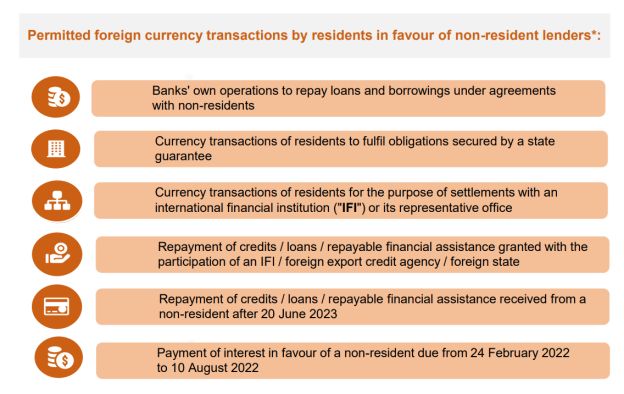

Following the outbreak of the full-scale Russian invasion, the National Bank of Ukraine (the "NBU") implemented temporary restrictions on cross-border foreign currency transactions. These restrictions were outlined in Resolution No. 18 of the NBU Board "On the Operation of the Banking System during the Period of Martial Law" ("NBU Resolution No. 18"). NBU Resolution No. 18 established an exclusive list of crossborder foreign currency transactions permitted during the martial law period.

Initially, residents were prohibited from conducting transactions to service external debt financing. However, the NBU has gradually relaxed the restrictions by allowing interest repayments under specific conditions and defining a list of lenders to whom payments are allowed.

In late June 2023, the NBU took significant steps to expand the capacity of Ukrainian businesses to attract and service external loans and borrowings. This newsletter provides an overview of the provisions outlined in NBU Resolution No. 18 concerning the fulfilment of debt obligations of residents to non-resident lenders.

*subject to the requirements set out below

Requirements for fulfilment of debt obligations to a non-resident under a credit / loan / repayable financial assistance provided with the participation of an IFI or a foreign export credit agency / foreign state

Resident borrowers may make:

- Repayments of the principal amount of the credit / loan / repayable financial assistance;

- Payments of interest, commissions, fees and other payments specified in the agreement; and

- Purchases of foreign currency for the above purposes,

If the credit / loan / repayable financial assistance is fully or partially:

- Secured by a guarantee or suretyship of an international financial institution (e.g., the European Bank for Reconstruction and Development or the International Finance Corporation); or

- Provided, insured, or secured by a guarantee or surety provided

by:

- a foreign export credit agency;

- a foreign state through an authorised entity; or

- a foreign entity whose members (shareholders) include a state or a foreign bank (provided that the foreign state is a member (shareholder) of this bank).

Requirements for the fulfilment of a resident's debt obligations under a loan / credit / repayable financial assistance received from a non-resident only after 20 June 2023

Resident borrowers may make:

- Repayments of the principal amount of the credit / loan / repayable financial assistance;

- Payments of interest, commissions, fees and other payments specified in the agreement; and

- Purchases of foreign currency for payment of interest, commissions, fees and other payments (except for repayment of the principal amount) of a loan granted for a period exceeding three years,

Subject to the following conditions:

- The borrowed funds under the credit / loan / repayable financial assistance are received by the Ukrainian borrower from abroad to an account at a Ukrainian bank after 20 June 2023;

- The total amount of payments for the use of a credit / loan / repayable financial assistance (interest, commissions, fees and other payments) does not exceed the maximum interest rate of 12% per annum;

- If the credit or loan is granted for a period of less than three years, all payments under the relevant agreement are made only at the expense of the borrower's own funds (not purchased, not attracted in the form of a credit or a loan from a resident);

- If the credit or loan is granted for a period of more than three years, payments to repay the principal amount of the loan during the first three years are made only at the expense of the borrower's own funds (not purchased, not attracted in the form of a loan, or a loan from a resident).

NB! Borrowers may make payments under such a credit / loan / repayable financial assistance only in accordance with the payment schedule specified in the relevant agreement (i.e., without the possibility of early repayment).

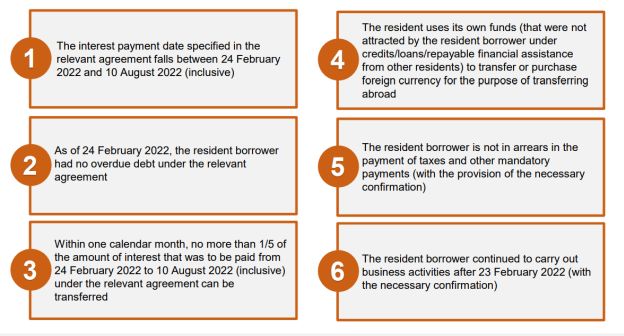

Requirements for making permitted interest payments to non-residents

If a debt obligation owed to a non-resident does not fall within the above criteria for permitted transactions, it should be remembered that the NBU previously allowed the purchase of foreign currency and the transfer of funds abroad for the purpose of paying interest (without the possibility of repayment of the principal amount of the loan or payment of commissions, fees and other payments) under loan agreements with non-residents, provided that the following requirements are met:

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.