Recognising the threat of climate change and the importance of sustainable development, Singapore has made a commitment to establishing a robust framework of environmental and climate change laws and regulations – an unprecedented initiative in the Southeast Asia region.

Singapore launched its key environmental strategy in 2021 with the Singapore Green Plan 2030, a comprehensive roadmap laying out the Lion City's sustainability vision for the next decade.

This Legal Update presents a brief overview of: (i) main targets and goals under the Singapore Green Plan 2030, (ii) key regulations and initiatives implemented, or to be implemented, in an effort to attain such targets and goals, and (iii) recent carbon market developments in Singapore.

A. The Singapore Green Plan 2030

The Singapore Green Plan 2030 is Singapore's contribution to the international sustainability agenda and global climate goals, underpinned by five (5) pillars:

(i) Net Zero Emissions Targets

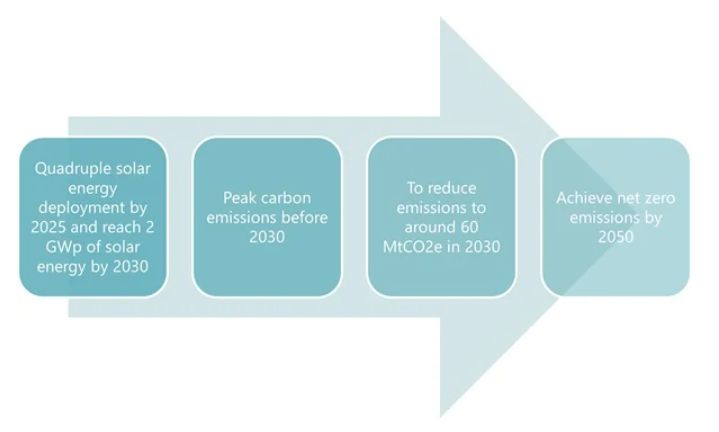

Ultimately, the overarching end-goal of the Singapore Green Plan 2030 is for Singapore to eventually achieve its national climate target of "net zero emissions by 2050". To achieve that, the following milestone targets have been set:

(ii) Sector-Specific Targets

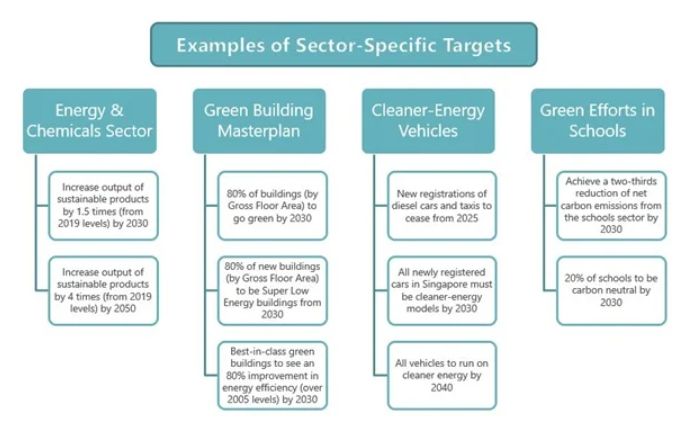

To achieve the goal of hitting net zero emissions by 2050, the following more sector-specific targets are also set under the Singapore Green Plan 2030:

B. Key Regulations and Initiatives

There are two main aspects to the regulation regarding climate change and the carbon market: (i) Carbon Tax; and (ii) Climate Disclosure.

(i) Carbon Tax

Implemented in 2019, the imposition of carbon tax under the Singapore Carbon Pricing Act 2018 is the cornerstone of Singapore's climate regulations. Currently, the tax is applied to facilities emitting more than 25,000 tCO2e equivalent per year, with an initial rate of S$5 per tonne. This carbon tax rate is intended to be increased gradually:

| Year | Carbon Tax Rate |

| 2019 – 2023 | S$5/tCO2e |

| 2024 | S$25/tCO2e |

| 2026 | S$45/tCO2e |

| 2030 | S$50-80/tCO2e |

From 2024, the International Carbon Credit (ICC) Framework, which was introduced in November 2022, allows carbon tax-liable companies to use voluntary carbon credits to offset up to 5% of taxable emissions. For more details on this see the section below on 'Recent Carbon Market Developments in Singapore'.

(ii) Climate Disclosure

In addition to carbon tax obligations there are additional climate disclosure obligations imposed on SGX-listed companies in Singapore:

- Sustainability Reporting – (a) mandatory annual sustainability reporting; and (b) for most companies, Task Force on Climate-Related Financial Disclosures (TCFD) reporting on a "comply or explain basis"; and

- Mandatory TCFD Reporting – for (a) SGX-listed companies in finance, agriculture, food and forest products and energy industries (from 2024); and (b) SGX-listed companies in materials and buildings, and transportation industries (from 2025).

C. Recent Carbon Market Developments in Singapore

On 4 October 2023, the Ministry of Sustainability and the Environment (MSE) and the National Environment Agency (NEA) set out the Eligibility Criteria under the ICC Framework.

Under the ICC Framework, carbon tax-liable companies can use eligible ICCs to offset up to 5% of their taxable emissions from 1 Jan 2024. This Framework will be aligned with Article 6 of the Paris Agreement to enable Singapore to cooperate with other countries to support the respective climate targets of the contracting parties via international cooperation.

The Eligibility Criteria requires ICCs to represent emissions reductions or removals (that occur within the timeframe specified under Article 6 of the Paris Agreement), and meet the seven principles (set out below together with their definitions) to demonstrate high environmental integrity.

| Principle | Definition |

| To comply with Article 6 of the Paris Agreement, the certified emissions reductions or removals must have occurred between 1 January 2021 and 31 December 2030. | |

| Not double-counted | Certified emissions reductions or removals must not be counted more than once in contravention of the Paris Agreement. |

| Additional | Certified emissions reductions or removals must exceed any emissions reduction or removals required by any law or regulatory requirement of the host country that would otherwise have occurred in a conservative, business-as-usual scenario. |

| Real | Certified emissions reductions or removals must have been quantified based on a realistic, defensible and conservative estimate of the amount of emissions that would have occurred in a business-as-usual scenario, assuming the project or programme that generated the certified emission reductions or removals had not been carried out. |

| Quantified and verified | Certified emissions reductions or removals must have been calculated in a manner that is conservative and transparent, measured and verified by an accredited and independent third-party verification entity before the ICC was issued. |

| Permanent | Certified emissions reductions or removals must not be reversible, or if there is a risk that the certified emissions reductions or removals may be reversible, there must be measures in place to monitor, mitigate and compensate any material reversal of the certified emissions reductions or removals. |

| No net harm | The project or programme that generated the certified emissions reductions or removals must not violate any applicable laws, regulatory requirements or international obligations of the host country. |

| No leakage | The project or programme that generated the certified emissions reductions or removals must not result in a material increase in emissions elsewhere, or if there is a risk of a material increase in emissions elsewhere, there must be measures in place to monitor, mitigate and compensate any such material increase in emissions. |

(Source: National Environment Agency, "Singapore Sets out Eligibility Criteria For International Carbon Credits Under The Carbon Tax Regime", Table 1: Eligibility Criteria for ICCs (4 October 2023), https://www.nea.gov.sg/media/news/news/index/singapore-sets-out-eligibility-criteria-for-international-carbon-credits-under-the-carbon-tax-regime)

By understanding the implications of key regulations and initiatives, businesses in (or intending to enter) Singapore will be able to gain a competitive edge while simultaneously contributing to a sustainable future.

This Legal Update briefly introduces the key environment and climate change regulations (in particular, in relation to the carbon market) in Singapore in a summarised and engaging manner and should not be construed as legal advice in any form or manner.

Other Author - Maria Chang, Senior Associate of PK Wong & Nair

Visit us at mayerbrown.com

Mayer Brown is a global services provider comprising associated legal practices that are separate entities, including Mayer Brown LLP (Illinois, USA), Mayer Brown International LLP (England & Wales), Mayer Brown (a Hong Kong partnership) and Tauil & Chequer Advogados (a Brazilian law partnership) and non-legal service providers, which provide consultancy services (collectively, the "Mayer Brown Practices"). The Mayer Brown Practices are established in various jurisdictions and may be a legal person or a partnership. PK Wong & Nair LLC ("PKWN") is the constituent Singapore law practice of our licensed joint law venture in Singapore, Mayer Brown PK Wong & Nair Pte. Ltd. Details of the individual Mayer Brown Practices and PKWN can be found in the Legal Notices section of our website. "Mayer Brown" and the Mayer Brown logo are the trademarks of Mayer Brown.

© Copyright 2024. The Mayer Brown Practices. All rights reserved.

This Mayer Brown article provides information and comments on legal issues and developments of interest. The foregoing is not a comprehensive treatment of the subject matter covered and is not intended to provide legal advice. Readers should seek specific legal advice before taking any action with respect to the matters discussed herein.