The Cayman Islands Tax Neutral regime is a globally responsible tax model that is simple and transparent and efficiently supports the global free flow of investment capital and financing without posing tax harm to other countries' tax bases.

Importance of Global Cross-Border Economic Activities

Supporting cross-border economic activity between countries with similar or differing tax systems is essential to the economic success of developed and developing countries. The European Union recognises the importance of cross-border economic activity and has established oversight for national tax rules and policies to ensure the free flow of goods, services, and capital.

Double Taxation Poses a Significant Obstacle to Global Cross-Border Economic Activities

Tax conflict arises when the two countries involved in the cross-border activities both have domestic tax laws and rules that would result in the same income or profit being taxed twice, once in each country. This tax conflict is generally referred to as "Double Taxation" and is considered by the United Nations, OECD and others as a significant barrier to beneficial cross-border economic activity.

Easing of The Double Taxation Burden is a Goal of Most Nations' International Tax Policy

Double Taxation Treaties (or Double Taxation Agreements) and Tax Neutrality are important tax policy models for effectively addressing double taxation. Double Taxation Treaties are generally modelled under the United Nations Model Double Taxation Convention or the OECD Model Tax Convention.

The main objective of tax treaties is to seek to alleviate

double taxation by allocating taxing rights between the two

countries. In addition, tax treaties may also contain provisions

for tax conflict mediation and sharing of tax information to

address tax evasion and aggressive tax avoidance.

Almost all EU members pursue the benefits of easing of the double

taxation burden through the use of Double Taxation Treaties. Some

EU Member States have in excess of 70 double taxation agreements or

treaties.

Concerns Regarding the Abuse of Double Taxation Treaties and Treaty Shopping

Double Taxation Treaties are by nature complex and less transparent, and therefore sometimes pose a risk of abuse for tax evasion or aggressive tax avoidance.

According to the European Commission, "some companies avoid taxes by 'treaty shopping' i.e. by setting up artificial structures to gain access to the most beneficial tax treatment under various tax agreements with other Member States or third countries." This practice is widespread enough that the EU has had to take measures to combat the abuse.

An IMF Working Paper ['The Cost and Benefits of Tax Treaties with Investment Hubs: Findings from Sub-Saharan Africa'] did "not find that the tax treaties increase Foreign Direct Investment (FDI) in the treaty partner countries. The study does indicate however that there are revenue losses in source countries after they have concluded a treaty with Mauritius and with investment hubs more generally."

These could indicate that concluding a tax treaty gives rise to rerouting of investment and income flows, and potentially increases incentives for base erosion and profit shifting, rather than increasing the overall investments made.

Cayman's Tax Neutral Policy

Cayman pursues easing of the double tax burden through a policy of Tax Neutrality, which means investors in Cayman are still subject to their home jurisdiction's tax requirements, but the Cayman Islands does not add an additional layer of taxation on to the proceeds from their investments.

This straightforward policy allows Cayman to achieve the same objective as countries with double tax treaties but with similar or stronger safeguards against abuse.

"The use of collective investment funds domiciled in locations such as...the Cayman Islands is legal, common and widely considered best practice portfolio management," the manager said. "The collective investment fund provides a tax-neutral jurisdiction to ensure its collective income does not pay a second layer of foreign tax in relation to income on which all applicable taxes have already been paid at source." [Managers of New Zealand's €21.7bn NZ Super Fund]

Cayman's Tax Neutral Policy Is Supported By UN, OECD Model Conventions

While the OECD Model Convention gives guidance on the use of Double Taxation Treaties to address the burden of double taxation on cross border economic activities, it also recognises alternative tax policy models for addressing double taxation, tax conflict mediation and tax information sharing to protect against tax evasion and aggressive tax avoidance. The Cayman Islands Tax Neutral regime meets the criteria of an alternative tax policy model.

Cross-border economic transactions involving the Tax Neutral jurisdiction of the Cayman Islands do not require tax treaties as there is no tax conflict and no risk of double taxation. In addition, cross-border transactions between the Cayman Islands and other countries do not require tax treaties for the purpose of administrative assistance (such as the ability to exchange tax information) because the Cayman Islands has in place numerous bilateral tax information exchange agreements (TIEAs) and is covered by the Multilateral Convention on Mutual Administrative Assistance in Tax Matters through extension by the United Kingdom.

Transparency

Tax Neutral jurisdictions like Cayman support a level of transparency that arguably make them better at combatting tax evasion and aggressive tax avoidance than those that rely on the often-opaque system of Double Taxation Treaties.

The Cayman Islands is a transparent, cooperative jurisdiction that already meets or exceeds the full range of globally-accepted standards for transparency and cross-border cooperation with law enforcement and tax authorities. The OECD's Global Forum in 2017 assessed Cayman to be "largely compliant" with the international standard for transparency and exchange of information, the same rating given Germany, Canada and Australia.

The Cayman Islands also has had a world class verified ownership regime in place for more than 15 years. All companies established in the Cayman Islands must be formed using a licensed and regulated Cayman Islands corporate service provider. There is no ability for the general public to form Cayman Islands companies online. The information in the Cayman Islands ownership regime is collected and verified by these licensed and regulated Cayman Islands corporate service providers under existing anti-money laundering and know-your-customer laws and regulations and that information forms part of the Cayman Islands' current enhanced information exchange arrangements with the UK.

In May 2019, senior FBI official Steven M. D'Antuono testified before a Senate committee that the Cayman Islands provides "immense value" in combating financial crime, noting beneficial ownership information is able to be provided to law enforcement within 24 hours of a request to support investigations by the FBI and other law enforcement agencies.

Cayman is not a tax haven and meets none of the accepted definitions of a 'tax haven.' Unlike countries with Double Taxation Treaties or other domestic tax incentives, Cayman does not have different headline versus effective tax rates.

Automatic Exchange of Tax Data Enables Tax Collection

Cayman meets the highest global transparency standards, in part, through the automatic exchange of tax data with international tax authorities.

- Cayman has adopted US FATCA and the OECD's Common Reporting Standards for the automatic reporting of financial information for accounts maintained in the Cayman Islands. Cayman proactively shares tax information with over 100 other governments, including the UK and all EU member countries – a level of transparency which essentially assists them in the collection of their own taxes, regardless of what their unique tax laws are.

- Since 2005, Cayman has complied with the EU Savings Tax Directive to report interest paid to EU beneficial owners to the respective EU competent authority.

No Base-Shifting Mechanism in Cayman

Base-shifting to evade or avoid taxes requires a legal mechanism – usually in the form of terms of a double tax treaty. The Cayman Islands operates a Tax Neutral regime and has no Double Taxation Treaties; therefore, it has no legal mechanism to allow base-shifting.

Cayman's globally responsible Tax Neutral regime is a distinguishing feature among International Financial Centres (IFCs), many of which are tax treaty investment hubs with extensive double tax treaty networks.

In addition, the Cayman Islands has adopted the principles of the EU's Base Erosion and Profit Shifting (BEPS) initiative. The Organisation for Economic Co-operation and Development (OECD) has completed a review of the Cayman Islands' domestic legal framework that includes economic substance legislation and found that the Cayman Islands tax neutral regime is not harmful and meets all economic substance requirements. [OECD Harmful Tax Practices – Peer Review Results; Inclusive Framework on BEPS – Action 5, Jul 2019]

Why Use Cayman If Not for Tax?

Global investors are increasingly engaged in a flight to quality — relocating their resources based on sophisticated assessments of which financial centres offer the best combination of:

- efficiency and neutrality

- a global network and diverse industry;

- an experienced legal infrastructure and neutral tax environment;

- high regulatory standards and respect for appropriate privacy;

- world class professionals and credibility;

- stability.

Very few international financial centres meet those qualifications – and none do it as well as the Cayman Islands.

"Legitimate reasons for using an intermediate jurisdiction may include, but are not limited to... parties to a joint venture or partnership may be from different jurisdictions and want neutrality in selecting the jurisdiction for their venture (including equal legal and tax treatment) ..." [World Bank Group]

"Tax was paid in relation to prevailing Danish and international legislation. The reason it was placed in the Cayman Islands at the time was that the fund was also intended for international investors, and the Cayman Islands had an investment set up that international investors can easily adapt to their business." [PFA Pension company, Denmark]

In Summary, the Cayman Islands Tax Neutrality regime is a globally responsible tax model that is simple and transparent and efficiently supports the global free flow of investment capital and financing without posing tax harm to other countries' tax bases. The Cayman Islands Tax Neutral regime meets the criteria of an alternative tax policy model that is allowed under the OECD Model Tax Convention.

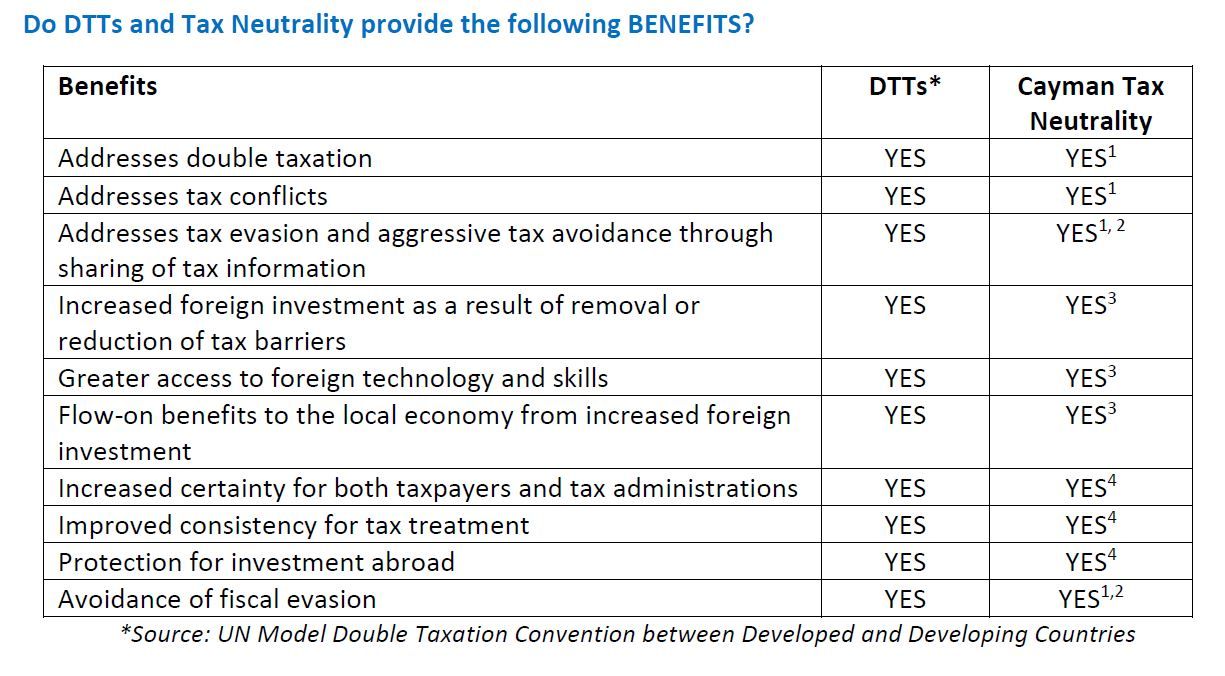

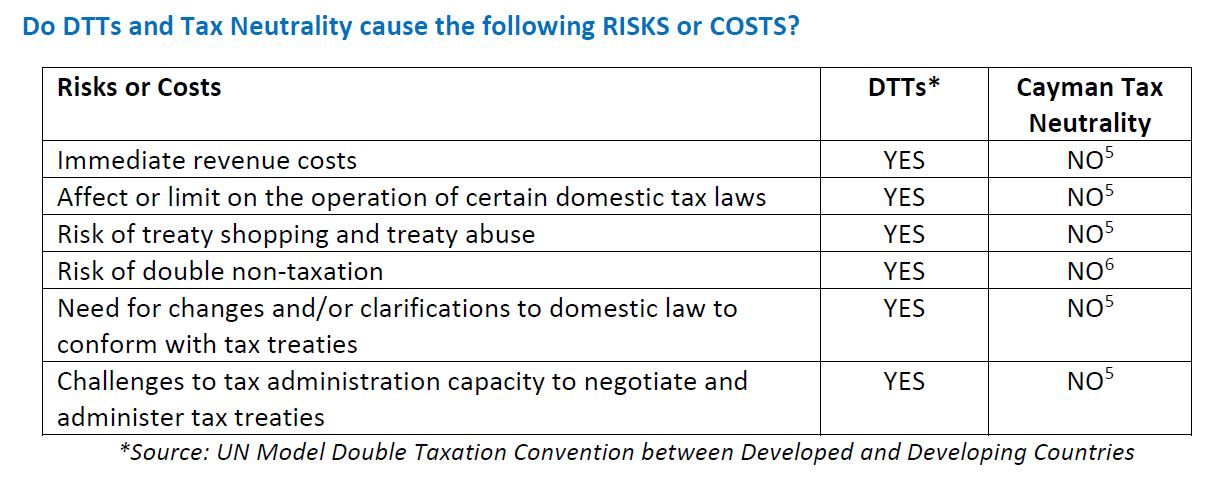

Comparative Benefits & Risks for Double Tax Treaties & Tax Neutrality

There are some circumstances where tax treaties are more suitable and other circumstances where Tax Neutrality is more suitable when addressing issues of double taxation and the following are important in considering the benefits, as well as the potential risks and costs:

TABLE 1

TABLE 2

Footnotes

1 Two countries "that consider entering into a tax treaty should evaluate the extent to which the risk of double taxation actually exists in cross-border situations." The OECD Model Tax Convention goes on to indicate that where a country levies no or low income taxes and the other country is satisfied there are no risks of double taxation, a tax treaty would not be necessary. "In the absence of any actual risk of double taxation, these administrative provisions would not, by themselves, provide a sufficient tax policy basis for the existence of a tax treaty because such administrative assistance could be secured through more targeted alternative agreements, such as the conclusion of a tax information exchange agreement [TIEA] or the participation in the Multilateral Convention on Mutual Administrative Assistance in Tax Matters." [OECD Model Tax Convention on Income and Capital, 2017]

2 Cayman was among the first countries to undertake automatic exchange of tax information with relevant authorities in other countries under the OECD's Common Reporting Standard (CRS). With other countries adopting CRS, Cayman now shares take information with over 100 other governments –including the UK and all EU Member Countries – which essentially assists them in the collection of their own taxes, regardless of what their unique tax laws are. [OECD AEOI: Status of Commitments, Aug. 2019]

3 There is no tax conflict and no risk of double taxation in cross-border economic transactions involving the tax neutral jurisdiction of the Cayman Islands. Therefore, as with DTTs, the elimination of double taxation barriers results in increased foreign investment into developed and developing countries, greater access to foreign technology and skills and flow-on benefits to these countries' local economies from the increased foreign investment.

4 Cayman Islands tax neutrality is simple, transparent, and does not affect the domestic taxing rights of other countries. The result is increased certainty for both taxpayers and tax administrations in cross-border transactions with Cayman as well as consistency for tax treatment and certainty for foreign investment.

5 Cayman Islands tax neutrality does not affect the domestic taxing rights of other countries, therefore other countries do not lose tax revenue as they do when allocating or giving up taxing rights to other countries under Double Taxation Treaties. As there are no treaties involved, there is: 1) no affect or limit on the operation of other countries' domestic tax law and no risk of treaty shopping or treaty abuse; 2) no need for changes and/or clarifications to other countries domestic laws ; 3) no demands or challenges to other countries tax administration capacity to negotiate or administer treaties.

6 Cayman cannot pose risk of double non-taxation because (i) it does not have tax treaties and (ii) Cayman's stated tax rate is exactly the same as its applied tax rate. Double non taxation is generally caused by the use of provisions in a tax treaty to shift the tax base from one country to a second country, and domestic tax policies in the second country (eg. Exemptions, exceptions, tax rulings, credits, etc.) that dramatically reduce the actual tax collected and retained to an amount substantially less than the stated tax rate the second country used to justify the shift of tax base under the treaty. [OECD Harmful Tax Practices – Peer Review Results; Inclusive Framework on BEPS – Action 5, Jul 2019]

(Technically, Cayman has signed a double taxation treaty with the UK, but it is merely the form in which the UK preferred to execute its tax information exchange agreement with Cayman. The agreement provides no tax benefits to Cayman as Cayman does not have any taxes covered by the agreement.)

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.