IN SIMPLE TERMS, enhanced equipment trust certificates (EETCs) are corporate debt securities, typically issued by airlines. EETCs are secured on the aircraft operated by the airlines, and are structured through special purpose companies (SPVs) created specifically to own the aircraft and "enhanced" by elements such as debt tranching, availability of liquidity facilities and over-collateralisation.

The airline is the "deemed issuer" of Pass-Through Certificates for US securities laws purposes. Separate classes of EETCs are issued to bondholders representing tiered secured claims on multiple underlying aircraft, in accordance with intercreditor arrangements in the transaction documents. This effectively underpins credit quality for senior tranche holders, pushing first loss risk down to subordinated classes.

EETCs have grown in popularity since the 1990s, fuelled primarily by use amongst US airlines able to access the well-established, creditor-friendly US bankruptcy regime ("Section 1110 US Bankruptcy Code" or "Section 1110") in these structures. Commercial banks traditionally formed the financing mainstay for the aviation market, however, the development of capital market products enticed new market entrants, as evidenced by the burgeoning number of asset-backed securitisation transactions and EETC issuances over the last few years.

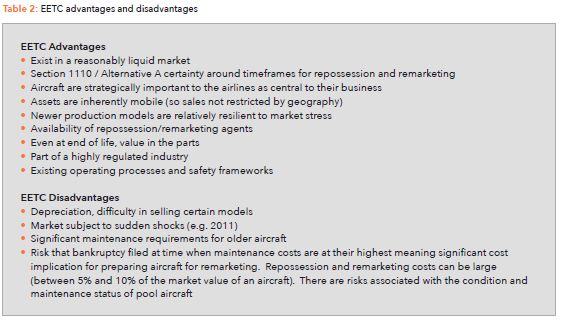

EETCs offer airlines access to a lower cost form of finance, and are balanced in attractiveness to investors, offering predictability in recoverability in a default scenario (there is a high degree of collateral coverage and recovery expectations are good even in circumstances where the aircraft pool is severely stressed and aircraft are rejected early in the airline bankruptcy), more attractive rates of returns on investments and shorter term commitments. EETCs are also well suited to repeat issuances, allowing carriers with established histories in the market to achieve more attractive terms on subsequent issuances.

In this article, we will examine some of the key features underpinning the success and popularity of EETCs. We will consider in particular the applicability and attractiveness of these features to non-US investors and airlines and how Cayman Islands and Irish structures are well placed to be utilised in these transactions.

EETC market

Recent notable EETCs include:

- Air Canada EETC (February 2017) – three tranches of EETCs: four B787-9s and nine B737 MAX8s. Very competitive rates achieved, the lowest of the four EETCs for Air Canada issued over the previous four and a half years.

- Spirit US$421m (November 2017) - this was notable in that the Spirit EETC priced above initial expectations by one quarter of a percentage point (in 3% range). Interest rate was only 2.5 bps wider than American Airlines US$545m AA Notes issued in July 2017. This was particularly significant given that Spirit is a smaller and less well known airline, and it achieving such competitive rates may point to further EETC opportunities for such airlines.

- Turkish Airlines (March 2015) – Japanese yen denominated with an increased number of alternative currencies expected. However, aircraft are typically purchased and sold in US dollars thus creating currency mismatch (with full currency hedge required for a full rating by the credit agencies).

KEY FEATURES OF AN EETC

Quick access to collateral

EETC structures are specifically designed to survive an airline bankruptcy, mitigating the risk of a payment default and ensuring prompt and predictable access to aircraft equipment. While an airline bankruptcy filing represents an indenture event of default with respect to equipment notes held by the trust, the bankruptcy itself does not trigger a default for the trust certificates.

Via the application of Section 1110, the associated airline has 60 days to affirm its aircraft obligations and cure all past defaults or relinquish the aircraft to the trustees for disposition. Extensions may be requested but are not typically entertained. In all scenarios, creditors retain considerable leverage in the bankruptcy process. EETC holders (particularly senior tranche investors) have considerable flexibility to address the need to remarket and monetise aircraft with sufficient time to avoid default. EETC holders have a right to act where others would be subject to automatic stay, a key credit advantage compared with typical corporate debt securities.

Over-collateralisation (OC) / cross-default / crosscollateralisation

EETC transactions are structured to provide significant OC to safeguard against declines in aircraft values throughout the life of the deal.

With initial EETCs, cross-default provisions were not included which enabled carriers to be selective as to which aircraft financings and leases to retain or reject in a reorganisation. Thus, certificate holders were subject to increased risk of an equipment note default and a potential shortfall post-rejection for a particular aircraft. The inclusion of cross-default provisions limits an airline's ability to choose which aircraft financings and leases to retain or reject in a bankruptcy scenario.

With earlier EETCs, cross-collateralisation provisions were not included, meaning that any excess proceeds from disposition of a particular aircraft could be retained by the airline, even in scenarios where the aircraft in the pool were disposed of at a loss to the bondholder. The inclusion of cross-collateralisation provisions means that if an airline defaults on an underlying equipment note or lease obligation, any excess proceeds from the disposition of the associated aircraft is held for the benefit of holders of that particular EETC in support of recovery.

Liquidity Facility (LF)

The presence of a LF is a significant favourable element of the EETC structure, providing the investor with breathing space upon a payment default prior to an event of default being called (pass-through certificate documents generally define default as occurring when an interest payment is missed after expiry of the LF (or full principal is not paid at legal final maturity)).

For US EETCs, the LF is typically sized to 18 months of interest coverage (a significant cushion over the 60-day collateral access period provided by Section 1110 in most cases). It ensures 18 months' worth of interest payments will be made before debt service stops altogether. In the case of non-US EETCs, the LFs have been significantly larger to account for a potentially long reorganisation process (e.g. the Doric / Emirates EETCs).

Rating

EETCs are often rated which improves pricing and liquidity. The principal considerations for the rating agencies include asset quality, business risk, diversity (both geographic and revenue), and regimes supportive of creditor rights.

Also relevant is the lessor's legal jurisdiction, the reliability of its legal system, confidence in its country's bureaucracy to enforce the legal framework, existence of legal precedent and political factors. All can impact the ability of lenders to repossess and deregister the aircraft and fly it out of the country if an airline rejects aircraft after entering administration.

Non-US EETCs and brief overview of LATAM EETC structure

Traditionally, the criticism of non-US EETC issuances is that creditors are not afforded the same level of certainty and predictability in terms of recourse to the aircraft equipment as with its US counterpart.

Successful non-US EETC transactions have however utilised alternative means to allow for quick access to the collateral following an airline insolvency. Alternative A of Article XI of the Protocol to the Cape Town Convention ("CTC") serves as a notable alternative, giving creditors a substantially similar protection regime to Section 1110. These are however issues such as the lack of clarity and predictability around the legal protections and the timelines for repossession of aircraft equipment (given the variances in the ratification and implementation process of the CTC from country to country) and insufficient testing in the courts, which limits the acceptance of Alternative A of the CTC as a fully viable alternative.

LATAM Airlines Group S.A. (LATAM) is the only airline in Latin America to successfully complete an EETC transaction.1 The proceeds of the equipment notes issued by each SPV were used to fund the acquisition of the relevant aircraft for such SPV.

The deal was structured so that each aircraft would on delivery be leased (and in some instances subleased) within the LATAM network on terms by which the rental payments under each relevant lease would be sufficient to cover all amounts required to be paid by the SPV in respect of the corresponding equipment notes. The equipment notes issued in respect of each aircraft were secured by a mortgage granted by the relevant SPV over the relevant aircraft and an assignment of such SPV's rights under the lease agreement. Each equipment note was issued under a separate indenture for each aircraft.

With respect to aircraft that were registered in Brazil, and subject to subleases with the airline, the loan trustees for the equipment notes related to such aircraft were entitled to the benefit of the CTC and Alternative A in exercise of its remedies.

One key requirement of the rating agencies was the appointment of an independent director to the board of each SPV. Certain reserved matters termed "significant actions or proceedings of the SPV" were specifically reserved as requiring unanimous approval of all directors. These reserved matters include commencement of insolvency proceedings, the winding up or dissolution of the relevant SPV, amendments to the SPV's constitutional documents, amalgamation or merger or sale of any of the assets of the SPV (other than the disposition of any engine or aircraft of part thereof that is permitted under the transaction documents). The independent director was defined to be a person who, at any time during such person's tenure as a director or during the five years preceding his appointment as a director did not have, or was not committed to acquire any direct or indirect financial, legal or beneficial interest in the relevant SPV and had no affiliation with the airline.

The deal terms also included enhanced provisions of the latest EETC transactions, including cross-collateralisation, equipment note guarantees and cross default provisions among all indentures.

Outlook

An upsurge in non-US EETCs has been predicted for several years but progress in this space has been slow.

Until the Spirit EETC reissuance in November 2017, only American Airlines had used EETCs in 2017. While EETCs have traditionally been a reliable source of capital for a select group of carriers, the easy availability of cheap alternative sources of funds has diminished the attractiveness of EETCs for many.

There has, however, been a growing cadre of non-US investors, with investment banks and manufacturers engaging in active outreach efforts. In 2014-16, investors for nine countries bought public EETC paper for the first time (comprising 5.8% to 8.3% of investors). It is expected that this trend will continue. In addition, Boeing Capital has been exploring EETCs opportunities in the sukuk market.

However, currently, 2018 is looking quiet for EETC issuances. Air Canada has announced the pricing of a private offering of two tranches of EETCs with a combined aggregate face amount of approximately C$301m and a weighted average interest rate of 3.76% (Class A and Class B Certificates). United Continental has stated that it plans to use the EETC market to finance 2018's deliveries and it may be that the 2017 Spirit issuance at very competitive rates will be a harbinger of a new class of low-cost carriers accessing the EETC market.

In terms of other previous users of EETCs, IAG is expected to continue to rely on leases and JOLCOs in 2018. Likewise, Avianca appears to be pursuing JOLCOs and its 2018 deliveries are already financed. LATAM is expected to choose to keep a mixture of leases and debt for 2019 which makes a 2018 EETC less likely.

EETC Structures and use of Cayco/Ireco SPVs

A Cayman incorporated SPV/Irish tax resident structure (commonly referred to as a "Section 110 Company") can be utilised to undertake an EETC Transaction. Cayman Islands exempted companies (Caycos) are highly flexible, making them a popular choice for use in structured finance, asset finance and leasing transactions. Aside from maintaining a registered office and certain registers in the Cayman Islands, the ongoing statutory requirements under Cayman Islands law applicable to Caycos are simple and cost-effective and allow Caycos to, among other things:

- financially assist the acquisition of their own shares (provided the directors ensure that the transaction is in the best interests of the company and is carried out for proper purposes);

- migrate out of the Cayman Islands into any other jurisdiction that allows migration inwards;

- merge with a company from any other jurisdiction that allows mergers without needing to be the surviving entity;

- take advantage of a creditor friendly insolvency regime, including express provisions for the recognition of nonpetition covenants to prevent a bankruptcy-remote SPV being put into liquidation by an aggrieved party, as well as express recognition of the ability of a secured party to enforce their security interest outside of any liquidation and no form of bankruptcy moratorium or stay on enforcement of a security interest;

- appoint auditors located anywhere and adopt IFRS, US GAAP or any other appropriate accounting standard;

- dispense with annual general meetings and the need for directors or officers to be resident in or meet in the Cayman Islands;

- dispense with the need to prepare or file audited annual accounts or financial statements;

- use share premium to fund dividends, share repurchases and share redemptions; and

- maintain the share register and minute books outside of the Cayman Islands.

Caycos can be established quickly and efficiently - incorporation can be concluded on an express basis in as little as 24 hours. In addition, as there is no direct taxation in the Cayman Islands, a Cayco will not be liable to pay any tax on income, capital gains or withholdings in the Cayman Islands, although stamp duty may be payable on original documents executed in, or subsequently brought into, the Cayman Islands.

While many of the benefits of Caycos set out above are not available to Irish incorporated companies ("Irecos"), Ireland is internationally recognised as a leading location for aircraft finance and leasing activities. There are a number of reasons for Ireland's pre-eminent reputation in the aviation industry, not least of which is the Irish tax regime. The tax rate on trading profits is 12.5% which, coupled with beneficial tax depreciation and interest deductibility rules, can often reduce Irish corporation tax to a minimal amount provided the lessor has some substance in Ireland. Alternatively, it is possible to avail of the Irish "section 110" regime which allows for corporation tax neutral treatment for an Irish special purpose company which holds and/or manages aircraft and engines.

An important additional tax benefit for Irish tax residents is the large and ever-growing international network of double tax treaties (Irish DTTs) to which Ireland is a party. There are 73 Irish DTTs currently in effect, including with the US, many Asian countries and countries in the Gulf region. The treaties protect an Irish based lessor from double tax in their international operations and in particular often allow a foreign lessee make lease rental payments to an Irish lessor free from foreign withholding tax. This ability to eliminate or reduce foreign withholding tax on lease rentals is critical to the commercial success of a lessor leasing to multiple jurisdictions.

To fall within the Irish tax regime and benefit from Ireland's treaties, a company must be resident in Ireland for tax purposes. Tax residency is primarily determined by the "central management and control test" which relates to the decisions of strategic importance to the business of the company as opposed to the day to day administration. In practice, the test can be satisfied by the board of directors meeting regularly in Ireland, and ideally the majority of them being Irish resident.

Conclusion

EETCs are an important feature of the aviation financing market but to date has proved most attractive to the larger US airlines. There is an expectation that use will increase among non-US issuers (using Alternative A or certain local law regimes) and potentially among lower-cost carriers. In the current financing environment, however, with easy availability of super-competitive financing across the spectrum of borrowers, one should not expect a significant upsurge in issuances in the short to medium term.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.