HEDGE FUNDS - PART 2

From our vantage point as advisers to many of the world's top investment fund managers and financial institutions, broad market forces flow through to our instructions, and ultimately drive many of the terms of the funds we advise.

In this four-part series we look at the current themes we have noticed in the investment funds market. Parts one and two focus on Hedge Funds and parts three and four explore Private Equity.

All data, unless referenced, is taken from Walkers' in-house investment funds survey.

LOCKED UP FOR LONGER

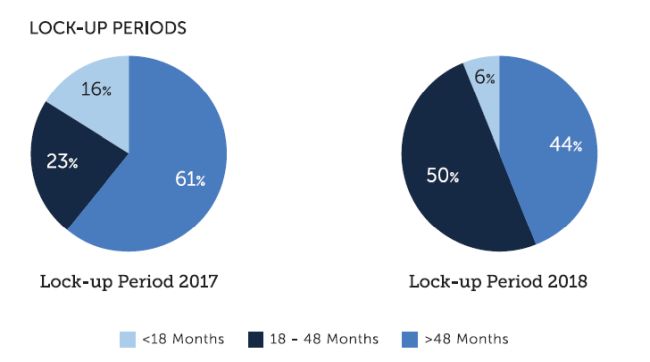

Although the percentage of funds using a lock-up is broadly consistent with our prior surveys (about one third of funds surveyed use a lock-up of some sort), the way funds used lock-ups in 2018 has evolved. Funds are now locking up their investors for longer: over half the funds that were using lock-ups are now locking their investors up for eighteen months or more (compared with 39% in 2017).

The nature of the lock-up has changed this year too. In prior surveys, the split between funds employing 'hard' lock-ups (where the lock-up prohibits redemption during its term) has been broadly in-line with those employing 'soft' lock-ups (where early redemptions are permitted, but subject to an early redemption fee for the benefit of the fund). This year, however, hard lock-ups were more than twice as common as soft lock-ups.

As industry data shows, the average hedge fund investor, measured by dollars invested, becomes more institutional each year. A classic side letter trade of recent years has involved an incoming investor agreeing to be locked up (sometimes even where the fund's base terms do not provide for a lock-up) in return for lower fees. As most initial investors in a fund, particularly the larger anchor institutional investors, plan on committing for several years, and most managers in the early years require stability of the capital base while they build a track record, this has been a mutually beneficial arrangement.

In a similar vein, we have seen a small uptick (25%, up from 20%) in the percentage of funds employing a gate to provide a mechanism to smooth the impact of significant redemption activity. While too early to observe any meaningful trend, as a proxy for managers' expectations of future redemptions, it is a statistic we will keep under review.

GOVERNANCE AND CONTROLS

Last year, one of the departures from the established trend was a small but notable decline in the number of funds, including one or more independent directors on their board. At the time, we cautioned against reading too much into a single year's data, and promised to revisit the question this year. While independent representation on boards has risen slightly (76%, up from 67% last year), this still represents a smaller percentage than we saw in our pre-2017 surveys. For funds using independent boards, majority independence remains dominant (nearly 90%), and most funds (over 70%) select independent directors from different providers. These remain broadly consistent with prior years' results, and reflect the institutional consensus regarding appropriate governance.

These statistics reflect the significant task facing many of our clients in selecting an appropriate governance framework for their fund, and then finding appropriate individuals to fill the roles. We work with virtually all of the professional directors, and are well placed to help clients work through these issues.

We have also seen a significant increase in the number of funds employing administrators that are based in the Cayman Islands (43%, up from 27% last year). To a degree, this may simply reflect administrators' own internal preferences in running Cayman funds from their Cayman offices. It may also reflect clients' preferences for administrators who are most familiar with the Cayman Islands anti-money laundering regime, which was updated in 2018, and who are able to offer the required anti-money laundering officers. We shall keep this under review in future surveys.

WHAT TO LOOK FOR IN 2019

As so much in the industry flows from performance, whether or not the last two years' positive returns can be extended remains the key question. It has been a busy year for new fund launches in 2018, both for start-ups and institutions alike. Beyond the new registrations captured by our surveys, Walkers has advised on a wide range of restructurings of existing funds in anticipation of renewed activity and investor demand.

That activity may in part come from the growth of crypto-related funds and the development of artificial intelligence, machine learning and big data to analyse and invest in markets. We expect to see more in the crypto custody space, with progress being made towards a regulated solution to the custody of crypto assets. This is expected to ease a key constraint to institutional participation in crypto funds. Another area to watch with interest is the growing trade tensions between the US and China. With both sides expected to increase the number of tariffs and other protectionist measures in the near term, any resulting market volatility may lead to opportunities for investors and managers alike.

Investors continue to look at positive societal outcomes when analysing investment opportunities. Institutional managers now routinely incorporate environmental, social and governance (ESG) principles into their investment policies. We expect this trend to continue.

Finally, there is a growing consensus among industry commentary that the last decade of relative market stability (in the principal equity markets at least) and low interest rates, may become increasingly vulnerable to economic and political risks. If so, and volatility increases, hedge funds should be well placed to put into practice the strategies that have often been frustrated by strong and stable equity markets and low interest rates. To a degree, some of the trends and themes observed in this year's data may already reflect forward planning by managers in contemplation of these possibilities.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.