In this new series of articles, Alistair Wade aims to demystify Cayman real estate law. Here he explains important changes to Stamp Duty for Caymanian buyers.

Stamp Duty is a government imposed tax applicable to real estate transactions. In the context of a property purchase, Stamp Duty is payable as a percentage of the sale price.

The standard rate for calculating Stamp Duty in Grand Cayman is 7.5% of the sale price, but the specific percentage can depend on the circumstances of the transaction, the status of the buyer and the location of the property. For example, certain properties in the West Bay and George Town areas of Grand Cayman are excluded from Stamp Duty exemption/reduction (and it should be noted that Stamp Duty is generally treated differently in Cayman Brac).

First time Caymanian buyers currently benefit from a reduced rate if their transaction falls within certain criteria and, in such instances, the rate of Stamp Duty can fall to as little as 0%.

The Cayman Islands Government has recently expanded the existing criteria, which means more people can potentially benefit from these savings. This criteria is extended further to include instances where two to ten first time Caymanian buyers are purchasing together.

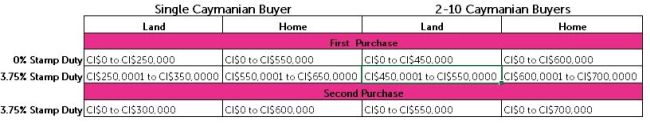

Under the new criteria a single first time Caymanian buyer would pay 0% Stamp Duty on the purchase of a home up to CI$550,000 and land up to CI$250,000. In addition, purchases of a home up to CI$650,000 will only be charged 3.75% Stamp Duty on the element over CI$550,000. This could represent a CI$45,000 saving compared to the current system.

Two to ten first time Caymanian buyers purchasing together would enjoy increased thresholds with 0% Stamp Duty on purchases of a home up to CI$600,000 and only 3.75% Stamp Duty on the next CI$100,000, up to a maximum of CI$700,000.

Another highly anticipated change affords certain concessions to Caymanians purchasing a second property. Caymanians will pay 3.75% in Stamp Duty for a second parcel of raw land valued up to $300,000, or a second home or developed residential property valued up to CI$600,000.

Groups of two to ten Caymanians making a joint purchase will pay 3.75% in Stamp Duty for a second parcel of raw land valued up to CI$550,000, or a second home or developed residential property valued up to CI$700,000.

A table summarising these concessions is set out below:

It is essential that buyers seeking to rely on these changes or any similar exemptions ensure that their Purchase Agreements contain appropriate conditions. An attorney can help with this process and give peace of mind to any prospective buyer.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.