The Cayman Islands is one of the most popular jurisdictions for hedge funds in the world. Maples and Calder's London Funds & Investment Management Partner Harjit Kaur and Associate Shae Roberts examine what sets the Cayman Islands apart

The Cayman Islands is one of the most popular and dynamic international financial services centres for hedge funds globally, with over 12,000 mutual funds currently registered or licensed with the Cayman Islands Monetary Authority (CIMA), the local regulator.

A cornerstone to the success of the Cayman Islands' funds regime is the ability to combine robust yet flexible laws, which are continually updated to respond to developing international trends and to meet the requirements of industry participants.

Structures Available

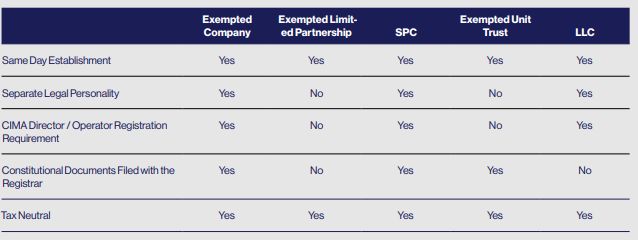

Cayman Islands hedge funds typically take the form of an exempted company, limited partnership or unit trust, and it is also possible to establish funds structured as limited liability companies (LLC). Exempted companies limited by shares are the most commonly used vehicle for open-ended funds. Segregated portfolio companies (SPC) are also available for managers looking to form umbrella funds with statutory segregation between assets and liabilities of sub-funds. The principal characteristics of the structures available are set out in the table opposite.

Mutual Funds Act Regulation

Cayman Islands open-ended pooled investment funds are regulated under the Mutual Funds Act – also known as the Act. The most common category of mutual fund is known as the 'registered fund', accounting for over 92% of all regulated open-ended investment funds in the Cayman Islands as at 31 December 2020 . The straightforward registration process and the absence of a pre-approval process contribute to the popularity of the registered fund. In short, a mutual fund may register as a registered fund, if it has a minimum initial investment per investor of at least US$100,000 or its equity interests are listed on a recognised stock exchange.

Registration of a registered fund involves submission of an application form filed via CIMA's dedicated web portal, together with a copy of the fund's offering document and consent letters from its administrator and its Cayman Islands auditor. A registered fund structured as an exempted company, SPC or LLC must appoint a minimum of two directors or managers (as applicable), each of whom must be registered or licensed by CIMA prior to the registered fund's registration with CIMA.

The offering document of a registered fund must describe the equity interests in all material respects and contain such other information as is necessary to enable a prospective investor to make an informed decision whether or not to invest. The offering document must also contain the disclosures mandated by CIMA's rule on the contents of offering documents. Registered funds also need to comply with CIMA's rules on the segregation of assets and calculation of asset values.

There are other categories of mutual funds under the Act, including limited investor funds, where the fund intends to have no more than fifteen investors and those investors have the power to appoint and remove the operator(s) of the fund. The registration requirements are similar to those of a registered fund, except that a limited investor fund is not subject to the minimum investment requirement applicable to a registered fund and may file marketing materials or a summary of its terms with CIMA in lieu of an offering document.

Continuing requirements for registered funds

All registered funds must have their accounts audited annually by a Cayman Islands-based auditor approved by CIMA, and submit such audited accounts, together with a key data elements form and a fund annual return to CIMA within six months of each financial year end.

For as long as a registered fund is continuing to offer its equity interests and a material change occurs that affects information contained in the offering document, an amended offering document or a supplement must be filed with CIMA within 21 days of the promoter or operator becoming aware of such change. Registered funds are also required to pay an annual registration fee by 15 January of each year following registration.

CIMA has wide-ranging powers under the Act for non-compliance and has the power to impose administrative fines for breaches of prescribed provisions of the Act committed by entities and individuals.

Other regulatory and compliance obligations

The Cayman Islands government and CIMA continue to work closely with governments and international authorities to ensure that the Cayman Islands is recognised as a trusted, well-regulated, co-operative and transparent jurisdiction.

The Cayman Islands was an early adopter of FATCA and the OECD Standard for Automatic Exchange of Financial Account Information – Common Reporting Standard (CRS). Hedge funds are required to comply with the related registration, due diligence and reporting requirements. In addition, hedge funds are required to maintain anti-money laundering, countering of terrorism and proliferation financing and sanctions procedures in accordance with the relevant Cayman legislation and regulations, and must appoint natural persons in the roles of anti-money laundering reporting officer, money laundering reporting officer and deputy money laundering reporting officer.

The FATCA and CRS requirements and AML functions can be performed by third-party service providers, subject to satisfaction of certain conditions. Cayman Islands funds also need to comply with the Data Protection Act (As Revised), including the requirement to adopt a privacy notice.

Funds regulated by CIMA under the Act are currently exempted from complying with the primary obligations of the Cayman Islands beneficial ownership regime, but are required to file a written confirmation of such exemption with their regulated corporate services provider. Such funds are also currently outside the scope of the Cayman Islands economic substance legislation, but must make an annual notification confirming their classification as an 'investment fund' with the Cayman Islands authorities.

Summary

The ease of formation of new entities, variety of structures available, quality and range of service providers and the straightforward registration process for registered funds, combined with a responsive legal and regulatory system, demonstrates why the Cayman Islands is a leading jurisdiction for hedge funds. These factors make the Cayman Islands an ideal jurisdiction for the establishment of all types of hedge funds including, most recently, those focused on ESG, crypto assets and the Chinese market.

Originally published by HFM Connect

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.