In their quest to increase shareholder value owners and managers will often look to growth, specifically growth in net income. Although growth is often desirable, it doesn't necessarily indicate whether a company is fundamentally healthy, in the sense of being able to sustain its current performance and to build profitable businesses in the future. Value-minded executives know that although growth is good, returns on invested capital can be an equally - or still more - important indicator of value creation.

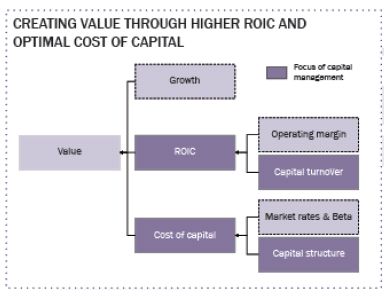

Increases in a company's cash flow and, ultimately, its market value stems from a combination of its long-term growth in revenues and profits and from its returns on invested capital (ROIC) relative to its cost of capital.

The key to creating value is understanding how to manage this subtle balance between growth and ROIC. We often meet executives with companies that earn high returns on capital but who are unwilling to let those returns decline to encourage faster growth. Conversely, we repeatedly come across executives whose companies earn low returns working to promote growth instead of improving their ROIC.

In our experience, it is the "Capital Management" component of this relationship which is most often overlooked by managers, resulting in a larger but relatively less profitable organization. This article will identify and discuss a handful of initiatives which can lead to improvements in an organizations ROIC and generate significant increases in shareholder value.

Companies create value by investing capital to earn a return that is greater than the cost of the capital - in other words, when the return on invested capital (ROIC) exceeds the weighted average cost of capital (WACC). The more that companies can invest and grow their capital at positive returns, the more value is created.

Effective capital management maximizes a company's value by:

A. Optimizing capital structure (to achieve a competitive cost of capital), and

B. Improving capital efficiency (to improve ROIC).

A. Optimizing Capital Structure

Many approaches to investment analysis fail to account for the impact of financial leverage. Two companies which created underlying value equally well could generate very different returns on equity simply because of the difference in debt-equity ratio and the resulting differences in risk.

Debt is traditionally a less expensive source of funding than equity capital because shareholders bear a greater risk of loss in the event of financial distress than lenders, and seek a higher return to compensate for this. Also, the interest payable on debt is deductible for tax purposes, which further reduces the effective cost of this capital.

Where a business utilizes a relatively greater proportion of debt capital it will (in most cases) have lower repayment obligations (or "costs", also referred to as a WACC1) associated with its capital financing. This, in turn, leaves a greater proportion of the businesses after-tax proceeds for owners and serves to increase the value of the company.

However, in practice, as the proportion of debt funding increases the cost of equity capital and debt funding both tend to rise as the risk and cost of financial distress becomes an important factor for capital providers. Determining the optimal balance between debt and equity capital requires an assessment of the businesses financial flexibility.

A company's financial flexibility will be a function of the variability in its operating income caused by the inherent factors of the business (as opposed to the level of debt financing). For example, variation in operating income can be influenced by changes in prices, variability of inputs, sales volume, and competition levels.

Assessing the optimal capital structure within a 'shareholder value' framework allows a company to determine the relative proportion and amount of capital required to maximize the value of the business.

Designing and achieving an optimal capital structure is indispensable to financial resilience, and is a good indication of the necessary discipline to use capital providers' funds wisely. For those companies which generate returns at or below their weighted-average cost of capital, they will have increasing difficulty accessing capital to finance further growth unless they improve their operations and earn the right to grow.

B. Improving Capital Efficiency

Apart from optimizing capital structure, companies must also strive to improve their capital efficiency. There are three fundamental aspects to capital efficiency:

1. Working capital efficiency

2. Capital Expenditure (â€ÜCapex') efficiency

3. Disposal of non-core assets and activities

Working capital efficiency

Improve working capital efficiency: through managing accounts receivable, accounts payable, cash and inventory management

Capex efficiency

Improve capex efficiency of non-recurring/strategic investments: look at the strategic, portfolio, project and organization levels of capex management to make go/no-go decisions, prioritize initiatives, decide on the degree of spend for each initiative and ensure that capex achieves target objectives and values

The decision to invest in growth (a new project) often hangs on reasonable expectations of its return on invested capital. But what constitutes "reasonable"? Companies that rely on the wrong benchmark can overlook good investments or pursue bad ones. Empirical analysis of ROICs can help executives ground their expectations in the collective long-term experience of other companies.

Historical ROICs can vary widely by industry. In the United States, the pharmaceutical and consumer packaged-goods industries, among others, have sustainable barriers, such as patents and brands, that reduce competitive pressure and contribute to consistently high ROICs. Conversely, capital-intensive sectors (such as basic materials) and highly competitive sectors (including retailing) tend to generate low ROICs.

Disposal of non-core assets and activities

Employ various tools to improve their capital efficiency: determine disposal of non-core assets/activities: a 3-step test will help to determine whether or not to dispose a particular asset or activity.

Observations on capital management practices indicate that many would benefit from devoting greater management attention on their balance sheets. Optimal capital structure would enable companies to pursue business growth and seize opportunities. Managing capital efficiency will enable a business to enjoy a competitive advantage over its peers.

One disadvantage of ROIC and growth, however, is that neither incorporates the magnitude of the value created, so a small company or business unit with a 30-percent ROIC seems more successful than an enormous company with a 20-percent return. We use economic profit to convert ROIC into a dollar metric so that we can incorporate the size of the value created into comparisons with other companies.

Conclusion

Not all forms of earnings growth create value equally. Earnings growth creates more value when it is rooted in activities that generate high returns on capital - such as the discovery of new customer segments for a company's products - than in activities with low returns on capital, such as many acquisitions when goodwill is taken into account.

When an industry reaches maturity and consolidates, companies may find it impossible to avoid slow growth and, at the same time, compressed margins. And when a company cannot find growth opportunities or improve its returns on investment, executives might better serve shareholders by selling the company to owners who can drive higher growth or by returning capital to shareholders through dividends or stock buybacks.

Empirical evidence suggests that companies enjoying strong ROIC can afford to let it decline over the short term to pursue growth - and that companies with low returns are better off improving ROIC than emphasizing growth. Large companies in particular will find it difficult to grow without giving up some of their existing returns.

Some ways of measuring a company's financial performance are better than others. Metrics, such as ROIC, economic profit, and growth, that can be linked directly to value creation are more meaningful than traditional accounting metrics like EPS. Although growing companies that earn an ROIC greater than their cost of capital generate attractive EPS growth, the inverse isn't true - EPS growth can come from heavy investment or changes in financial structure that don't create value. In fact, companies can easily manipulate earnings per share, for example, by repurchasing shares or undertaking acquisitions.

Footnotes

1 The average cost of equity and debt weighted in proportion to their contribution to the total capital of the company.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.