We observed a pattern in the strategies that were chosen among family businesses that reflected two key factors: the leadership and the ownership composition of the company.

Is the business led by a family member or a non-family CEO?

Are the company's shares highly concentrated among a small number of shareholders or are they widely dispersed among multiple family (and potentially non-family) members?

From a global perspective, family ownership is high among the survey respondents. On average, more than 90 percent of their companies' shares are owned by the family, keeping control of the business firmly in family hands. In addition to the family ownership, companies led by a family CEO are exercising the additional authority of the family to direct strategic decision-making while also controlling the assets of the business.

When we looked, for example, at businesses led by a family CEO, we saw a pattern: the higher the family's involvement in the business, whether that was in leadership, managerial or ownership roles (or a combination of all three), the more likely it was that their initial response to the pandemic was to focus on the welfare of their employees and the communities where the families live and operate.

The lower the family's overall involvement, the more likely it became that the leader of the business (whether that was a family or non-family CEO) would make difficult business decisions regarding the company's employees, overall cost reductions and the potential restructuring of the business itself.

These two factors, and other widely recognized business family characteristics, allowed us to identify distinct family business types that share similar qualities. We have characterized them as four family business personas that provide a perspective on the patterns of behavior within different family businesses.

FOUR FAMILY BUSINESS PERSONAS

When the family/non-family CEO and family ownership factors were combined, we were able to identify four clusters of different family business types. They share common characteristics and adopt similar strategies based on their characteristics and they are presented below in four illustrative family business personas: the "Family Corporation", "Family Enterprise", "Family Consortium" and "Family Venture".

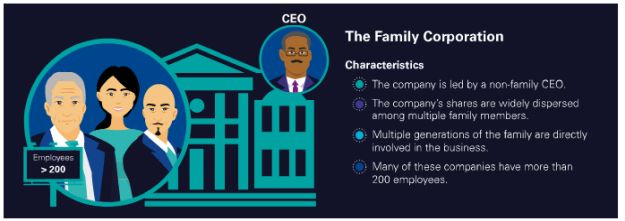

Family Corporation

Primary COVID-19 response strategy: Social responsibility

A social responsibility strategy has been the most widely adopted response to the impact of COVID-19 among Family Corporations. Considering that the companies in this group are older and larger than the firms in other groups, we have inferred that they were more stable economically and better prepared financially to support an external shock.

While they introduced some cost-cutting measures and adjustments to their executive compensation arrangements, they were primarily committed to retaining their employees and sustaining the family's reputation, legacy and social commitments by using their financial resources and social capital.

Family Consortium

Primary COVID-19 response strategies: Social responsibility, business transformation

Companies in the Family Consortium have made community support a priority, similar to those in Family Corporations, where the longevity of the business and the family's legacy are of primary importance. The difference is that Family Consortiums have been likely to adopt a business transformation strategy, which may reflect their added agility because of their relatively smaller size.

A combined social responsibility and business transformation strategy has often been influenced by the number of family members who are participating in the business as shareholders, operators and stewards of the family's reputation. Having a family CEO has also encouraged high family involvement in the firm with families that are deeply embedded in the business and are being encouraged to actively contribute to important decision-making.

Family Enterprise

Primary COVID-19 response strategies: Social responsibility, business transformation, exercising patience

Overall, Family Enterprises have adopted all three strategies equally. We believe this reflects some of the challenges in governing and managing family businesses that have a non-family CEO and a small number of family shareholders who are also actively engaged in the business.

With a high concentration of family ownership, non-family CEOs often have less control over organizational changes that may be required in times of crisis and it can be challenging to manage and govern a firm in which the family shareholders are acutely aware of – and often directly involved in – day-to-day operations.

In such cases, we have seen that the CEO's role has often focused on protecting the financial exposure of the business through cost-cutting measures and financial support programs, while the family is engaged in the strategic review of the business and maintaining their societal commitments.

Family Venture

Primary COVID-19 response strategies: Exercising patience, business transformation

The initial strategy adopted by Family Ventures has been one of exercising patience; to wait and see how the impact of the pandemic evolves over a period of time. However, it is important to highlight that the second-most important strategy for this group has been to begin transforming their businesses after they have taken sufficient time to assess the situation and their options.

These companies generally have fewer financial and strategic resources to implement major changes. Because they are relatively small and young, some may not have a clear competitive model yet. They are generally more family-oriented than business-oriented and their immediate reaction has been to preserve their economic and emotional investment in the firm by remaining patient before considering how to transform their business.

Learn more about how family businesses are mastering a comeback and helping to lead the global economic recovery. Download the full Report.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.