licence and comply with certain ongoing obligations. The same applies to investment institutions that do not have a separate manager. As of 1 July 2011, such managers and investment institutions can request to be made subject to voluntary supervision. The aim of this new regime is to allow investment institutions to attract institutional investors that are legally permitted to invest only in participation rights of investment institutions that are regulated and supervised.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.