By encompassing various sectors, including banking, payments, lending, investment, insurance, and regulatory technology (RegTech); and drives innovation in the finance industry. Fintech is the cutting-edge sector within finance that integrates technology into how individuals and businesses interact with money and financial transactions. In this article, we explore the dynamic realm of Fintech in Egypt, including an understanding of what is Fintech, while exploring the myriad opportunities and challenges it presents for investors. From the transformative impact on financial accessibility to the reshaping of daily interactions with financial services, we delve into the multifaceted world of Fintech.

What is FinTech?

FinTech (financial technology) is a term that refers to software, mobile applications, and other technologies shaped to improve and automate traditional forms of finance for businesses and consumers alike. FinTech can be best described as a computer program and other cutting-edge technologies designed to underpin, facilitate, and enhance banking and financial services.

The significance of FinTech can not be emphasized enough, not only it enhances financial accessibility and improves efficiency, but also opens up new avenues for financial advice and services. FinTech has a pivotal role in our day-to-day life, as it can provides convenient and user-friendly financial solutions. Its impact on our daily lives is significant as it offers accessible and efficient financial services, empowers individuals with personalized advice, and facilitates secure and practical transactions. Embracing fintech is not just a strategic move; it's a dynamic leap that empowers individuals and businesses to proactively navigate the constantly evolving financial landscape. By wholeheartedly adopting fintech solutions, they not only stay ahead of the curve but also strategically leverage the plethora of opportunities it unfolds. Fintech isn't merely a tool; it's a catalyst reshaping the very fabric of how we interact, engage, and experience financial services, ushering in a transformative era in the realm of finance.

Opportunities in Fintech for Investors in Egypt

In line with the Egyptian government's commitment to realizing Egypt's less-cash framework and, more broadly, aligning with Egypt's National Vision 2030, Egypt is striving to encourage innovation and digitization of the banking and financial sectors. The Egyptian government has a proactive stance toward innovation. Its enthusiasm to introduce and nurture Fintech is a key driver behind the sector's success. The supportive regulatory environment crafted by the government sets the stage for innovation, creating an atmosphere conducive to growth. The Central Bank of Egypt (CBE) has been pivotal in introducing regulations that are favorable to fintech startups, including simplified licensing processes. The establishment of a Fintech Regulatory Sandbox allows startups to test and refine their products in a controlled environment, reducing barriers to innovation and market entry. This progressive regulatory framework is crucial in providing the necessary support and guidance to nascent fintech ventures.

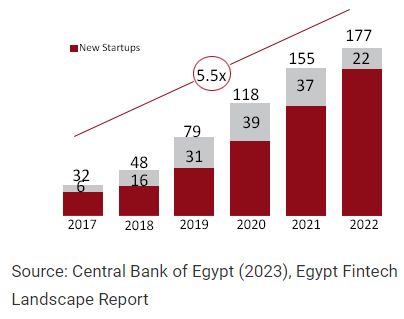

In the past five years, as shown in the graph above, the number of innovative startups and Payment Service Providers (PSPs) has surged by an impressive 5.5 times. This remarkable growth can be attributed to the escalating demand for FinTech and FinTech-enabled solutions within the dynamic landscape of the Egyptian market. According to the Central Bank of Egypt (CBE), the Egyptian market currently boasts a vibrant ecosystem comprising 177 FinTech and FinTech-enabled startups, alongside Payment Service Providers (PSPs), all delivering innovative solutions. Among these, 139 startups specialize in providing pure FinTech solutions, while an additional 38 offer a unique blend of technological solutions combined with embedded finance. In Egypt's fintech landscape, key players encompass notable entities across various sectors, including national financial infrastructure providers and PSOs like Instapay and Meeza, lending and alternative finance represented by Valu, and payments and remittance services offered by Fawry. These fintech companies play pivotal roles in shaping and advancing financial services within the Egyptian market.

Challenges Faced by Investors in Egyptian Fintech

In Egypt's financial landscape, multifaceted challenges persist. While the fintech sector in Egypt holds immense promise, it also faces its share of challenges. Ensuring cybersecurity and protecting digital transactions and data privacy remain paramount concerns.

Despite their digital proficiency, children often lack financial education, Low-income consumers and vulnerable groups face barriers to financial inclusion due to a lack of knowledge, Millennials lack awareness of personal financial management. Therefore, enhancing financial literacy and consumer education is crucial to ensure the widespread adoption of fintech services.

Moreover, while regulatory challenges can present daunting obstacles for fintech startups, the hurdles associated with funding are equally formidable. The development and launch of innovative products and services often demand significant capital, but securing funding can be a formidable task, particularly in the face of high inflation and interest rates. This dual challenge underscores the financial tightrope that fintech startups must navigate, balancing the need for compliance with regulatory standards alongside the imperative of securing adequate funding for sustainable growth in a dynamic and competitive landscape.

Conclusion:

Egypt's fintech revolution represents a remarkable leap forward for the nation's financial sector. Fueled by supportive government policies, an expanding community of tech-savvy consumers, and an influx of entrepreneurial talent, Egypt is poised to emerge as a frontrunner in the fintech landscape within the region and beyond. This transformative journey not only fosters financial inclusion but also catalyzes broader economic growth, laying the foundation for a more inclusive and technologically advanced financial future. The confluence of these factors propels Egypt toward a pivotal role in shaping the future of finance, making significant strides towards a more dynamic, accessible, and innovative financial ecosystem.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.