It has been another twelve months in which the extraordinary has become the norm, the unthinkable the mundane. Lockdowns have oscillated between full, partial and non-existent. Offices, restaurants and borders across the globe have creaked open and slammed shut as the pandemic has continued to shape the way we live our lives. And yet, throughout it all, lock-up funds have continued to be raised: investors were wooed over Zoom, side letters were negotiated at kitchen tables and the universe of participants and stakeholders in the closed-ended funds industry repeatedly showed themselves to be nimble and flexible enough to keep the wheels turning.

As the dust starts to settle on this moment in history, the question becomes this: has there been a fundamental shift in the manner in which closed-ended funds are raised and operated? Are we seeing a paradigm shift allowing and encouraging new working practices, which foster greater diversity in the industry and thereby allow it to continue to attract and retain the best and the brightest, working practices? While only time will tell, one prediction can be safely made: we have at least another year or two of the unprecedented to come.

Fund Strategies

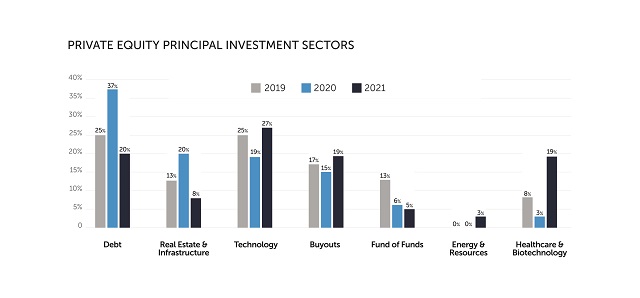

As the pandemic continues to be at the forefront of the global consciousness, it is no surprise to see a significant uptick in funds focussing on healthcare. This reflects not just the commercial opportunity, but also potentially a desire by the funds industry to back assets which are not just profitable but societally beneficial. In that vein, ESG has continued to be a theme underlying a number of fund strategies with buyout, technology and infrastructure funds all having ESG obligations in their investment terms. Some funds have launched with more directly focussed ESG strategies, including by way of example investments focussed solely on climate change mitigation and carbon-neutrality efforts.

Technology has continued to grow in popularity: one fund in particular, with a specific focus on gaming and associated software and hardware, will have piqued the interest of some investors looking for extra value. The popularity of technology focussed funds in some cases also reflects a new strategy focussed on growth equity: these are funds which target investments which have matured beyond their start up roots, but are not quite ready to be taken public or acquired wholesale. While there is some correlation between these types of growth funds and the number of smaller funds which have been raised this year, it should be noted that a number of the bigger, global managers are now taking forward growth equity as a key fundraising strategy: expect to see a number of multi-billion dollar growth funds launch over the next few years. Additionally, growth equity investments are often structured through series financing vehicles structured as Cayman Islands exempted companies, as the reputation of Cayman as a hub for technology and innovation businesses continues to grow.

Finally, we are of course not alone in noticing the prevalence of SPACs and it is no surprise to see a few funds raised solely to invest in units in SPACs: the quality of the business combinations available will directly impact the returns of those funds.

Fund Geographies

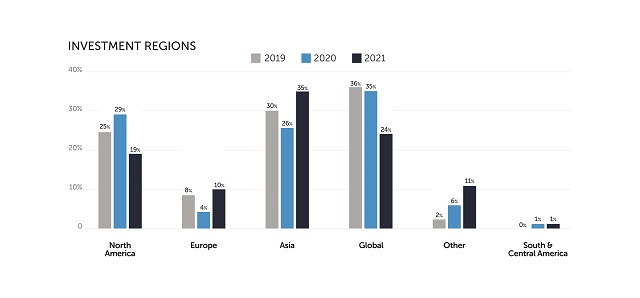

It has been a busy year for funds concentrating on Asia as their specific geographical investment focus.

North American and globally focussed funds have remained popular but, while the numbers have remained strong, their relative percentages have dipped due to the high number of, typically smaller, Asia focussed funds.

There has been a small uplift in the number of European focussed funds, albeit from a relatively low base. This could be a one year anomaly but one that we will watch with interest going forward: the Cayman private funds legislation was driven by European Union requirements and one outcome of its adoption could be a realignment of European interest in Cayman Islands domiciled funds.

Fund Duration

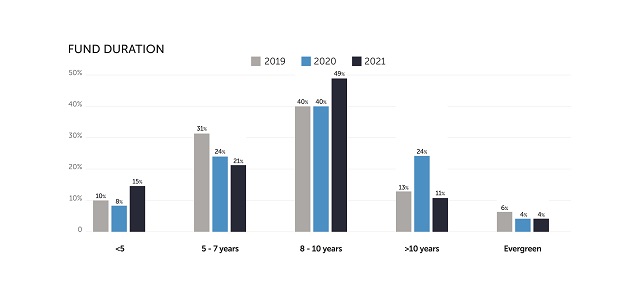

8-10 year terms have reinforced their position as the most common term generally.

There has been a slight dip in funds with 5-7 year terms, perhaps reflecting the lower percentage of credit funds which historically have had shorter terms. Conversely however there has been an increase in sub-5 year terms, which may be a consequence of the larger number of start-up funds raised in Asia, which often have shorter terms.

While there has been a percentage decrease in funds with 10 year+ terms, extension periods remain available to general partners under fund partnership agreements. Two single year extension periods remain most common, with a slight increase in the number of single year extension periods.

Looking at the partnership agreements in detail however suggests the landscape is a little more nuanced. The ability to extend is structured in a variety of different ways, often requiring general partner consent for the initial year or two and then LP advisory committee consent thereafter. Numerous partnership agreements moreover specifically allow for more bespoke extension provisions, with a specific number of annual extensions replaced by the ability to request consent from LPs, under a specifically agreed consent threshold, for such number of one or two-year extensions as may be agreed depending on the composition of the portfolio at the relevant time. As always therefore, the interests of the general partner and the investors are aligned in maximising sale value of assets: if GPs can construct a sufficiently persuasive narrative that more time is required, LPs have the power to give them the time they need.

Investment periods have also widened a little: a 5-7 year investment period remains the most common duration and there has been a slight increase in the number of 7 year plus periods. As always, industry specific trends remain, with credit funds in particular often having shorter investment periods.

Fees

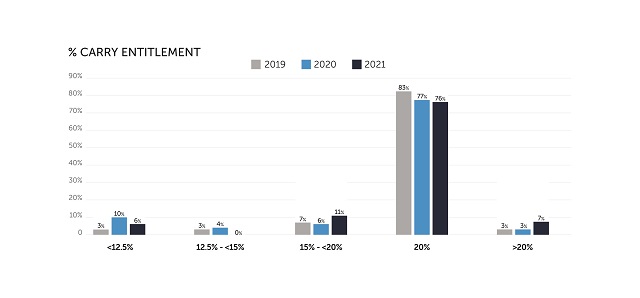

Carried interest rates continue to hold relatively firm at 20% over an 8% preferred return.

There remains some variance around the edges, particularly for managers raising their first funds. We have seen some trade off on a lower percentage to a certain level of performance, but rising to as high as 30% if and when a higher level of performance is achieved.

After a dip last year, 2% has returned to being the most prevalent management fee rate, subject as always to side letter pressure behind the scenes.

Time will tell if last year, where sub 2% rates were most prevalent, was an anomaly or reflected the start of a downwards trend, which this year merely stalled rather than halted.

A Fundamental Shift?

At the outset we contemplated the 'new normals', yet in many ways our data suggests a return to some of the older norms for the funds industry: a broad range of fund strategies, familiar fee pressures and funds carefully considering whether independent governance is right for them. The fundamental task remains to deliver risk-adjusted returns as contemplated in the fund's offering document.

Yet very few managers would say their business runs in the same way it did two or three years ago. They report an increasingly involved investor base with opinions on matters of governance, diversity, ESG factors and the like. For some managers, explaining how returns are delivered is as important as the delivery itself. Add in the continued challenges of attracting and retaining top-tier talent, succession planning as veterans of the Global Financial Crisis contemplate retirement, and the ever-increasing regulatory and compliance burden, the challenges for managers don't get any easier.

However, for all of the disruption and challenges that the last few years have brought, these are also times of immense and fascinating opportunity, as those shifts that are transitory, and those that are more lasting, reveal themselves. Rising to meet these challenges and take advantage of these opportunities is a task for the whole industry, across all time zones and cultures. The fund terms described in this White Paper represent not only the balance of hundreds of individual negotiations, but the beginning of these shifts into the next stage of the industry.

More Reading

- Walkers Fundamentals White Paper 2021 – Hedge Funds

- Walkers Fundamentals White Paper 2021 – Closed-Ended Funds Part 1

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.