1 Legislative framework

1.1 Which legislative provisions govern private client matters in your jurisdiction?

In Japan, several major statutes pertain to private client matters, including the following:

- the Civil Code, which governs family matters and inheritance;

- the Income Tax Act, which governs individual income tax;

- the Inheritance Tax Act, which governs inheritance and gift tax;

- the Trust Act, which governs trusts; and

- the Act on Promotion of Use of Adult Guardianship System, which governs adult guardianship.

For cross-border private client matters:

- the Act on General Rules for Application of Laws (AGRAL) determines which laws apply in Japan; and

- the Immigration Control and Refugee Recognition Act is also important.

1.2 Do any special regimes apply to specific individuals (eg, foreign nationals; temporary residents)?

At a high level, there is no special regime or 'two-tiered' system which makes a distinction based on foreign national or temporary residence status. However, as discussed in question 2.1, there are factors relevant to the determination of the scope of income or assets which are subject to inheritance/gift tax, including:

- whether an individual is a temporary resident (for income tax purpose) and/or a foreign national; and

- the length of domicile for income tax and inheritance/gift tax purposes.

1.3 Which bilateral, multilateral and supranational instruments in effect in your jurisdiction are of relevance in the private client sphere?

As of 1 October 2023, Japan had concluded 72 treaties on income tax with 79 countries and regions which follow the Organisation for Economic Co-operation and Development (OECD) model. Under Japanese law, residents can deduct a certain amount from their income tax when foreign-sourced income is subject to taxation equivalent to income tax under foreign laws and regulations. This is called the 'foreign tax credit' for income tax purposes. If there is a difference between the foreign tax credit for income tax and the tax treaty, the tax treaty will prevail. In addition, Japan has concluded 11 tax information exchange agreements with 11 countries. Furthermore, Japan has signed the OECD Convention on Mutual Administrative Assistance in Tax Matters as Amended by Protocol in 2011. The Convention to Implement Measures to Prevent Base Erosion and Profit Shifting came into force in Japan on 1 January 2019. As of 27 September 2023, 43 countries and regions had elected to be covered by the convention.

Japan has concluded an inheritance and gift tax treaty with the United States, which does not follow the OECD model and focuses on the place of the decedent's estate. Generally, under Japanese law, when foreign property is acquired by inheritance/gift and tax equivalent to inheritance/gift tax is imposed in the country in which the property is located, the inheritance/gift tax in that country can be deducted up to the amount of the Japanese inheritance/gift tax on the property (foreign tax credit for inheritance/gift tax). However, the provisions of the treaty with the United States supersede these general rules.

2 Taxation

2.1 On what basis are individuals subject to tax in your jurisdiction (eg, residence/domicile/nationality)? How is this determined?

Income tax: The main factors determining income tax liability are:

- domicile;

- residence;

- nationality;

- length of domicile and residence in Japan; and

- whether the income is Japan-sourced income.

Individuals who are liable for income tax in Japan can be broadly classified into two categories for tax purposes:

- residents, who can be further classified into two categories:

-

- residents other than non-permanent residents; and

- non-permanent residents; and

- non-residents.

Residents are individuals:

- who have had a domicile or residence in Japan for at least one year; and

- whose worldwide income is taxable.

Non-permanent residents are individuals:

- who do not have Japanese nationality; and

- who have had a domicile or residence in Japan for less than five years within the past 10 years.

Their taxable income includes Japan-sourced income and other foreign-sourced income paid in or remitted into Japan.

Non-residents are individuals who are not residents; they are taxed only on their Japan-sourced income.

'Domicile' means the individual's 'centre of living'. Whether a person has a domicile in Japan is determined based on a combination of objective factors, such as:

- the number of days actually stayed in Japan;

- occupation;

- location of assets;

- residence status of family and relatives; and

- nationality.

There is no clear-cut rule such as a 183-day test.

Inheritance/gift tax: All individuals (both decedents and statutory heirs and beneficiaries) are classified considering mainly four factors:

- nationality;

- domicile;

- length of domicile; and

- visa status if the individual is a non-Japanese resident.

The scope of Japanese inheritance tax is summarised in question 2.5(a)(b). However, given that the analysis of the scope of inheritance/gift tax is very complex, individuals should consult an estate planning professional on the scope of their taxable property.

2.2 When does the personal tax year start and end in your jurisdiction?

For individuals, the tax year runs from 1 January to 31 December. Individual income tax returns and gift tax returns must generally be filed no later than 15 March of the following year. Inheritance tax returns must be filed within 10 months of the death of the decedent. In our experience, extensions for inheritance/gift tax returns are granted only in very exceptional cases.

2.3 With regard to income: (a) What taxes are levied and what are the applicable rates? (b) How is the taxable base determined? (c) What are the relevant tax return requirements? and (d) What exemptions, deductions and other forms of relief are available?

(a) What taxes are levied and what are the applicable rates?

Income tax is calculated by dividing income into 10 categories:

- interest income;

- dividend income;

- real estate income;

- business income;

- employment income;

- retirement income;

- forestry income;

- capital gains income;

- temporary income; and

- miscellaneous income.

The tax is calculated by subtracting each income deduction from the gross income and then multiplying the remaining balance, which is the taxable amount, by the progressive tax rates, ranging from 5% (for amounts of JPY 1.95 million or less) to 45% (for amounts over JPY 40 million). For further details, please see question 2.3(b).

A special restoration income surtax due to the Great East Japan Earthquake of 2.1% applies to income earned through 31 December 2037 on the amount of income tax each year. An inhabitant tax of 10% is also imposed, which is divided into municipal income and prefectural income taxes.

(b) How is the taxable base determined?

Income tax is calculated by multiplying the gross income – which is the sum of various types of income (eg, employment income and real estate income) that are subject to the aggregate taxation method – by the applicable tax rate, according to the following progressive tax rates:

| Amount of taxable income (amount rounded down to the nearest JPY 1,000) | Rates | Deduction |

| JPY 1,000 to 1,949,000 | 5% | JPY 0 |

| JPY 1,950,000 to 3,299,000 | 10% | JPY 97,500 |

| JPY 3.3 million to 6,949,000 | 20% | JPY 427,500 |

| JPY 6,950,000 to 8,999,000 | 23% | JPY 636,000 |

| JPY 9 million to 17,999,000 | 33% | JPY 1,536,000 |

| JPY 18 million to 39,999,000 | 40% | JPY 2,796,000 |

| JPY 40 million+ | 45% | JPY 4,796,000 |

Separately from income that is subject to the aggregate taxation method, some income – such as interest and capital gains income – will be calculated separately from gross income (ie, not added to gross income). This calculation is called 'separate taxation'. In turn, separate taxation can be further classified into:

- separate withholding taxation; and

- separate declaration taxation.

(c) What are the relevant tax return requirements?

For individuals, tax returns and income tax payments are due on 15 March of the following year.

(d) What exemptions, deductions and other forms of relief are available?

Available deductions and exemptions include, among others:

- deductions for social security premiums;

- deductions for small business mutual aid premiums;

- deductions for life insurance premiums;

- exemptions for widows or single parents;

- exemptions for working students;

- exemptions for persons with disabilities;

- exemptions for dependants;

- the basic deduction;

- deductions for casualty losses;

- deductions for medical expenses; and

- deductions for donations

Tax credits include, among others:

- credit for dividends:

- special credit for housing loans, exc. etc.

- special credit for contributions to political parties;

- special credit for donations to public interest incorporated associations; and

- credit for foreign taxes.

For non-residents, the available deductions and tax credits are limited.

2.4 With regard to capital gains: (a) What taxes are levied and what are the applicable rates? (b) How is the taxable base determined? (c) What are the relevant tax return requirements? and (d) What exemptions, deductions and other forms of relief are available?

(a) What taxes are levied and what are the

applicable rates?

(b) How is the taxable base

determined?

Certain types of capital gains are taxed separately from income, which is subject to the aggregate taxation method. Gains from the transfer of real estate held for more than five years are taxed as long-term capital gains at a flat rate of 20.315% (15.315% national tax and 5% local tax), separately from income under the aggregate taxation method. On the other hand, gains from the transfer of real estate held for five years or less are taxed as short-term capital gains at a flat rate of 39.63% (30.63% national tax and 9% local tax).

Gains from the sale of certain securities are taxed separately from other income at a flat rate of 20.315% (15.315% national tax and 5% local tax). Capital gains/losses from the sale of listed securities cannot be applied to capital gains/losses from the sale of non-listed securities.

(c) What are the relevant tax return requirements?

In principle, tax returns for capital gains must be filed by 15 March of the following year as part of the income tax return. However, if the taxpayer has a specific account for which withholding is chosen for capital gains for a listed company's securities, the taxpayer need not file a tax return for such capital gains.

(d) What exemptions, deductions and other forms of relief are available?

At a high level, acquisition costs and brokerage commission can be deducted from the capital gain from the transfer of the stocks and so on. Losses on the transfer of listed stocks cannot be deducted from the capital gain on the transfer of non-listed stocks. Also, losses on the transfer of general stocks cannot be deducted from the capital gain on the transfer of listed stocks.

2.5 With regard to inheritances: (a) What taxes are levied and what are the applicable rates? (b) How is the taxable base determined? (c) What are the relevant tax return requirements? and (d) What exemptions, deductions and other forms of relief are available?

(a) What taxes are levied and what are the

applicable rates?

(b) How is the taxable base

determined?

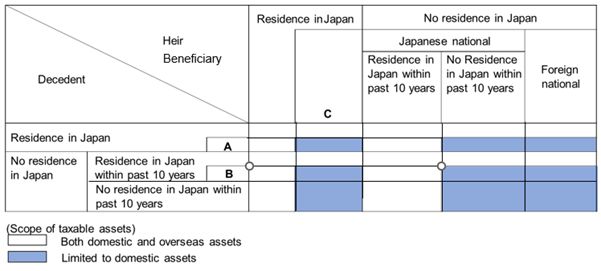

Individuals who are liable for inheritance tax are classified into three categories according to the nationality and domicile of the decedent or heir/beneficiary:

- resident unlimited taxpayers;

- non-resident unlimited taxpayers; and

- limited taxpayers.

The rules on the scope of inheritance tax were substantially amended recently. As of October 2023, the position of heirs and beneficiaries who are subject to inheritance tax is summarised in the following chart:

- A: An individual who retains resident status with a Table 1 visa.

- B: An individual who has not been a Japanese citizen continuously while he/she has domicile in Japan within past 10 years.

- C: An individual who retains resident status with a Table 1 visa in Japan and with domicile in Japan whose total period of domicile in Japan within the past 15 years was 10 years or less.

Inheritance tax is imposed on the aggregate value of all assets acquired on the death of the decedent. If the aggregate value does not exceed the basic deduction – which is currently JPY 30 million, plus an amount equal to JPY 6 million multiplied by the number of statutory heirs – there is no need to file an inheritance tax return and pay inheritance tax. The inheritance tax rate, which is progressive, ranges from 10% (amounts of JPY 10 million or less) to 55% (amounts of over JPY 600 million). It is applied not to the decedent's estate as a whole, but to the amount that each statutory heir legally acquires pursuant to his or her statutory share. The total tax amount calculated according to the statutory share is then allocated among those who actually acquire the estate according to the will or estate distribution agreement among the statutory heirs and beneficiaries. If a person who acquires the assets is not a spouse or first-degree family member of the decedent, an additional 20% inheritance tax will be imposed.

However, as various detailed rules and regulations apply in this regard, an experienced Japanese professional should be consulted if an individual wishes to determine which assets are subject to Japanese inheritance tax.

(c) What are the relevant tax return requirements?

The inheritance tax return should be filed within 10 months of the taxpayer learning of the death of the decedent.

(d) What exemptions, deductions and other forms of relief are available?

In addition to the basic deduction explained in question 2.3(a)(b), available deductions and exemptions include, among others:

- a gift tax credit for persons who paid gift tax for assets gifted from the decedent in the three years prior to the death of the decedent (within seven years from 1 January 2024);

- a spousal credit, which is JPY 160 million or the spousal intestacy shares of the total taxable assets;

- an exemption for minors;

- an exemption for disabled persons; and

- an exemption for inheritance from successive generations.

2.6 With regard to investment income: (a) What taxes are levied and what are the applicable rates? (b) How is the taxable base determined? (c) What are the relevant tax return requirements? and (d) What exemptions, deductions and other forms of relief are available?

Interest income is subject to withholding tax at the time of payment, which is calculated at a flat rate of 20.315% (15.315% national tax and 5% local tax).

Dividend income is subject to withholding tax at the time of payment in accordance with the category of stocks. In the case of dividends from listed stocks, income tax is withheld at a flat rate of 20.315% (15.315% national tax and 5% local tax). In the case of dividends from other sources, income tax will be withheld at a flat rate of 20.42% (without local tax). In calculating dividend income, any interest payable on loans to acquire the stocks can be deducted.

Interest and dividend income are subject to withholding tax, but in principle they are subject to the aggregate taxation method. However, dividends from listed stocks may be subject to separate taxation on declaration instead of aggregate taxation by opt-in. Therefore, except for dividend income from listed stocks, which is subject to separate taxation by opt-in, income tax withheld at source is deducted when calculating the amount of income tax under the aggregate taxation for the year.

2.7 With regard to real estate: (a) What taxes are levied and what are the applicable rates? (b) How is the taxable base determined? (c) What are the relevant tax return requirements? and (d) What exemptions, deductions and other forms of relief are available?

Real estate acquisition tax (local tax): Real estate acquisition tax is imposed on the acquirer when the real estate is acquired. The standard tax rate is 4%, but currently a reduced rate of 3% is applicable to land and residential buildings. A notice of tax payment will be sent from the competent local government accordingly and payment must be made by the deadline stated in the notice.

Registration tax (national tax): Registration tax is imposed on the registration of real estate when the application for registration is filed. The standard rate for the ownership of new buildings is 0.4%, but currently a reduced rate of 0.15% is applicable to the ownership of new residential buildings. The standard rate for the transfer of real estate is 2%, but currently a reduced rate of 1.5% is applicable to land and 3% to residential buildings.

Ongoing taxes:

- The standard rate of property tax is 1.4%, although this varies depending on the local government.

- City planning tax: Maximum tax rate is 0.3%, which varies depending on the local government.

Sale of real estate: For details of taxation of the seller's capital gain, please see question 2.4(a)(b).

2.8 With regard to any other direct taxes levied in your jurisdiction: (a) What taxes are levied and what are the applicable rates? (b) How is the taxable base determined? (c) What are the relevant tax return requirements? and (d) What exemptions, deductions and other forms of relief are available?

Wealth tax: There is no wealth tax in Japan.

Exit tax: An exit tax was introduced on 1 July 2015. Under the exit tax regime, where an individual who meets the following criteria leaves Japan, he or she will be subject to income tax on unrealised gain from those taxable securities as if they were deemed to have been realised on emigration:

- He or she is a resident who stayed in Japan for more than five of the 10 years prior to emigration (except for a foreign individual staying in Japan under a Table 1 visa); and

- He or she owns certain taxable securities (including certain securities, interest in a silent partnership or unsettled derivatives) with an aggregate value of JPY 100 million or more.

An individual who notifies the authorities of emigration through a tax administrator must file a tax return by 15 March of the following year. However, an individual who has not appointed a tax administrator in relation to his or her emigration must file and pay tax upon emigration. An individual who is subject to exit tax can apply to defer payment for five years (this five-year period may be extended to 10 years if an application meeting the requirements is filed before the date on which the five-year period elapses).

Exit tax will also be imposed on a non-resident beneficiary where an individual:

- who is a resident stayed in Japan for more than five of the 10 years prior to his or her death or gift (except for a foreign individual staying in Japan under a Table 1 visa); and

- who owns certain taxable securities (including certain securities, interest in a silent partnership or unsettled derivatives) with aggregate value of JPY 100 million or more) passes away or gifts passes away or gifts the subject assets to the non-resident beneficiary.

The relief afforded to foreign resident individuals with a Table 1 visa is not available for individuals who hold a Table 2 visa (eg, a spouse or child of Japanese national visa or permanent resident visa). Accordingly, some foreign residents try to retain a Table 1 visa to enjoy such relief for estate planning purposes.

2.9 With regard to any indirect taxes levied in your jurisdiction: (a) What taxes are levied and what are the applicable rates? (b) How is the taxable base determined? (c) What are the relevant tax return requirements? and (d) What exemptions, deductions and other forms of relief are available?

Consumption tax is imposed on transactions such as the sale of goods and the provision of services. It is borne by the consumer and paid by the supplier of the goods and services.

Consumption tax is imposed on the transfer of assets, the lending of assets and the provision of services by the supplier of such goods and services. Thus, most transactions in exchange for consideration – such as the sale of goods, transportation and advertising – are subject to consumption tax. Imports of goods from abroad are also subject to taxation at the time of import.

The following transactions are exempt from consumption tax:

- the transfer or lease of land (except for temporary transactions);

- the transfer of securities;

- interest, guarantee fees and insurance premiums;

- administrative fees for documents such as a certificate of residence or an extract from the Family Register;

- foreign exchange transactions;

- payments for social insurance, medical care and so on;

- long-term care insurance services, social welfare services and so on;

- childbirth expenses;

- burial and cremation fees;

- tuition fees, admission fees, entrance examination fees, facility and equipment fees and so on for certain schools;

- the transfer of books for teaching purposes; and

- housing loans (except temporary housing loan for the period less than one month).

The standard tax rate is 10% (7.8% national and 2.2% local). The reduced tax rate is 8% (6.24% national and 1.76% local). The reduced tax rate applies to the sale of food and beverages (excluding alcohol drinks) and newspapers.

3 Succession

3.1 What laws govern succession in your jurisdiction? Can succession be governed by the laws of another jurisdiction?

In Japan, succession is governed by the Civil Code.

3.2 How is any conflict of laws resolved?

In cross-border matters, foreign laws may apply, as the Japanese provisions on conflict of laws state that the laws of nationality of the decedent will govern his or her inheritance, pursuant to the Act on General Rules for Application of Laws (AGRAL). However, the AGRAL adopts the doctrine of renvoi, which provides that the conflict of laws provisions under the laws of the decedent's nationality must be considered. This means that the conflict of laws provisions of the decedent's nationality may determine the governing law for inheritance in Japan.

For example, in most common law countries (eg, Singapore), the conflict of laws provisions state that:

- the decedent's last domicile should apply when determining succession in relation to his or her personal property; and

- with respect to real estate, the law of its situs should apply.

Thus, if a Singapore national's last domicile was in Japan, the Japanese Civil Code may end up applying to his or her personal property. Furthermore, if a Singapore national living in Singapore had real estate in Japan at the time of his or her death, the Japanese Civil Code will apply to the succession of the real estate, regardless of where the decedent lived at the time of passing.

3.3 Do rules of forced heirship apply in your jurisdiction?

Yes, Japan has rules of forced heirship, which apply to certain statutory heirs.

Upon the death of the decedent, all of his or her rights and obligations – including positive assets (legal title to tangible and intangible assets and claims) and negative assets (debts and unpaid taxes and dues) – are automatically succeeded by the statutory heirs.

In principle, an individual is free to dispose of his or her property. During his or her lifetime, the individual may dispose of his or her property through:

- gifts;

- transfers;

- trusts; and

- wills.

However, certain statutory heirs (eg, spouse, descendants (including adults) and ascendants, but not siblings) are entitled to a certain percentage of the estate ('statutory share'). This will comprise:

- half of the statutory share in case of a spouse and descendants; and

- one-third of the statutory share if only ascendants are heirs.

A recipient of the estate who infringes the forced heirship share must pay monetary compensation equivalent to the statutorily reserved share if the forced heirship claim holder so requests within one year of the holder learning that the recipient has infringed his or her statutorily reserved share.

3.4 Do the rules of succession rules apply if the deceased is intestate?

In principle, an individual is free to dispose of his or her property. Accordingly, during his or her lifetime, the individual may dispose of his or her property through:

- gifts;

- transfers;

- trusts; and

- wills.

However, if the decedent dies intestate without any will or will alternative, the estate will be distributed according to the Civil Code. If the decedent dies intestate and there is only a sole statutory heir, that statutory heir will succeed all rights and obligations. However, if there are multiple statutory heirs, the heirs must agree on how to distribute the estate, as the statutory heirs have a share in the estate as a whole in accordance with the intestacy shares.

The spouse of the decedent is always a statutory heir. Blood relatives other than the spouse become statutory heirs in accordance with the following priorities:

- First priority: Children of the decedent (if one of the children predeceases the decedent, his or her lineal descendants will be statutory heirs).

- Second priority: Ascendants of the decedent (if parents and grandparents survive the decedent, the parents will have priority over the grandparents).

- Third priority: Siblings of the decedent (if one of the siblings predeceases the decedent, his or her children (ie, the decedent's nieces and nephews) will be statutory heirs; but their children will not be statutory heirs if the nieces and nephews do not survive the decedent).

Moreover, a person who renounces inheritance is considered not to have been an heir from the beginning. In addition, persons in common-law relationships are not included as heirs.

The intestacy shares of statutory heirs are as follows:

| Composition of statutory heirs | Spousal intestacy share | Aggregate intestacy shares of others |

| Spouse only | 100% | 0 |

| Spouse and first-priority heirs (children and other descendants) | 50% | 50% |

| Spouse and second-priority heirs (ascendants) | 2/3 | 1/3 |

| Spouse and third-priority heirs (siblings) | 3/4 | 1/4 |

Generally, the statutory heirs negotiate based on the intestacy shares and execute an estate distribution agreement which specifies who will take what from the estate. However, if the statutory heirs cannot agree, they may file a petition for mediation at the family court and must then have a tribunal make a determination at the family court if the mediation efforts fail.

3.5 Can the rules of succession be challenged? If so, how?

No.

4 Wills and probate

4.1 What laws govern wills in your jurisdiction? Can a will be governed by the laws of another jurisdiction?

The Civil Code governs wills in Japan. Unlike in some countries, where the testator can designate the governing law for inheritance in his or her will, in Japan, a testator cannot designate the governing law at his or her discretion if the governing law is Japanese law.

4.2 How is any conflict of laws resolved?

The laws of the nationality of the decedent govern his or her inheritance under the Act on General Rules for Application of Laws (AGRAL), which sets out the Japanese conflict of laws. Thus, if the governing law designated by the AGRAL allows for the testator to designate the governing law at his or her discretion, the testator can choose the governing law for inheritance.

4.3 Are foreign wills recognised in your jurisdiction? If so, what process is followed in this regard?

Under the Act on the Law Governing the Formalities of a Will, a foreign will is formally valid if it complies with the laws of:

- the place where the testator made it;

- the place where the testator had his or her nationality when he or she made the will or died;

- the place where the testator had his or her domicile or habitual residence when he or she made the will or died; or

- the place where the real estate is situated, if the will concerns such real estate.

Thus, most foreign wills will be valid and recognised in Japan. However, as a practical matter, it is recommended that foreigners who own assets in Japan – whether they are Japanese residents or not – make a Japanese notarised will to transfer title to the beneficiaries smoothly and without going through probate in Japan. To have a foreign will recognised in Japan, financial institutions and the Legal Affairs Bureau must be convinced that the foreign will is valid both in formality and in content according to the applicable law (as translated). Recognition of a foreign will in Japan can also involve substantial costs and time if the Legal Affairs Bureau and/or financial institutions request a legal opinion on the applicable law, in addition to a Japanese translation.

4.4 Beyond issues of succession discussed in question 3, are there any other limitations to testamentary freedom?

As explained in question 3.3, a testator is free to dispose of his or her property by will or will alternatives. However, a recipient of the estate who infringes the statutory reserved share must pay monetary compensation equivalent to the statutorily reserved share if a forced heirship claim holder so requests within one year of learning that the recipient has infringed his or her statutorily reserved share.

4.5 What formal requirements must be observed when drafting a will?

There are three ordinary types of wills under the Civil Code.

Notarised will: This is a will made through a notary, to whom the testator recites its contents in the presence of two witnesses. The testator and two witnesses sign the will in the presence of the notary and the notary attests to this. The notary retains the original will. The will can be executed immediately after the testator's death without probate at the family court. A notarised will must be written in Japanese, as this is a public document in Japan. However, a testator who cannot speak and read Japanese can make a notarised will with the assistance of an interpreter.

Holographic will: This is a will that is:

- drafted in the testator's own handwriting with his or her seal;

- signed; and

- dated.

A holographic will need not be written in Japanese and does not require any witnesses. However, as Japanese law does not allow a typed holographic will, it must be handwritten (due to a recent amendment to the Civil Code, a testator can attach a typed asset list as a separate document to a holographic will). To execute the will, it must be filed for probate at the family court. This type of will frequently results in conflicts among heirs – for example, over:

- whether the will was made in the testator's handwriting; or

- the testator's capacity.

Since the Civil Code was amended in 2020, a testator can ask the Legal Affairs Bureau to keep a holographic will. In such case, probate at the family court will not be necessary.

Secret certificate will: This is a will which is drafted and signed by the testator (either handwritten or typed) with his or her seal. The testator seals the envelope with the same seal affixed on the will. The testator must:

- present the envelope to a notary before two witnesses, declaring that the document in the envelope is his or her will; and

- provide his or her name and address.

The notary notes the date on which the will is presented and the statement of the testator on the envelope, and the testator and the two witnesses sign the envelope. Secret certificate wills are rarely used in Japan.

Generally, foreign nationals who have assets in Japan are advised to make a notarised will for their Japanese assets to transfer them to beneficiaries in the most efficient manner possible.

4.6 What best practices should be observed when drafting a will to ensure its validity?

As mentioned in questions 4.1, 4.2 and 4.3, as Japan will recognise most foreign wills made outside Japan, a testator can in theory prepare a single will covering his or her worldwide assets, including Japanese assets. However, as a practical matter, we recommend the execution of a separate will for assets on a country-by-country basis – for example, making a Singapore will for assets in Singapore and a Japanese notarised will for assets in Japan from the Japanese legal perspective.

4.7 Can a will be amended after the death of the testator?

If there is a will, the estate will be distributed according to the will. However, the estate distribution agreement between all heirs (if there are beneficiaries other than the heirs stated in the will, the agreement of such beneficiaries is also required) may amend the will in part or whole. This is not possible if:

- the will executor does not consent to a different distribution from that stated in the will; or

- there is a clause in the will that prohibits the conclusion of an estate distribution agreement.

4.8 How are wills challenged in your jurisdiction?

Individuals with a financial interest in an estate can challenge the validity of a will by initiating court proceeding mainly on the following basis:

- non-compliance with the formality requirements; and/or

- lack of testamentary capacity of the testator.

Most of the invalidation claims are based on the testator's incapacity to make a will. In particular, this problem arises when an elderly person with dementia passes away after making a will in his or her own handwriting. In order to avoid such disputes, it is advisable to make a notarised will, as the notary can assess the testator's testamentary capacity prior to his or her making a will (although it is advisable to have the testator take a cognitive capacity test with his or her physician both before and after making the will).

4.9 What intestacy rules apply in your jurisdiction? Can these rules be challenged?

See question 3.3.

5 Trusts

5.1 What laws govern trusts or equivalent instruments in your jurisdiction? Can trusts be governed by the laws of another jurisdiction?

Despite its civil law regime, Japan has had a trust system for more than 100 years. The Trust Act governs trusts. However, the trust was not used widely in Japan as an estate planning device until 2006, when the Trust Act was substantially amended. The amendments introduced several improvements to facilitate the use of trusts for family wealth management and estate planning. However, the taxation of trusts, which takes a hostile view of estate transfers, discourages some high-net-worth families from using trusts.

In addition to the trust, the following are also used as vehicles for estate planning:

- general incorporated associations and general incorporated foundations; and

- asset management companies (eg. stock companies or limited liability companies)

In particular, asset management companies are often used because they are relatively flexible in managing their organisation and assets.

Japan has not ratified the Hague Convention on the Law Applicable to Trusts and on their Recognition. There are no explicit provisions on the governing law for trusts in the Act on General Rules for Application of Laws, which sets out the Japanese conflict of laws provisions. However, according to court precedent, a foreign trust established under foreign law is legally valid and recognised in Japan if it is validly established under the governing law specified in the trust agreement.

5.2 How is any conflict of laws resolved?

Please see question 5.1.

5.3 What different types of structures are available and what are the advantages and disadvantages of each, from the private client perspective?

The main types of structures used for estate planning purposes are as follows:

- Will trust: A testator can create a trust by appointing a trustee and beneficiaries in the will. If the person appointed as trustee by the will refuses to act as trustee when the testator passes away, the beneficiary can file a petition to the court requesting the appointment of another trustee.

- Living trust: This is a trust whereby the settlor appoints himself or herself as a beneficiary during his or her lifetime with the consent of the trustee. At the time of settlement of the trust, no tax is imposed on the beneficiary, as there is no change in owner. The settlor can appoint secondary beneficiaries to address the possibility of the settlor passing away. The secondary beneficiaries who receive the beneficial rights are subject to Japanese inheritance tax on the death of the settlor (the first beneficiary).

Unlike other common law countries such as Singapore, Japan does not require probate. Strictly speaking, while holographic wills and secret certificate wills must go through probate at the family court, this is merely procedure to acknowledge the existence of the will and its terms, in order to avoid forgery. Therefore, there is no need to rely on trusts to avoid probate. Furthermore, a person who assumes the role of trustee as a business needs a licence to act as such pursuant to the Trust Business Act. This licensing requirement has also hindered the use of trusts in Japan.

Trusts can be used to designate the beneficiaries not only in the event of the death of the settlor, but also after the death of the next generation, which is not possible through a will under the Civil Code. Trusts are also used to manage the property, for example, of:

- persons at risk of dementia;

- elderly persons; and

- family members with disabilities.

However, unlike in the United States and other countries, there is no preferential tax treatment for trusts in Japan.

5.4 Are foreign trusts recognised in your jurisdiction? If so, what process is followed in this regard?

Please see questions 5.1 and 5.2.

5.5 How are trusts created and administered in your jurisdiction?

With regard to the creation of trusts, please see question 5.3. A trust is administered by the trustees, who must act in accordance with:

- the terms and conditions of the trust instrument; and

- the fiduciary and other duties stated in the Trust Act (see question 5.6).

5.6 What are the legal duties of trustees in your jurisdiction?

There is no clear concept of fiduciaries in Japan. However, the following are the core duties of trustees, some of which can be modified by the terms and conditions of the trust instrument:

- the duty to comply with the trust terms;

- the duty of care;

- the duty of loyalty;

- the duty of impartiality;

- the duty to maintain trust assets separately;

- the duty to provide information; and

- the duty to supervise delegating trust administration to a third party.

5.7 What tax regime applies to trusts in your jurisdiction? What implications does this have for settlors, trustees and beneficiaries?

In Japan, the three main types of trust are as follows, depending on their legal characteristics:

- Transparent (beneficiary-taxed trust): A designated beneficiary of a trust is considered to own the assets in the trust and is liable to be taxed even if he or she does not actually receive the assets in the trust. Therefore, the beneficiary is subject to inheritance/gift tax when the settlor transfers the assets to the trustee, unless:

-

- the settlor and the beneficiary are the same individual; and

- the beneficiary is subject to income tax on the income from the trust assets.

- Collective investment trust: Under this type of trust, beneficiaries are taxed when the profits are distributed to the beneficiaries. Neither the trust itself nor the trustee is subject to tax on income derived from the entrusted property. Mutual funds are typically included in this category.

- Corporate taxable trust: This type of trust is taxable in a similar manner to an ordinary corporation. A specific purpose trust and a trust with no actual beneficiary are typically categorised as corporate taxable trusts.

Companies, including asset management companies, are subject to:

- corporate income tax (at the national and local levels); and

- enterprise tax on their income.

General incorporated associations and general incorporated foundations are also subject to the same taxes on their incomes, like other companies. If an individual donates assets other than cash to companies and/or general incorporated organisations, he or she may be subject to capital gains tax if the donated assets have an unrealised gain. However, capital gains tax and corporate income tax may be avoided if the general incorporated organisation meets certain requirements.

As there is no concept of ownership in general incorporated organisations, the assets in the name of the organisation are not subject to inheritance tax.

5.8 What reporting requirements apply to trusts in your jurisdiction?

When a certain income is generated from the trust assets, the trustee must submit a statement of trust. The submission period for this statement is from 1 January to 31 January of the calendar year following that in which the income was generated.

A trustee must submit a statement by the beneficiary to the tax office when:

- the settlor is not a beneficiary; and

- the beneficiary changes.

5.9 What best practices should be observed in relation to the creation and administration of trusts?

As outlined in question 5.7, the Japanese regime on the taxation of trusts is unique. Therefore, sound legal and tax advice should be sought to ensure that a trust is appropriate to each family's circumstance. This is especially the case where a family with a family trust which has no nexus to Japan considers moving to Japan. In this case, the family should discuss with a Japanese estate planning professional whether moving to Japan would have any substantial adverse legal or tax implications. It will likely be too late to commence such an analysis once they have arrived in Japan.

6 Trends and predictions

6.1 How would you describe the current private client landscape and prevailing trends in your jurisdiction? Are any new developments anticipated in the next 12 months, including any proposed legislative reforms?

There is a special system in Japan whereby a taxpayer can make an irrevocable election to integrate inheritance and gift tax if certain requirements are met. Under this special system, a donor may fix the fair value of the gifted property for inheritance tax purposes by:

- gifting the same before his or her death; and

- paying the gift tax at a flat rate of 20%.

If the donee elects to opt for this special system, he or she must pay inheritance tax on the death of the donor after deducting the amount that he or she has paid as gift tax. However, the amount of inheritance tax is calculated based on the value of the gift. Currently, the annual basic exemption of JPY 1.1 million for gifts is not allowed where the donee opts for this special system. However, this annual basic exemption will be allowed for gifts made after 1 January 2024 for donees who elect to opt for this special system.

Furthermore, the aggregate value of gifts given in the three years prior to the donor's death is currently added to the value of the estate and is subject to inheritance tax. However, this period will be extended to seven years prior to the donor's death to encourage earlier living asset transfers in the case of inheritances after 1 January 2024.

Generally, a tax reform package plan is announced in December every year and the reforms are submitted to the Diet.

7 Tips and traps

7.1 What are your top tips for effective private client wealth management in your jurisdiction and what potential sticking points would you highlight?

The Japanese tax and trust regimes are unique. In particular, inheritance tax has the following characteristics:

- Inheritance tax and gift tax rates are high (55% at maximum);

- The basic deduction for inheritance tax and gift tax is small;

- Spousal credit is limited compared to other jurisdictions; and

- The trust taxation is unique from that in other countries, including unexpected deadlines that can be triggered inadvertently.

Moreover, Japanese law has the following characteristics:

- Japan allows forced heirship claims, which can be an issue for foreign families if the decedent has his or her last domicile in Japan and/or has real estate in Japan;

- Same-sex marriage has not yet been legalised; and

- There is broad administrative discretion in relation to the grant of visa status.

Further, it may be difficult to find estate planning professionals who can provide comprehensive support for cross-border tax-related issues.

For a family or individual considering moving to Japan, the Japanese legal and tax implications of such a move should be assessed comprehensively beforehand. It may also be necessary to review estate planning that was previously done outside Japan. Similarly, departing from Japan may also require such an analysis. Therefore, individuals should plan well in advance so that they can benefit from the advice of competent Japanese professionals, in close collaboration with foreign advisers from the relevant jurisdictions.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.