In brief

- China has enacted Announcement 11 to clarify several significant issues on tax treaties clauses:

-

- Permanent establishments (PEs)

- Partnership enterprises

- Shipping and air transport

- Artists and athletes

- The new rules have taken effect from 1 April 2018.

In detail

China's State Administration for Taxation (SAT) has issued Announcement 11 to clarify the following tax issues. It is believed that ambiguity and inconsistency in some tax treaty clauses has driven the need for clarification.

1. Permanent establishments (PEs)

- For some time, two different

China-day thresholds have been used in China's tax treaties for

determining PE presence in China for labour services, i.e. 183 days

or six months in any twelve-month period.

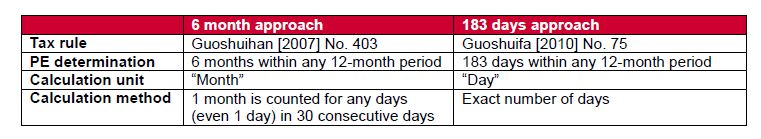

Announcement 11 has declared an end to the twin approaches, and adopted 183 days as the threshold for all tax treaty implementation. The distinction between these two approaches is summarised below:

As a matter of fact, the six-month approach has gained less popularity nowadays due to its widely criticised pitfall in PE determination - one day's presence in China within one calendar month could be counted as one month. The overall shift to the 183 days approach should be welcome by taxpayers. - Announcement 11 also mandates that PE is considered constituted by any premises used for educational activities by a China-foreign academic programme or an insitution without a legal person status. In other words, the length of presence in China by expatriates staff is no longer relevant for PE assessment.

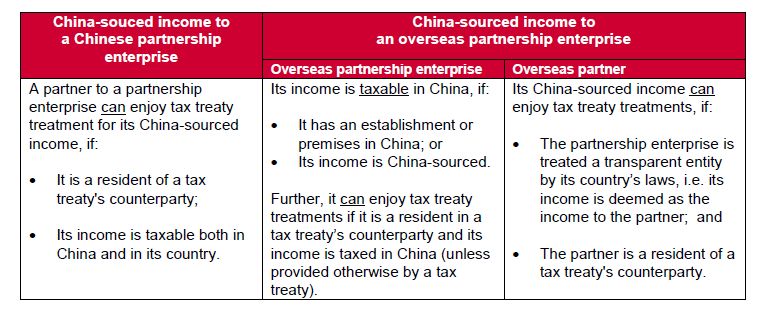

2. Partnership enterprises

- Announcement 11 clarifies how

partnership should be treated by the following manners:

- We illustrate what the new rule means

in three cases below whereby an individual (called "A")

is a partner to a partnership enterprise (called "B"),

and a country (called "C") has concluded a tax treaty

with China. A and B are bound by some conditions mentioned below if

intending to enjoy tax treaty treatments:

- A, an overseas individual and a partner to a Chinese partnership enterprise, can enjoy tax treaty treatments, if A is a resident in country C, and his China-souced income is taxable in C;

- B, an overseas partnership enterprise, can enjoy tax treaty treatments, if B is a tax resident in C;

- A, a tax resident in C and a partner

to an overseas partnership enterprise in C, can enjoy the tax

treaty treatments for his China-sourced income, if:

- The tax treaty allows A to enjoy tax treaty treatments for his income from a partnership enterprise; and

- A's home country regulates that the income of a partnership enterprise is deemed as income to A.

To view the full article please click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.