1 Intro

1.1 Scope

This article shall at first give a brief overview of the blockchain technology and a potential range of its applications under the premise of a decentralized technological environment. The article shall then point out the fundamentals of a sharing economy, outline the mechanics of trust in intermediating technology platforms and finally show where disruptive technologies such as the decentralized blockchain technology may have an impact on a sharing economy, as set out by the research issue pursuant to the below section.

1.2 Research Issue

The above introduction to and outline of the topic at hand "Trust in Blockchain-Technology in a Sharing Economy" leads to the following research question: "What is the role of the economically defined 'trust' when it comes to blockchain technology, more specifically do 'trust-less' decentralized technological environments exist?", as well as the sub-question: "What is the potential impact of blockchain technology as a model of trust on a sharing economy?" This essay is theoretical-conceptual in its approach.

2 Distributed Ledger Technologies

A blockchain is one of several variations of the distributed ledger technology. A blockchain may be described as a database which is in general both public and decentralized and which also stores data in a permanent manner. This typically occurs through transactions of tokens which represent a specific economical value (either an underlying asset which is being represented or the actual token itself, as is the case with a bitcoin, which basically derives its value from supply and demand) (Bergt, 2020, p. 6 et seq.). Transactions on a blockchain are carried out through decentralized apps, so-called smart-contracts, which are mostly based on "if-then-else" instructions, meaning if a condition "A" occurs, action "B" is executed, otherwise another action "C" will be carried out. (Bergt, 2020, p. 10 et seq.). Possible transactions on a blockchain are either carried out peer-to-peer, human-to-machine or machine-to-machine (Mehrwald, Treffers, Titze, Welpe, p. 4585, 2019).

While the "public" aspect of a blockchain implies that, on it every stored transaction may be viewed publicly, the factor of "permanence" is the result of a cryptographic hash function (without going into technological details, broadly speaking the hash function results in a a unique value or identifier, which in turn leads to e.g. a transaction on a blockchain to being permanent). This aspect prevents corruption of transactions on a blockchain. The immutability of transactions on a blockchain is further ensured by decentralization. "Decentrality" refers to a large number of network participants, so-called nodes, in a peer-to-peer network which constantly synchronize data. As the name "decentralized network" suggests, a central instance, which is responsible for a (centralized) data storage system, does not exist on a standard public and open blockchain. The loss of a single network participant or network node does not per se endanger the functionality of the decentralized network as a whole (Bergt, 2020, p. 7).

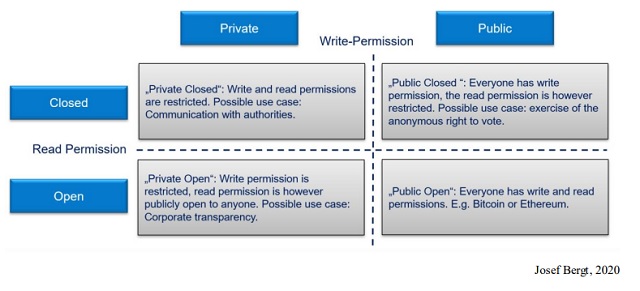

However, not all blockchains are public. Differentiation is necessary between "private" and "public" blockchains as well as between "open" and "closed" blockchains. The pair of values "private" and "public" refers to writing permission while the values "open" and "closed" refer to the reading permission. Both, the Bitcoin as well as the Ethereum protocols are public and open blockchains, which means that everyone can access and "read" the network protocol as well as "write" in the database (i.e., transfer tokens) (Bergt, 2020, p. 7, fn. 16).

While for example anonymous voting may be realized best through a public closed blockchain the general communication with authorities would be most suitable to be carried out on a private closed blockchain. When it is, for example, the aim to communicate the business conduct of a company in a transparent manner, a private open blockchain may be a feasible technological implementation to achieve this goal (cp. Bergt, 2020, p. 7, fn. 16).

For better understanding, compare the following figure:

To conclude, blockchain technology – in an ideal scenario – allows for permanent, tamperproof and distributed record-keeping and transfer of values and ensures consensus through cryptographic mechanisms (Böhme, Christin, Edelman, Moore, 2015, p. 213 et seqq.; Glaser, 2017, p. 1543 et seqq.).

2.1 Blockchain as an intermediating Technology

Different read and write permissions on a blockchain may lead to different use cases or different ways of conferring value in a shared economy through a technology which to some extent may replace the otherwise required trust in an intermediary, with the then required trust in the decentralized technology or network. One might therefore also be misled into calling this model of trust, "trust-less" technology, which is seemingly erroneously propagated by Nägele (2020, Section 4.2.5). (2018). As Hawlitschek, Notheisen and Teubner (2018) have concluded, "blockchain technology is to some degree suitable to replace trust in platform providers". However, it does not make the trust in intermediaries (institution-based trust) obsolete as will be elaborated in this article. Furthermore, even conceptualized trust-free systems based on blockchain technology "will crucially depend on the development of trusted interfaces for blockchainbased sharing economy ecosystems" in the first place (Hawlitschek et al., 2018). Ultimately, rendering the notion of a completely trust-free system, much less a trust-less system, an illusion.

However, as Mehrwald et al., 2019, p. 4585, point out "[c]ombining blockchain technology and smart contracts has the potential to facilitate disintermediation and realize true peer-to-peer transactions provided that sufficient trust is build." Blockchain technology therefore is not void of trust or "trust-less". On the contrary, there are different targets of trust as will be explained under Section 3. in more detail which play a major role even when it comes to distributed ledger technologies. Blockchain thus mediates trust and consequently facilitates disintermediation. If at all, blockchain shall not be called a "trust-less" but a "disintermediated", or better yet, an "(trust) intermediating" technology.

2.2 Sharing Economy

The term "sharing economy" is oxymoronic in its nature contrary to the standard commercial economy. While sharing radically simplified refers to the allocation of assets to third parties, without the shared resource having a dedicated owner and the contribution being measured in money (e.g. Wikipedia), an economy is basically understood as a system of trade and exchange which ideally generates an added value to the parties of the exchange and thus poses a means to the accumulation and utilization of value, typically money (Belk, 2014a, p. 7 et seqq.; Belk, 2014b, p. 1595 et seqq., Mehrwald et al., 2019, p. 4586).

Originally Published February 2021

Click here to continue reading . . .

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.